Edition #187

Inflation vs. Growth, Historically Weak Asset Returns, Bitcoin's 48-month Moving Average

Investors,

If you’re looking for more research & analysis of mine to compliment these weekly reports, I’d encourage you to subscribe to Cubic Analytics on YouTube. I’ll be posting exclusive analysis on that channel to discuss market dynamics and key insights on the economy. For example, here’s a video that I posted on Wednesday afternoon to discuss the risk-off signals that I was seeing in the market:

If we cross 500 subscribers by next Friday, July 8th, I’ll run a 50% discount for a premium membership to Cubic Analytics research.

As a precursor to this newsletter, I want to communicate that I expect these reports to become increasingly focused on the “Macroeconomics” section. Considering that asset prices are being driven by the Federal Reserve and monetary policy, which is driven by inflation, labor market, and economic data, it has become vital to understand the economic landscape in order to be a successful investor. With my academic background in monetary economics, I will continue to spend a substantial amount of my time focused on economic data and the key inputs to inflation & the labor market. If you want to see more stock market or Bitcoin focused content, I’d encourage you to sign up for the premium version of this newsletter where you’ll receive exclusive research reports every weekend specifically focused on stocks & financial markets.

Macroeconomics:

This was an extremely important week for economic data, particularly in light of recent inflation dynamics. I’d like to take this opportunity to discuss the shift in focus and concern away from inflation towards economic growth, as the U.S. & global economy continue to sputter towards a recession. First, regarding inflation, there have been four primary aspects that I’ve been sharing with subscribers that are likely to keep pushing inflation higher:

Supply Bottlenecks

Commodity Pressures

Wage-Price Spiral

Credit Creation

Based on the most recent data that we have available, it appears that supply bottlenecks & commodity pressures are beginning to improve. While this doesn’t guarantee that inflation must go lower from here, this is an encouraging sign. With respect to supply bottlenecks, container prices along the Shanghai → Los Angeles shipping route have declined by -38% since the peak in 2021, which is a great sign!

With respect to commodity pressures, we’ve seen a dramatic decline in energy, agriculture, and industrial commodities in recent weeks. Here are some notable declines as of 6/30/2022 relative to their respective 52-week highs:

Energy:

Crude Oil -14.5%

Natural Gas -41.1%

Industrial Metals:

Platinum -24.2%

Palladium -35.7%

Copper -25.2%

Aluminum -37.2%

Steel -52.2%

Iron Ore -40.9%

Agriculture:

Lumber -53.2%

Cotton -36.1%

Wheat -31.3%

Corn -22.3%

Soybean Oil -25.6%

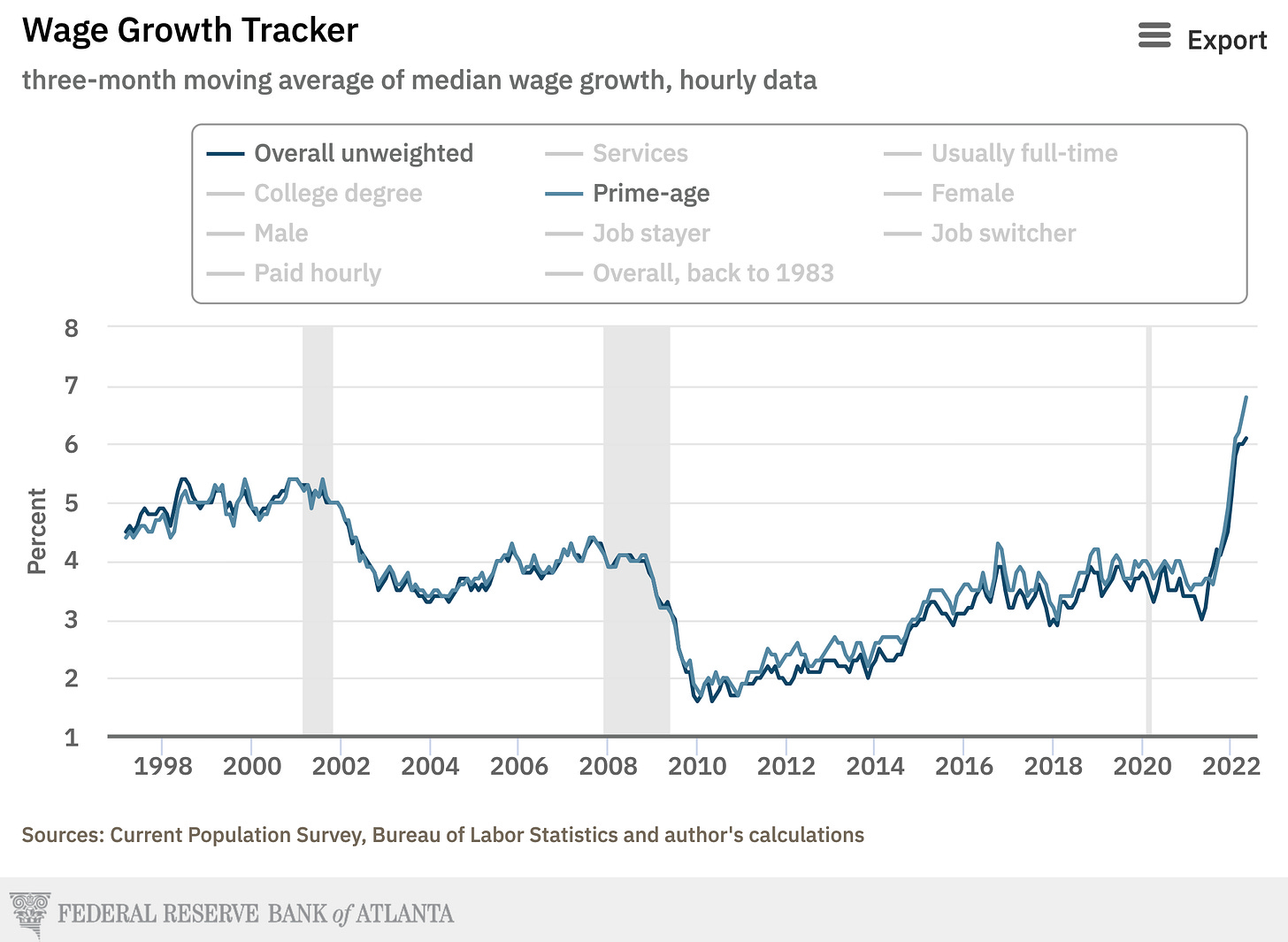

Considering that commodities generally perform very well in an inflationary period, the dramatic declines that we’re seeing across the commodity markets could be hinting that inflation is beginning to subside. However, the final two components that I monitor indicate that inflation will remain persistent. The quits rate continues to be historically elevated at 2.9% as of May 2022, reflecting an extremely dynamic labor market where the labor force is able to find new positions at higher pay. The Atlanta Fed’s Wage Growth Tracker reflects nominal wage growth of +6.1% for the total labor market and +6.8% for the prime-age labor force (employees age 25-54):

