Edition #209

Will The Housing Market Pop Next?

Investors,

We had an important week of economic data, which caused financial markets to respond negatively. I’m going to specifically focus on two key macroeconomic dynamics in this report: inflation & the real estate market.

Tomorrow’s premium market analysis will provide in-depth analysis & discussion about ongoing dynamics in the stock & crypto markets!

As a reminder, I’ll be releasing my second edition of “Portfolio Strategy — What I’m Buying & Why” this upcoming Wednesday. These reports are exclusive for premium members, so please consider upgrading your subscription if you’d like to receive a deep-dive on the next two stocks I’ve been buying in client accounts.

Inflation Analysis:

The August 2022 CPI was projected to increase at a rate of +8.0% on a YoY basis and -0.1% on a MoM basis. Without knowing these estimates, I previewed my expectations for the August CPI data on YouTube and shared the following perspectives:

The results for August were significantly worse than median estimates were projecting, seeing a YoY increase of +8.3% in headline CPI and a month-over-month increase of +0.1% While some might observe a silver-lining that the YoY increase decelerated for the second consecutive month, down from +8.5% in July and +9.1% in June, I can’t find anything to celebrate in this report. If we analyze core inflation, which excludes food & energy prices, the YoY rate of change increased from +5.9% in July to +6.3% in August.

Throughout 2021, Team Transitory (those who believed a rise of inflationary pressures was temporary) cited the core CPI data to support their argument that headline inflation was neither significant nor widespread. Today, we’re seeing headline inflation moderate, largely driven by disinflationary dynamics caused in the energy markets, while core CPI continues to accelerate higher. Considering that food & energy prices can be volatile, core CPI helps to provide additional context about inflation dynamics. Unfortunately, it’s not giving us any positive context right now.

After diving into the CPI data, these are the key aspects that I want to highlight:

Since the end of June 2022, gasoline has fallen by more than -18%. The broad basket for Energy has similarly fallen by -10%. Despite these massive improvements, the All Items rate of inflation is +0.1% since June 2022. While falling energy & fuel prices have been deflationary since June 2022, we’re still experiencing broad-based inflation. I wonder, what would headline inflation be if energy & fuel prices hadn’t fallen so significantly?

The Shelter component, which is measured via owner’s equivalent rent, increased at a monthly rate of +0.7%. In fact, the Shelter component has been rising at a monthly pace of at least +0.5% since February 2022. Shelter increased by +6.3% on a YoY basis, rising at the fastest pace since April 1986:

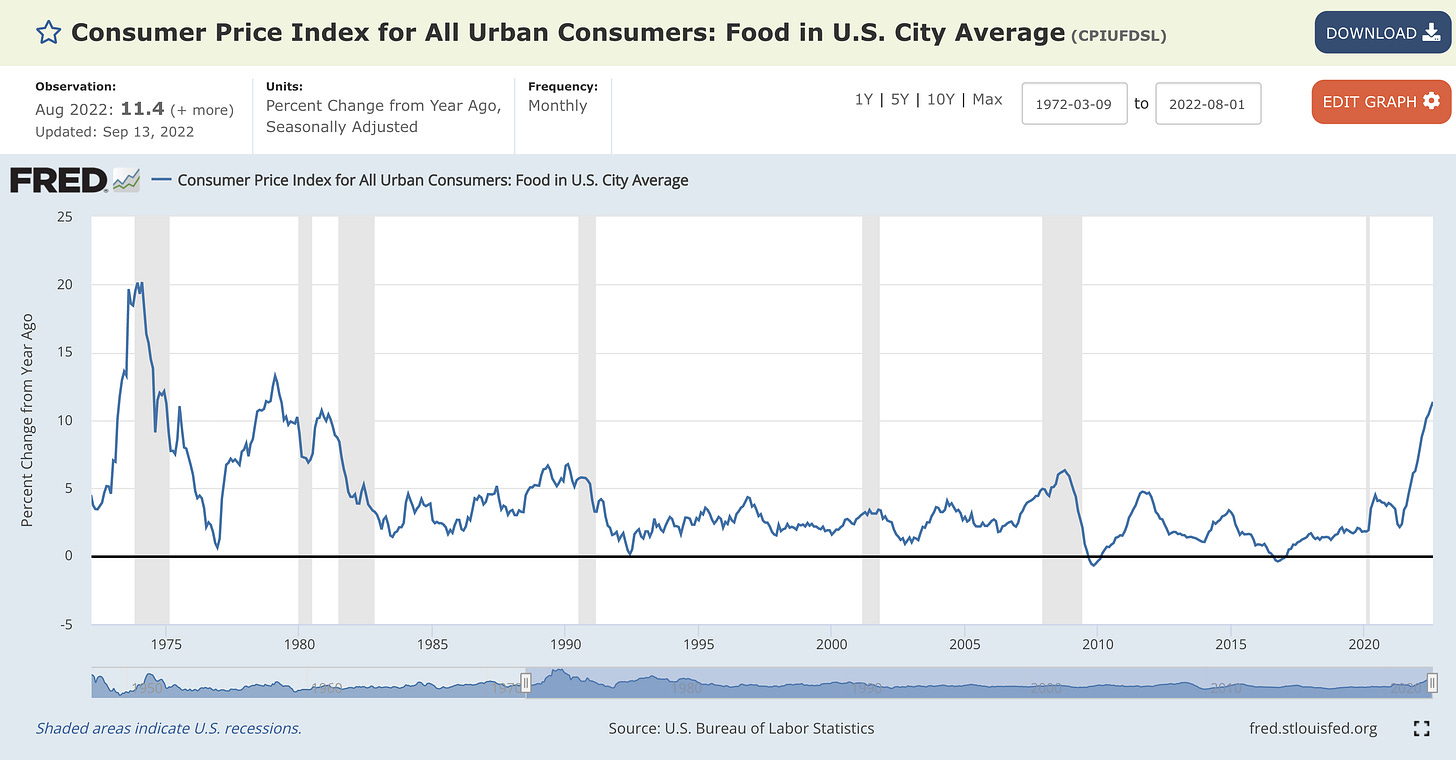

Food prices, which are excluded from core CPI, continue to accelerate higher. The YoY rate of change increased from +10.9% in July to +11.4% in August. This was up from +10.4% in June, when inflation “peaked”. Unequivocally, U.S. consumers are paying exorbitantly higher prices at the grocery store & restaurants. The +11.4% YoY rate of change is the highest since April 1979.

Across the board, consumer prices are increasing. As I mentioned at the intro of this section, the deceleration in YoY inflation could be viewed as a silver-lining, but the alternative measures of inflation continue to rise. In the chart below, we can monitor the evolution of headline CPI, core CPI, median CPI, and trimmed-mean CPI:

This is further proof that any disinflationary pressures that we’ve witnessed in recent months is being entirely caused by falling energy & commodity prices. This dynamic was the core message that I highlighted when we received the July CPI data, and I think it will remain extremely relevant going forward. These alternative measures of inflation indicate that the underlying trend in consumer prices is still accelerating, something that the Federal Reserve is likely concerned about. From my perspective, the August 2022 CPI data reaffirmed the likelihood that the Fed keeps their foot on the gas pedal, so to speak.

Housing Market Analysis:

With inflation out of the way, I also wanted to highlight another key component of the U.S. economy: the housing market.

I was able to access data from the National Mortgage Database in order to find extremely important figures about the underlying health of the mortgage market. Specifically, I was curious to know what percentage of total outstanding mortgages are locked into a fixed interest rate.

Why? Recall back to the Housing Bubble of the early 2000’s, largely fueled by a lack of lending standards, adjustable rate mortgages, and speculative Wall Street activity in the mortgage-back securities market. The adjustable rates (ARM’s) were designed to attractive relatively unqualified buyers via cheap financing costs that would eventually increase depending on interest rates at some point in the future. With the perception that interest rates would remain low for the foreseeable future, prospective buyers flooded into the market and borrowed money at these variable rates.

Once holes in the housing market started to show, illustrating a rise in credit risk, interest rates began to rise and ARM’s kicked in at higher rates. In addition to these natural dynamics in the credit market, the Federal Reserve started to raise interest rates in Q2 2004. These two effects drove interest rates higher, which punished borrowers with ARM’s and further exacerbated weakness in the real estate market. We know how that story ended…

Over the past year, we’ve witnessed a historic acceleration in mortgage rates. There are two ways to contextualize the rapid increase in mortgage rates, which I produced on the Federal Reserve’s Economic Database:

YoY % Change (Rate of Change): The average 30-year fixed mortgage rate has increased by +110.5% over the past twelve months, the fastest acceleration ever. Quite simply, we’ve never seen the cost of real estate debt double on a YoY basis.

Nominal % Difference: This time last year, the average 30-year fixed mortgage rate was 2.86%. As of Thursday, September 15th, it’s 6.02%. This 3.16% increase is historically high, with only a few prior achievements over the past 50 years. In fact, the last time the 30-year mortgage increased by this much on a nominal basis was in November 1981!

