Edition #65

Manufacturing Boom, S&P 500 Achieves Milestone, Institutional Money Flows Into BTC, National Rents Accelerate

Economy:

Friday was a fairly thin day in terms of economic data, however we did get some interesting data on U.S. manufacturing. The Chicago Purchasing Manager Index (PMI) is a useful gauge on the health of the manufacturing sector, in which a reading above 50 indicates an expansion in manufacturing activity and a reading below 50 indicates a contraction. The data is specific to the greater Chicago area, and is thus isn’t necessarily indicative of the overall state of U.S. manufacturing. With that said, many economists will track the Chicago PMI to try to gauge information about the U.S. ISM PMI.

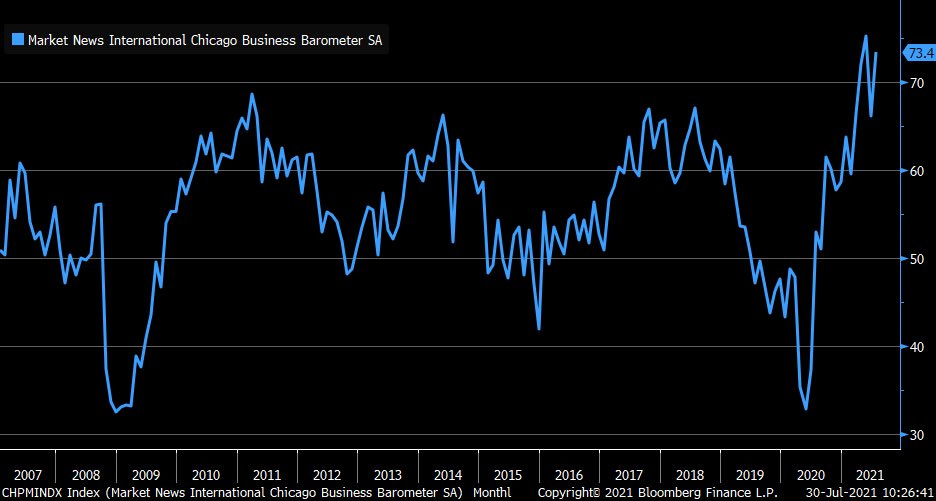

For the month of July, the Chicago PMI increased to 73.4 vs. estimates of 64.2. Considering that the June data was 66.1, it seems that economists were largely expecting a slowdown in the growth rate of manufacturing. It’s important to note that a month-over-month decrease doesn’t imply a contraction, but simply that the rate of expansion slowed down. Based on this new data, not only did the result massively beat estimates, but we can see that Chicago experienced a strong acceleration in manufacturing activity. Consider this historical chart of the Chicago PMI:

It’s expected to see a sharp rebound after the wake of a recession, as we saw in the aftermath of 2008. One thing worth considering is that it took the manufacturing sector nearly 1 year from the bottom of 2008 to go back over 50. In the COVID crash, we essentially retested the same lows of 2008, then sharply rebounded within 2 months from the bottom to break above 50. The resilience has continued, reaching multi-year highs in April before experiencing a two-month downturn. I don’t believe we’ll stay above 70 for too many more months, but I certainly expect to see data in the 58-65 range for the remainder of the year which would be a great sign for overall economic activity.

Stock Market:

With a full month of data behind us in the stock market, we can start to search for some takeaways on a longer-term scale. In fact, the S&P 500 just had its sixth consecutive positive month, an accomplishment that has only happened 3 other times in the past ten years. Expanding to a longer historical view, it seems this is quite a major feat. Based on the following data I saw from LPL Research, we can extrapolate how the S&P 500 performs after achieving this accomplishment based on the historical data.

As we can see from the data, the streak could certainly extend further as there are several incidents of reaching 10+ months. The important point is, the data reflects an extremely positive outlook for stocks going forward. Over the next month, the data is a bit choppy (positivity rate of 67%), but becomes consistently positive the further out we look. There are only three instances (14.3% of the time) in which the S&P was lower 1, 3, and 6-months (April 1971, June 1975, and September 2018), in which the average loss at the 6-month mark was -5.8%.

Looking out twelve months after the signal, there were six instances (28.6% of the time) in which the S&P 500 increased by +20% or more and ten instances in which the S&P 500 had returns less than +10%. Of those ten instances, only three were negative.

In my opinion, it seems the momentum we’ve seen on a monthly basis is likely to continue going forward. The market may experience choppiness and even some losses in the near-term, but the long-term thesis remains intact.

Cryptocurrency:

In prior Bitcoin cycles, the only drivers of buying/selling activity was coming from individuals, aka “retail investors”. In the first 3-5 years after being invented, these early adopters were referred to as cypherpunks & were an extremely niche group of people. Bitcoin’s adoption continued to grow & started to receive mainstream momentum & attention during the 2016-2018 period; however, the user-base was still almost entirely individuals & retail investors.

One thing that makes this current Bitcoin cycle fundamentally different than the prior cycles is the presence of institutional investors. Institutional investors are firms, companies, and financial institutions who allocate capital on behalf of their investors. They include hedge funds, pension funds, banks, insurance companies, etc. Over the course of the last yeah, we’ve continued to see more and more headlines about institutional adoption as new firms get involved in the space.

The newest headline that came out on Friday was that GoldenTree Asset Management, a credit-focused firm with roughly $45Bn assets under management, has started to purchase Bitcoin. The amount & purchase dates are undisclosed; however, this is another key development as Bitcoin & cryptocurrencies continue to gain adoption by institutional money managers. If 1% of the firm’s assets are invested into BTC, that would imply around $450M of net inflows of demand. While that number may seem significant, considering that the current market cap of Bitcoin is $745.8Bn, the inflows of $450M are only 0.06% of the current market. Essentially, a drop in the bucket.

Real Estate:

Over the weekend, I read a fantastic report from Apartment List that gave some great insights about trends in national rents. Their report in its entirety can be found here, which was less than a 10 minute read. Here are two of the key charts that I found the most insightful:

First off, the growth in the median cost of rent is rising substantially faster than the pre-pandemic trend. Based on this report, the national median rent is currently at $1,244 vs. a projection of $1,200. On a YTD basis, rents are up +11.4% so far in 2021 and are up +10.3% from July 2020. It’s important to note that the pace of rents is growing faster than Apartment List’s projections and not any sort of consensus projection; however, it’s still an important piece of information to recognize.

When it comes to some of the micro & city-specific data, I thought the chart below did a great job of characterizing the cities that were hit the hardest by the pandemic.

One thing that immediately jumped out to me is the fact that Bay Area cities (SF, Oakland, San Jose, and Fremont) were hit the hardest. As tech companies & startups have fully embraced the work-from-home culture, they’re workforce has been the most flexible to get up & go. Considering that California has the highest state income taxes & some of the least friendly business environments out of any state, it’s reasonable to see why there’s been an exodus focused in those areas. At the same time, the sharp rebounds have shown how resilient these economy of the Bay Area is & how demand has quickly snapped back.

Until tomorrow,

Caleb Franzen