Edition #5 - 5.21.2020

Federal Reserve Balance Sheet & Unemployment Filings, Sector Rotation, Crypto Regulation, Mortgage Rates

Economy:

In regards to this section, there are two primary charts that I want to call attention to. The first is relevant particularly due to the fact that yesterday’s newsletter was the highlight & key summary of the FOMC minutes from the policy meeting in April 2021. One of the key bullet points from that newsletter was related to the Committee’s policy actions:

“Purchase $80Bn/month of Treasury securities & mortgage-backed securities by $40Bn/month (both are at record-high paces), in order to “sustain smooth functioning of markets”. This indicates that the Federal Reserve’s balance sheet will continue to grow, keeping interest rates at historical lows, and reaffirms my positivity on dollar-denominated assets (notably equities, real-estate, tangible assets/commodities, crypto).”

I want to add color to this by showing an update of the Federal Reserve’s balance sheet, which was published yesterday morning based on the close of 5/19/2021.

As we can see from the chart above, the Fed’s balance sheet has decisively moved higher, with rapid ascension since the Great Recession. The pre-COVID level of roughly $3.75Tn was already near historical highs after peaking between 2015-2018. Since the monetary policy response to the pandemic, the Fed’s balance sheet accelerated faster than ever before & grown by more than a factor of 2x, reaching $7.923Tn as of 5/19/2021.

The Fed has continued to indicate that they intend to maintain their existing rate of asset purchases. As outlined in yesterday’s newsletter, they reaffirmed a commitment to purchasing at least $80Bn/month in Treasury securities & $40Bn/month in MBS. The Fed’s activity in the repo market has also become elevated, particularly in the reverse-repo market which is an interesting development. Perhaps I’ll cover the reverse-repo operations & impact in a future newsletter if it continues to play an important role in monetary policy.

In any event, the Fed’s asset purchases have continued to grow at an elevated level & should continue to grow at the current pace since the immediate pandemic response. So long as this activity continues (which I believe will be at least another 12-18 months), I remain optimistic on equities & dollar-denominated assets in general. I used to complain about the Fed’s activities, believing that they were distorting asset markets by providing artificial demand & monetizing the national debt. Now, I’m only concerned about the correlation between the Fed’s activities, interest rates, and asset prices. I remain long equities, Bitcoin & Ethereum.

I also wanted to provide some quick details on the recent report for weekly unemployment claims, which is being shown in this second chart as the initial claims on unemployment insurance.

After stabilizing between September 2020 and February 2021, the downward trend has regained momentum in a persistent & gradual decline. This marks the sixth consecutive week in which the number of initial claims has declined week-over-week. The result for the week ending 5/15/2021 was 444,000 claims, which declined by 34,000 from the prior week. The Fed is obviously monitoring these developments, but a declining number in unemployment filings won’t mean much unless the employment figures in & of themselves develop in a positive and meaningful way.

With the unemployment rate at 6.1% vs. the pre-pandemic level of 3.5%, and the labor force participation rate at 61.7% vs. the pre-pandemic level of 63.4%, there is much ground to cover in order to return to maximum employment.

Stock Market:

I didn’t find any interesting charts that stood out to me today in terms of conditions of the broader equity market. In a day where the Nasdaq led the S&P 500 which led the Dow Jones, it’s worth wondering if the rotation out of tech/growth & into value is coming to an end? Today marks the third consecutive day in which the Nasdaq has outperformed. My hunch is that value sectors (notably materials, industrials, energy, financials, & healthcare) will continue to push the broader market higher. Tech will certainly outperform over certain periods, but lose that outperformance during mini-corrections & risk-off cycles. At the present moment, my tech exposure is non-existent & I would be hard-pressed to accept the elevated levels of risk during these choppy market conditions & volatility spikes.

In yesterday’s market, here is a sector overview of what led/lagged the market relative to the following index returns:

Dow Jones ($DJX) +0.55%

S&P 500 ($SPX) +1.06%

Nasdaq-100 ($NDX) +1.94%

Russell 2000 ($RUT) +0.64%

Cryptocurrency:

While the crypto market continues to try and recover from a massive drawdown, the U.S. Treasury announced that they intend to increase regulatory controls around crypto & will require individuals/businesses to report transfers of $10,000 or more worth of crypto. Bitcoin held up relatively well on this news & seemingly shrugged it off, which I think is sensible. The agency intends to enact this reporting requirement for transfers over $10,000 for the 2023 tax year. It’s still unclear what the impact of this requirement would be, but it’s being sold as a way to combat illegal activity facilitated through cryptocurrencies, citing that “cryptocurrency already poses a significant detection problem… including tax evasion”. The agency continued by insinuating that cryptocurrencies are adding to a “two-tiered tax system, where most American workers pay their full obligations, but high earners who accrue income from opaque sources often do not”.

There is a lot of irony in these statements/concerns. While there is a case to be made that there is a two-tiered tax system, largely due to a progressive income tax structure, 74,000-page tax law, & legislation that is more accommodative to businesses than individuals, this has existed long before crypto’s were created. This kind of posturing is going to be shrugged off, although I don’t doubt that new regulations/requirements will be introduced over the next few years.

Additionally, legacy financial institutions, such as the Treasury & Federal Reserve, as well as international governments often make statements that Bitcoin is used to facilitate fraud, money laundering, criminal activity, etc. Meanwhile, since the year 2000, the financial services industry (primarily the large banking institutions) have incurred $331.56Bn in fees for a variety of violations. These violations (more than 6,100) include, but are not limited to, mortgage abuses, investor protection violations, economic sanction violations, toxic securities abuses, fraud, banking violations, consumer protection violations, insider trading, anti-money-laundering deficiencies, anti-competitive practices, and Foreign Corrupt Practices Act violations. Bank of America, JPMorgan Chase, Citigroup, and Wells Fargo are responsible for roughly ~$165Bn, or almost precisely half, of the total fees for violations since 2000.

Real Estate:

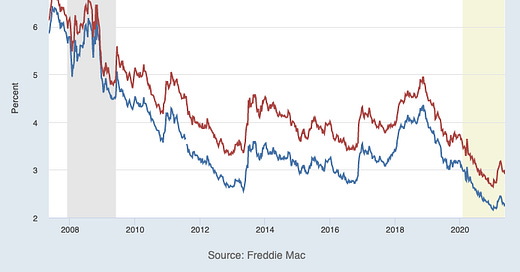

Yesterday, the Federal Reserve Bank of St. Louis released their weekly update on average fixed mortgage rates, with the historical graph shown below:

As of 5/20/2021, the average 15-year fixed rate was 2.29% while the average 30-year was 3.00%. The all-time lows are 2.16% & 2.65%, respectively.

While the trend is decisively to the downside, rates certainly started to increase at the beginning of the year & through March 2021. Since their peak, both 15 & 30-year mortgage rates have pushed back towards their all-time lows. While yields on Treasuries have maintained near their YTD highs, quite close to the pre-COVID levels, I suspect that mortgage rates will make new all-time lows this year. As the Federal Reserve continues to purchase $40Bn/month in agency mortgage-backed securities, the artificial demand that the Fed provides will likely continue to push mortgage rates substantially lower. As such, I reaffirm my positive outlook on the real estate market, particularly in metropolitan areas & their nearby suburbs.

Until tomorrow,

Caleb Franzen