Economy:

As part of the continuously evolving review of inflationary factors, I saw two fantastic charts that have strong implications for consumer prices. In yesterday’s newsletter, I highlighted how crude oil prices have an important direct relationship with inflation. While it should be clarified that oil prices are the most important commodity with a causal effect on inflation, commodity prices in general impact production, manufacturing, and transportation costs that get passed along to the consumer.

One commodity that we’ve looked at in the past was lumber, specifically noting that it was falling dramatically from the peak in May 2021. The last time we reviewed lumber data was in Edition #26 on 6/16/21, at which point the price of lumber was $1,010. This was already a substantial decline from the peak price of $1,670 on 5/27/21, implying a -40% drawdown in roughly 3 weeks. This downward momentum has only continued to accelerate since my post on 6/16, currently trading at a price of $685.

This means that lumber prices have declined by -59% from the ATH’s on 5/27/21. This is extremely important for the dynamics in the housing market, as home-builders have substantial costs related to the raw materials (notably lumber) used to build a new home. As their input costs go up, home builders need to accommodate for this increase by raising the price of the home in order to maintain comparable margins. An article was published by the National Association of Realtors Magazine in early May that the growth in lumber prices over the last year had caused the average price of a new single-family home to increase by $35,872 and multi-family by $12,966. Based on this data from the National Association of Home Builders, the $12,966 increase in multi-family home prices would indicate a $119 increase in the monthly rental price for each unit. At the time of publication, the price of lumber was over $1,400 vs. less than $400 in May 2020.

Therefore, as lumber prices continue to plummet from their historical run, this will likely help to mute inflationary pressures and the high cost of new homes & rents.

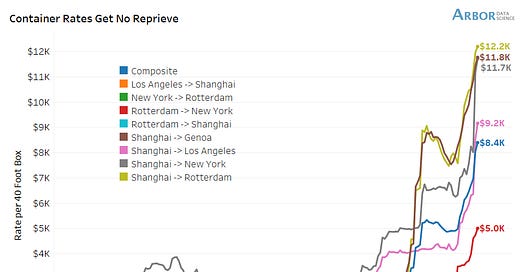

Unfortunately, lumber prices aren’t the only dynamic that influence inflation, as yesterday’s newsletter highlighted. Many of the supply-chain dynamics that have caused inflation to be higher-than-expected have continued to remain in place. For additional color, here is an update to the data I shared in Edition #32 on 6/24, showing how shipping rates have continued to move higher:

Relative to the data on 6/24, every single shipping route has increased in cost and by a relatively substantial amount. Notably, the Shanghai - Los Angeles rate increased from $6.4k to $9.2k (+43.75%), and the overall composite rate increased from $7.0k to $8.4k (+20%). To echo what I said in that edition, “these factors for international supply chains will continue to provide tailwinds for inflationary pressures to rise”.

Stock Market:

Goldman Sachs released a statement providing their views on the overall equity market & updating their year-end targets. I thought it would be useful to share this info, at the very least to gauge where the large institutions believe the market is headed generally.

“Our year-end S&P 500 target remains $4,300, consistent with our Rates strategists’ forecast that Treasuries rise to 1.9%. But we recently noted that if rates instead end 2021 at 1.6%, our dividend discount model suggests an index fair value of $4,700, all else equal”.

Considering that the S&P 500 closed yesterday’s session at $4,384, Goldman’s guidance (based on a 1.9% Treasury yield) implies that the index will be flat for the remainder of the year. Even in their scenario of a 1.6% yield, an end-of-year value of $4,700 would imply an upside of +7.2% relative to the current price of the index. Considering that the $SPX has already gained +16.76% so far YTD, an additional +7.2% gain would imply an estimated 2021 performance of roughly +25.2%. This is calculated by the following equation [100*(1.1676)*(1.072)-100]. If so, this would be the 3rd highest annual return going back to the year 2004, in which only 2013 and 2019 would have been higher. So far, it’s shaping up to be a historically great year for the stock market.

Cryptocurrency:

No update.

Until tomorrow,

Caleb Franzen