Investors,

Bitcoin has gained more than +25% since the lows on July 5th, 2024.

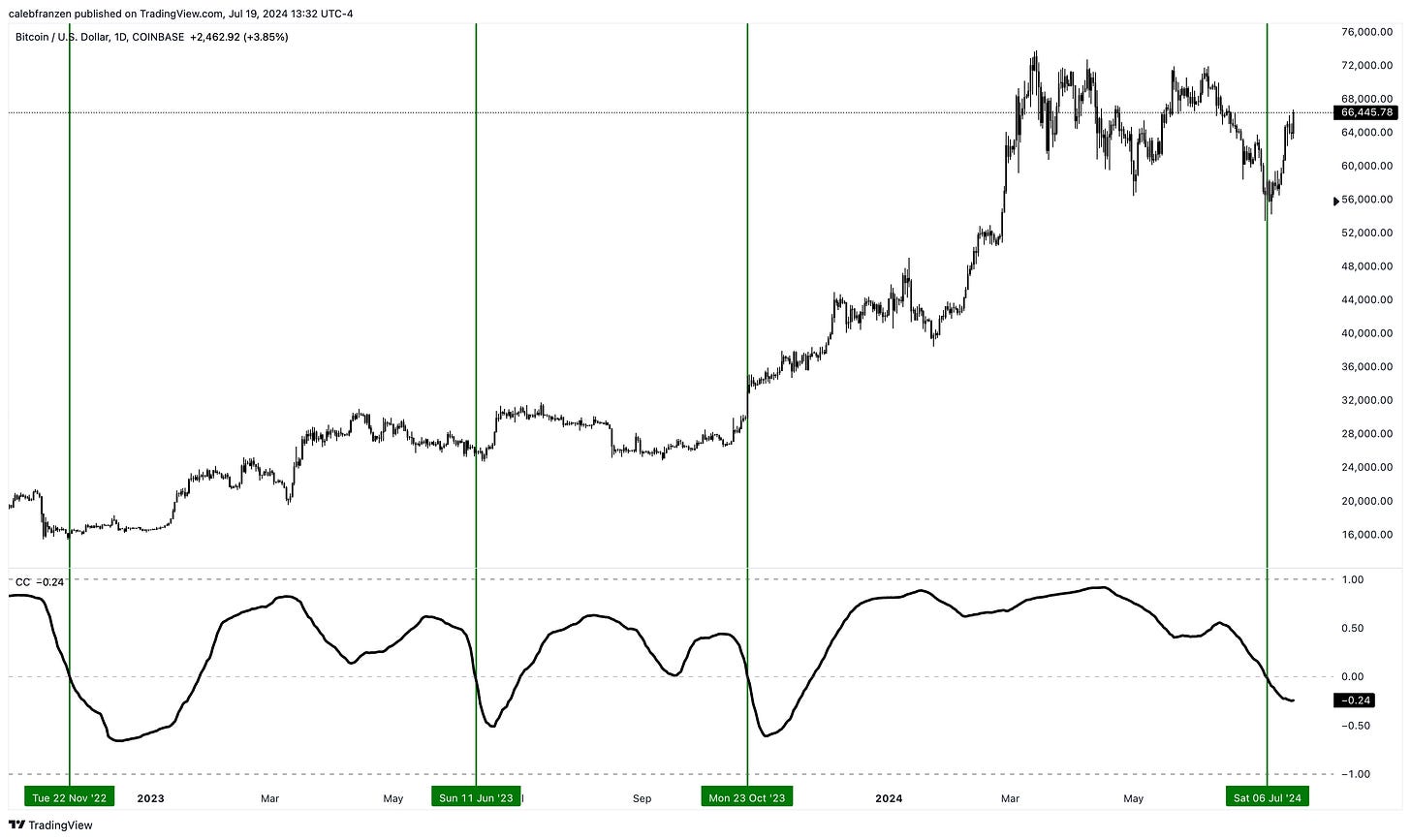

This past week alone, the digital asset gained +15% during a period where the S&P 500 fell by -1.9%, highlighting a recent divergence between Bitcoin and the stock market. I highlighted this negative correlation on July 3rd in a post on X, which I interpreted as a potentially bullish signal for BTC, shown in the updated chart below:

In the original post, I highlighted that these periods of negative correlation have been quite bullish for Bitcoin, and it looks like we’re seeing that follow-through take place.

This has occurred in an environment where demand continues to remain strong via spot Bitcoin ETFs, with the BlackRock iShares Bitcoin Trust ($IBIT) remaining at the top of the pack.

The BlackRock ETF alone had more than $707M in cumulative net inflows this week.

Thankfully, the recent release of REX Shares’ 2x leveraged spot Bitcoin ETF ($BTCL) has been extremely timely for this current Bitcoin rally that started on July 5th, and my new position in BTCL has been working out beautifully so far.

As you know, I have been extremely bullish on BTC since the initial breakout above its short-term holder realized price in January 2023 and the move above the 200-day moving average shortly thereafter. I viewed this latest decline from $74k to $53.5k as a massive opportunity, similar to the decline last August at $25k.

I received a tremendous amount of criticism for this post in August 2023, very similar to the DM’s and comments on my X posts three weeks ago when BTC had a range invalidation. The bearish sentiment was so extreme, it gave me even more confidence to allocate more. So I bought the retest of $58k and even had purchases below $55k, in addition to getting leveraged BTC exposure via different ETFs.

Since the release of the BTCL from REX Shares on July 10th, I’ve been rotating out of the futures-based leveraged products and rotating that capital directly into their spot-based ETF for long + leveraged exposure.

