Investors,

I’m publishing this special report to discuss how financial markets are responding to economic data and extrapolating how the Federal Reserve’s monetary policy is likely to evolve. Quite simply, I fear that financial markets are getting too far ahead of themselves and focusing on what they want to hear rather than what is likely to occur. Generally speaking, economic fundamentals are becoming softer as the economy trends towards a slowdown or outright contraction. However, we’re seeing pockets of resilience in certain areas. Markets, which have become increasingly concerned about slowing growth, are starting to celebrate these pockets of resilience. I think this is short-sighted, as economic strength will be viewed as a justification for the Federal Reserve to become increasingly aggressive so long as inflation remains elevated.

Inflation is unequivocally accelerating higher, which indicates that the Fed will apply relentless pressure via rate hikes & balance sheet runoff for the remainder of 2022. They have expressed their goal to suppress demand and re-equilibrate the market at a constrained level of supply. Considering that they can’t control supply-side factors, they are forced to use demand-side tools to fulfill the price stability goal of their dual-mandate. With a labor market that is being perceived as too strong and consumer prices that are unstable, the Fed is attempting to rebalance the scales and embark on a path of demand destruction. As such, the more resilience they see in the economy as inflation remains historically elevated, the more they will need to take action.

Inflation is not a domestic issue, it’s accelerating higher on a global scale. In turn, global central banks are taking action to raise interest rates. Here are some key inflation rates for major global economies:

India +7.0% as of June 2022.

Canada +7.7% as of June 2022.

European Union +8.6% as of June 2022.

United Kingdom +9.1% as of June 2022.

Brazil +11.9% as of June 2022.

