Edition #25 - 6.15.2021

Consumer Expectations of Inflation, Equity Indecision, BTC Technical Analysis, Housing Market & Mortgage Rates

Economy:

As I mentioned in yesterday’s edition, economic news will largely evolve around the Federal Reserve’s policy meeting this week. Yesterday afternoon, the Federal Reserve Bank of New York released their Survey of Consumer Expectations, which includes some useful info regarding inflation, the labor market, and general household finance.

With so much focus & discussion on inflation, I thought it would be worthwhile to quickly review the median expectation that consumers have for the 1 and 3-year inflation rate going forward from May 2021. The 1-year expected inflation rate was +4% vs. 3.4% response in April. The 3-year rate also increased from 3.1% to 3.5% in May. No major surprise here, as consumers are echoing the Fed’s belief that any significant increases in the inflation rate are going to be transitory and fade back towards historical trends at/below 2%.

The graph from the report is a little distorted & unfortunately I can’t adjust the y-axis to elongate the data more clearly, but in any event, here it is:

Interestingly, consumers’ inflation expectations have been steadily rising since October 2019. Considering that last week’s report for the May 2021 inflation data showed a 12-month increase in the CPI of +5.0%, consumers are expecting inflation to slow down over the next 12 months. Let’s see if they’re right.

Stock Market:

Yesterday was a relatively boring but informative day for U.S. equities. I was posting on Twitter in real-time about my views on the market’s behavior & here are some of those tweets in chronological order:

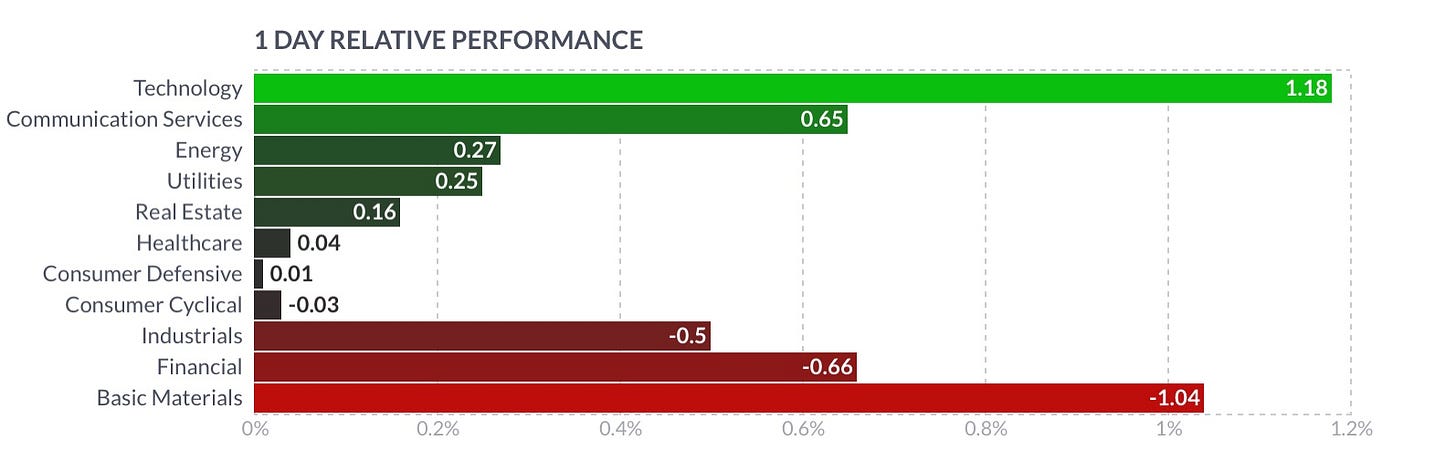

I typically feel that you can identify the daily theme in the market within the first hour of the trading session and it felt like the lack of action shortly after the open was the story for the remainder of the day. Growth continued to outperform value throughout the day and tech was actually the highest performing sector.

