Investors,

If you’re limited on time, here’s a brief synopsis of the full analysis in this edition:

Q3 2022 GDP growth appears strong, drastically improving from anemic results in Q1 & Q2, but likely strengthens the Fed’s resolve to combat inflation and maintain an aggressive monetary policy stance.

Despite ongoing rate hikes, designed to tighten financial conditions & anchor borrowing/lending activity, total loans & leases in bank credit and private fixed investment continue to hit new all-time highs.

The stock market is experiencing the strongest rally of the 2022 bear market, led by the Dow Jones Industrial Average, despite negative reactions to Q3 corporate earnings. The Dow has been steamrolling higher, up +14.6% from the intraday lows on 10/13/2022.

Bitcoin & crypto successfully participated in the stock market’s bullish momentum, after weeks of underperformance & stagnation. Relative to the Nasdaq-100, Bitcoin was able to increase in value, but remains at a pivotal support level.

Macroeconomics:

The biggest headline in terms of economic data was the release of the Q3 2022 GDP for the United States. Real GDP grew at an annualized pace of 2.6%, representing a growth rate of +0.64% quarter-over-quarter. This +2.6% result came in higher than estimates of +2.3%, considerably stronger than the negative real GDP growth of -0.6% in Q2 2022. On the surface level, the result for Q3 GDP paints an optimistic picture of economic output & productivity; however, it’s important to note that net exports contributed +2.77% to GDP growth. Said differently, all of the real GDP growth can be attributed to stronger net exports (exports - imports).

Considering that it was the significant contributor to real GDP growth, I was curious to analyze net exports over time. Interestingly, I noted that net exports typically begin to rise as a precursor to each U.S. recession since the 1980’s:

It appears that net exports can increase for a few quarter or several years before a recession comes, but I thought that this was an intriguing characteristic. That isn’t to say that rising net exports is the causal factor for a recession, but simply that there’s a somewhat distinct correlation in their occurrence. Speaking of recession, the infamous relationship between the 10-year Treasury yield and the 3-month Treasury yield has officially inverted. This inversion, indicating that the 3M yield is greater than the 10Y yield, has a 100% success rate in predicting a recession:

If you want to learn more about this, I’d encourage you to read my former analysis, “Yield Dynamics, Curve Inversions & Market Implications”.

Thinking about the broader implications of the GDP data, I’m having a hard time discerning whether or not the Federal Reserve views this as a win in their fight against inflation. On one hand, they are attempting to engineer a soft landing in order to reduce aggregate demand. As such, stronger-than-expected GDP is likely antithetical to their goal. On the other hand, resilient economic output could strengthen the idea that the Fed is successfully creating a soft landing. They don’t want real GDP to nosedive, so perhaps they are pleased with relatively anemic economic output that occasionally comes in stronger than expected.

Either way, I think the GDP data strengthens the argument that the Federal Reserve will continue to raise interest rates at a steady & persistent pace. Nothing about this data will encourage them to reverse course or slow the pace of their rate hikes, particularly with headline CPI at historically high levels.

The market appears fully prepared for the Federal Reserve to raise the federal funds rate by another +0.75% next week, on November 2nd. As of Friday evening, CME futures are pricing in an 81% chance that the Fed hikes by +0.75% points next week:

Markets have started to gain optimism that this could be the final +0.75% rate hike, with the perception that the Federal Reserve could raise by +0.50% in December 2022, followed by +0.25% in January 2023. Personally, I think that this optimism has gotten too far ahead of itself and would encourage investors to remember that the actual path of monetary policy has been much more aggressive than the market had expected. My view is that the underlying measures of inflation (core CPI, median CPI, trimmed-mean CPI, and core PCE) will continue to accelerate while headline CPI decelerates. In this scenario, I don’t believe that the Fed will be able to justify a shift in their path of tightening financial conditions, barring a financial crisis or unforeseen risk event.

It’s vital to remember that the Federal Reserve is trying to reduce aggregate demand and therefore re-equilibrate the market at a lower equilibrium price. Their primary tool to reduce inflation is to tighten financial conditions, which will in turn create the following effects:

Higher interest rates will increase the cost of capital, reducing demand for credit-based consumption & debt-financed investment activity. As the cost of capital rises, the Fed expects to see the labor market soften, therefore reducing aggregate demand.

