Forecasting Bitcoin Demand

A Deep-Dive On The Impact of ETFs

Investors,

BlackRock currently owns 28,622 Bitcoin (or the equivalent of $1.198Bn) on behalf of investors in their spot Bitcoin ETF, $IBIT, which began trading on January 11th.

I think it’s unquestionably an important and successful start to the new era of Bitcoin, one where institutions, their clients, and retirement accounts now have access to the apex digital asset, only 15 years after the public launch of Bitcoin’s software.

Think about it:

19.6 million Bitcoin of the 21M hard-cap have been mined (93% of the max supply).

The remaining 1.4M will be mined over the coming 120 years.

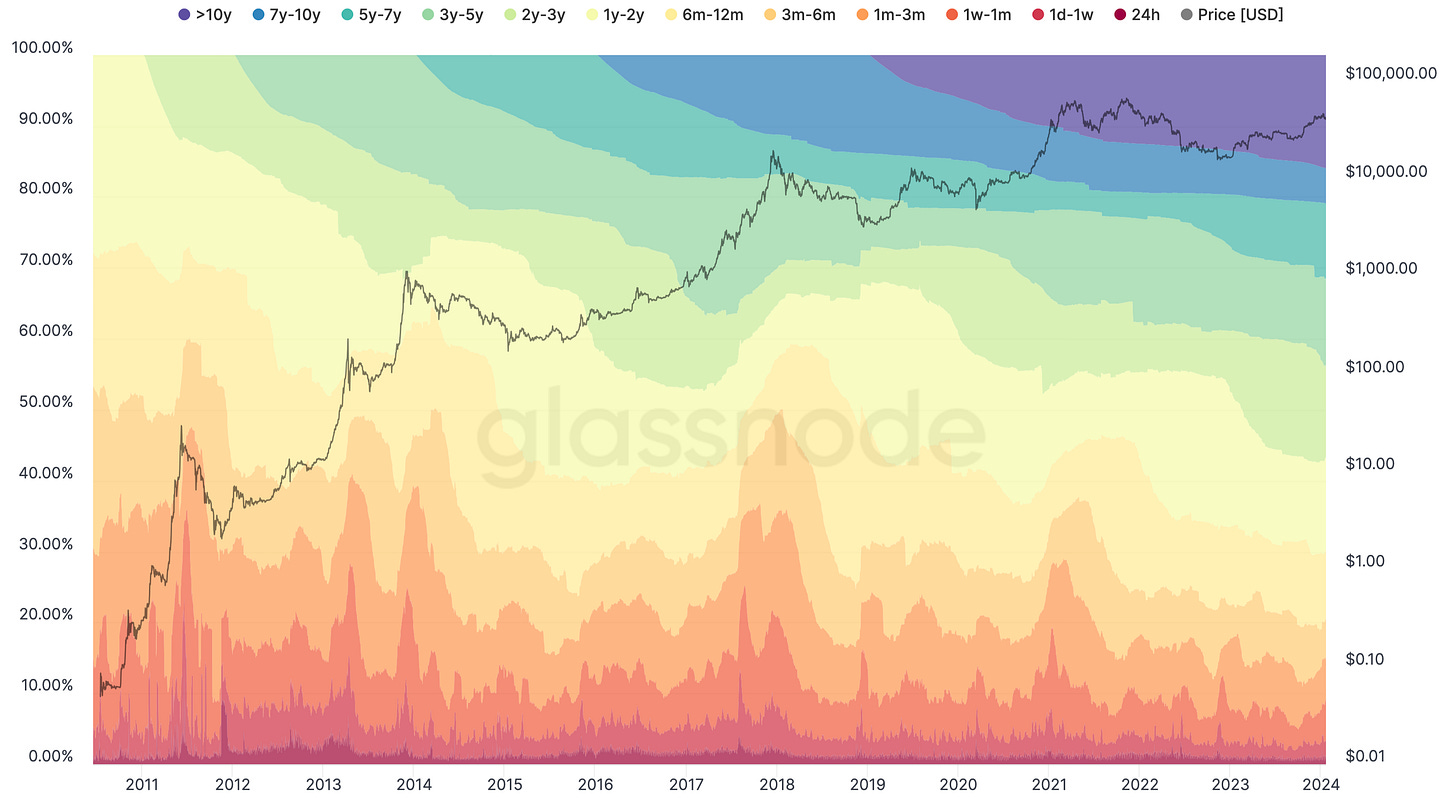

Of the current supply, 70% hasn’t been moved in 12+ months (chart below).

This means that only (1-0.7)*19.6M = 5.88M BTC have been liquid in the past year.

The halving is in 87 days, causing daily new supply to fall from 900 → 450 BTC.

And now we have massive institutional pockets opening the flood gates.

But how much capital is behind this dam? Quite a bit.

Let’s focus on BlackRock first and do a bottom-up approach: