Investors,

The S&P 500 & the Nasdaq-100 both achieved an incredible feat this week, securing 5 consecutive sessions where both indexes had their highest daily closes of all-time.

A specific cohort of investors continue to complain that breadth is weak and that the Magnificent 7 are putting the market on their back, using this information to justify a bearish outlook on the market…

I have a few retorts to this fallacious claim:

Was this an effective justification to be bearish in 2023? Answer: no, because we see clear evidence that the market continues to climb higher, despite the fact that there were periods of weak breadth in 2023. By very definition, an uptrend and/or a bull market requires expansion in new highs. Historically, periods of weak breadth are followed by expansion, as we’ve seen over the past 18 months.

Breadth is weak right now, no “ifs, ands, or buts” about it. So what should investors do with that information? I’ve provided three solutions:

Complain about it and cry that “most” stocks aren’t going up.

Stop stock-picking & just buy the index to benefit from market-cap weightings.

Start buying the MVP’s of the market because continue to act like MVP’s.

Complaining about it won’t solve anything, so investors are required to adapt or accept their fate when they invest in underperforming assets. I’d strongly suggest that there’s nothing bearish about the MVP’s of the market acting like MVP’s, as I’ve highlighted in the past. I talked about this on X earlier in the week, highlighting how the biggest & strongest stocks got that way because they have a consistent track record of being the strongest stocks:

You can complain about the fact that they’re acting like MVP’s or you can own them.

The choice is yours.

In the remainder of this report, I’ll specifically focus on disinflationary dynamics in the latest round of the CPI data, largely due to the fact that continued disinflation will create a bullish ripple effect for asset prices to remain in an uptrend. I’ve been pounding the table about disinflation for 18 months because of the positive impact that it has on asset prices, so it’s vital for investors to recognize that disinflation is intact. Unfortunately, many investors are still hating & misunderstanding disinflation.

Before jumping into that data, I also want to share a recent podcast that I did! I had a chance to catch up with my friends, Steve Strazza and Sean McLaughlin on their brand new show, “Off The Charts”. We talked about my decision to quit my corporate banking job, starting trading full-time, building a research business, and living abroad!

Check it out here:

Everyone Hates Disinflation:

First and foremost, it’s clear that disinflationary data has returned to the CPI (as well as the PPI and PCE) over the past two monthly reports; however, the data in the latest report for May 2024 was unequivocally disinflationary.

Yes, prices are still going up.

Yes, the rate of inflation is going down.

By definition, that’s disinflation (not deflation, characterized by falling prices).

It’s important to recognize that the Federal Reserve is not trying to achieve deflation.

On the contrary, they want to avoid deflation and are instead trying to produce sustainable disinflation until they achieve their target inflation rate of +2% YoY.

While half of the Fed’s dual-mandate is for “price stability”, I’ve often argued that the Fed doesn’t target price stability, but rather “inflation stability”.

Why?

If they aimed for price stability, the target inflation rate would be 0%. Given that their target is for an inflation rate of 2%, it’s impossible to have stable prices if prices are constantly rising, by definition. The math here is quite simple, at a 2% annual inflation rate, the purchasing power of a currency gets cut in half every 35 years.

I don’t know about you, but that doesn’t sound like price stability to me.

As market participants, it’s vital for us to understand five things:

The Fed is trying to achieve inflation stability of +2%, not price stability.

Disinflation (rising prices at a slower pace) and deflation (falling prices) are not the same.

The Fed is trying to produce disinflation in order to achieve their +2% target.

They are accomplishing this goal, but perhaps more slowly than desired.

There is still more disinflationary progress required to achieve this goal in order to change the current stance of monetary policy.

If you understand these five components, you’re better prepared than 99% of investors.

With this theoretical/qualitative information out of the way, let’s talk about the data…

Specifically, I want to highlight the following five charts & datapoints:

1. Headline CPI ex-Energy inflation was +3.2% YoY, down from +3.4% prior: While Headline CPI (all items) and Core CPI (ex food & energy) are important, my personal view is that All Items ex-Energy is a better metric than Core CPI. Plain and simply, this is because the Fed has zero control over energy prices and because energy prices are extremely volatile. I’m not saying that energy prices aren’t important (they are very important), but taking them out of the CPI helps to measure how all other non-energy components are evolving in terms of their rate of inflation.

Looking at the chart of YoY Headline CPI ex-Energy, we see the following:

The disinflationary trend in this variable has been crystal clear, aside from one hiccup in March 2024, and continues to show that disinflation is still intact. The YoY inflation rate for All Items ex-Energy is still too high, above the peak levels in the mid-90’s and the early 2000’s, but is trending back towards normal levels after spiking above +7% in mid-2022.