Higher interest rates & less liquidity will cause the present value of asset prices to fall. This creates an inverse wealth effect, theoretically reducing aggregate consumer demand as consumer wealth declines.

Interestingly, rate hikes & higher debt-servicing costs haven’t materially reduced demand for borrowing. Total loans & leases, which includes consumer loans, mortgages, and commercial & industrial loans, reached $11.747Tn in October & grew at a pace of +11.8% YoY.

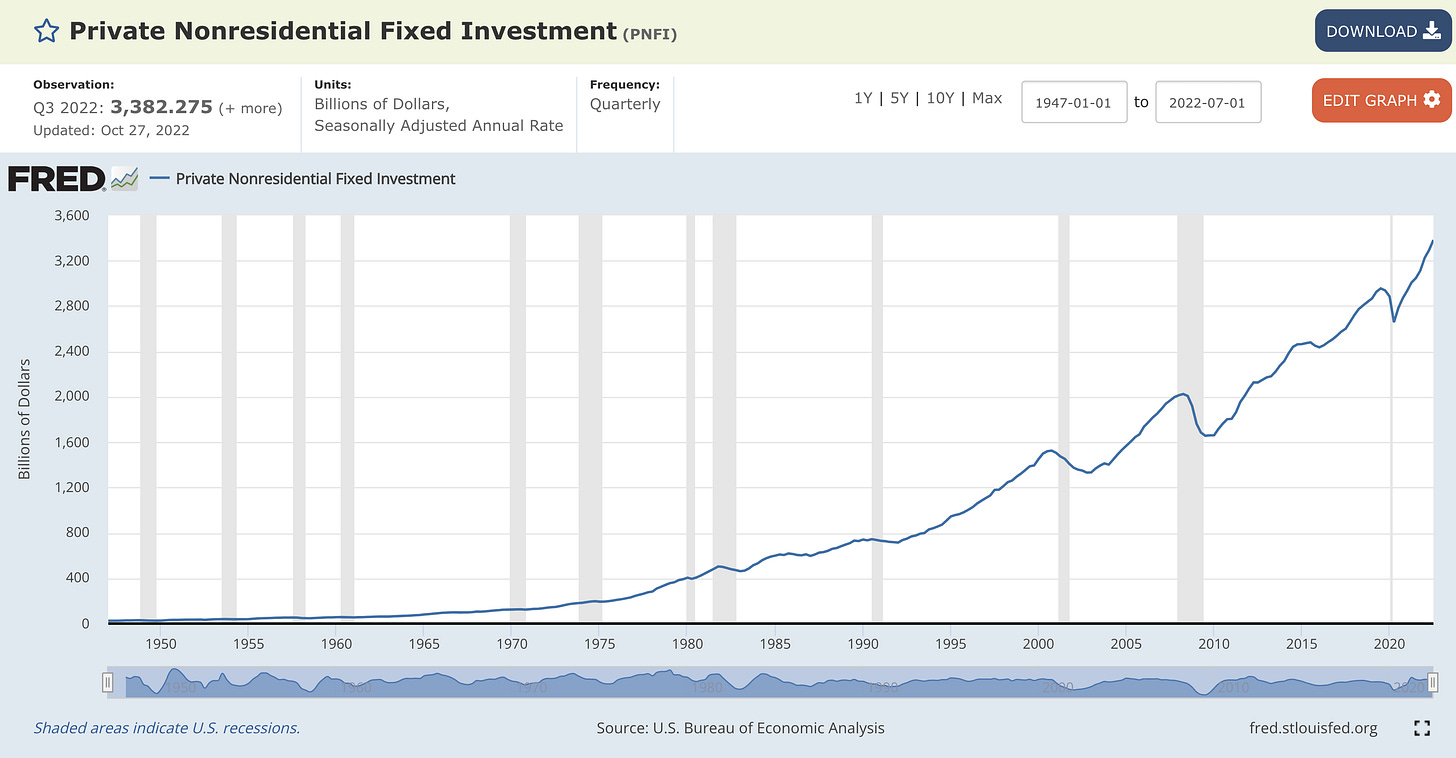

Private nonresidential fixed investment (PNFI) also continues to rise, indicating that capital expenditures are expanding. The latest data for Q3 2022 shows PNFI of $3.382Tn, up +2.7% QoQ and +11.0% YoY.

