Economy:

Yesterday, the Beige Book report published by the Federal Reserve was released for the month of August. The report 32 pages about economic activity and business conditions in each of the 12 Federal Reserve Districts. On a national scale, here were the main highlights that caught my attention, followed by my own personal opinions & commentary in italics.

On “Overall Economic Activity”:

Economic activity decelerated, but continues to grow at “a moderate pace”. The deceleration is attributed to contractions in the dining, travel, and tourism amidst the rise of the Delta variant.

Strongest sectors: manufacturing, transportation, non-financial services, and residential real estate. I was optimistic when I saw this because it’s a good combination of goods and services. It appears construction spending in both residential & commercial was up slightly and picked up moderately. I think these factors

Declining activity was generally caused by “supply disruptions and labor shortages, as opposed to softening demand”. The silver lining here is that consumption trends have remained relatively strong. The issue is that supply & labor bottlenecks are serious problems within the fundamental economic system. It would be harmful to remain in an environment where these conditions persist for another 6+ months. I’m hopeful that the labor shortages will get ironed out, truly improving in December 2021 & consistently getting stronger. I suspect the semiconductor shortage could be a persistent problem for the entirety of 2022, so I’m not overly optimistic that it will end soon. That has implications for a wide variety of sectors & industries, including the auto market.

Loan volumes were mixed, ranging from positive to negative depending on the District. Business outlook remains positive for their “near-term prospects”. Ideally, I’d like to be seeing more demand for loans. Specifically, loans for business investment and capital expenditures, as opposed to refinancing or purely an expansion in their borrowing capacity.

On “Employment and Wages”:

All Districts are reporting rising employment, but at a pace of “slight to strong”. There’s a strong demand for workers, but “all Districts noted extensive labor shortages that were constraining employment and… impeding business activity”. No surprise here, this is the general theme that we’ve been covering since I started this newsletter in May 2021. I suspect it will persist until December 2021 at the earliest.

“Employers were reported to be using more frequent raises, bonuses, training, and flexible work arrangements to attract and retain workers”. Great news for employees, who are seeing nominal increases in their wages & value-earned in job skills. The fact that wages have accelerated is an important win for employees and unemployed individuals seeking opportunities. Because there are incentives to remain on unemployment, the discontinued benefits at the end of Q4 2021 will speed up the recovery in the labor market.

On “Prices”:

50% of the Districts reported the pace of rising inflation as strong, while the other half “described it as moderate”.

Pervasive resource shortages have caused input prices, such as raw materials or commodities (oil, aluminum, copper, electricity, uranium, etc.), to continue to rise. Notably, the price of lumber has collapsed in recent months.

In response to rising price pressures, businesses are “finding it easier to pass along more cost increases through higher prices”. No surprise here. When demand remains strong, but supply constraints make it difficult to meet that demand and in combination with rising input prices, producers will transfer those higher input prices to the end-consumer.

Businesses in several Districts “anticipate significant hikes in their selling prices in the months ahead”. At this point, this isn’t a great sign for the Fed’s expectation of “transitory” inflation. Transitory is simply temporary. However, if inflation has already been rising substantially since January 2021, and businesses are planning to continue raising prices, inflation may be more persistent than the Fed believes. I’ve been on record saying that I believe inflation will be transitory, but I am starting to have increased doubts. I’ve also said that I think the 12-month change in the CPI could reach 7% to 10%. All predictions are still in play, but I continue to be open to the idea that I’m incorrect.

The link to the full Beige Book report can be found here.

Stock Market:

We’ve had two straight days of choppy market conditions; however, each index remains at/near ATH’s. Over the last two days, each of the indexes have performed as follows:

Dow Jones: -0.96%

S&P 500: -0.47%

Nasdaq-100: -0.21%

Russell 2000: -1.85%

Clearly, it’s been toughest for value stocks, mature businesses, and small-cap companies. It’s an interesting group to all be struggling at the same time, particularly as tech companies are a mixed back. Regardless, all four indexes are in the red so far this week.

Last Friday, I raised my cash levels by closing out winning trades in some of my largest positions, with the intent to do one of two things: increase other positions on a dip, or to purchase an NFT. With the dip over the last two days, I have almost fully reallocated all of the cash I raised last Friday. I started several new positions over the last several trading sessions, and also added to very new positions that I intend to still buy more of. I remain optimistic on equities in the short, medium, and long-term, as shown by my full allocation and primary holdings in technology and consumer discretionary stocks.

