Edition #63

U.S. Q2'2021 GDP + Unemployment Miss Estimates, S&P 500 vs. Foreign Stocks, Crypto Adoption

Economy:

By far the most important economic news from yesterday’s session was the release of Q2 2021 GDP in the United States. The result of this data has serious implications for monetary policy & continues to act as the ultimate measure of success for the U.S. economy. The consensus estimate was for an annualized quarter-over-quarter growth of +8.5%; however, the actual result was +6.5%. The chart below shows the quarterly growth rates (annualized) of U.S. GDP going back to 2010:

One gripe that I have with GDP reports is the way in which the data is portrayed, in which the quarter-over-quarter change is turned into an annualized figure. Quite simply, this is done through the following equation: [(1 + g)^4 = annualized growth], where g = the QoQ growth rate. The reason why this frustrates me is because the annualized calculation is an extrapolation of quarterly data, that attempts to make it sound like the real result. The U.S. economy did not grow by +6.5% relative to the prior quarter, in fact it grew by +1.587%. By calculating an annualized growth rate, we’re simply taking the actual growth rate of +1.587% and extrapolating what the implied annual growth rate is if each subsequent three quarters had the same growth.

Sure, projections are important & have a valuable role in forecasting where the economy is headed, but it’s somewhat misleading to say that the economy grew by +6.5% in my opinion. For example, when a company reports Q2 2021 earnings figures, analysts & investors will compare the quarterly revenue in Q2’2021 vs. Q1’2021 and Q2’2020. This is important because we can then assess the company’s current performance relative to the prior quarter & the prior year. We don’t just simply take the QoQ growth, compound it four times, then pronounce that it grew by that rate!

Therefore, if we compare Q2 2021 real GDP vs. Q2 2020 real GDP, we can actually evaluate how much the economy has grown over the last twelve months. With Q2 2020 GDP of $19.477Tn & Q2 2021 GDP of $22.722Tn, we can quickly conclude that nominal U.S. GDP grew by [(22.722-19.477)/19.477] = +16.6%. This is a monster result, but absolutely must be considered under the context that Q2 2020 was the toughest economic period of the pandemic. Shutdowns were the most severe, social distancing guidelines were strictly enforced, and the economy suffered as a result. So while the +16.6% growth rate appears impressive, we must consider the baseline from where we’re starting. Nonetheless, the fact that economic activity in Q2 2021 was +16.6% higher than it was in Q2 2020 is a good indication of where we are in our path towards economic recovery.

The other main data point that was released was initial unemployment claims for the week ending July 24, 2021. Recall, the prior week’s data was a massive miss relative to expectations, in which 419,000 people filed for unemployment. Unfortunately, that data got worse, as the prior week’s figure was revised to 424,000. With a consensus estimate for this current report at 385k, the data came in at 400k. Another significant miss with worse than expected results.

Continued weeks claimed for UI benefits in all programs rose to 13.156M. Per the Department of Labor, this figure measures “a person who has already filed an initial claim and who has experienced a week of unemployment then files a continued claim to claim benefits for that week of unemployment… continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits.” This means that of the total civilian labor force of 161M people, 8.17% are currently collecting unemployment.

In my opinion, these two reports are perfectly fitting with the context of the Federal Reserve policy meeting earlier in the week. While there appears to be pressure on the Fed to taper sooner rather than later due to rising inflation, it’s necessary to understand that the Fed has a dual-mandate of price stability & maximum employment. As more data continues to develop, showing that we’re still very far from maximum employment, this will buy the Federal Reserve more time to kick the can down the road in terms of tapering/raising rates. Especially with relatively anemic growth that falls short of expectations, the Fed will not be in any rush to reduce their monetary stimulus. As I said in yesterday’s edition, I believe rates will stay “lower for longer” than most economists & market participants expect.

Stock Market:

Per my assessment, the S&P 500 just hit an all-time record high for the 50th time so far in 2021. That means that out of 144 trading days so far this year, the S&P 500 has hit an all-time high intraday nearly 1/3 of the time. As of the market close on 7/29/2021, the S&P 500 is currently +17.6% so far YTD. At the end of 2020, market historians, investors, and economists were warning that 2021 (the second year of a recovery) would not bode well for stocks. They warned that stocks wouldn’t be able to repeat their success in 2020. Meanwhile, I remained confident that the current monetary policy regime & framework would provide strong tailwinds for asset prices, leading to strong gains for dollar-denominated assets. If you want to read the paper that I published on January 4, 2021 to discuss my outlook on the economy & equity markets in 2021, feel free to click here.

While market conditions have certainly changed, the indexes are all on track for historic gains in 2021. Have equity markets been choppy? Yes. Has it been difficult to pick individual stocks? Yes. This is why owning a diversified basket of high-quality stocks is so important, and emphasizes the value of ETF’s to provide intrinsic diversification & the ability for thematic investing.

One important thing to note is that the U.S. stock market is rapidly outpacing the performance of global stocks. In fact, we can even compare the performance of the S&P 500 to an ETF that tracks the performance of international stocks, excluding United States companies. This ETF, the Vanguard All-World ex-US ($VEU), is a basket of 3,543 foreign companies with a median market cap of $41Bn. Comparatively, the S&P 500 is clearly a basket of 500 U.S. companies, of which the median market cap is $187Bn. It’s somewhat of an apples to oranges comparison simply because the median S&P 500 company is more than 4.5x larger than the median $VEU company. Nonetheless, those are the facts.

As we can see from the data, the YTD return of $SPX is more than double $VEU so far in 2021. The two ETF’s tracked very similarly up until mid-June, at which point the S&P 500 continued to accelerate higher while the world ex-US index has dipped. Much of that dip is due to the continued deterioration of Chinese stocks; however, this ETF only has an 11% allocation to Chinese equities as of 6/30/2021. Therefore, it certainly accounts for a substantial portion of the dip, but it’s clear that the divergence isn’t only being caused by Chinese equities.

