Edition #61

Job Postings Accelerate, Apple & Google Report Earnings, Case-Shiller Housing Index Hits All-Time High

Economy:

Aside from the typical labor market reports that we receive from the Bureau of Labor Statistics, I’ve started to follow some of the economists who work at Indeed, one of the foremost job board websites. Considering their position in connecting employers with potential employers, they’re also a data analytics company as well. Courtesy of Jed Kolko (@JedKolko on Twitter), I saw the following chart in regards to job postings:

One important takeaway to note is that it took exactly 12 months for job postings to recover from their baseline in February 2020. The second thing to note is that employers are hiring at a phenomenally higher rate than the onset of the pandemic. Also, if we consider that job postings fell by nearly 40% and are currently +37% higher than the baseline, that means that job postings today are +128% higher than the bottom in May 2020.

However, just because job postings seem to reflect a roaring job market, we still continue to see signs of slack in the labor market. As with all things in economics, you must always consider both supply & demand in order to understand the full picture. As always, I’ll be playing close attention to this week’s update on initial unemployment claims & continuing unemployment data. Additionally, we’ll have the June 2021 JOLTS (Job Openings and Labor Turnover Survey) report coming out on August 9th. In the aggregate, these reports will paint the full picture along with the unemployment rate & labor force participation rate.

Stock Market:

I didn’t see any broad-market stock data worth sharing for this newsletter, however, both Apple & Google reported their most recent quarter earnings. Considering how my last few topics have been about mega-cap tech & the importance of FANGMAN, I thought it would be fun to provide a high-level overview of their respective quarterly results.

Apple Inc. ($AAPL) - Q3 2021: Total revenues grew by +36% relative to Q3 2020, reaching $81.4Bn. You can break down their total revenue into products vs. services, in which products accounted for $63.95Bn & services were $17.45 (up +33% YoY). Even further, iPhone sales grew by +50% to $39.6Bn (more than half of total product revenue). Apple’s gross profit, operating profit, and net income margins all expanded, showing that they were able to grow revenue without equally growing their costs. At the end of the day, net income was $21.7Bn vs. $11.2Bn in Q3 2020. In terms of their balance sheet, they had $34Bn in cash and cash equivalents as of June 30, 2021, declining by $4Bn relative to Q3 2020. Their current assets of $114Bn are moderately larger than their current liabilities of $107Bn. Personally, I like to see companies have at least a 1.5x ratio of (current assets / current liabilities). They’re total debt is sizable, with short & long-term debt at around $113Bn. Based on the profile of their current assets, plus annualized net income of $86.8Bn, I’d feel very comfortable about the health of their balance sheet & ability to repay debt. No surprise there.

Alphabet Inc. ($GOOGL) - Q2 2021: Total revenue grew by +62% to $61.8Bn in the most recent quarter. Google Search accounted for $35.8Bn of their total revenues, while YouTube ads and Google Network provided $7Bn & $7.5Bn, respectively. In total, advertising revenue was $50.4Bn! I find it pretty astonishing that cloud services only account for $4.6Bn & I suspect that figure will double over the next 2-3 years. I’m aware that they operate in totally different businesses, but Amazon’s AWS accounted for 12.5% in Q1 2021 meanwhile Google Cloud is currently accounting for 7.4% of total revenue. Even more striking is the fact that Google Cloud generated an operating loss of ($591M) in the most recent quarter. While that seems like a dire figure, it’s substantially better than the ($1.4Bn) loss from Q2 2020. I fully expect this figure to trend towards profitability rather quickly. Operating income & net income margins expanded in the most recent quarter relative to the prior year, and a net income of $18.5Bn grew by +168% YoY. Alphabet had $23Bn in cash & cash equivalents, as well as $112Bn in marketable securities. After diving into their 10-K filing, Alphabet invests “all excess cash primarily in government bonds, corporate debt securities, mortgage-backed securities, time deposits, and money market funds”, all of which have a maturity greater than three months. My guess is a substantial portion of the $112Bn is in government bonds. Their current assets of $175.7Bn is substantially larger than their current liabilities of $55.7Bn. As I said, I like to see a ratio of at least 1.5x, and Google’s comes in at more than 3x. With long-term debt of $14Bn, they appear to be in great financial shape.

To no surprise, two of the stock market’s most important players had another stellar quarterly report. Aside from the short-term gyrations these companies will experience, they both appear poised for continued long-term success. I still believe the best way to own these companies, other than through outright equity ownership, is through 3 exchange-traded funds (ETF’s): $XLK, $XLC, and $MGK.

Cryptocurrency:

No update.

Real Estate:

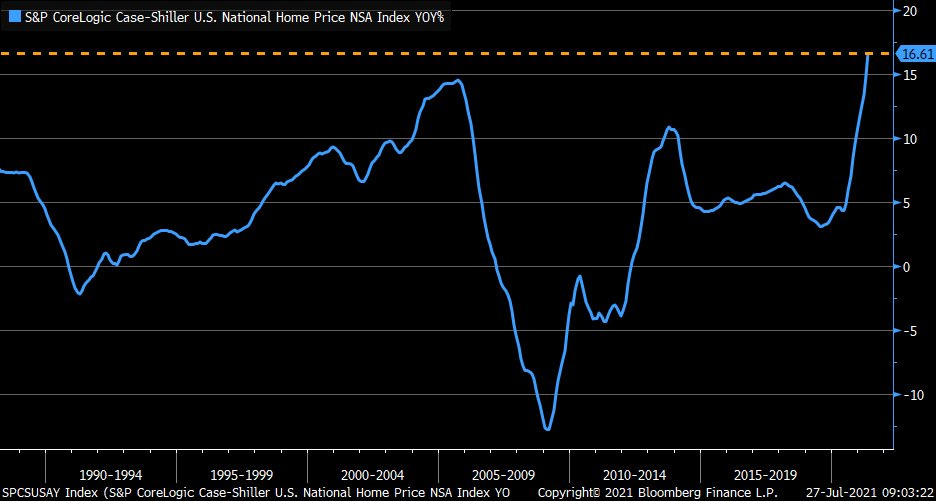

The S&P CoreLogic Case-Shiller U.S. National Home Price data was released for May 2021, showing a +16.6% increase YoY vs. a +14.8% YoY increase in April 2021. The Case-Shiller measures the average value of an existing single-family house in the U.S., and there’s an elaborate 35-page document outlining the methodology of the calculation for those who are interested. Going back over the last 30+ years, the +16.6% increase is the highest reading on record.

Specifically, Charlotte, Cleveland, Dallas, Denver, and Seattle, recorded their all-time highest 12-month gains. The cities with the highest gain were Phoenix (+25.9% YoY), San Diego (+24.7%), and Seattle (+19.9%). This was the 24th consecutive month in which Phoenix was the top-performing city. The full article, with in-depth commentary & analysis, can be found here.

Until tomorrow,

Caleb Franzen