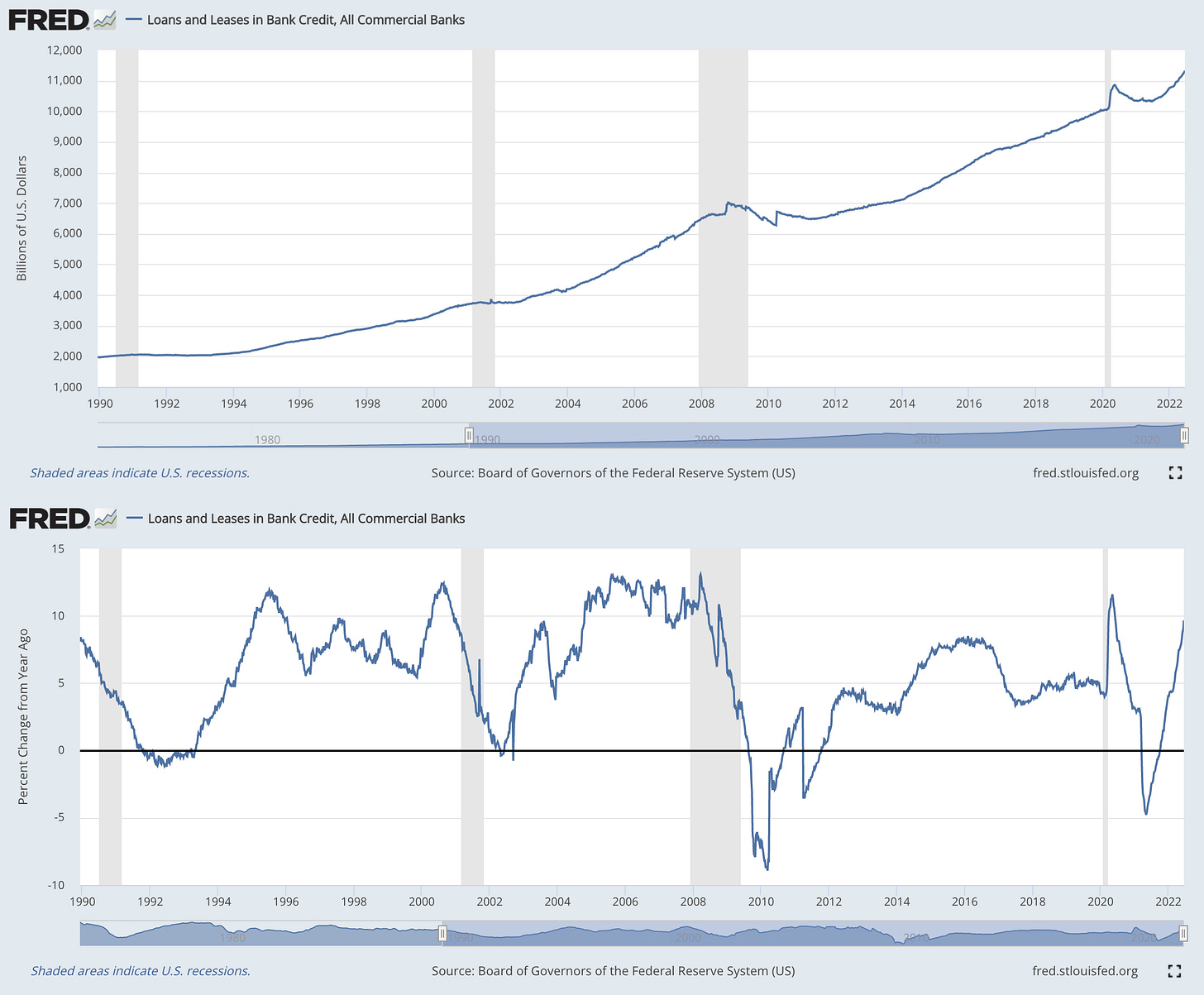

Meanwhile, credit creation continues to accelerate as total loans & leases hit new all-time highs ($11.37Tn as of June 22, 2022) and are growing at a rate of +9.7% YoY:

Therefore we have two conflicting dynamics:

Supply bottlenecks and commodity prices are declining

Wage pressures and credit creation are increasing

It’s too early to tell who will win this tug-of-war; however, the bond market appears to be shifting it’s focus and attention towards slowing economic growth. Keynesian economics implies that inflation and economic growth will move in the same direction, which is why the Federal Reserve intrinsically targets a positive — but moderate — rate of inflation. Therefore, if economic growth slows or outright contracts, then Keynesian economics implies that inflation should also decline! This is why there’s so much discussion about the Fed trying to engineer a soft landing recession in order to push demand lower to re-equilibrate with a low supply.

Based on recent data, it appears that the Fed’s rate-hike policy is working to move the economy towards a recession. First of all, Q1 2022 real GDP growth was already very weak at -1.3% on an annualized basis. However, the BEA has provided a revision to Q1 data to reflect a negative growth rate of -1.6%. The bad news merely gets worse.