This following post was shortly after the first, highlighting divergence between nominal yields on Treasuries and the performance of the financials & banking groups.

As yields rise, this is generally considered to be beneficial for banks & financials who then experience a wider spread on their interest margins & thus should have higher revenues & profit potential. Because yields were rising throughout yesterday’s session, but financial equities weren’t responding positively, that made me think that equities aren’t convinced by the bond market. It’s likely too difficult to tell right now, but my expectation is that yields will push lower in the short-term, therefore my bias is that the equity market is correct in this case. As I said, time will tell.

Finally, this last tweet was posted at 3:06pm ET, highlighting how most stocks continued to sell off throughout the session as downward momentum continued to mount. With that said, the equity market had a power-hour for the final hour of the session, erasing a significant amount of losses. In fact, the S&P 500 even flipped into positive territory! For the day, the Dow Jones closed -0.25%, S&P 500 was +0.18%, Nasdaq-100 was +0.74%, and the Russell 2000 finished at -0.41%.

It will be interesting to see if the momentum thrust in the last hour of yesterday’s session continues today.

Cryptocurrency:

Quick update on the price action in BTC. At 9:13am ET on 6/14, I posted the following chart & commentary on Twitter:

Great continuation overnight as price is now back over $40k. Even though price has broken above the 21 day exponential moving average, it’s getting closer to retesting structural resistance from prior ATH’s in January 2021. Essentially, I’m cautiously optimistic.

Just to highlight the significance and power of technical analysis, here is the updated price chart with the same structural levels highlighted in white:

Price continued to rally until it exactly retested the overhead resistance zone that I highlighted. Now, just because price is slowing down at this level does not necessarily imply that it will fall back towards the lower-end of the range to retest support. It’s very possible the price of BTC continues to accelerate tomorrow, but my expectation is to see some consolidation at this level as buyers/sellers get re-accommodated with price back over $40k. I’ve continued to be a buyer in the $31k - $37k range, and even bought more at a price of $38.9k on Sunday evening. With price at this level, I’m taking a pause on my purchases in order to have more clarity on price structure.

Real Estate:

I continue to have interesting conversations regarding the housing market, including affordability in terms of debt-servicing costs and if this recent trend is sustainable. It definitely feels like an unprecedented time, which echos the thoughts of Glenn Kelman, the CEO of Redfin, that I included in Edition #10. As such, I was excited to see some housing data as part of the SCE report that I covered in the “Economy” section above.

What we’re looking at below is a graph that shows the median expectation of how much consumers believe housing prices will rise over the next 12 and 36-months. The median 1-year expectation is a +5.5% increase and the 3-year is +9.8%. The funny part was that the 3-year expectation of +9.8% is quite literally off the charts.

In my opinion, I actually find both of these median estimates to be far too conservative and in-line with historical trends. With my views & opinions on where 15 & 30-year mortgage rates are going, keeping in mind that the Federal Reserve continues to aim to purchase $40Bn/month in agency mortgage-backed securities, I believe debt-servicing costs as a percentage of disposable personal income will continue to trend lower. Certainly, mortgage payments only comprise a fraction of a household’s total interest payments, but the relationship is clear.

Below is the data from the Fed on household debt service payments as a percent of disposable income, starting in 2000, that shows a distinct downward pressure since the monetary policy regime following the Great Recession. The data point peaked at 13.21% in Q4 2007 and is currently at 9.4% as of Q4 2020.

My belief is that this will continue to be the trend, which is further evidenced by the trend in the average 15 & 30-year fixed mortgage rates (both of which are near the historical lows that were created in January 2021). Below is the graph of these average mortgage rates, from 2000 - Present. The trend is even more decisively moving towards zero and one thing I know is that you shouldn’t fight the trend.

Based on the inverse relationship between interest rates and the present value of an asset, my expectation is that housing prices will continue to rise over the short and long-term, and likely at a rate faster than +5.5% over the next year.