Economy:

Up until this point, most of my analysis on the economy has been centered around retail sales, inflation, fiscal stimulus, the Fed’s balance sheet, and the labor market. While these are all different aspects within the American economy, they are certainly interrelated. I won’t repeat the discussion here, but I’m hoping that the connection between these topics is becoming more apparent. Thanks to the fiscal stimulus provided under the Trump & Biden terms and the monetary stimulus & liquidity injections provided by the Federal Reserve, both of which have been at historic levels, the U.S. economy is en route to a potentially historic recovery.

According to a survey by the Federal Reserve, the Economic Well-Being of U.S. Households, 75% of the 11,000 respondents said that they are better off financially than they were one year earlier. The survey was taken in November 2020, therefore it’s important to note that the labor market has substantially improved, average hourly earnings have increased by +1.9% to $30.17/hr, and additional stimulus checks have been distributed at the Federal & even State level. It’s interesting to note that the sample group of 89% of college-educated respondents (bachelor’s degree or higher) indicated that they were better off financially than pre-COVID.

With the majority of American’s having an improved financial situation, and likely greater spending power, it makes sense to see strong retail sales and higher-than-expected inflation as the economy begins to reopen and social-distancing regulations are eased.

With that said, some prices are accelerating faster than others. This past weekend, I saw the following chart which shows an index developed by Manheim, the world’s largest wholesale auto market, showing wholesale used vehicle prices. The full report can be found here.

The rise in used car prices is truly quite astonishing, showing a +48% increase for the 12-month period ending May 15, 2021. Aside from the period immediately following the Great Recession, this is the fastest the index has accelerated, but this time is significantly higher in terms of the magnitude. In fact, to achieve a +48% growth in the wholesale used car index following the bottom in Q4 2008, it took more than 10 years. Essentially, we just achieved that in 1/10 the amount of time. In fact, since the lows in March 2020, the index has grown by +64%. It’s truly an unparalleled acceleration in used car prices. It’s hard to imagine how much higher this can rise, but it seems difficult to argue that the trend will reverse in the short-term considering that the fundamentals are still intact & the recovery is strong.

This is not an attempt to feed into an inflationary frenzy or to insinuate that I think hyper-inflation is around the corner - I truly don’t believe that will happen. With that said, I believe the Fed has done a sufficient job of downplaying how high inflation can rise over the next 24 months through their rhetoric & consistent reassurances that they’ll be able to reel in consumer prices if/when they need to. From my perspective, I wouldn’t be surprised if we see the 12-month CPI inflation numbers between +6% to +10% at some point in 2021. Even in this forecast, I think it’s far more reasonable that the CPI inflations remains below +7%, but I’m certainly open to the idea that we move higher than that. Time will tell, but I thought this data on the wholesale used car index was worthwhile to share.

Some of the companies that I’ve been watching that operate in the auto & vehicle sectors are: $XPEL $ORLY $AZO $CAR $CVNA $PAG $AN. I believe all of these companies have benefitted tremendously from the industry tailwinds, and are in position to continue to do so if the trends persist.

Stock Market:

