Equities Are Outperforming

Investors,

Since the stock market bottommed in October 2022, the following statements are true:

The Nasdaq-100 has outperformed the S&P 500.

The S&P 500 has outperformed the Dow Jones.

The Dow Jones has outperformed the Russell 2000.

Based on these truths, we can arrive at a few key conclusions.

First of all, we can conclude that technology stocks have outperformed the broader market, given that the Nasdaq has the most tech concentration, followed by the S&P 500, followed by the Dow Jones, with the least amount of tech in the Russell 2000. Additionally, we can conclude that the more concentrated indexes have outperformed, implying that larger market-cap stocks have provided more alpha than smaller companies, on net.

Bears have used these objective facts to argue that the market is unhealthy, producing an unsustainable rally that’s been catalyzed by FANG+ stocks alone. While this statement is simply untrue (look at equal-weight technology stocks up +20% YTD), it’s also lazy and irresponsible. Would they prefer that the companies with poor fundamentals were outperforming? Would they prefer if the best companies in the world were underperforming? I don’t understand…

The fact of the matter is that equities have outperformed. Each of the indexes have produced CAGR’s that significantly exceed their average calendar year return!

I’ll say it again: equities have outperformed.

Not technology stocks. Not the “Magnificent 7”. Not AI stocks. Just stocks.

If you disagree, you must confront two facts:

Each of the indexes have produced CAGR’s that significantly exceed their average calendar year return! In other words, they’re outperforming their historic returns.

The Dow Jones just hit new all-time highs relative to U.S. Treasuries (TLT).

In fact, each of the indexes have hit new all-time highs relative to Treasuries within the past month. Relative to their alternative, equities have outperformed. That’s a fact.

In the remainder of this report, I’ll be covering the following topics:

Macro: Disinflation is still in effect, despite sequential increases in YoY CPI.

Stock Market: Indecision and the impact of seasonality.

Bitcoin: Bitcoin dominance.

Before diving in, I want to thank the team at MicroSectors for sponsoring this edition of Cubic Analytics! In addition to providing innovative investment products via their funds, they’re an amazing follow on Twitter & I’d encourage you to follow them. To learn more about MicroSectors, please read the notes at the end of this report.

Macroeconomics:

Since December 2022, I’ve firmly been in the camp of disinflation, arguing that the rate/pace of inflation is poised to decelerate and trend back towards the Federal Reserve’s illustrious 2% target. For the second consecutive month we saw an uptick in the YoY rate of inflation, as measured by headline CPI; however, I’m urging investors to dig deeper into the data in order to get a firm grasp on actual inflation dynamics.

My conviction in disinflation is unchanged and arguably stronger than ever.

As I’ve been saying for the past year, inflation has peaked but prices haven’t

Inflation is merely the rate of change of prices, and specifically the pace with which prices are rising; however, we can (and must) dive deeper under the surface in order to truly understand what’s happening with inflation.

Disinflation is simply the term used to describe an environment where prices are rising (aka inflation), but at a slower pace than they were before. For example, if the rate of inflation falls from +3% YoY after previously rising at a pace of +9% YoY, that’s disinflation. If it then falls to +2.5%, that’s also disinflation, even though prices are +2.5% higher than they were one year ago.

Disinflation is not the same as deflation, which describes a period in which prices are falling on a relative basis. For example, a period in which the CPI fell -1% YoY is deflation, implying that prices are 1% lower than they were one year ago. Again, disinflation is not the same as deflation because prices are rising in a disinflationary environment.

With this critical context in mind, these are the most important takeaways from the latest round of inflation data:

1. Headline CPI came in hotter than expected, driven by higher energy & gasoline costs.

On a month-over-month (MoM) basis, the Consumer Price Index increased by +0.6% in August vs. estimates of +0.6% and prior month results of +0.2%. On a year-over-year (YoY) basis, prices increased by +3.7% vs. estimates of +3.6% and prior results of +3.2%. This re-acceleration, both on a MoM and YoY basis, has many investors & economists scared that a second wave of inflation is now upon us. However, contextualizing the acceleration is key.

