Edition #89

Mega-Cap Tech vs. Central Bank Assets, S&P 500 Grinds Higher, Bitcoin Transaction Volume Hits New ATH

Hey everyone,

Quick reminder that after this edition, we are going to be switching to a new cadence of two reports per week. The format & topics of these reports will remain intact, where I’ll cover the most important data and provide analysis on economic conditions, stock market dynamics, cryptocurrency adoption, and occasionally on real estate. The general plan will to publish one edition on Saturday morning and one during the work week, likely on Wednesday or Thursday depending on the flow of new data. Keep an eye out on Saturday morning for the next version of the newsletter!

Economy:

Realistically, the following graph could fall under either the “Economy” or “Stock Market” section, but I figured to include it here since the data includes central bank liquidity metrics. Below, we can see the tight correlation between the aggregate performance of mega-cap technology stocks vs. the aggregate growth of global central bank balance sheets.

In the paper that I published at the beginning of 2021 to explain my outlook on U.S. equities, this was arguably the primary reason for my exuberance. Since that publication, the Fed has been purchasing at least $120Bn/month in assets (comprised entirely of Treasuries and agency-MBS) and the assets on their balance sheet have increased from $7.3Tn on December 30, 2020 to $8.3Tn today.

Even when the Federal Reserve begins to launch the tapering process, they’ll continue to purchase assets at a near-historic rate, which should continue to provide strong tailwinds for dollar-denominated assets going forward. Will it be less monetary stimulus? Yes, but it will still be a substantial amount of monetary stimulus.

Stock Market:

The folks over at LPL Research continue to post great information about the S&P 500, highlighting how the index has now achieved seven consecutive months of positive gains. I previously analyzed the data that they shared when the S&P 500 achieved six consecutive months in Edition #65 in the “Stock Market” section:

As we’ve now added one more month to the count, this is simply just an updated version of the chart that we previously covered.

The main takeaway remains exactly the same: the outlook for U.S. equities should remain very positive. The 12-month return after achieving seven consecutive months of positive returns is an average of +9.5%. In the 21.4% of cases where the S&P 500 is negative twelve months later, the average loss is -5.4% Meanwhile, the 78.6% of cases where the index is higher has an average return of +13.6%.

On every time frame, the index is higher on average. Historically, there are certainly individual cases where the index has slipped, but these are less likely to occur relative to the historical data & results. Basically, someone with an investment horizon of longer than three months should be feeling fairly optimistic (but cautious as always).

Cryptocurrency:

After Bitcoin briefly eclipsed back over $50,000 over one week ago, the price of BTC continues to fluctuate in the $47k-$49k range. I haven’t been too concerned with the daily performance, as I expect it will take time for investors to get re-acclimated to these prices after three months of hard times. Additionally, there are likely a lot of investors who purchased in the $45k-$63k range and have had a hard time stomaching the volatility. Maybe they were determined that they wouldn’t sell their BTC at a loss, and will be sellers once price gets back above their cost basis. This should put some downward pressure on BTC after mini-spikes in price, similar to the exact kind of price action we saw when price rose from $43k —> $50k in less than a week, then proceeded to consolidate for at least a week.

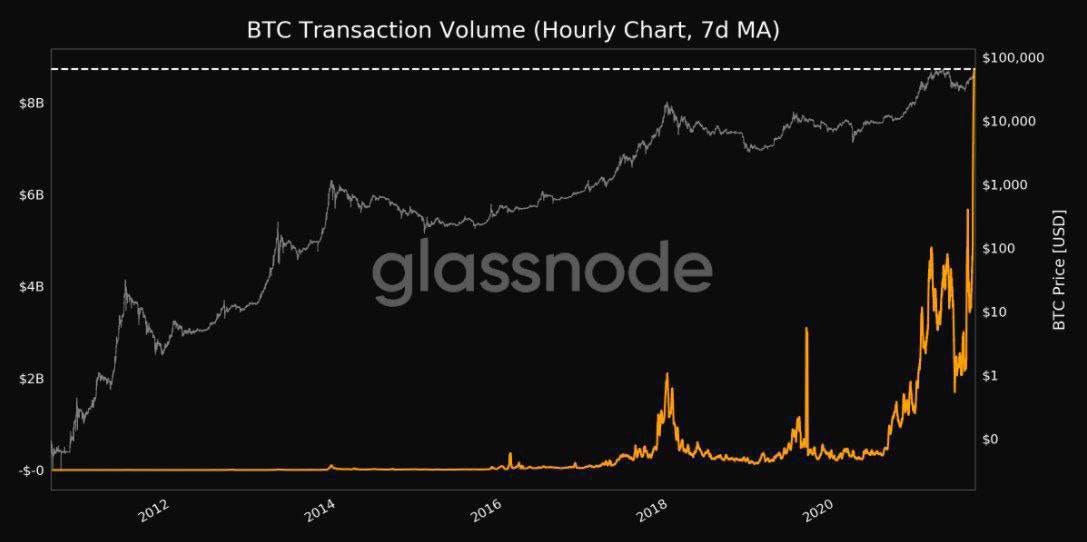

The market is merely digesting these new prices; however, trading volume is extraordinarily high. This somewhat confirms the market psychology that I just outlined above. In fact, the average transaction volume of a seven-day span for last week was $8Bn, a new all-time high.

I don’t think that this new record has any direct implication on the short-term price, but this is just further confirmation that adoption & usage continue to rise. I think it’s pretty clear that I expect price & adoption to continue to rise over time.

Talk soon,

Caleb Franzen