Therefore, despite the rapid increase of interest rates & tighter financial conditions, businesses & consumers continue to borrow & spend at historically strong levels. This is the exact opposite of what the Federal Reserve wants to see in order to combat inflation. I think it’s prudent to remain skeptical of optimism surrounding a pivot.

Stock Market:

Markets have grown accustomed to the Fed’s ongoing +0.75% rate hikes, becoming convinced that “75 is the new 25”. With markets starting to expect that a +50 basis point rate hike is potentially around the corner in December, the perceived path of monetary policy is becoming less aggressive. Considering that markets are forward-looking pricing mechanisms, we’ve seen asset prices experience a substantial rally since the market lows on 10/13/22.

This recent week was mayhem for the markets, in the midst of earnings season dominated by mega-cap tech stocks. While earnings season has largely been a drag on individual stock performance, the broader markets had a phenomenal weekly return:

Dow Jones $DJX: +5.7%

S&P 500 $SPX: +3.95%

Nasdaq-100 $NDX: +2.1%

Russell 2000 $RUT: +6.0%

Markets have roared higher since the YTD lows on 10/13, arguably experiencing the strongest & fastest rally of the ongoing bear market. The Dow Jones has gained +14.6% since the intraday lows on October 13th, a span of 12 trading days. For context, it took the Dow nearly 41 trading days to produce a gain of +14% from mid-June through mid-August 2022.

Considering that Apple Inc. AAPL 0.00%↑ was the only stock to respond positively to their earnings, up +7.56% on Friday, it's amazing to see that the broader market was so resilient. For example, these are the returns of other mega-cap tech stocks the day of/after earnings:

Microsoft MSFT 0.00%↑: -7.7% on Wednesday

Alphabet GOOGL 0.00%↑: -9.1% on Wednesday

Meta/Facebook META 0.00%↑: -24.5% on Thursday

Amazon AMZN 0.00%↑: -6.8% on Friday, but down more than -20% after-hours Thursday evening.

Nonetheless, the S&P 500 was able to shrug off market pressure & generate a strong weekly return:

Last weekend, I expressed a cautious outlook for the market and said the following:

“It’s prudent to begin decreasing risk as soon as next week while still leaving enough portfolio exposure to benefit in the event that the market does continue higher.”

This is exactly what I did on Thursday and Friday, reducing exposure to short-term trades that were highly profitable. I simultaneously DCA’d into core holdings in long-term portfolios, steadily increasing my exposure to high-conviction stocks. If you want to know exactly what I’m buying and why, I’d encourage you to explore my “Portfolio Strategy” series where I’m sharing the qualitative and quantitative investment thesis behind each of the 15 individual stocks & ETF’s I’m buying!

Here’s the latest edition:

I don’t want to get overly optimistic as the stock market climbs higher, particularly when underlying fundamentals haven’t materially changed. While stocks could continue to accelerate from here, I am fully supportive of decreasing short-term risk while marginally increasing long-term portfolio exposure. This concept isn’t fun, sexy, or exciting, but it’s worked all year and I think it will remain effective.

Bitcoin:

After starting the week slowly, Bitcoin was able to generate upside momentum & participate in the stock market’s rally. This is a positive development for risk assets across the board, as I mentioned in last week’s premium newsletter:

“If Bitcoin & crypto cannot build upside momentum, I don’t believe that stocks will be able to produce a sustained rally. It’s that simple.”

From my perspective, Bitcoin certainly produced the follow-through that bulls were looking for. This is a sign that risk appetite is increasing across the asset markets. If we zoom out and compare the performance of Bitcoin vs. the Nasdaq-100, the 2022 trend indicates that risk appetite has drastically decreased. This isn’t news to any of us, but I think it’s key to highlight that BTC/NDX is retesting a key support range and will need to show signs of life along this level:

Looking closely, we can see that BTC/NDX rose this past week, confirming that risk appetite is trying to create upside momentum. It is vital that this upside momentum continues to grow, otherwise I’m fearful that this latest market rally will turn into another bear market rally.

With risk appetite broadly increasing this past week, Ethereum and other altcoins managed to outperform Bitcoin. I believe that we could continue to see ETH outperform BTC over the coming weeks, possibly extending into the proven resistance range highlighted in red:

Time will tell how this will play out, but I look forward to see how things evolve next week!

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.