Edition #68

ADP Payroll Misses, ISM Service & Manufacturing Sectors Beat, Commercial Real Estate Recovering

Economy:

Over the last two weeks, we’ve continued to cover data regarding initial unemployment claims, in which the results have been significantly worse than expectations. While I continue to believe that these figures will trend down over time, I have been on the record that we’d see a stagnation in employment data in the July to September months. We’ve started to see this become a reality, which is further exhibited by yesterday’s ADP private payroll data for the month of July. This data specifically measures the month-over-month change in private employment. Consensus estimates were expecting an increase of approximately 695,000 jobs while the prior month data was at +692,000.

The result for July 2021 was an increase of 330k, significantly lower than estimates & the prior month data. While employment did expand, it was not up to par with the recent data that reflected a labor market that was roaring back. Here’s a great chart showing the monthly ADP data going back to July 2020, in which the average over these 13 months of data is 429k.

As the labor market continues to reflect softness, the Federal Reserve will likely interpret that to mean that their current level of asset purchases & monetary policy are appropriate. This will extend the timeline for them to start tapering, ensuring that ample liquidity is flooding the financial system. In my opinion, if labor data remains at/around current levels for the remainder of Q3 & majority of Q4, we will not see tapering by December 2021 and it will likely get pushed out towards the end of Q1 2022 or early Q2 2022.

To make a long story short, weaker labor data means the Fed can substantiate a continuation of their current asset purchases for longer than the market is currently expecting. As those expectations adjust, meaning rates will be lower for longer, asset prices will see strong tailwinds & likely continue to rise in the intermediate term.

