Edition #26 - 6.16.2021

Lumber Leading Inflation, Junk Bond Yields at All-Time Lows

Economy:

Since the mid-March 2020 lows, lumber prices have massively accelerated at a historical pace. There are some fundamental market dynamics that help to explain this dramatic increase in price, but has been further accelerated by rising inflation expectations & a strong housing market. Over the last 5 years, here is the chart for lumber prices:

After bottoming at $296 on 3/25/2020, the price of lumber 5x’d and reached highs of $1,670 on 5/27/21. It’s estimated that the rapid increase in lumber has caused the price of a new home to increase by $34,000, as homebuilders are simply passing along the cost to the buyer. Since reaching that peak in early May, the price of lumber has fallen -40% to $1,010 as of 6/15. Lumber isn’t the only commodity to have fallen substantially since peaking in early May. Corn futures fell more than -17% from their 5/7 highs. Wheat futures are currently down -13.3% from the 5/7 highs. Copper is down -11% from the 5/10 highs. Two other industrial metals, platinum & palladium are also down considerably from their May highs, falling -10% and -8%, respectively.

So why is this potentially important? One of the substantial factors that have caused these commodities to rise has been the increase in inflation expectations & actualized inflation. Therefore, as these commodities begin to correct, I’m forced to ask if this is a standard correction after a significant rally, or if these commodities are moving lower as a precursor to declining inflation. The divergence is odd, although many other commodity prices are still at/near their highs and oil prices are currently making multi-year highs.

It’s something I’ll continue to monitor, as it has several implications for economic conditions as well as within my own investment portfolio. Premium subscribers are aware that oil & gas services have been some of my most high-conviction trades, as well as dry bulk/tankers, based on my views on inflation & commodity prices. I’ve almost fully closed out my oil & gas services trades, but would be interested in adding back to them in the event that oil prices continue to develop in a constructive manner.

Stock Market:

I saw a great chart from Bloomberg Opinion columnist Brian Chappatta that I believe has strong implications on equities, although the data isn’t directly related to the stock market. Below is a chart showing the yield on junk bonds, which are currently at record lows of 3.84%, beginning from the year 2000:

There’s one main reason why I think this is important, but it might take a roundabout way to explain why. Junk bonds are quite characteristic of their names, and are considered to be some of the more risky corporate debt in the market, in which the issuer has a below investment grade credit rating. In order to justify the increased default risk of the issuer, the issued bonds have a higher yield in order to attract investors & offset the underlying risks.

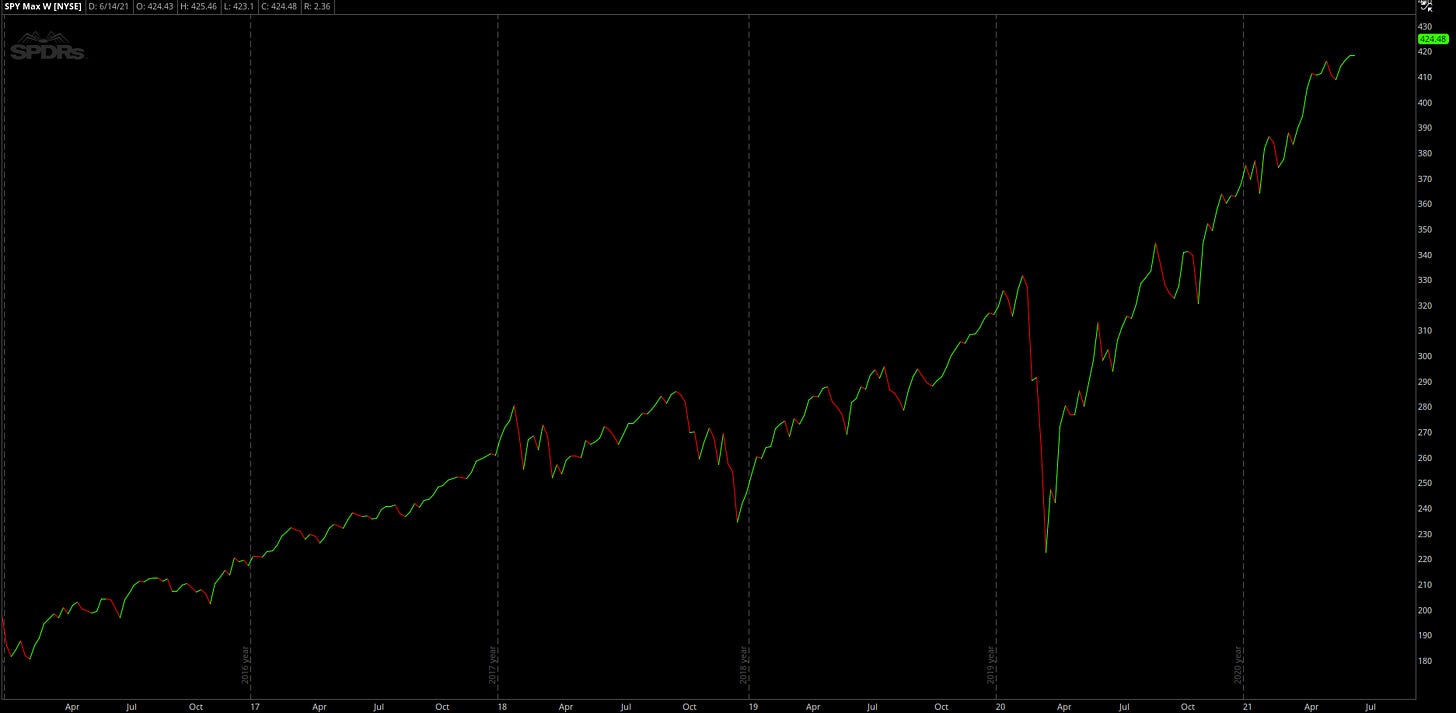

Because of the elevated risk of these assets, the value of the asset actually behaves much more similarly to equities than they do to Treasuries. For example, here are three charts highlighting the performance of the S&P 500, junk bonds, and 20-year Treasuries, all spanning from January 2016 - Present:

At the end of the day, junk bond prices move very similarly to the S&P 500, hitting peaks and troughs almost in synchrony. With that said, the S&P has been rising much more decisively & with more magnitude. While each of these two markets were falling substantially at the onset of the COVID response, government Treasuries were rising as investors fled to safety!

Now that we understand some basic mechanics on how/why junk bonds are quite correlated to equities, we can return back to the initial point that junk bond yields are at all-time lows. As I’ve highlighted on this newsletter before, as yields fall, the present value of an asset goes up, all else being equal. Therefore, given the correlation between junk bonds and equities, as the yield on junk bonds continues to make new lows, my expectation is for junk bonds to make multi-year highs and for equity prices to continue to make all-time highs!

Cryptocurrency:

No updates. At the time of writing, BTC is $40,020 and ETH is $2,526.

Until tomorrow,

Caleb Franzen