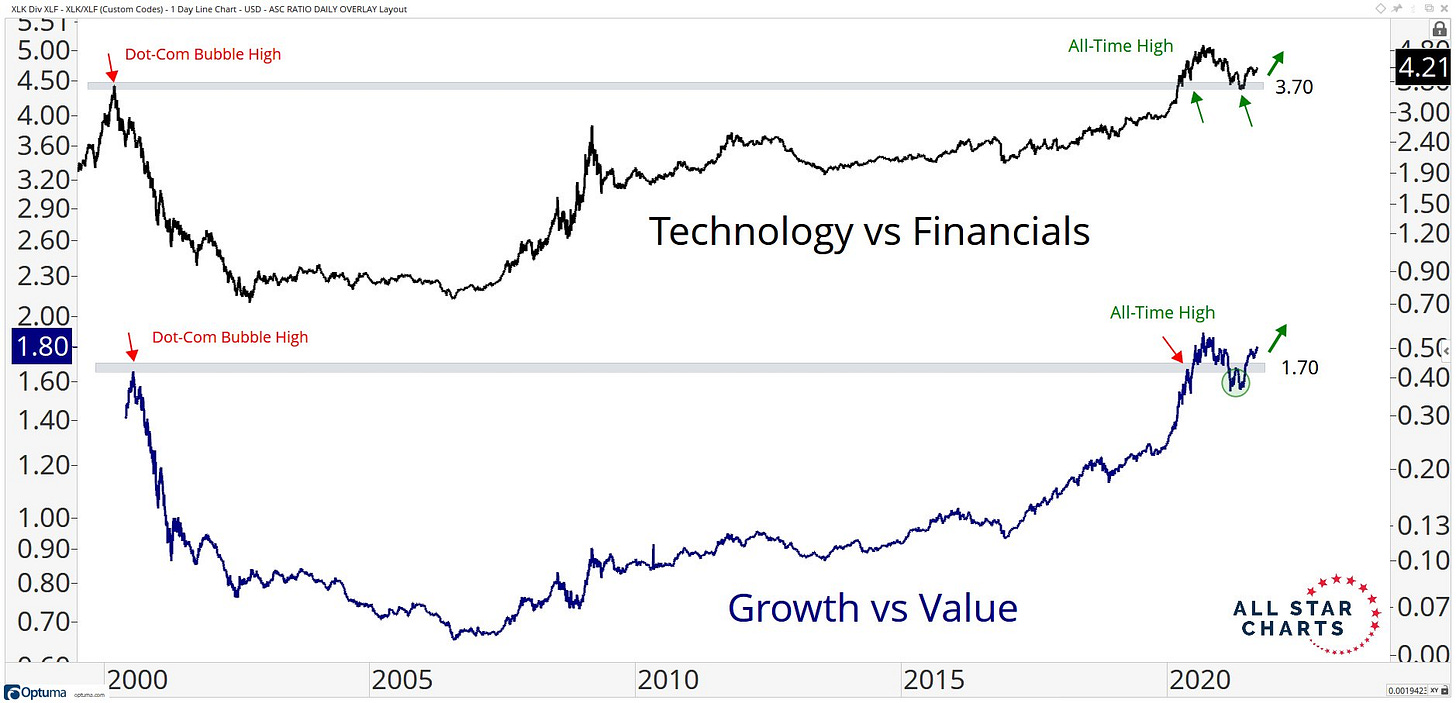

With that being said, I’m also willing & comfortable to convert more than 50% of my equity portfolio into cash in a single-day if need be, so I’m comfortable taking on higher levels of short-term risk if I have the capacity for it. Per the data below from Steven Strazza (@sstrazza on Twitter), we can clearly see how tech has outperformed financials meanwhile growth has outperformed value.

Until proven otherwise, that’s where risk-tolerant investors are likely to continue to have high demand for tech & growth companies. These companies will generate high (and hopefully sustained) revenue growth, reinvest everything into their future growth, and not be inhibited if they generate a net loss. They can borrow at historically low levels of interest & thereby have lower debt-servicing costs per dollar borrowed, so they have clear incentives to leverage their future growth.

Cryptocurrency:

There are several quick-hit topics that I want to cover because there’s been impactful news in this space since my last report.