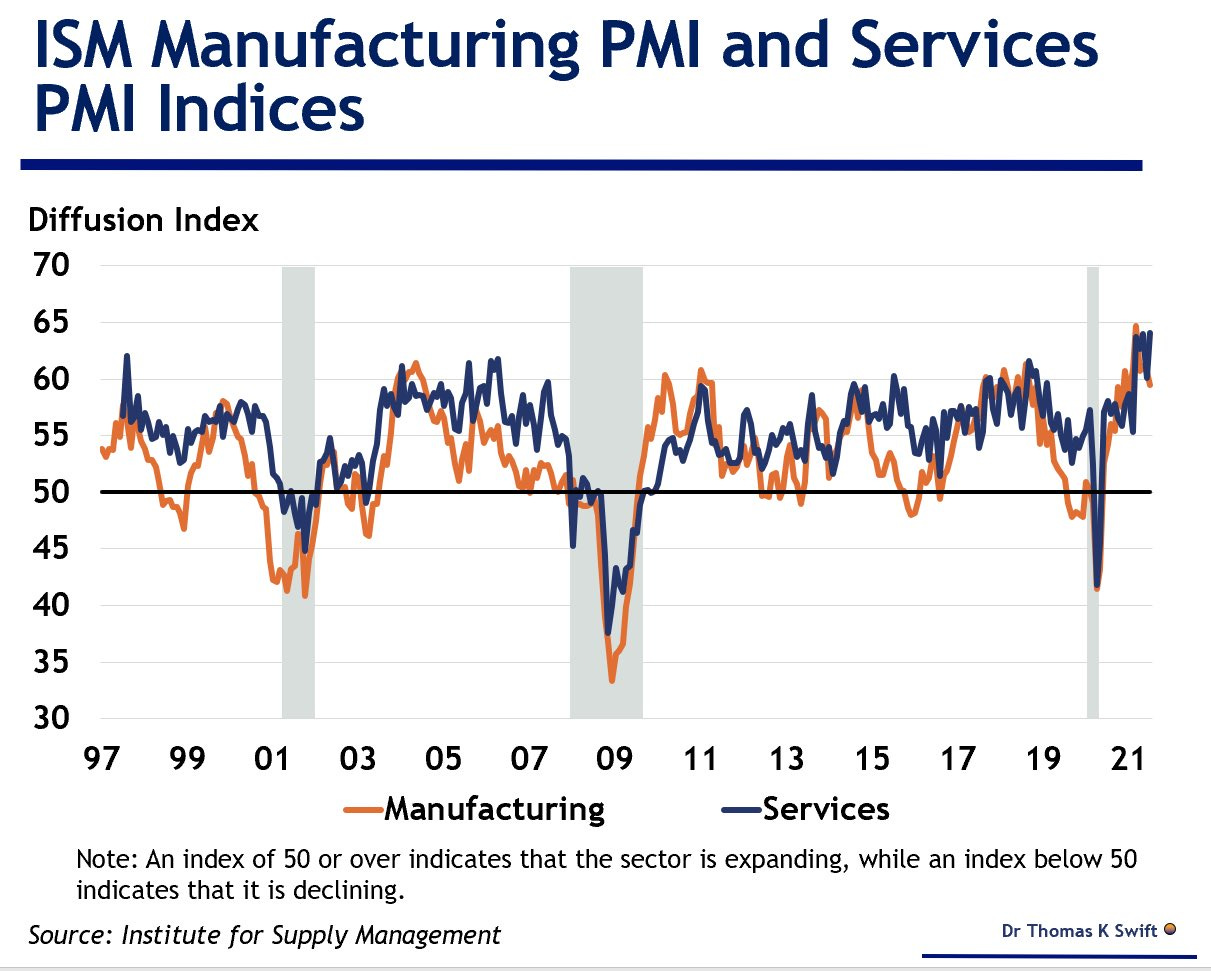

While labor data came out fairly weak, leading to an immediate decline in 5, 10 and 30-year Treasury yields, the U.S. ISM services index hit a record level of 64.1 for July 2021. Similar to the Chicago PMI that we covered earlier in the week, a reading over 50 indicates that the service sector is expanding. The index rose by 4.0 points relative to the prior month, indicating that the service sector grew at an accelerated pace. New orders, business activity, and new export orders all came in stronger than expected. Considering that the ISM manufacturing index came out a few days ago at 59.5 (also beat expectations), it appears that both the service & manufacturing sectors are doing extraordinarily well & are clearly expanding.

This makes the job data even more concerning in my opinion, as it reflects a high degree of slack between the business environment and the labor market. This divergence will certainly close at some point, but economists are hoping that will come sooner rather than later.

Stock Market:

No update.

Cryptocurrency:

No update.

Real Estate:

DoubleLine Capital, an asset management firm founded by one of my favorite investors and market analysts Jeffrey Gundlach, published research on the commercial real estate market for the month of July. The link to the full paper, written by Morris Chen and Mark Cho, can be found here. The observations in this market update provided a strong analysis on broader economic conditions, as well as the complexities & specifics within the commercial real estate (CRE) market. Here are some of the key takeaways I had from the report:

Within CRE, lodging & retail properties continue to be the hardest-hit sectors, “while multifamily, industrial and office demonstrated stronger resiliency”.

Delinquencies greater than 30 days have improved across all property types over the last 12 & 15-month periods, however, the industrial sector is the only one of the 5 sub-groups that has a lower delinquency level today than it did as of 3/31/2020. On the aggregate, delinquency rates are approximately 6%.

Transaction activity is substantially higher than it was one year ago, with volume approximately +79% higher.

Within the office sector, “tenants have… traded up in quality to properties that are newer, better located and better amenitized” due to their need for less space. As such, office space tenants are downsizing & upgrading, essentially offsetting any real increase in costs.

Office spaces are trending towards an emphasis on collaboration & flexibility.

“Many tech companies, which have been at the forefront of the WFH dynamic, have actually expanded their office footprints across markets and were one of the biggest drives of leasing demand in 2020”.

DoubleLine expects “continued inflationary pressures from rising demand, driven by the government stimulus and continued reopening of the economy, coupled with supply constraints due to supply-chain bottlenecks, imbalances within the labor market and impacts from climate change”.

Real estate and tangible cash-flowing assets in general have historically acted as strong inflation hedges due to their cash flow appreciation and value appreciation. Because rents reset periodically, the owner of the rent can adjust prices on a relatively frequent schedule and even contractually agree to inflation-adjusted pricing terms. Hotels have the most flexible pricing frequency on a daily basis.

Outstanding commercial mortgages are $3.9Tn, in which nonbank lenders comprise 10% of the market. Of this $3.9Tn, it is expected that $2.4Tn will mature over the next five years.

I found this report to be extremely informative, doing an excellent job of framing the CRE market within the broader economic dynamics. I found it especially interesting due to the fact that the narrative at this time last year was extremely pessimistic on commercial real estate as a whole. In fact, I had even been offered a job in June 2020 as a junior broker at a national CRE firm and interviewed with their associates in a variety of sectors in the San Francisco area. At the time, I was most keen to work with the industrial and multifamily property types due to their economic resilience and the negative sentiment on retail & office spaces. Almost all of the guys I spoke with at the firm portrayed a high degree of confidence that their respective sector would bounce back, but noted that transaction activity and inventory levels were historically low. Even though they maintained a sense of optimism, I’d be willing to bet that they’d all be surprised with how the market has surpassed almost all expectations.

Until tomorrow,

Caleb Franzen