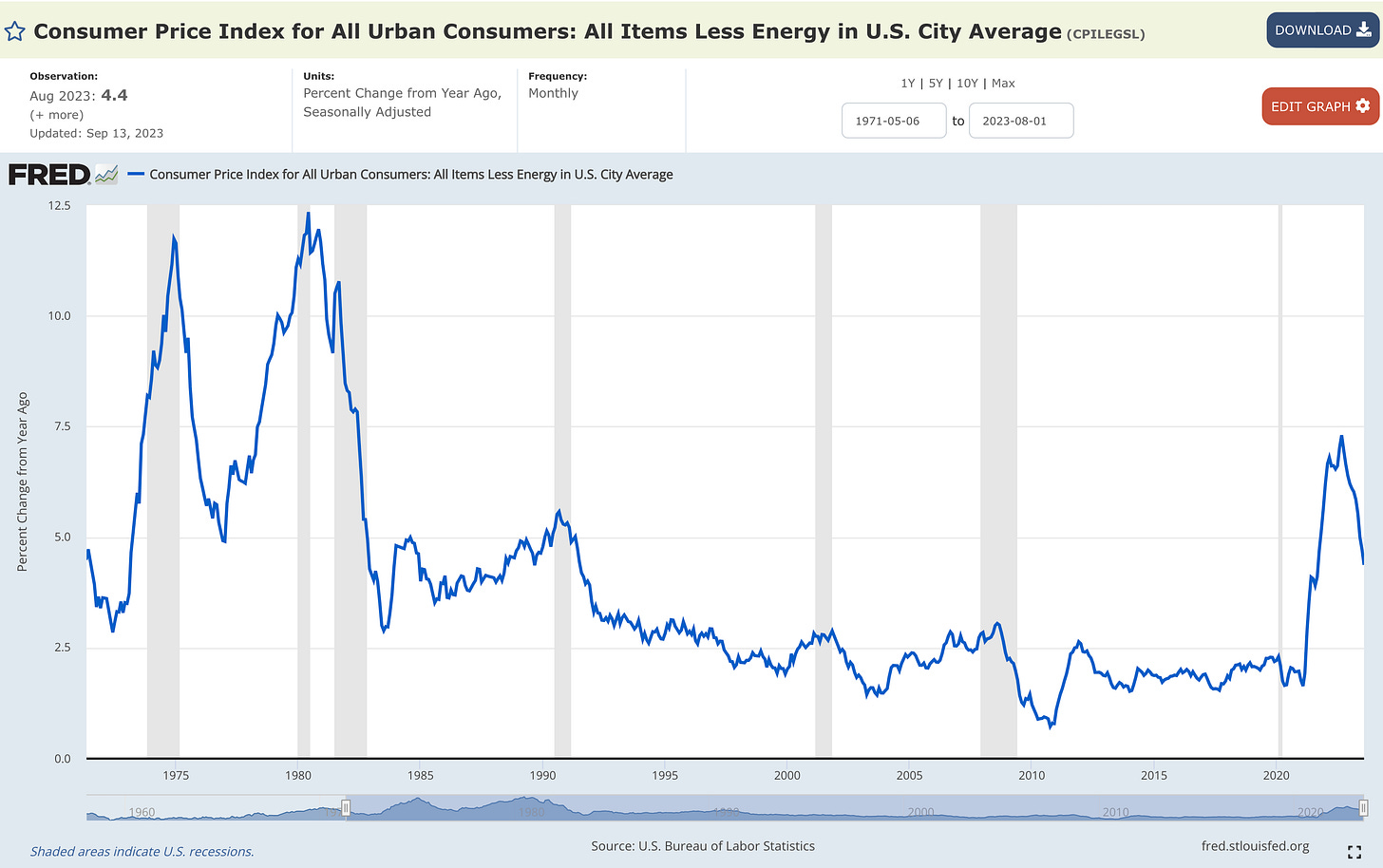

For example, more than half of the +0.6% MoM increase is attributed to higher gasoline costs. The Fed cannot control/influence energy prices, which are volatile and unguaranteed to remain high. While core CPI measures the rate of inflation excluding food & energy prices, we can isolate the influence of energy prices by looking at the following measurement: the Consumer Price Index All Items less Energy (YoY):

The result in August 2023 was +4.37%, down from July’s pace of +4.73%. This deceleration highlights how, on the aggregate, all other components of the CPI are experiencing disinflation on a YoY basis.

Is a pace of +4.4% still too high? Absolutely.

Is the pace decelerating? Absolutely.

It’s that simple.

After peaking at +7.3% in September 2022, it’s clear that disinflation is the theme.

2. Broad-based disinflation is unequivocal.

This post speaks for itself:

Expanding on point #1 above, a quick glance at the key individual components of the CPI shows us that we are experiencing broad-based disinflation. Notably, the Shelter component of CPI, which is 33% of headline CPI and 41% of core CPI, experienced substantial disinflation in August.

After rising +7.7% YoY in July, the result for August was +7.2%. This -0.5% differential was the largest sequential decline in the YoY measurement since it peaked in March 2023. Shelter dynamics continue to evolve exactly as I’ve predicted them, and I continue to reiterate my expectation that we’re going to see a massive deceleration in the Shelter component (aka disinflation) in the months/quarters ahead.

As yourself the following: What happens to the CPI if the largest and most significant component is experiencing massive disinflation? The answer: more disinflation, simply due to the composition of the CPI.

3. Core, median, and trimmed-mean CPI are still experiencing disinflation.

While headline CPI is an important metric, the volatility of food & energy prices have a significant influence and can perhaps distort our understanding of inflation dynamics. We shouldn’t dismiss headline CPI, but we must dive deeper.