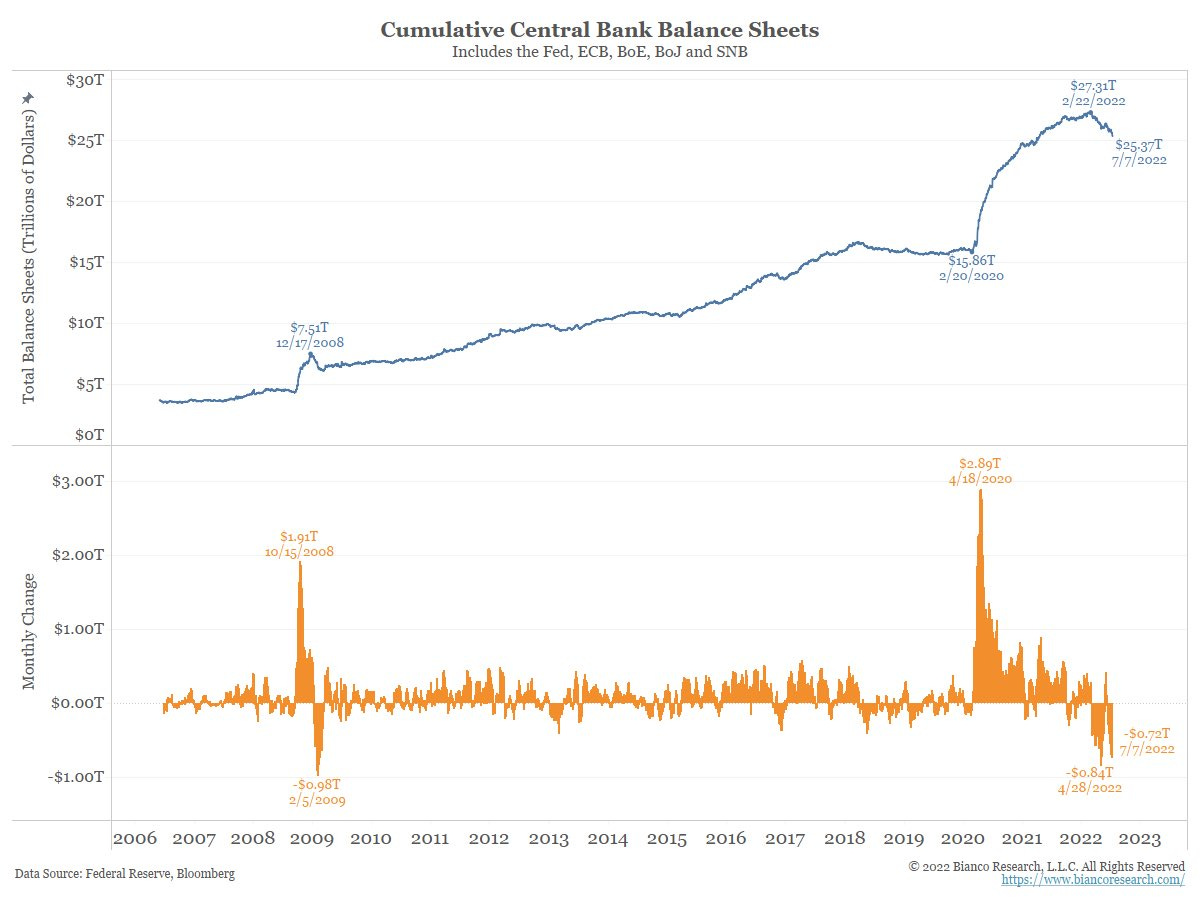

Central bank balance sheets are officially contracting as a result of the monetary tightening regime:

In this deep-dive, I’ll be reviewing the key economic data I saw this week and why I believe it will continue to embolden the Federal Reserve to raise rates more aggressively going forward. We aren’t seeing signs of inflation abating and economic data is a mixed bag. It’s vital to remain focused on the trend in the Fed’s behavior and the message that they’re communicating, rather than to impose what we want the Fed to do for our portfolio’s sake. Recognizing this innate bias, hoping for the Fed to pivot, is important.

Economic Factors & Monetary Policy:

On June 26th, I explained my belief that the market was at an important inflection point, illustrated by a dislocation between financial market dynamics and economic data. Yields & commodities were telling us one thing, while economic activity was telling us another. In that publication, Edition #186, I explained that:

“We’re currently witnessing “smart money” in financial markets indicate that inflation has peaked prior to any material evidence that inflation is slowing down or peaking.”

This inflection point was so significant because it prompted multiple questions, the most notable being: what if the bond market (aka “smart money”) is incorrect about inflation?

This is a question that I’m still exploring to this day; however, I’ve been steadfast in my belief that inflation has not peaked. The June 2022 CPI data was arguably more important than the May CPI report because it would help to confirm or deny the bond market signal that we’ve been seeing since mid-June. Particularly considering that we’ve seen weaker economic data in recent weeks, my belief was that the bond market was simply becoming more preoccupied with a reduced economic growth outlook than inflation. In turn, this was prompting a severe decline in yields as investors rushed to safety, shifted away from risk assets, and increased their demand for bonds and the U.S. dollar. Still, we couldn’t ignore the fact that the bond market was potentially indicating a peak in inflation.

As it turns out, inflation has continued to accelerate higher despite market participants shouting that inflation has peaked (once again). These were the notable figures for the June 2022 CPI data, which was released on 7/13:

The year-over-year inflation rate increased from +8.6% in May to +9.1% in June.

The month-over-month inflation rate increased from +1.0% to +1.3%.

The year-over-year core inflation rate decreased slightly from +6.0% to +5.9%.

The month-over-month core inflation rate increased from +0.6% to +0.7%.

All of these figures came in higher than expectations.

If we look at the 2-year inflation rate, we can get a deeper understanding of how consumer prices have evolved. In June 2020, the Consumer Price Index was measured at 257.2 vs. the June 2022 measure of 295.3, implying that consumer prices have risen by +14.8% over the past two years. This measure includes the drastically underreported “Shelter” component, which comprises roughly 1/3rd of the CPI weighting. With the Case-Shiller U.S. National Home Price Index up more than +41% and rents up more than +20% over the past two years, I think we can conservatively estimate that the real inflation rate exceeds +20% over the past two years, rather than the +14.8% official figure.

On the aggregate, this data reaffirms that the Federal Reserve is chasing inflation higher and will need to increase the aggressive rhetoric and nature of their policy decisions in order to combat inflation. Not only are they fighting a quantitative battle to bring inflation back to their long-term inflation target of +2%, but they’re fighting an increasingly important qualitative battle to restore their credibility.

As inflation remains elevated & unrelenting, I’m growing increasingly fearful that inflation will continue to become embedded in consumer psychology. The two most important inflation factors that I monitor – credit creation & the wage-price spiral – continue to be persistent factors driving inflation higher. As it pertains to credit creation, loans & leases hit a new all-time high as of $11.41Tn as of July 6th, representing a YoY increase of +10.2%.

