Edition #39 - 7.2.2021

Jobless Claims Hit Pandemic Low, Relationship Between Central Banks, Interest Rates, and Asset Prices, & Housing Market Divergence

Economy:

The most important news from yesterday’s data was the weekly initial jobless claims data, which was a surprising beat after several consecutive weeks of worse-than-expected results. For the week ending June 26, the seasonally adjusted initial claims was 364k vs. estimates of 388k. The prior week had initially reported initial claims of 411k, but this was revised up to 415k, indicating even weaker data than we initially believed.

This week-over-week decline was certainly welcomed, representing the lowest reading since the start of the pandemic in 2020. The 4-week average now stands at 392.7k. For the full context, here is a graph from Bloomberg showing the initial unemployment claims starting January 2020 through the present:

As I’ve highlighted on here, I suspect this figure will continue to decline steadily, with more substantial declines beginning in September & October 2021. There will continue to be unexpected spikes in claims, but the trend will continue to be to the downside. Steady progress is the best we can hope to ask for as the economy continues to rebound and the labor market begins to regulate itself to normalcy.

Stock Market:

After yesterday’s mid-year review of my top investment themes & individual stock picks for 2021, I thought it was perfect timing that I saw an updated chart of the relationship between major central bank balance sheets and the aggregate value of global stocks & bonds. I continue to believe that this is the most important correlation in the world of investing, which completely changed the way that I view financial markets & investing in assets. In my opinion, the number one rule to investing is don’t fight the Federal Reserve, although it could certainly be expanded to global central banks!

As global money supply increases, and the majority of the digitally printed money stays in the financial/banking system (primarily through reserves & excess reserves), the monetary stimulus primarily boosts liquidity and increases the present value of asset prices. With lower interest rates, the present value of a company’s future cash flows are discounted at a lower rate, which also boosts the valuation of that company.

Let’s prove it mathematically, calculating the present value of an asset that generates $5M in income/year for the next 10 years applying a 4% interest rate vs. a 2% discount rate. These formulas are taught in introductory finance & investing courses in college, in which the present value of an asset is equal to the discounted cash flows of the life of an asset.

If the interest rate = 4%: Present Value = $5M/[(1+0.04)^10] = $3,377,820.84.

If the interest rate = 2%: PV = $5M/[(1+0.02)^10] = $4,101,741.49

As we can see, by keeping all other variables constant & simply decreasing the interest rate from 4% to 2%, the present value of the expected cash flows increased by $723,921. The asset still paid the same $5M/year for 10 years, but the value of the asset increased substantially from a mere decrease in the discount rate.

Considering my strong belief that global central banks will continue to be net printers of money, providing ample liquidity & monetary stimulus, this artificially suppresses interest rates below the market rate & provides a strong tailwind for asset prices. When I realized this in 2016 as a young economist & investor, this entirely changed my perception of investing and is why I have & will continue to remain bullish on stocks.

Cryptocurrency:

No update.

Real Estate:

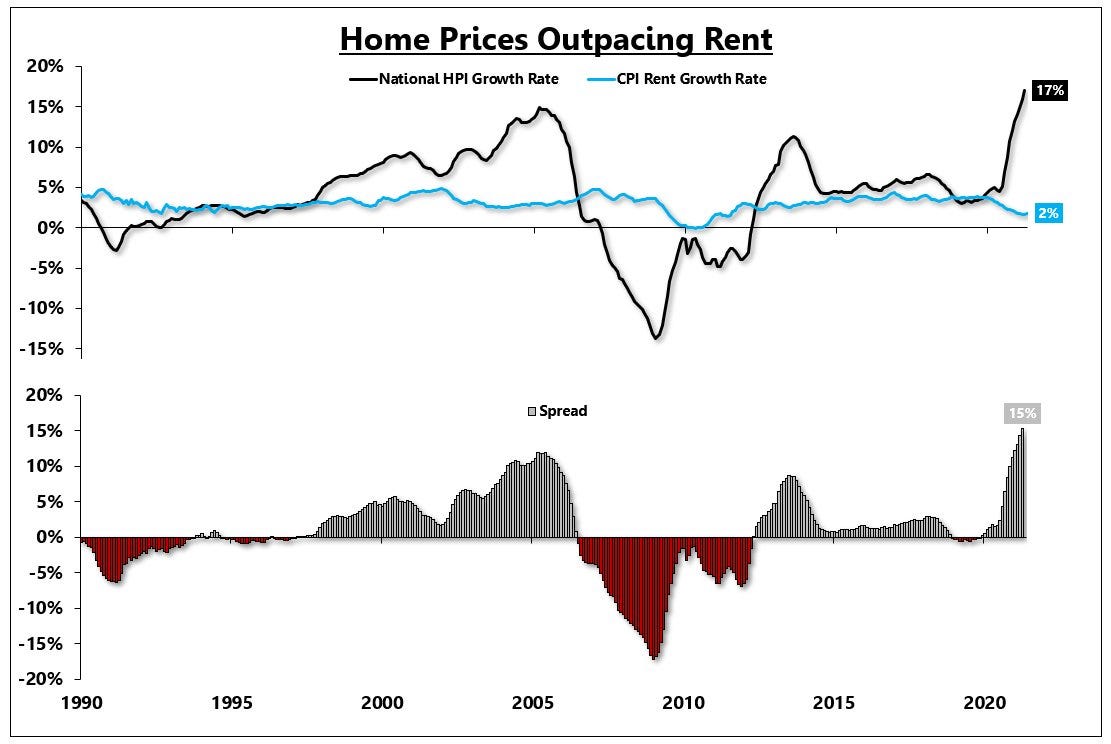

I saw a fantastic graph highlighting the relationship between the growth rate in housing prices vs. rents. Among traditional supply vs. demand factors, the value of a home can be calculated in a similar fashion to the net present value equations shown above, in which the cash flow is the monthly rent minus the cost of the mortgage. As such, it would be reasonable to expect that housing prices and rents have a positive correlation! If a homeowner can generate higher levels of rents than they did previously, the value of the home will rise (all else being equal), considering that the asset generates more cash flow.

First of all, it’s worth noting that home prices are growing at a historical pace, reaching a +17% growth over the trailing 12-month period ending May 2021. However, these tremendous gains have been achieved during a period in which rents have decreased! This divergence is definitely possible, but not necessarily expected. So how could this be happening? Hint hint, we just covered it above in the section on the stock market & how there is an inverse relationship between interest rates & present value of an asset.

One thing that’s worth considering is, as we come out of the pandemic & the labor market gradually recovers back to the pre-pandemic trend, won’t rents likely rebound? As the San Francisco, New York, and Los Angeles real estate markets rebound (recall, the SF market saw upwards of -30% declines in rental prices due to lack of demand), the national CPI rent growth rate will surely begin to slope upward. My guess is that this will provide additional tailwinds to the housing market, adding fuel to the fire of an already hot market. It’s very possible that a full-blown economic recovery, entering the “boom” phase of the economic cycle, will cause rents to rise & housing prices to accelerate.

Personally, I don’t see any reason for the housing market to slowdown. The housing market has seen historic gains due to a supply shortage, demographics, and work-from-home dynamics that allowed Silicon Valley tech workers and NYC bankers to work anywhere in the country. In regard to the tech industry, many of the major employers have granted the ability to permanently work-from-home, and the employees moved to more desirable, affordable, and enjoyable destinations. I refer to this as a logistics dynamic.

As we approach the potential “boom” phase of the economic cycle, we will start to see more demand-side pressures that will cause housing prices to increase. The Federal Reserve continues to purchase at least $40Bn/month in mortgage-backed securities, helping to push mortgage rates lower. New housing starts continue to inch higher after seeing a massive decline at the onset of the pandemic, although we remain drastically below the housing crisis peak by approximately 800,000 homes/month.

As I said earlier, if the fundamentals are reasonably secure, my number one rule in investing is “don’t fight the Fed”.

Talk soon,

Caleb Franzen