Edition #88

Shanghai Shipping Rates, Corporate Earnings vs. S&P 500, New Home Sales by Price

Economy:

I continue to remain focused on shipping and freight costs as a way to gauge supply constraints and bottlenecks. As we know, the Federal Reserve has recognized that these supply bottlenecks pose a threat to keeping inflation transitory, making it more probable that inflation persists for longer than expected. Therefore, keeping a pulse on this could allow us to preemptively monitor how the Fed is viewing inflation factors. Additionally, the shipping market dynamics have important impacts on the semiconductor industry, particularly as the shortage remains prevalent.

If we focus specifically on some of the Shanghai routes, it’s clear the market is in an extremely unique space. Is this healthy? Certainly not. Is it extremely damaging to the economy? Not necessarily. However, I continue to believe that a sustained rise in shipping costs will put a floor under the inflation rate. The hope is that it doesn’t lead to sustained inflation.

I also believe the Fed and align with their expectation for inflation to be transitory, although there’s certainly a risk that it persists longer than expected. I’ve tried to think of what conditions I would consider “longer than expected” to be damaging to underlying economic conditions. This is both a time factor, as well as a magnitude factor. For example, I think a 12-month CPI rate of +5% for eight months would be considered far from ideal. Similarly a rate of +8% for three consecutive months would be unwelcome. Are these likely outcomes? I don’t think so, but it’s worthwhile to be aware that it’s possible.

Stock Market:

One of my views that I’ve made very clear is that I think the interest rate & monetary policy environment is the key driver of stock returns. Fundamental operating performance, consumer confidence, fiscal policy, and a variety of other variables also play extremely important roles, so I don’t mean to discount their importance.

Quite simply, companies are producing revenues & earnings at a higher rate than ever before. It’s undeniable.

As earnings consistently and substantially have risen over time, so has the S&P 500. This only tracks the volume of corporate profits after tax, so I’d also be keen to see data showing the correlation between EPS growth rates each quarter vs. quarterly returns for the S&P 500.

Seeing this chart forces us to ask a simple question: will corporate profits continue to rise over time? If so, we’d be able to reiterate a positive view on U.S. stock returns going forward, even if that means having to survive downturns and/or higher volatility. I fully expect corporate profits to keep chugging along — companies are driving innovation forward, producing new value that didn’t used to exist. For example, cloud computing wasn’t a factor 25 years ago, but is a key service in today’s economy. Amazon’s AWS generated $4.192Bn in operating income in Q2 2021 alone! That $4.192Bn was nonexistent until 2006, when AWS became operational. In Q2 2020, it was $3.357Bn and only $863M in Q2 2016.

Innovation drives value creation, and the direction of computer science, healthcare, consumer technology, business intelligence, and robotics are extremely encouraging. Investing in stocks is essentially a bet that innovation will continue to flourish. I’ll always bet on smart people doing amazing things.

Cryptocurrency:

No update.

Real Estate:

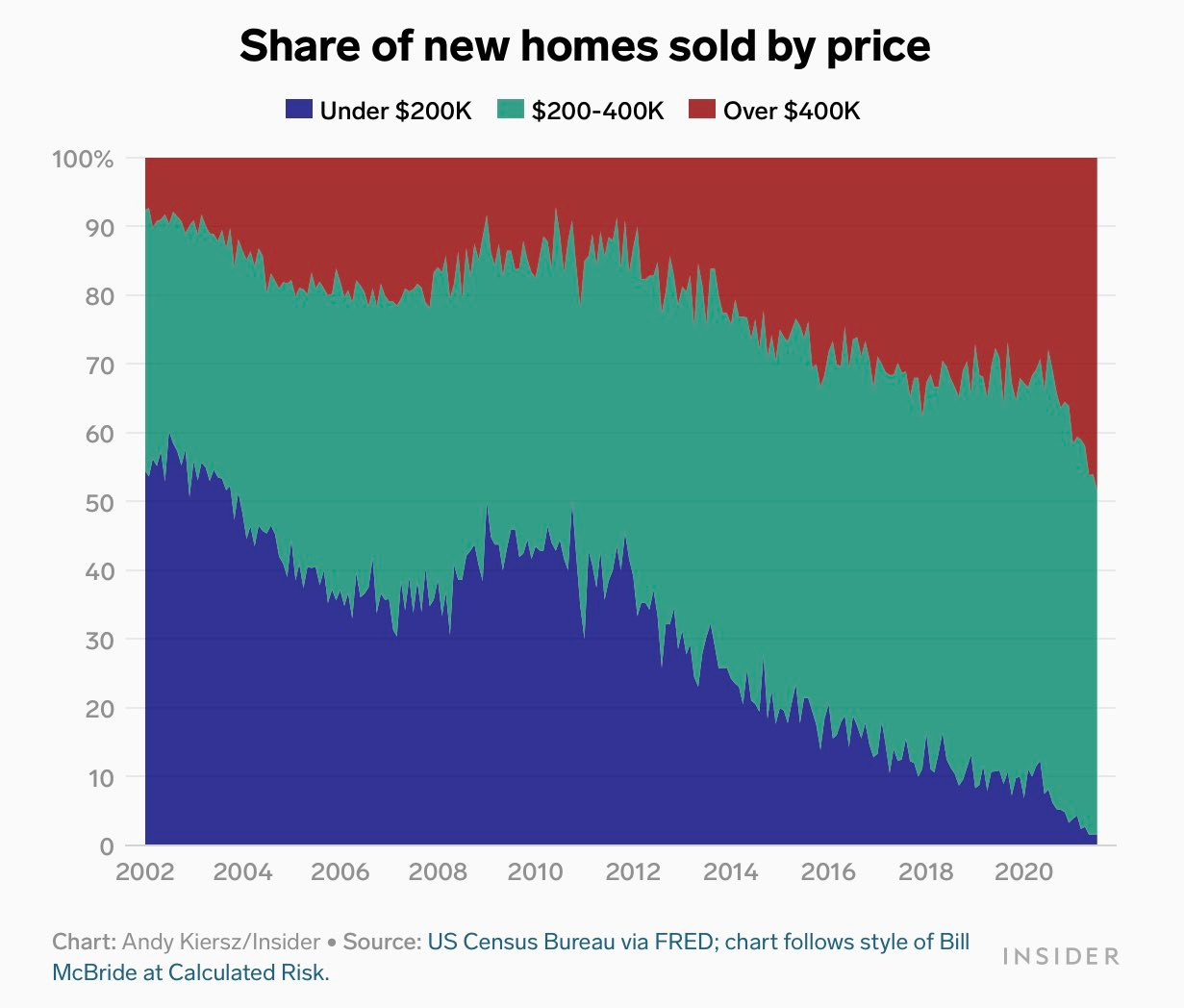

I saw some great data from Liz Ann Sonders (@LizAnnSonders on Twitter) about the percent of housing sales by housing price in the United States.

Based on this data, it’s quite evident that more expensive homes are increasing in market share while low income homes are becoming less sizable in relation to total new home sales. The simplest conclusion is that the price of new homes continues to rise over time, or that the floor of prices in new home sales is also rising over time. This is largely a function of two things: a rise in income per household and a decrease in mortgage costs as a result of lower interest rates.

As a result, housing prices have risen substantially, and it’s become increasingly hard to find new homes at the lower-end of the price scale. I hadn’t previously seen data illustrated this way before, but I was not at all surprised to see this evidence. This trend will likely continue to persist.

Until tomorrow,

Caleb Franzen