This figure continues to accelerate higher since Q4 2021, indicating that demand for new loans is strong and that banks are incentivized to increase lending activity in a higher interest rate environment. In turn, I believe that this will siphon money out of the financial/banking system into the real economy and cause more money to chase fewer goods.

In addition to the credit creation data helping to fuel inflation pressures, the Atlanta Fed’s Wage Growth Tracker has continued to accelerate higher.

The trend is well-above historical norms. Wages for young workers are also rising at a historic pace, as shown by the +12.5% nominal wage growth for people aged 16-24:

As we remain in a dynamic labor market with ample opportunities, the labor force continues to control negotiating power and has the ability to pursue jobs with the strongest earnings potential. In order to try and stay on-pace with inflation, employees are negotiating higher pay. In turn, this is increasing their personal disposable income, ability to absorb higher prices, and propensity to spend. Businesses, facing increased input & production costs, have raised prices while noticing that strong consumer trends have been able to absorb these higher prices. These two dynamics create a recursive feedback loops, facilitating higher wages & higher prices simultaneously. This is referred to as the wage-price spiral, which is also being fueled by an elevated quits rate and a series-low layoffs rate.

Until we see a material deterioration in the labor market and a sustained decrease in the growth of credit creation, I expect to see inflation remain around these historically elevated levels and likely increase further.

What do I mean by “material deterioration in the labor market”? Here are some specifics:

A sharp rise in unemployment, likely above 4.4% vs. the current level of 3.6%.

A drastic decrease in labor force participation, below 61.7% vs. the current level of 62.2%.

A notable & sustained decrease in nominal wage growth, likely below +3.5%.

A decrease in job openings, particularly as a result of employers delisting potential employment opportunities.

A net decrease in employment gains, indicating that layoffs exceeded hiring for any given month.

In the latter-half of the week, we received new economic data (June 2022 Retail Sales & the University of Michigan consumer survey) that were both better than expected. Most notably, retail sales increased by +1.0% in June 2022 vs. -0.3% in May; meanwhile, 5-year inflation expectations by Michigan participants decreased from 3.1% to 2.8%. The consumer sentiment index also increased marginally from 50 to 51.1.

While these data points beat expectations, there were also some disappointments. Capacity utilization, a measure of an economy’s actual output vs. potential, decreased slightly in June to 80 from 80.3 in the prior month. This represents a slight increase in slack. Industrial production fell by -0.2% in June, another confirmation that many economic fundamentals are trending lower. With that said, the year-over-year change in industrial production increased by +4.2% relative to June 2021. It’s worth noting that most of this increase came during 2021 & Q1 2022.

On the aggregate, recent economic data continues to reaffirm a trend towards a recession; however, we are seeing pockets of resilience and surprises to the upside. Immediately following the release of the June 2022 CPI, markets estimated an 85% chance that the Federal Reserve would increase the federal funds rate by 100 basis points in the July 27th meeting. As of Saturday morning, that estimate now stands at 29%, with the market pricing in a 71% chance of another 75bp rate hike. Financial markets celebrated the stronger-than-expected data and the fact that inflation expectations have decreased, per the University of Michigan survey. However, I don’t have much confidence that inflation expectation surveys are accurate or valid. For example, 5-year breakeven inflation rates, the rate at which investors are willing to be compensated for inflation, have fallen dramatically since March 2022; however, inflation has continued to accelerate higher since that peak.

Why is this happening? The market is growing increasingly convinced that the Federal Reserve will be effective in inducing a recession & combatting inflation. However, this is the same market that believed the Fed when it said that inflation wouldn’t happen and that inflation would be transitory. I think the market is in for a rude awakening as inflation remains persistent, and I also expect that a recession will be less impactful in reducing inflationary pressures than the market currently believes. The likelihood of stagflation is a growing risk, one that the market continues to underestimate. The market unequivocally believes that a recession will kill inflation; however, what about the period between 1972-1980?

There have been occurrences, albeit rare ones, where consumer prices have continued to accelerate higher during a recession. The longer inflation persists, the more concerned I’m becoming about this possibility. Stagflation would destroy the credibility of the Fed and drastically reduce their ability to fulfill their dual-mandate. As such, I think they are beginning to optimize policy to ensure that stagflation risks are removed. With this in mind, I think that a pivot in 2022 or even a pause in early 2023 is highly unlikely. Investors should not be preoccupied with a Fed pivot and simply accept that market conditions will likely remain difficult for the foreseeable future, so long as inflation dynamics persist, which I expect they will.