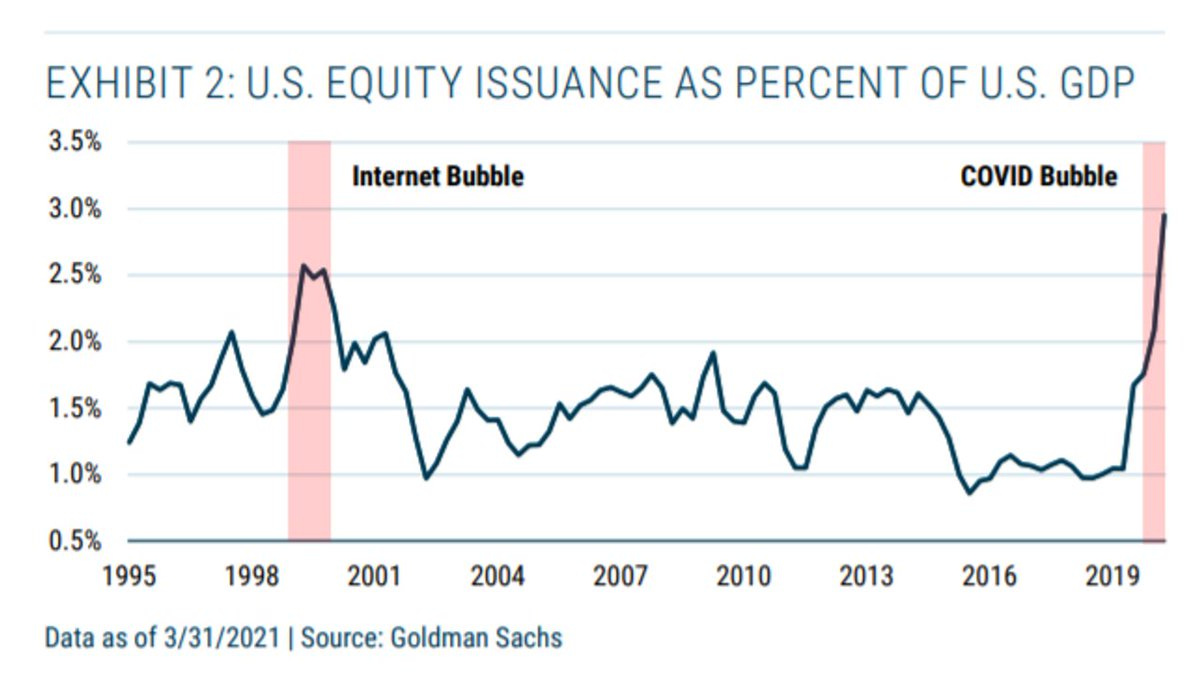

Courtesy of Callum Thomas (@Callum_Thomas on Twitter), I saw the following chart on equity issuance as a percent of national GDP.

Charts like this typically get circulated as a way to predict a market top or indicate that we’re bound for a 2001-esque crash. IPO’s & equity issuance are easy ways to bring investors back to the late 90’s when fundamentals were thrown to the wayside in favor of unprofitable tech companies that appeared to have significant growth potential. This chart in particular is interesting because it indicates that U.S. companies are issuing equity at a greater level relative to the size of the U.S. economy than ever before. There are a lot of factors that would cause companies to do this, but it certainly adds more ammo to the bears & pessimists who have continuously argued that stocks are overvalued & that we’re in a bubble.

I can’t quite recall the interview, but sometime over the last 18 months Howard Marks said something along the lines of: “there is a difference between saying ‘stocks are expensive/overpriced’ and ‘stocks are going to fall tomorrow’”. I think this is such an important distinction! Just because something is expensive doesn’t necessarily mean that it won’t be even more expensive in the future. As it relates to this chart, just because equity issuance as a percent of U.S. GDP is at ATH’s, doesn’t necessarily mean that it’s bound to crash in the near or even intermediate future.

One of my all time quotes in finance and investing is that “the market can stay irrational longer than you can stay solvent”, which essentially points to the phenomenon that trends can persist for longer than we may deem reasonable & that it isn’t necessarily wise to bet against those trends. While the rate of equity issuance may seem to have reached an irrational level, I believe this trend will continue to persist longer than many economists & market-commentators are anticipating. Either way, it certainly gives food-for-thought & helps to frame the current market conditions within a historical context.

Cryptocurrency:

The price of Bitcoin continues to face mounting pressure, as the price of the cryptocurrency fell by -18.5% over the 24-hour period ending at 1pm on 3/22. Around that time, it reached a low of $31,383, but is currently at $35,800 as of 11:00 pm ET. Throughout Bitcoin’s prior cycles, it has faced massive volatility & has repeatedly fallen more than -30% on it’s way to reaching new highs just a few weeks later. Here is a chart showing it’s historical drawdowns from the ATH peaks during prior cycles:

This chart was captured on May 21, 2021 around 2:00 pm ET, showing that Bitcoin was -37.13% lower than the ATH’s from the mid-April 2021 highs. Short-term momentum has clearly shifted to the downside, so I’m intrigued to see which levels we retests if this persists. To add color to the above, I wanted to share another chart that I saw showing the historical price of Bitcoin using monthly candlesticks.

Each of the red & green candles represents one entire month of price data, showing the open, high, low & closing price. On the bottom of the chart, we have another chart showing the percent decline of each red candle, in which the current month closed below the prior month’s closing price. While the chart was taken on May 23rd & we still have several days left to close out the month, at the current level, Bitcoin is on track for the largest calendar month correction in history. At a price of $34.7k, that indicates a calendar month decline of -39.9%.

Ouch.

Personally, I’m not convinced that the hardest part is over & posted early Sunday morning that I wouldn’t be surprised if we see a retest of the $27k-$29k range in the coming days or week. I believe that price action is still on the table & as new investors continue to get liquidated out of the market & the panic selling ensues. At the end of the day, I really don’t know where it goes in the short-term, but I reiterated to some of my close connections that I think price may get back over $50k again sometime this year. I may write about this more in a future newsletter, but I think the one outcome that isn’t being considered right now is sideways price action. The narrative is either that Bitcoin is going substantially higher or substantially lower, but no one is calling attention to the idea that price may continue to fluctuate between $30k & $50k for the intermediate term. Perhaps we start to see some stability within the range as newer Bitcoin investors start to hit reset & the veteran investors & institutions (who continue to purchase BTC from “younger” wallets) allow for price to become more sticky.

Either way, I’m watching with bated breath.

Until tomorrow,

Caleb Franzen