In addition, the Federal Reserve of Atlanta provides estimates for Q2 2022 real GDP growth known as GDPNow, which gets updated on a frequent basis. As of June 27th, the Atlanta Fed was forecasting a real GDP growth of +0.3%. That figure was then revised on June 30th to -1.0%. On July 1st, the Atlanta Fed provided another update by forecasting a real GDP growth of -2.1% for Q2. In a matter of four days, their expectations for GDP growth fell by -2.4%!

In addition the manufacturing Purchasing Managers Index (PMI) was also updated for June 2022. The result was a reading of 52.7 vs. prior month results of 57.0. While this still reflects an expansion in manufacturing activity for June 2022, it’s a substantial deceleration relative to the May 2022 data, reaching the lowest level in two years.

In addition, business confidence regarding the year-ahead outlook fell to the lowest level since October 2020, citing weak customer demand and ongoing disruptions to supply chains. However, businesses expanded their workforce in June and hiring activity was strong.

On the aggregate, the data reviewed above reflects the continued slowing of economic growth, or confirms an outright contraction in Q2 2022. With a confirmed contraction in Q1 2022, it appears that the U.S. economy will officially reach the formal definition of a recession (identified as two consecutive quarters of negative real GDP growth). The labor market remains strong, for now, but continues to add pressure to inflation dynamics. Considering that inflation is such a multivariate vector, it’s too early to know if inflation is peaking or even slowing down. Personally, I have yet to see any convincing evidence that it has peaked. Should inflationary pressures persist during a recession, we will by definition reach a period of stagflation.

Stock Market:

Stagflationary periods are historically bad for stock market and bond performance, which might help to explain why the stock market has been panicking over the past several weeks and months. Considering that financial markets are a forward-looking mechanism, investors have clearly been cautious about the increasing probability of stagflation. In fact, this has been a historically bad period for traditional markets.

This has been the worst two-quarter performance for the S&P 500 since Q1 2009:

This was the second worst 6-month return for the S&P 500 since 1970, with only the first half of 2009 being worse. During this period, the S&P 500 fell a total of -20.4% and officially closed the first half in bear market territory.

In addition, it’s been the worst first-half return for 10-year Treasuries in 200+ years:

Investors might be thinking “it can’t get worse from here”, but the data doesn’t necessarily show that to be true. Momentum and investor psychology have a real impact on the forward-returns of asset prices, which are clearly in a historic downward spiral. With the economy appearing to be entering an official recession, or in the early stages of one already, I suspect to see continued downside in Q3 2022.

Quite simply, there’s been no reprieve for investors this year and no escape from heightened volatility. Even if you’ve been sitting in cash all year, you likely have a negative real return greater than -5% due to inflation.

Bitcoin:

As discussed above, there has been no reprieve in 2022 and crypto is no exception. In fact, considering that crypto is further out on the risk-curve, it’s experienced the most downside and volatility in 2022.

Total crypto market cap has fallen by -61.5%, or $1.34Tn, in the first half of the year. With crypto facing relentless pressure, Bitcoin has been breaking historical milestones. Not only is Bitcoin’s Relative Strength Index (RSI) at all-time lows, but it’s also managed to break other statistical indicators that have held up throughout BTC’s brief history.

For the first time ever, Bitcoin closed the month of June 2022 below the 48-month moving average cloud, a long-term measure of trend and value.

This is a bad sign for the short & intermediate term outlook for Bitcoin, which leads me to believe that the price of the digital asset will fall to $13.9k in this bear market. $13.9k was the final monthly close of the former bull cycle in December 2017, which also acted as resistance in a future retest in 2019. The market appears to have price memory there, which suggests that it’s an important level of interest.

In addition, the past two Bitcoin bear markets have experienced peak to trough declines of -84% and -86%. In traditional markets -85% drawdowns in tech assets is quite common, which would suggest that Bitcoin’s peak to trough decline could bottom around $10,500. While it isn’t certain that we will fall to these levels, the price of Bitcoin has already fall substantially further than most analysts predicted, much faster than they predicted. As such, I think these scenarios are worth planning for even if they don’t materialize.

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.