Edition #2 - 5.18.2021

Fiscal Stimulus, 2021 Equity Rotations, Galaxy Digital Earnings, & the California Housing Market

Economy:

Thanks to an article that I saw published from Reuters, I was reminded of a key aspect of the American Rescue Plan that was signed by President Joe Biden in March 2021. The specific piece of the relief bill is the expansion of the child tax credit (CTC), in which “people will get up to $3,000 per child, or $3,600 for each child under the age of 6, in 2021, subject to income restrictions”. Previously, the CTC was capped at $2,000/child. Unlike traditional tax credits, which are received when an individual/married couple files taxes, this tax credit will be advanced in monthly payments via direct deposit beginning in July 2021 through the remainder of the year, with a final credit given at the time of tax filing for 2021. Essentially, the payments will follow this general breakdown:

For each child age 5 and younger: payments will be up to $300/month from July 15 - December 15, 2021, with a final $1,800 (maximum) payment received at the time of tax filing.

For each child ages 6 - 17: payments will be up to $250/month, with a final $1,500 (max) payment at the time of tax filing.

In either scenario, half of the CTC is being paid during 2021 with the final half being received once 2021 taxes are filed. In a joint-statement by the IRS & Department of the Treasury on 5/17, they expect that roughly 39 million households are set to receive the payments this year, benefitting “88% of children in the United States”. Additionally, qualifying dependents between ages 18 & 24 are set to receive a one-time $500 payment.

I am not here to debate whether this decision is right or wrong, but I am very keen to try and understand the implications this will have on economic activity. For 2018, the IRS estimated that the total dollar amount of the child tax credit was was $118Bn & benefitted “90% of taxpayers with children who had income between $30,000 and $500,000”. If the credit is being raised by at least 50% (from $2,000/child to $3,000/child at the low end), we could estimate that the total amount of the child tax credit paid for the 2021 tax year will be at least $177Bn (given by 1.5*$118Bn). With half of the entire CTC being paid during the 2021 calendar year, we could estimate that at least $88.5Bn will be deposited into household bank accounts, or roughly $7.4Bn/month. Note that this figure doesn’t include the expansion of the $500 check for each qualified dependent ages 18-24. As such, I expect that the total amount being deposited into American’s bank accounts from the CTC in 2021 will be substantially higher than $88.5Bn, but I don’t know exactly how high.

What I do know is that I fully expect the retail boom to persist throughout 2021. As I shared during yesterday’s post, the YoY% change in advanced retail sales is the highest it’s ever been according to the oldest recorded data from the Federal Reserve Economic Database dating back to 1991. If we look at the actual dollar amount of total advanced retail sales, the U.S. has dramatically surpassed the pre-COVID level & is substantially higher than the pre-COVID trajectory.

Considering that the April 2021 result was $619.9Bn, the estimate of an additional $7.4Bn/month would produce a +1.2% increase. I definitely made some key assumptions & used back-of-the-envelope calculations to get to this point, but it’s merely an educated guess. I’m also aware that Americans won’t spend the full CTC disbursements on consumer spending, as some portion of the funds will go to pay down debt, save, invest, etc.

Despite the month-over-month stagnation from March - April 2021, the trend above is very clear & I expect retail spending to persist at elevated levels for the remainder of the year, barring any major deterioration or negative shock to the economy. If consumer spending remains elevated beyond the historical/pre-COVID trend, I also expect to see CPI & inflation data consistently beat estimates, as it did during the most recent report for April 2021. As a reminder, this was the bell curve of estimates for April 2021’s YoY change in the CPI:

With a median estimate of +3.6% & the highest estimate of +3.9%, the +4.2% result was an overwhelming result. The Federal Reserve has pounded the table to emphasize their desire for sustained inflation over 2.0%. I believe they’ll achieve that goal, particularly with the enormous levels of fiscal stimulus, direct payments, and unemployment insurance being distributed.

