Investors,

On July 10th, I shared the following analysis of the Nasdaq-100 with premium members:

“This is a vital retest for the broader tech market, which may continue to act as resistance. If we can break above the upper-bound of this channel, then continue to extend above the grey zone, I think that would bode well for short-term bullish momentum. This is why the Monday & Tuesday sessions (July 11 & 12) will be important.”

Since that publication three weeks ago, the Nasdaq-100 has gained +8.9% and has now rallied +19.7% from the YTD lows. These bullish possibilities that we discussed actually produced a bullish outcome, with price shattering through key resistance levels and making higher highs on a short-term basis:

The Nasdaq-100 is successfully trading above the June 2022 highs and the March 2022 lows, evidence that the current market trend has been making strong developments in terms of price structure. Risk assets have drastically outperformed relatively less risky assets, indicating that investors have made a decisive move further out on the risk curve. Considering that more risk equals more reward, investors are being compensated for their risk appetite.

With that being said, I think it’s safe to say that this current rebound classifies as a speculation-fueled rally. For right or for wrong, markets believe that at least one of the following statements are true:

Inflation is in the process of peaking.

The Federal Reserve has reached peak hawkishness & will be successful in their fight against inflation.

The U.S. economy is stronger than expected & may potentially avoid recession.

If new data forces the market to reconsider any of these opinions, market turmoil is likely to resume. If new data reaffirms any of these opinions, market exuberance will likely resume.

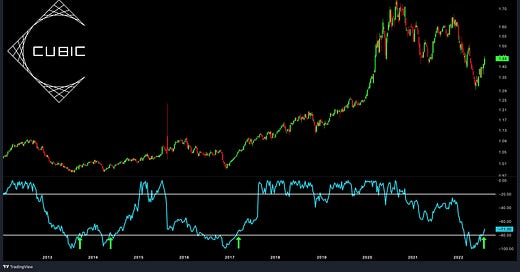

In the remainder of this analysis, I’ll focus on how risk appetite is evolving across the market by analyzing inter & intra-market relationships. These 5 charts include new analysis that I’ve never shared before and 4 of them were new discoveries that I’m very excited to share. I think these signals are screaming an important message for investors that shouldn’t be ignored, regardless of how short-term volatility develops.

In addition to sharing the implications of these crypto & stock market charts, I’ll be analyzing the under-the-hood metrics for the S&P 500 and what it may (or may not) be telling us. The goal of these reports, as always, is to provide objective analysis about market developments in order to equip you with the tools to make informed decisions. I can’t make those decisions for you, but I’ll continue to share how I’m using this data to make my own decisions.