Edition #47 - 7.14.2021

CPI Inflation for June 2021, S&P 500 All-Time Highs or Turbulence?

Economy:

One of the reasons why I’ve been keenly focused on inflationary topics in the last several newsletters was in anticipation of the June CPI data that was released yesterday. With the Federal Reserve’s assurance that the recent uptick in inflation is going to be transitory, the markets are giving a lot of scrutiny to inflationary data to ensure that it is indeed transitory and not running too hot.

While the market is seemingly convinced by the Fed’s rhetoric, we still have no real confirmation that the surge in inflation is transitory. This is one reason why I’ve been paying close attention to data regarding inflation expectations as well as the nominal yields on U.S. Treasury securities. With that said, here is some of the key data from yesterday’s data for the June 2021 consumer price index (CPI).

Relative to the prior month, both the total CPI and core CPI (which is the total CPI excluding food & energy prices) increased by +0.9% in June. Meanwhile the consensus estimate for the core CPI was a month-over-month increase of +0.4%, so this was a significantly higher-than-expected result. This brings the 12-month total CPI increase to +5.4%, the highest annual increase since the 12-month period ending August 2008. The consensus estimate was +4.9%, so this reiterates how the data significantly outpaced expectations.

Here’s a visual graphic provided by the Bureau of Labor Statistics showing the monthly CPI data over the last 13 months

I think it’s important to recall the analysis that I provided on May 24, 2021 in Edition #6 when I said the following:

I believe the Fed has done a sufficient job of downplaying how high inflation can rise over the next 24 months through their rhetoric & consistent reassurances that they’ll be able to reel in consumer prices if/when they need to. From my perspective, I wouldn’t be surprised if we see the 12-month CPI inflation numbers between +6% and +10% at some point in 2021. Even in this forecast, I think it’s far more reasonable that the CPI inflation remains below +7%, but I’m certainly open to the idea that we move higher than that.

At the time, the most recent data that we had was for April 2021, in which the 12-month CPI inflation was +4.2%. In the month of May, it steadily increased to a 12-month rate of +5.0%, therefore this most recent result of +5.4% continues to move us closer to my targets.

In fact, when the May data was released, I even started to doubt the last sentence of my quote above, expressing that “I’m starting to recognize that this is developing faster than I initially anticipated. As such, the +7% or less figure I gave as a “more reasonable” account of my expectations might be underestimating the rising momentum in consumer prices” (Edition #21, June 11, 2021).

One important factor to consider, which is something that I discussed in one of my earliest newsletters is that the monthly advances for the Child Tax Credit will start to be disbursed on July 15, 2021 through the remainder of the year. For a full breakdown, analysis & commentary on the CTC, I highly recommend that you go back to Edition #2. Considering that roughly 39 million households are set to receive these payments beginning on 7/15/2, this should help to provide additional tailwinds for elevated levels of consumption for the remainder of the year, hence providing a boost to the CPI, all else being equal. Recall, I provided a back-of-the-envelope calculation that explained why I believe the total disbursement from the CTC will be “substantially higher than $88.5Bn”.

The full report from the Bureau of Labor Statistics can be read here.

Stock Market:

On June 16th’s Edition #26, I analyzed the correlation between junk bond yields and the S&P 500, concluding with the following statement:

Therefore, given the correlation between junk bonds and equities, as the yield on junk bonds continues to make new lows, my expectation is for junk bonds to make multi-year highs and for equity prices to continue to make all-time highs!

Since that post, the S&P 500 has continued to ascend to new ATH’s, gaining +3.5%. While the S&P has continued to rise, many market analysts have noted that many stocks within the index aren’t participating in the upside momentum. This is referred to as limited breadth, implying that only a handful of companies are dragging the market higher. This typically makes traders & investors somewhat uneasy, because the “under the hood” dynamics aren’t as strong as the overall index is implying. Typically, I find these fears to be overstated, but it’s certainly worth monitoring.

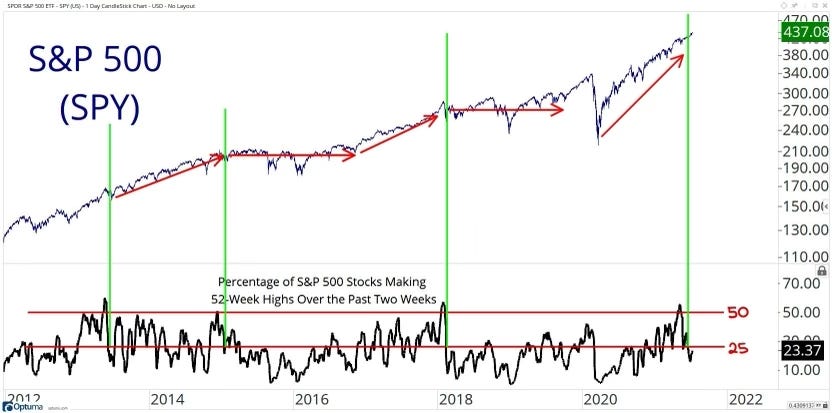

Therefore, I wanted to show an interesting chart that I saw from Grant Hawkridge (@granthawkridge on Twitter), with some personal edits that I added in red & green.

The chart shows the performance of the S&P 500, as measured through the ETF $SPY, dating back to 2012. The lower-bound oscillator shows the percent of stocks in the index that are making new 52-week highs during the last rolling two-week period. Somewhat surprisingly, only 23% of the 500 stocks in the S&P index are making new 52-week highs, which helps to highlights some of the concerns regarding limited breadth.

One aspect that I was curious about in regard to the lower-bound oscillator is that we can clearly identify some peaks within the data, which happens to align fairly closely to the 50% level. As such, I was curious to see how the S&P 500 behaved in scenarios where the oscillator plunged from above 50% to below 25%, which I have drawn onto the chart.

Aside from the present occurrence, this has only happened three other times since 2012, so it’s a fairly unique signal. In two out of the three occasions, the S&P 500 experienced sideways or rangebound behavior with somewhat deep troughs before accelerating again to new highs after an extended period of time (12-18 months). Only the first signal on the chart, in 2013, was followed by a continuous ascension to new ATH’s without experiencing a sideways action or consolidation shortly after the signal.

Per my best estimation, the 12-month returns after each of the signals were:

June 2013-2014: +19%

January 2015-2016: -8%

February 2018: +4%

Average 12-month return: +5%

It’s important to note that this is only one data point & study to consider, which must fit within a broad & vast range of data that are used to determine estimates and projections. By no means am I predicting that the 12-month return of the S&P 500 is going to be roughly +5%, based on the average of this one study.

Cryptocurrency:

No update.

Until tomorrow,

Caleb Franzen