If you compare these two funds over a 3, 5, and 10-year period, the S&P 500 outperforms world ex-US in every single one of those time frames by a substantial margin. Quite simply, it pays to own the best companies in the best economy in the world.

Cryptocurrency:

I read a fantastic research paper published by crypto.com, which can be found in its entirety here. The key takeaways from the report are:

The number of global crypto users reached 221 million in June 2021

It only took four months to double the global crypto population from 100M to 200M. In comparison, it took nine months to reach 100M from 65M since we began this initiative.

Although Bitcoin drove growth in January and February, altcoin adoption in May led to a massive surge in crypto users, from 143M at the end of April to 221M as of June.

Altcoin adoption was likely spurred by the influx of new users who were interested in tokens like Shiba Token (SHIB) and Dogecoin (DOGE), among others.

One aspect that I’ve highlighted in the past is the adoption curve of crypto, and Bitcoin specifically. In doing so, I’ve mentioned Metcalfe’s Law, exponential adoption curves, and network effects. On a YTD basis, here is some great data showing just how quickly the user-base across 24 exchanges has grown for crypto overall, and then specifically for BTC & ETH.

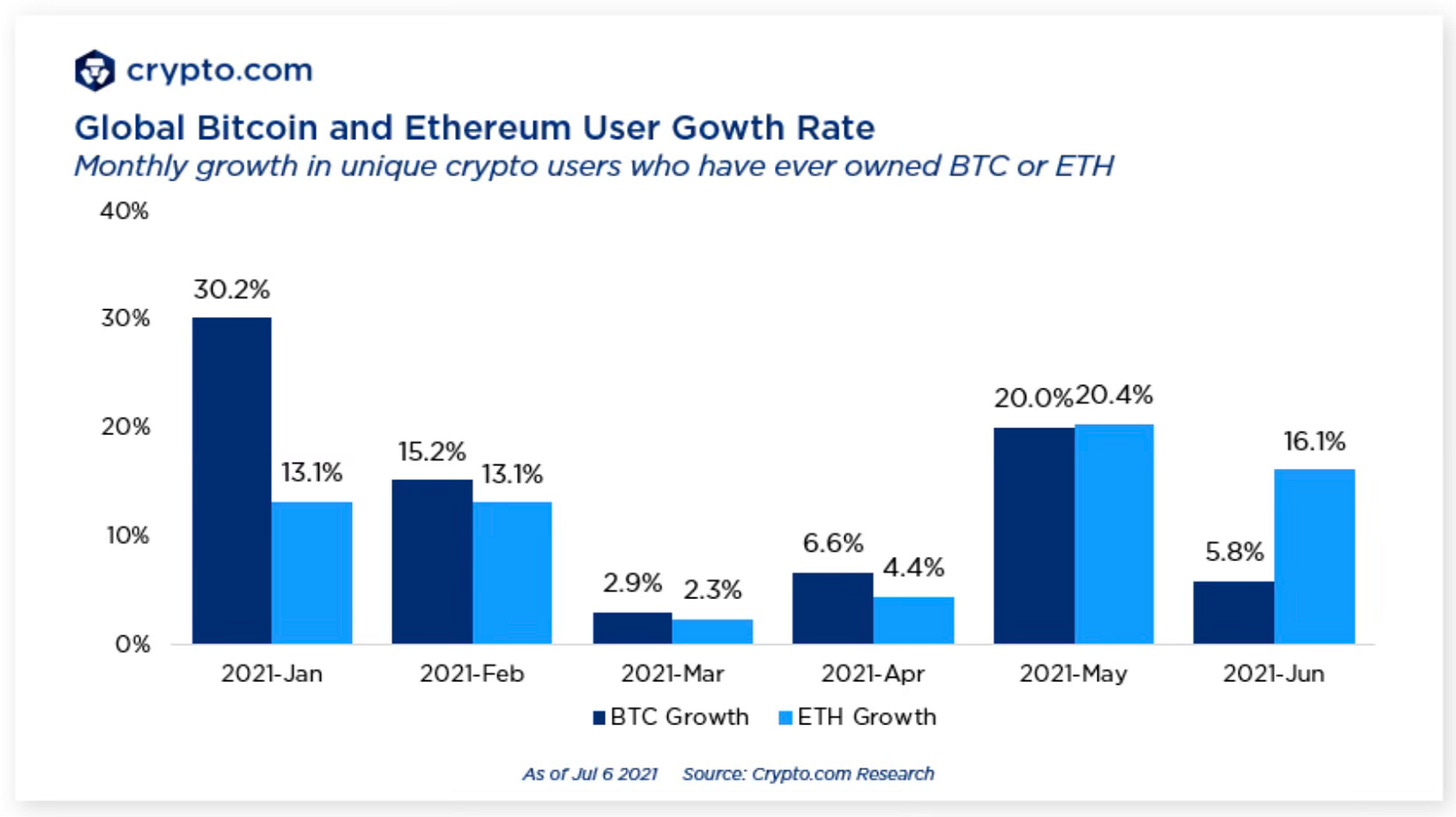

It’s also worth noting that of the 24 exchanges used to scrub this data, Coinbase was not included. Considering that they’re one of the largest exchange platforms, these figures are understated. In that sense, it’s almost more valuable to analyze the month-over-month growth rates, rather than the actual number of accounts, which can be seen below:

In my opinion, it is without question that the adoption of both BTC & ETH will continue to rise substantially over the medium & long-term.

Talk soon,

Caleb Franzen