Seeing how quickly interest rates have risen, I was curious to know how many borrowers had secured fixed-rate financing while rates were historically low. Are ARM’s still significant and do they pose a threat to the market? Based on the data from the National Mortgage Database, here’s what I was able to discover:

96.4% of all outstanding residential mortgages had a fixed interest rate, meaning that only 3.6% had a variable rate, or ARM.

65.2% of all outstanding residential mortgages had an interest rate less than 4%.

24.4% of all outstanding residential mortgages had an interest rate less than 3%.

85.5% of all borrowers have “good” or “excellent” credit, with an average credit score of 740.

My first takeaway is that the real estate market isn’t being threatened by a fundamental risk of a high concentration of mortgages with an ARM. In fact, it’s quite the opposite — the real estate market is likely being strengthened by the amount of debt that’s locked into historically low rates. Borrowers were extremely smart and locked in historically low financing costs in order to purchase their home or refinance existing mortgages. With roughly 65% of all existing mortgages having an interest rate less than a 4%, I technically view that as an asset relative to the current 6.28% rate, according to BankRate.

Not only is the home an asset, but the debt is as well. I’ve been vocal about this opinion before:

When I published this post in early April 2022, the average 30-year fixed mortgage rate was 4.7%. The wider the spread becomes between the low fixed rate that a homeowner locked in vs. the current mortgage rate, the more of an asset that debt becomes. We’re seeing evidence of this dynamic in the amount of refinance applications, with the MBA U.S. Refinancing Index reaching the lowest level since October 2000 and declining for the eighth consecutive week:

The second takeaway is related to the first, which is that existing homeowners who own their primary residence won’t be easily swayed to sell their house in order to buy a new home. This is primarily for two reasons:

With 65% of all mortgages having a fixed rate less than 4%, why would a borrower sell that home, and therefore depart from the financing terms of their existing home, in order to buy a new home in a bloated market at a 6% interest rate?

With home prices still elevated, homebuyers would have to consider the increased amount of property tax expense that would be incurred by purchasing a new home.

Not only would a home-seller pay higher debt-servicing costs via higher mortgage rates, but they’d also incur higher property tax expenses as well. This is a double-whammy, which I expect to reduce supply & housing inventory even further. At the end of the day, existing home-owners are disincentivized to sell their home.

Using the Phoenix, AZ market as an example, we can analyze the higher costs associated with selling an existing home to purchase a new one. In January 2020, the median sales price of a Phoenix home was roughly $275,000 vs. the current median sales price of $430,000, according to Redfin data.

Consider the following homeowner, who purchased a home in January 2020 at $275,000 with a 15% down payment and a fixed interest rate of 3%. This homeowner would have the following cost breakdown, according to results from Mortgage Calculator:

Monthly mortgage payment, including insurance = $1,400/month

Annual property tax (0.6% of appraised value) = $1,650/yr = $137/month

Total monthly expense = $1,537/month

Suppose they are looking to upgrade their primary residence, selling their $430,000 home in order to buy a new residence for $500,000. Back-of-the-envelope, here’s what their new monthly expense would be with a 15% down payment and 6% mortgage rate:

Monthly mortgage payment, including insurance = $3,120/month

Annual property tax = $2,950/yr = $245/month

Total monthly expense = $3,365/month

Therefore, a homeowner who sells their existing home in order to buy a marginally better home is now paying more than double in terms of their monthly cost. The aggregate value of their monthly mortgage payments (excluding property tax) over the life of the loan increased from $440,500 to $1.015M, simply to buy a new home that was worth $70,000 more at the time of purchase.

This is completely illogical and highlights the disincentives that existing homeowners are currently facing in the real estate market. To be clear, while these values are rough estimates, I’m confident that the point I’m trying to illustrate is clear. Said differently, existing homeowners who might want to capitalize on their increased equity have their hands tied behind their back. This Twitter user summarized this sentiment perfectly:

This dynamic might help to explain why housing inventory continues to remain at/near record lows. No one wants to sell, because the prospects in the market are no longer affordable in terms of price or monthly mortgage expenses. For example, here’s MLS data for the amount of homes listed for sale in the Chicago Metropolitan area:

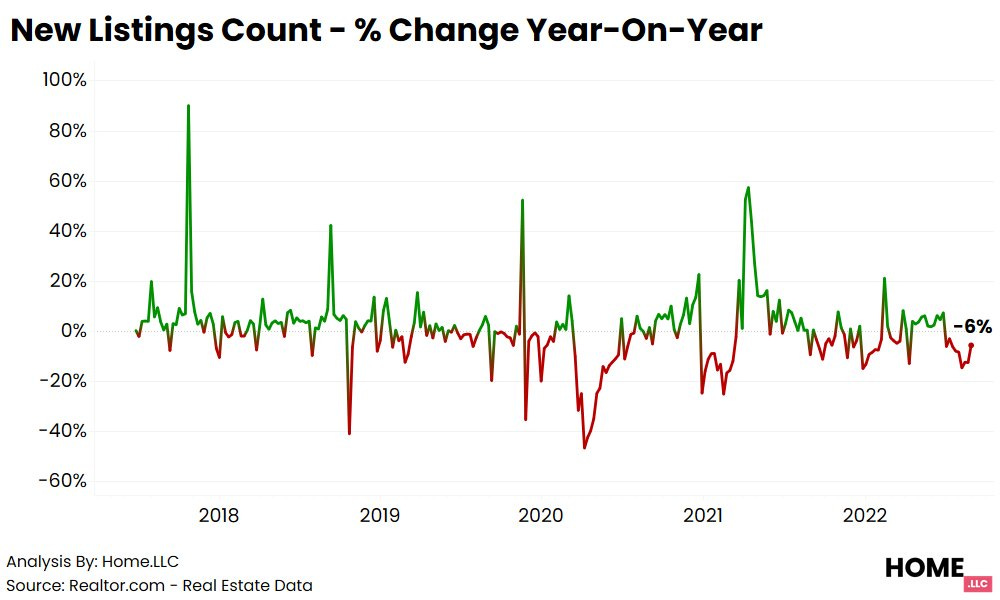

While this is merely one market, we can generally identify a consistent trend on a national level, with new listings on a YoY basis declining for 8 consecutive weeks:

The final takeaway is that borrowers will likely be able to service their existing mortgage, even if the labor market starts to weaken. With historically low rates locked at a fixed rate, I believe that the high concentration of “good” and “excellent” credit-rated borrowers will be able to service their mortgage even if the economy weakens. With the labor market continuing to show signs of strength & resilience, I have limited concerns about the ability of existing borrowers to make their payments in a timely & consistent manner. In fact, the delinquency rate on residential mortgages is 1.96% as of Q2 2022, the lowest level since Q4 2006!

You might be saying, “Well Caleb, the delinquency rate was 1.92% in Q4 2006 just before the housing bubble burst! Why is this necessarily good news?”

The key difference is the direction & trend of delinquencies. Delinquencies started to rise in Q1 2005, at an accelerating pace until the bubble finally burst. Conversely, delinquencies are steadily declining in the current market environment, and have been since mid-2020. Could this trend start to reverse soon? Sure, but I’m not going to hold my breath.

This delinquency data shows me that borrowers are making their payments on-time, with less and less borrowers being considered delinquent. The value and direction are both important! This is likely a function of a few things:

A strong & dynamic labor market with consistently rising wages/salaries.

The majority of mortgages are locked into extremely low financing rates, which borrowers are able to easily manage & service.

As of right now, I don’t see any signs of worry in terms of the delinquency data.

Housing Market Conclusion:

Based on the extreme divergence between the mortgage rates on outstanding mortgages and the current mortgage rate, I wouldn’t be surprised to see supply remain clogged & limited. Again, existing homeowners don’t have an incentive to sell their home in order to purchase a new primary residence. After being a homeowner, it’s unlikely that they’ll be willing to become a renter and forego potential upside in terms of equity.

Homeowner equity reached a new all-time high in Q2 2022, equalling $29.036Tn:

Objectively, this rate of growth seems unsustainable and slightly exuberant. Not only is the nominal value of homeowner’s equity rising at a consistently elevated pace, but the YoY rate of change is also historically elevated at +19.5%:

As we can see from this data, it’s generally quite rare for homeowner’s equity to increase at a pace near +20% on a YoY basis. However, I noticed that each peak is produced with a visible initial decline, similar to the one that we’re starting to experience right now. Additionally, it’s also very rare for homeowner’s equity to turn negative on a YoY basis. I believe this data could be foreshadowing a normalization in the percent change in homeowner’s equity, which would largely be driven by a decrease in housing prices. While I certainly expect to see the YoY rate of change normalize, I’m not convinced that we’re going to see a housing crash.

I’m very concerned at the rate of change in the average 30-year fixed mortgage rate, which is already have a drastic effect in terms of suppressing both supply and demand. With constrained supply & strong rental growth, home prices have remained resilient, broadly speaking. We’re starting to see cracks in some of the fastest-growing real estate markets in the U.S., notably in Phoenix, Tampa, Denver, and Austin. These could potentially be canaries in the coal mine, based on the fact that they provided high-magnitude returns to the upside during a bull market. Conversely, they could provide high-magnitude declines if the broader housing market starts to decline.