First, El Salvador has functionally adopted Bitcoin as legal tender as of Tuesday. Merchants & consumers throughout the country can accept or offer Bitcoin as a means of exchange, even at locations in McDonalds and Starbucks. This video below shows the transaction:

Aside from it being the official date of Bitcoin adoption in the country, the government made some key announcements about their own BTC purchases. El Salvador’s president, Nayib Bukele announced on Sunday that the government owned 400 BTC. This amounts to 0.0021% of the total circulating Bitcoin supply. However, Bitcoin’s price fell substantially on Tuesday morning, falling -17.3% in ten hours. during the collapse, president Bukele announced that the government bought more.

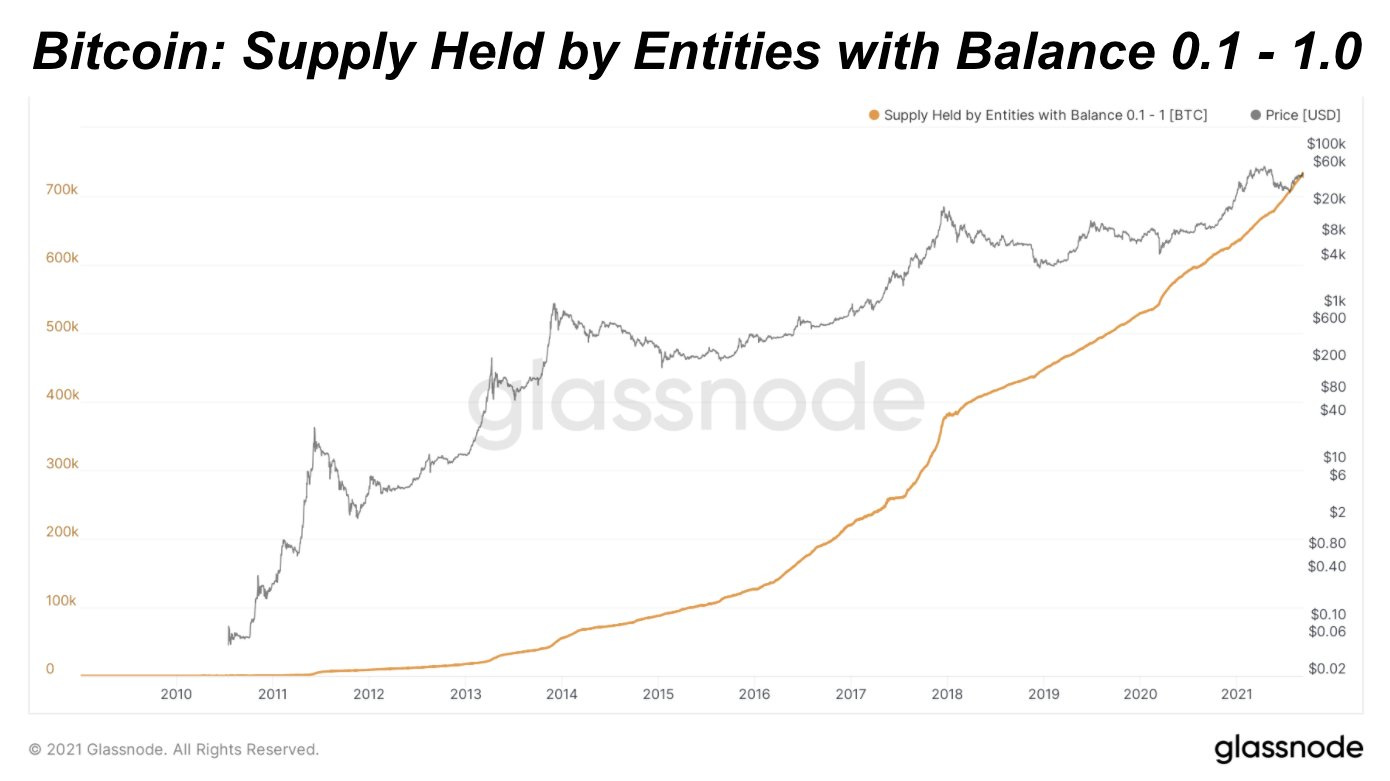

Finally, I want to end with this chart from Glassnode, showing the price of BTC over-layed with the number of account owning between 0.1 and 1 Bitcoin.

As we can see, adoption continues to grow at a steady rate. We’ve seen accelerations as the price accelerates, but the overall trend is distinctly a steady & consistent rise. Not only do I think this will continue to be the case, but I expect we’ll see an exponential curve in adoption soon, similar to what the market experienced in 2016-2018.

Talk soon,

Caleb Franzen