In other words, almost all of the uptick of YoY inflation in Q1’24 (and from Q3’23) can be explained by the sudden & unexpected rise in crude oil prices, which is something that I’ve been highlighting in real-time.

2. Headline CPI ex-Shelter inflation was +2.1% YoY, down from +2.2% prior: Shelter is the largest component of the CPI, comprising 33% of the headline basket and 41% of the core basket, but it’s also the laggiest & least practical component of the CPI due to the way that Owners’ Equivalent Rent is calculated. I’ve gone down that rabbit hole in the past, so I won’t dive into it today, but taking Shelter out of the CPI is a fantastic way of gauging “real-time” inflationary dynamics, particularly because private-market rental data is flat or negative on a YoY basis.

Therefore, given the large influence that Shelter has on the CPI calculation and the fact that it’s a laggy & inefficient component, I think it’s appropriate to remove it from the CPI and monitor how all other non-Shelter components are evolving!

As you’ll notice, a +2.1% YoY inflation rate is in line with the Fed’s +2% target!

Additionally, it has begun to experience disinflation again in the past 2 months, albeit at a modest pace. Either way, it’s also clear that the All Items ex-Shelter component is experiencing a rate of annual inflation that is consistent with the past 30 years! This metric quantifiably & indisputably tells us that the current rate of inflation for non-Shelter components is in the middle of the historically normal range!

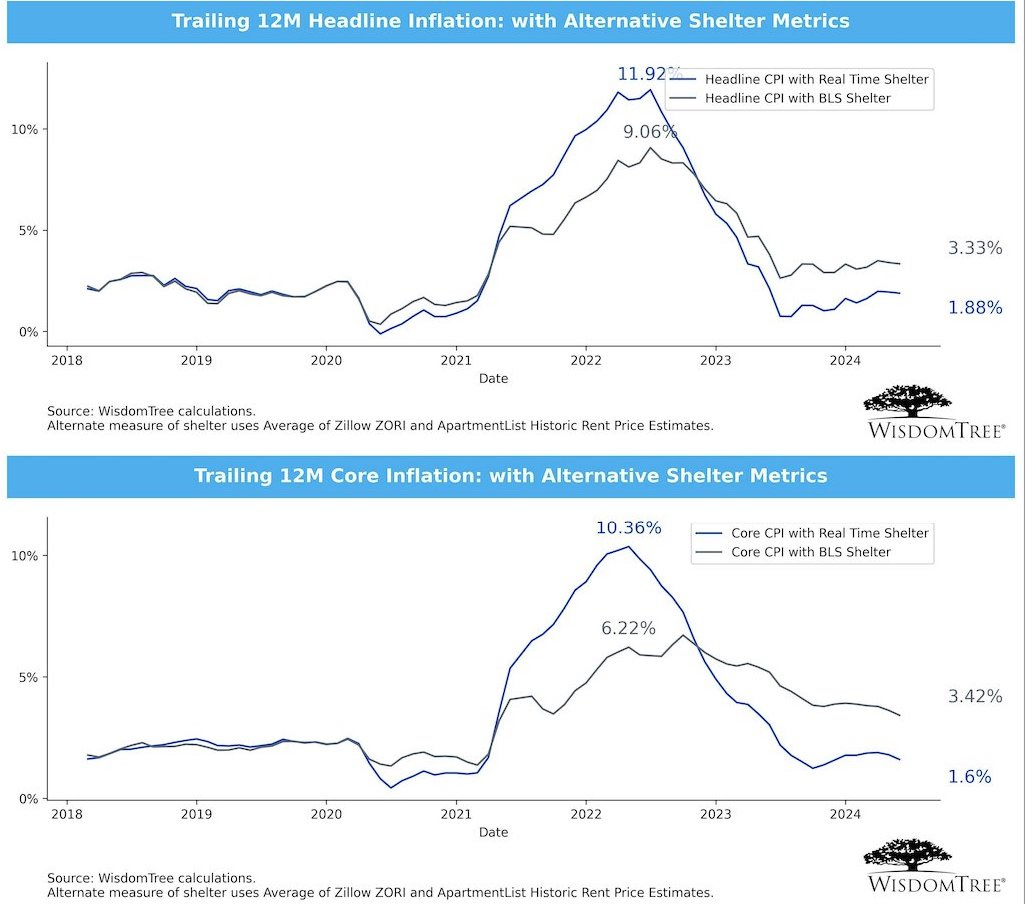

The fantastic team at WisdomTree actually calculates an “alternative” CPI measurement, swapping out Shelter for private market housing data from a composite of Zillow and ApartmentList data. They keep all other CPI components the same, but simply swap out OER for real, private-market data.