Stock Market:

I saw a great post this morning from Charlie Bilello (@CharlieBilello on Twitter) highlighting the major discrepancy between some of the top stock performers from 2020 vs. the underwhelming performers during 2020 and their respective 2021 YTD returns. Here’s the post:

The post is a great way to highlight the rotation out of technology & growth-related equities into value & beaten-down sectors. This rotation has been largely evident since the mid-February response to consistently rising yields & more optimism regarding the recovery of the U.S. economy. One thing that I would want to add to Charlie’s post is the decline of the top 2020 performers from their 2021 YTD highs:

$TSLA -37%

$PTON -47%

$ZM -32%

$FSLY -66%

$ETSY -35%

$PINS -36%

$SQ -30%

$TWLO -36%

For long-term investors, there’s an argument to be made that these are attractive levels to build a position in tech & growth companies. As someone with a 1-3 month investment horizon as a full-time trader, I have zero intention of trying to “catch a falling knife” & attempt to predict the bottom of these stocks. For me personally, I want to stay in high momentum spaces that are adjusting well to changing economic fundamentals & are experiencing high fund flows. So far, here are the YTD returns for a variety of sector-based ETF’s:

Energy, financials, materials, industrials & real estate are the top 5 performing ETF’s in this group. I’ve adjusted my portfolio to appropriately accommodate these momentum plays. At the present moment, I’m interested in $CEIX $ESTE $BTU $FANG $GOLD $AUY $KL $WPM $JPM $WFC $MS $GS $KKR $BX $WY $RYN $WELL $CAT $URI $DE, all of which are in these 5 sectors. I do have positions in a variety of these names.

Cryptocurrency:

Rather than giving an update on actual Bitcoin itself, it seems relevant to cover the earnings report from Galaxy Digital Holdings, a financial services and investment management firm within the digital asset, crypto, & blockchain technology sectors. Galaxy Digital is publicly traded on the Toronto Stock Exchange and trade OTC under the ticker $BRPHF. The firm has some very exciting catalysts & new developments that have been announced over the course of 2021 so far, including:

A relationship with Morgan Stanley, who announced in March 2021 that they would offer their wealthy clients access to three Bitcoin funds (of which two funds are managed by Galaxy Digital).

The largest acquisition in crypto history, agreeing to purchase BitGo in a $1.2Bn deal expected to close in Q4 2021. BitGo is considered the pioneer & a market-leader in custodianship, trading services, portfolio management, prime lending, and many other services. At the time of the deal, BitGo had over $40Bn in assets under their custodianship. The Newswire announcement can be read in detail here.

The high-level highlights from today’s Q1 2021 earnings report:

Q1’2021 revenue (referred to as “net comprehensive income”) was $849M vs. a loss of ($30.5M) in Q1’2020.

Within their quarterly revenue figure, Advisory & Management Fees (A&M fees) increased by +20.5% YoY. While the 20% growth rate is encouraging, the amount of $1.9M earned in A&M fees is extremely minimal relative to the co’s net comprehensive income. I find it concerning that 98.4% ($836.6M/$849.7M) of their net comprehensive income figure was derived from a net realized gain on digital assets, investments, and gains on derivates. This is likely not sustainable, as the price of Bitcoin increased by +101% from 1/1/2021 - 3/31/2021.

The co’s interest expense alone was $13.79M in the quarter, or 7.2x their core operating revenue (A&M fees). That is a very dire imbalance. Even if we take the sum of A&M fees + Interest Income of $8.5M, the interest expense is still 1.3x larger!

The company’s balance sheet as of 3/31/2021 is extremely solid, with a 3.11x ratio of current assets/current liabilities. It’s worth noting that nearly 67% of their current assets are held in digital assets (likely the majority of which is Bitcoin) & is subject to significant swings in value. As such, the current ratio (CA/CL) would quickly fall in the event that Bitcoin falls. On this point, the value of their digital assets is reportedly $2Bn vs. cash of $93M, or more than 21x larger than their cash position as of 3/31/2021.

