Edition #36

U.S. Household Wealth, Tech Outperformance, Facebook = $1Tn, and Semiconductors Update

Economics:

After yesterday’s post where I essentially charged the Federal Reserve with a significant amount of responsibility for widening the wealth gap, I thought it was apropos to include this fantastic post I saw on Twitter regarding household wealth.

Right off the bat, it’s amazing to see that there have only been two instances in which U.S. household wealth declined in a given year out of the 21 years shown. Considering that the tracking starts in 2000, I’m guessing the several prior years (the dot com bubble) also saw strong wealth growth.

The second glaring fact is that 2020 was a record year. If we take the average of the 20 prior years, we’d get an average growth in U.S. household wealth of +$3.45Tn/year. Therefore, the increase in household wealth in 2020 was 3.91x larger than the prior 20-year average! I’m certainly curious to know more about how the $13.5Tn increase can be attributed to different asset classes. Considering that we’ve had a moratorium on government student loans, a record high stock market, an impressive housing market, extended & increased unemployment benefits, and direct stimulus payments, all of which were sparked through historic levels of fiscal & monetary stimulus, it’s actually quite logical to see such a substantial increase. These programs, both on the monetary & fiscal side, borrowed future economic activity & forced it into the present, so an important factor to keep in mind is how long-term economic activity is impacted by such policies. The debt used to finance the stimulus will need to be paid back, at some point, plus interest.

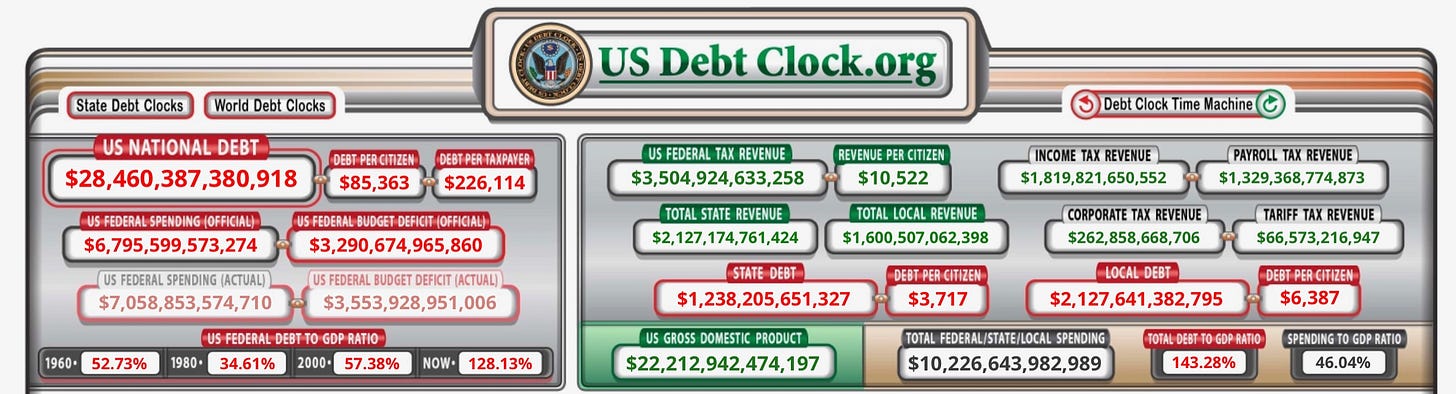

Just as a reminder, here is the national debt clock as of 9pm ET on 6/28/2021:

It’s quite sobering to see that each U.S. taxpayer is “responsible” for $226,114 of the national debt, if evenly distributed. The U.S. federal debt to U.S. GDP has grown from 57% in 2000 to 128% in 2021. I’ll go out on a limb here and predict that we’ll be over 150% in the next 5 years. If you include state & local debt in the calculation, the figure is currently at 143%. To tie back into my comment about paying back the principal plus interest on the debt, the debt servicing cost of the federal debt is currently $401Bn; however the largest single budget items can be seen below:

Plenty more to come.

Stock Market:

I have three important things I want to address here, all of which will be brief.

First of all, the tech/growth > value outperformance continues to be the theme in the market. This is something we’ve been covering at length since the start of this newsletter in May, when I started to see early signs of a rotation. I wasn’t convinced that the trend would stick, but after the FOMC policy meeting in mid-June, I got the green light. Paid subscribers just saw my recent top 10 allocations, and hint hint: the majority of the positions were tech/growth names. My portfolio will continue to become more overweight tech/growth over this week. Here’s a great chart to show the relative outperformance over the last day, week, and month:

1 month ago, these charts were essentially inverted!

The second topic that I want to cover is that there is a new member of the $1Tn club! Facebook accomplished this historic feat during yesterday’s trading session, closing at an ATH of $355.64. Since being founded in 2004, they are the fastest company to reach a $1Tn valuation. They now join Apple, Microsoft, Amazon, and Alphabet (Google).

The final topic that I wanted to cover was the semiconductor industry, which was a topic that I highlighted in Edition #32 last week! In that newsletter, I wrote the following in my analysis of the VaNeck Vectors Semiconductor ETF ($SMH):

“My prediction is that we are gearing up for a massive breakout above this level, based on the fact that we retested two key support areas: the grey range (prior ATH’s in 2020), which has acted as both support & resistance, and also the rising red trend line.”

As of today, only three trading days after the release of that analysis, $SMH has successfully broken to new ATH’s & is now above the breakout zone.

As we can see, it happened during yesterday’s session on a +2.43% gain. Now that the breakout has occurred, my focus is on ensuring that the breakout can successfully hold above the prior ATH’s. In today & tomorrow’s session, I will be monitoring the price to confirm that price will show strength, either through a continuation move or a closing price above the highest white price level at $258. Even if price does fall beneath, it doesn’t necessarily destroy the breakout momentum thrust. One way or another, I’m excited to see where this is headed & I wanted to update everyone that the breakout appears to be underway.

Cryptocurrency:

No update. BTC/USD = $34.7k and ETH/USD = $2,120 as of 10pm ET 6/28/2021.

Until tomorrow,

Caleb Franzen