It’s a big swing, but one that I feel is appropriate for my risk tolerance, conviction, and outlook. If you disagree with me, then you have the option to take the other side of the trade with their 2x inverse fund, BTCZ. Either way, their spot-based derivate ETFs seem to be more efficient than the existing futures-based products in the market, at a lower fee.

I encourage you to read more about their Bitcoin products and do your research here.

Macroeconomics:

There are five topics that I want to focus on in order to share the key charts & macro-related datapoints that I found during the week:

Retail Sales

Atlanta Fed GDPNow

Industrial Production

Leading Economic Indicators

Credit Creation

First off, retail sales data was released for June 2024, with estimates projecting for a month-over-month contraction of -0.3%. The result was underwhelming in a vacuum, coming in at ±0%, but the key aspect here is that it beat estimates.

On a YoY basis, retail sales grew by +2.0% YoY, slightly below the prior result of +2.2%.

Is the data great? No, but it’s sufficient and still indicative of growth & resiliency.

If we dig deeper, the numbers get more optimistic…

Specifically, I want to highlight the retail sales ex-auto portion, which grew +0.4% MoM vs. estimates of +0.1%. In other words, without the contraction in auto sales, overall retail sales grew during the month of June.

Additionally, the most important datapoint from the retail sales is the “control group” result, which actually feeds into the quarterly GDP calculation for Q2 2024.

This datapoint specifically grew +0.9% MoM, drastically beating the estimate of +0.2%

The 3-month moving average of this figure has increased in 3 of the past 4 results, highlighting how consumption is actually reaccelerating.

This leads perfectly into the next main topic, the Atlanta Fed GDPNow forecast for Q2’24, because the control group data from retail sales is likely going to boost GDP results that come out this upcoming week.

Prior to the retail sales data, the Atlanta Fed’s model was forecasting real GDP growth of +2.0% (annualized) in Q2 2024, which would represent a modest acceleration vs. the Q1 2024 result of +1.4%.

Just hours after the retail sales data was published, the GDPNow model was updated to +2.5% and was then revised even higher the next day to +2.7%.

Notably, the Atlanta Fed cited the following as the key justification for the upward revision:

“real personal consumption expenditures growth and second-quarter real gross private domestic investment growth increased from 2.1% and 7.7%, respectively, to 2.2% and 8.9%.”

None of that sounds recessionary to me… but I guess we’ll just have to wait for the actual results next week. Either way, based on what we know right now, we should expect to see real GDP growth accelerate in Q2 vs. the result in Q1.

We also received new industrial production data, providing a keen insight on the dynamics of U.S. manufacturing. Wall Street estimates were projecting for growth of +0.3% MoM, which would have been a deceleration vs. prior results of +0.9%, but the results came in at +0.6%.

This marked the 3rd consecutive monthly increase & the 4th increase in 5 months.

I’m specifically focused on the year-over-year data, which is now growing at a pace of +1.6% YoY. While this certainly isn’t a breathtaking figure, growth is growth.

The fact of the matter is that industrial production is accelerating, bouncing out of negative (or contractionary) territory, which is very reminiscent of what happened in 2003 & 2017, both of which extended the economic expansion for several years.

Another key dynamic taking place is the persistent re-acceleration in the Leading Economic Indicators from The Conference Board, which was just updated this week.

Recent data confirms that leading indicators are still contracting, but accelerating.

All else being equal, this suggests that real GDP growth should accelerate too.

Again, the weight of the evidence is firmly suggesting that consumption & broader economic activity are growing and/or reaccelerating, which only becomes even more apparent when we consider what’s taking place in the credit market.

Recent data for loans & leases issued by commercial banks in the United States is also showing that credit growth is accelerating:

This current bounce in credit creation is very similar to what happened in 1996, 1999, 2003, 2014, & 2018, all of which postponed a recession, often by several years.

If more money is leaving the financial system and entering the “real” economy for productive reasons (more hiring, investment activity, plant production, new equipment, etc.), then this expansion in credit will help to fuel broader growth.

Together, this new macro data indicates at least one of the following:

The economy is growing

Economic growth is accelerating

The economy is likely to keep growing

Everything isn’t perfect, as some datapoints are outright deteriorating or softening, but the key data that I use to make a judgement on economic trends is generally pointing in a positive direction.

If you have a different process or emphasize other datapoints instead, so be it.

I’ll stick to my process and make the best judgement call that I can at the time, willing to change my mind if the weight of the evidence warrants a shift in my outlook.

Stock Market & Bitcoin:

I initially planned to write updated analysis on stocks & Bitcoin in this report, but I’ve decided to save that research for tomorrow’s premium edition of Cubic Analytics.

Usually, the premium reports have a free intro to ensure that the 11,000+ free members of Cubic Analytics are getting some material value out of the Sunday premium reports, but tomorrow’s edition will exclusively go to paid members and the entire post will be behind a paywall.

To join the 700+ members who are part of the premium team, visit the link below:

Of course, I’d be remiss if I didn’t say a massive “thank you” to all of the premium members who continue to support my work as an independent analyst. I’m so grateful for the kind messages that I receive and for the relationships that I’ve built with many of you. It’s truly phenomenal to know that my analysis & opinions are so valuable for you, teaching how I conduct analysis and why I focus on certain datapoints while providing transparent & objective thoughts on market dynamics.

Best,

Caleb Franzen,

Founder of Cubic Analytics

SPONSOR:

This edition was made possible by the support of REX Shares, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged & direct/inverse, to the NYSE FANG+ Index.

I first collaborated with the REX Shares team in 2023 because I’ve been using their products as trading vehicles since 2022 and it was an organic & seamless fit. They have a unique product-suite, ranging from leveraged products, to inverse products, and income-generating products.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.

Great work Caleb!

Excellent piece Caleb! 👊