Quite simply, we can’t expect to see housing be impermeable to sky-rocketing financing costs and all-time high prices. As demand continues to dry up, I expect to see listing prices be reduced and for the YoY change in home prices to turn negative.

Incomes are growing, but not nearly at the pace that debt-servicing costs are. In order to counter-act the higher debt-servicing costs, demand is set to decline until home prices become enticing and monthly mortgage costs become more affordable. Remember, monthly mortgage costs are a function of the interest rate, the purchase price, and the amount of financing needed to purchase the home (difference between listing price and down payment). If interest rates are expected to remain high and financing needs remain constant, price must fall in order to bring demand back into the market.

With interest rates only expected to rise further, and the Federal Reserve moving closer to outright balance sheet runoff, I expect to see liquidity decrease across the financial system. In fact, this is the Federal Reserve’s goal: to tighten financial conditions, produce an inverse wealth effect, and reduce aggregate demand.

I’m fairly convinced that the Fed will accomplish their end-goal of reducing aggregate demand, one way or another. The question is whether or not their actions will also reduce aggregate supply, and therefore not have their desired effect to reduce inflation. For example, a deep recession could theoretically reduce both aggregate demand and supply, which could produce an unchanged level of equilibrium price.

In the example above, a reduction of demand from Demand(1) → Demand(2) with a simultaneous decline in supply from Supply(1) to Supply(2) would create a decline in aggregate quantity at the same equilibrium price. The total output produced by the economic system declines from Q(1) to Q(2) while price remains constant, such that P(1) = P(2). In this example, we see how inflationary pressures could persist despite a decrease in aggregate demand.

As a result of the Fed’s historic monetary tightening, we’ve witnessed the worst conditions ever for financial assets. The traditional 60/40 portfolio of stocks & bonds is having its worst year ever. Long-term Treasuries are underperforming the S&P 500. The cryptocurrency market has lost over $2Tn in value, or roughly -69%, since November 2021. Even gold has fallen more than -19% from the YTD highs in March 2022! I think it’s logical to expect the housing market to be the next domino to fall, though that doesn’t necessarily mean that real estate will plummet.

Over the coming months, I expect that yields will have tailwinds to rise. Considering that yields and asset prices have an inverse relationship, all else being equal, I expect that asset prices will face headwinds. This includes real estate.

While I can be categorized as having a bearish outlook over the short & medium term, which has generally been my view for all of 2022, I don’t have a “gloom and doom” outlook. I’m certainly cautious, though I’m opportunistic. At the present moment, I’m seeing limited short-term opportunities across the asset market and abundant long-term opportunities. Considering that we haven’t seen much of an impact in real estate prices, I don’t think opportunities are abundant… yet.

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.

1) what americans interface with on a daily basis is gas and food prices. with gasoline prices down -18% and the broad energy basket down -10% since june. there's a case to be made that inflation has likely peaked. sentiment play a role in the inflation narrative, and if that begins to change (due to falling gasoline prices), that could trickle down into other parts of the economy. also, take into account that oil is down ~30% since june. oil literally touches every part of the economy, directly via energy or indirectly via hydrocarbons. oil and CPI is historically correlated.

2) Powell told us few months back, that they're watching the price at the pump. if that comes down drastically, the Fed's would likely take their feet of the pedal. also, there's a correlation between lower gas price and winning elections. with mid-terms around the corner, prices around the pump will have to go lower so the democrats can remain in power.

3) if you ask SME's inflation has peaked. recent NFIB released this week has fallen off a cliff since june. historically, NFIB has a pretty tight correlation with CPI. can't post charts here, although Andreas Steno Larsen has one up on Twitter.

direction is one thing, while rate of change is another (and probably the most important). i don't see a scenario where CPI goes to 2% anytime soon, or going above 9.1%. the longer CPI remains below 9.1% (and moving lower), increases the odds that it has peaked.

the analysis on the housing market is brilliant 👍👏

Keep looking at your graphs Pascal. I look at my currency in my wallet and inflation has not peaked. I agree with Caleb that underlying inflation dynamics are increasing. Inflation is an increase in currency supply. With the trillions the US government spends and with all the beer sickness money created, the fed has to raise the funds rate above the CPI to bring inflation back to a crawling pace. Until then expect inflation to keep running to new highs. Good work Caleb.