Financial Markets & Risk Assets:

Bond market participants appear to have become increasingly focused on economic growth expectations rather than inflation concerns. In turn, we’re seeing yields stabilize and dip lower, fueling demand for risk assets. Stocks generally closed on Friday lower than the prior week; however, the major indexes had very strong performance during the second half of the week post-CPI. On a short-term basis, I believe we’re seeing encouraging signs of higher lows, but we have yet to see the production of higher highs. As such, we’re not even halfway to confirming a bullish reversal. We could certainly have more confirmation about this in the coming weeks.

Either way, I’ve continued to endorse the idea of elongating dollar-cost averaging schedules, remaining patient, and executing portfolio decisions from a risk management perspective that optimizes for long-term returns. My belief is that we remain within a major inflection point, trending towards global recession. With recession becoming increasingly likely and inflation becoming increasingly sticky, financial market dynamics will hinge on the dissipation or acceleration of inflation. If inflation can sustainably rollover (no signs yet), markets will celebrate. If we see further acceleration of inflation dynamics, markets will become fearful.

Either way, I suspect the U.S. dollar will have tailwinds to rise in either environment. I’ve been bullish on the U.S. Dollar Index $DXY since October 2021, and especially after the Federal Reserve announced tapering in November 2021. My simple thesis was that higher rates = higher dollar.

So far, that trade has worked beautifully, seeing investors flock into the premier safe-haven asset. As inflation has increased, yields have also risen, therefore pushing the $DXY higher. However, we’re now seeing a new dynamic, wherein yields are stabilizing/falling in response to recession fears. With investors continuing to exhibit concerns about economic growth, they’re shifting into the dollar with higher conviction.

Either way, the dollar has tailwinds to rise vs. a basket of global currencies regardless of the yield/inflation dynamics. This is something that I recently outlined on Twitter:

I think we’re generally seeing an increased effort for risk sentiment to overtake fear, indicating that buyers are attempting to out-muscle sellers. Eventually, buyers will win. As I’ve been sharing with premium Substack members, my long-term conviction in stocks & crypto are very strong. The question is how much pain is yet to be endured before shifting into a sustainable risk-on environment once again? Financial markets are forward-looking mechanisms, so I expect to see asset prices rally before a formal shift in monetary policy & inflation dynamics. However, we’ll likely see false signals before we achieve the official signal. Additionally, the official signal will only be identifiable once we have the benefit of hindsight. As such, I expect to see buyers & sellers struggle around these levels & for volatility to be the status-quo.

I still believe that risk assets have headwinds to rise in this environment, but that we’ll experience relief rallies and periods of FOMO. Generally speaking, I think the current market dynamics reaffirm this belief. When analyzing the broader crypto market, I think a relief rally to the 161.8% fibonacci level is a reasonable target. This would be a substantial rally of nearly +25% from today’s prices, but I expect we’ll likely see resistance at the yellow target:

The 1-year Williams%R oscillator (given by the 52-week measure) is still oversold. I will regain confidence in a bull market once the W%R thrust above the oversold threshold, as this was a critical signal in the past. Bitcoin is currently retesting the 48-month moving average cloud, which has the potential to act as resistance for the first time in Bitcoin’s history.

Considering that these are the premier risk assets, it’s vital to watch behavior in crypto to analyze broader risk sentiment that will impact all asset markets. There are signs for both caution & optimism, but I continue to lean towards caution in the current environment.

In conclusion, I am exercising patience in this market for the simple reason that I think financial markets are incorrect on inflation expectations and are discounting the probability of stagflation. As much as I am fundamentally bullish on stocks & Bitcoin long-term, I think we will remain in a defensive market likely for the remainder of 2022. If/when I see material evidence of a shift in investor sentiment, coupled with signs of improving inflation dynamics & a resilient economy, then I will shift towards a bullish stance in the short-run. In the meantime, I believe the market will continue to provide long-term investors with ample opportunity to increase exposure to core portfolio holdings. Those who emphasize a long-term mindset during periods of short-term fear are likely to generate outsized returns over time.

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.

This is fantastic!!. Job openings could also add fuel to the wage price spiral, as folks are more likely to get a pay raise when they change jobs, compared to their existing jobs.

That's something I'd be watching, to see a net negative in Job openings.