Galaxy Digital is at the cutting edge of institutional financial services in the crypto & digital asset markets, and is clearly involved in exciting projects. With that said, I’m not seeing enough organic operating growth that makes me encouraged as an investor & recognize this as an extremely speculative play. Not only is the stock going to ebb & flow with the factors that influence the overall equity market, but it is also correlated to the price of Bitcoin. While Bitcoin is currently +51.4% YTD, Galaxy Digital ($BRPHF) is +165%. Without question, investors are using this stock as a way to mimic leveraged returns on Bitcoin. I’m not sure how that story will end, but I expect heightened volatility in the stock price going forward.

The full earnings report is summarized here.

Real Estate:

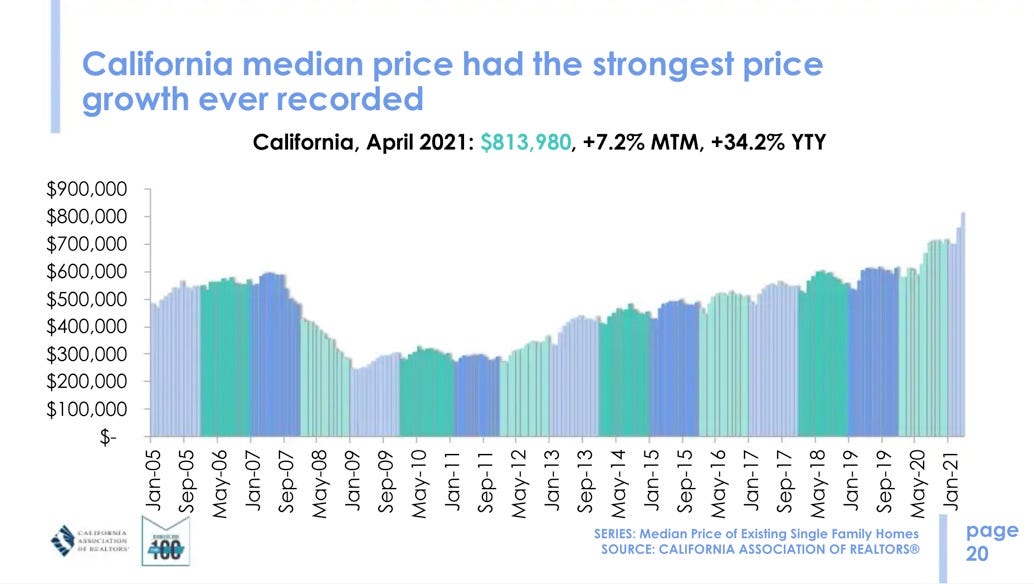

It won’t be often, but when I do find interesting data in regards to the real estate market, I’ll be sure to share it here. This morning, I stumbled across the “California Housing Market Update” from the California Association of Realtors. There’s a lot to digest here, but a common theme throughout the report was “all-time high” & “new record”. I’ve provided the link to the full report in the hyperlink above, but one chart that stood out to me the most was the following:

It’s no secret that the real estate market, both in the U.S. & globally, has been on fire. Even still, a +34% YoY increase in the median price of a single-family home in California is pretty astounding. For all the talk of the mass exodus out of California, that surely isn’t being reflected in housing prices. Scarier yet, perhaps it is impacting the market & anchoring the growth rate. To add to the topic of the mass exodus, it’s informative to see that the number of SFH sales in the Bay Area increased by +101.4% YoY (page 4). That’s what it looks like when major tech companies announce permanent remote-work & people get tired of the exorbitant cost of living, dirty conditions, overwhelming homelessness and increased crime rates.

Back to California as a whole. From the talks that I’ve had with my realtor connections in Santa Barbara, properties are flying off the market. This market report confirms that, citing median days on market of 7 days (down -46% YoY) & more than 67% of homes being sold above asking price.

Until tomorrow,

Caleb Franzen