These alternative metrics of CPI help us accomplish this deep-dive:

Core CPI (CPI excluding food & energy)

Median CPI (measures the median CPI component)

Trimmed-mean CPI (measures the weighted average of inflation rates of components whose expenditure weights fall below the 92nd percentile and above the 8th percentile of price changes. This is very convoluted, I know, but it’s basically tracking the average CPI component).

All three of these metrics experienced disinflation (once again) in the month of August on a YoY basis. The chart below from the Cleveland Federal Reserve shows the evolution of these three alternative metrics and the headline measurement on a YoY basis:

Specifically, here are the results & trajectories:

🟣 Core CPI fell from +4.7% to +4.3% (disinflation)

🔵 Trimmed-mean CPI fell from +4.8% to +4.5% (disinflation)

🟠 Median CPI fell from +6.1% to +5.7% (disinflation)

The data confirms, unequivocally, that the U.S. economy is still experiencing disinflation on a YoY basis. Given that the Federal Reserve targets YoY inflation, not month-over-month, I urge investors to stay focused on the bigger picture.

4. Conclusion about inflation & recent CPI data:

Are energy prices rising? Absolutely. However, they’re still negative YoY! I have no idea where energy prices will be trading 1 month from now, 3 months from now, or 6+ months from now. Stating, absolutely, that inflation will continue to accelerate based on the assumption of sustainably higher energy prices is irresponsible. I won’t ignore the possibility that energy prices are sustainably higher in the future, but many folks are basing their entire view of higher inflation on this premise. I simply won’t do that.

When we look at the consumer price index, on the aggregate and for individual components, I continue to see the manifestation of disinflationary trends. Nothing about the inflation data itself or broader economic data makes me believe that we’re going to see a sustainable re-acceleration of inflation, particularly due to the following:

Shelter disinflation is finally kicking into gear

Student loan payments will reorient demand

M2, deposits, and reserves are contracting

The real federal funds rate is positive

Nominal wages are decelerating

The quits rate is decelerating

Total hours worked is decelerating

Job openings are declining

China is experiencing deflation in both CPI & PPI

My belief is that these above dynamics will outweigh energy price trends, continuing to produce more disinflation in the months & quarters ahead.

If you disagree, please let me know why in the comments!

Stock Market:

Thankfully, investors are taking a nuanced approach to evaluate inflation dynamics and continue to be unfazed by the recent uptick in YoY headline CPI. In response to the release of both CPI on Wednesday and PPI on Thursday, the S&P 500 rallied +0.96% over those two days. Unfortunately, the market didn’t perform well on Friday, with the index falling -1.22%; however, I’m not able to point a finger at a specific catalyst that caused such decline.

As I highlighted earlier in the week, I’m feeling quite indecisive about the market right now and where the index is likely to go in the coming weeks.

If you’d like to join the premium team in order to attend future weekly Q&A sessions, consider upgrading your subscription today or reach out to me directly with any questions: calebfranzen@gmail.com

Adding to my indecision is the fact that seasonality implications are unfavorable.

Per data from Bespoke, the post-WW2 returns for the S&P 500 are quite choppy during this time of the year, on average:

Traditionally, the July - October window is a choppy mess for the S&P 500. So far, the market has been choppy during this window in 2023. In other words, there’s historical precedence for the lack of conviction in the market right now. Given the average historical performance, we can extrapolate a high probability that the market will remain choppy for the next 4-8 weeks. Therefore, barring a fundamental shift in the trajectory of future cash flows or the interest rate environment, we should be hesitant to make decisive statements about where the market is headed in the short-term.

Sometimes, saying “I don’t know” is the only proper answer.

Bitcoin:

If seasonality is indecisive for equities, we can also extrapolate such indecision and apply it to Bitcoin. If we expect more indecision for Bitcoin, we can expect a lot of indecision in the altcoin universe. Said differently, I wouldn’t be surprised if Bitcoin dominance rises in the coming weeks.

For the uninitiated, Bitcoin dominance is simply a calculation of Bitcoin’s market cap divided by the total market cap of cryptocurrencies, creating a percentage. That percentage currently stands at roughly 50%, implying that Bitcoin’s market cap is half of the total crypto market.

Structurally, this “price action” of Bitcoin dominance is bullish, implying that Bitcoin’s market cap relative to the the size of the total crypto market is expected to grow. Not only did we retest former resistance and flip it into support, but BTC.D is also breaking out of a short-term trendline that formed in June.

Objectively, this leaves me bullish on Bitcoin relative to altcoins. Perhaps Bitcoin falls over the coming weeks. If it does, I expect altcoins to fall further. Perhaps Bitcoin rises over the coming weeks. If it does, I expect it to outperform altcoins.

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged and direct/inverse, to the NYSE FANG+ Index. They have a suite of products ranging from big banks, to oil and gas, and even gold/gold miners.

I started a partnership with MicroSectors in 2023 because I’ve been using their products for over a year and it was an organic and seamless fit.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.