The result is stunning, for both of these alternative headline & core measurements:

With these real-time components, rather than the laggy OER, Headline and Core CPI inflation drop below the Fed’s YoY target! This is a fantastic, data-driven way to illustrate the lag effects and the inefficiency of OER.

3. Shelter inflation itself is +5.4% YoY, down from +5.5% prior: As I addressed above, the Shelter component is very important given that it has a 33% weighting in the headline CPI. While I like to extract it out of the CPI to analyze the inflation rate for all other components within the CPI, we can’t ignore the fact that Shelter has a significant influence on broader metrics for Headline & Core inflation.

As expected, this datapoint continues to experience disinflation and I expect that this trend will remain intact based on current readings for private-market housing data.

Just look at the correlation between Shelter & the Apartment List National Rent Index:

So we must ask ourselves, objectively, “what happens to Headline & Core CPI inflation if the largest component is expected to experience material disinflation over the next 8-12 months (the time-based lag effect of OER)?”

Hint: more disinflation (which has been my stance for the past 18 months).

4. Median & Trimmed-Mean CPI components continue to experience disinflation: These are alternative metrics for measuring broad-based inflationary dynamics, helping to provide additional context about inflation. Both of them have continued to exhibit disinflationary behavior during the Q1’24 uptick in headline readings and the are still exhibiting strong levels of disinflation today:

🟠 Median CPI was +4.3% YoY, down from +4.5% in the prior month.

🔵 Trimmed-mean CPI was +3.4% YoY, down from +3.5% in the prior month.

🟢 Headline CPI was +3.3% YoY, down from +3.4% in the prior month.

🟣 Core CPI was +3.4% YoY, down from +3.6% in the prior month.

Each of these four broad-based measures are experiencing disinflation YoY.

Regardless of how you slice it, there is unequivocal evidence that inflation is decelerating on a YoY basis, which is the exact definition of disinflation.

5. On a month-over-month basis, Headline CPI & PPI (producer prices) inflation showed significant progress: Producer price inflation is also showing clear disinflation on a YoY basis, but I’m keenly focused on how PPI inflation is evolving on a MoM basis as well, particularly because it actually experienced outright deflation on a MoM basis in May relative to April. Given the correlation between producer & consumer prices, and the fact that producer prices can act as a leading indicator for consumer prices, this is a vital component to monitor.

🔵 Headline CPI inflation (MoM) = ±0.0%

🔴 Headline PPI inflation (MoM) = -0.2%

Because MoM data will ripple into the YoY data over time, this is the exact type of progress that we (and the Federal Reserve) should be looking for to confirm that the YoY disinflationary trend will remain intact.

Conclusion: Looking at a broad range of data, it’s resoundingly clear that disinflation has returned after a brief hiccup in Q1’24, which was largely (if not entirely) caused by the rapid increase in energy prices. Inflation is a nuanced topic, requiring investors and analysts to parse through the data with surgical precision in order to evaluate the nature of the trend. By extracting certain components, analyzing alternative components, and looking at various time-based measurements of inflation, we allow ourselves to objectively review the data and develop a nuanced understanding of how inflation is evolving.

Why is this such an important exercise?

Because disinflation has been one of the primary catalysts, along with a variety of other catalysts, for the ongoing bull market in asset prices. Therefore, it’s been vital for investors to understand disinflation, the factors driving inflation dynamics, and to forecast how the Fed is interpreting this data.

Whether you like it or not:

Disinflation is intact

Disinflation is bullish for asset prices

Disinflation is what the Fed is trying to achieve

Disinflation will eventually cause the Fed to cut rates

Thankfully, myself and readers of Cubic Analytics have embraced nuance in order to understand these dynamics and use them to make beneficial investment decisions.

If you’re new to the team (11,500+ investors and counting), I hope this is informative and helpful to you and your journey as an investor/economist.

If you’ve been part of the team for awhile, I hope this was a refreshing overview of the ongoing dynamics that we’ve continued to monitor and stay on top of.

My belief is that disinflation is likely to persist and trend towards the Fed’s +2% target, which will create bullish tailwinds for the stock (and crypto) market amidst an environment of resilient & dynamic macroeconomic data.

This has been my outlook for 12+ months and I see no reason to change that outlook now, after a thorough review of the data and by taking the weight of the evidence.

Best,

Caleb Franzen

Founder of Cubic Analytics

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

I appreciate your analysis very much so, good job👍