Edition #183

Economic Deterioration, Stock Market Turmoil, Bitcoin's Correlation to $MU

Investors,

I’m happy to announce that we’ve officially crossed 1,300 subscribers to Cubic Analytics and continue to grow at a rapid pace! I’m honored to be able to provide investment research and macroeconomic commentary to this group and look forward to the growth that we have in store. To celebrate these ongoing milestones, I wanted to offer a 20% discount on premium memberships, giving you access to weekly deep-dives on stock market dynamics, analysis, and investment ideas.

If you want to spread the love, consider gifting a subscription to someone who would benefit from this research:

Finally, I launched a YouTube channel this week where I will be providing ad-hoc market research. I’ve already uploaded two videos to preview the Federal Reserve’s policy decision and to analyze Bitcoin data. Please check it out and subscribe if you’re interested!

Cubic Analytics Youtube Channel

Macroeconomics:

Without question, the most significant economic development was the Federal Reserve’s announcement to raise the target federal funds rate by +0.75% on Wednesday. At this point, I’m sure this isn’t news for most people, so I don’t have much value to add on this topic. Instead, I’d like to highlight some of the major implications as a result of this policy decision.

First and foremost, the Fed quantitatively hasn’t been this hawkish (aggressive) in decades. In fact, this was the first +0.75% rate hike since 1994, helping to contextualize the magnitude of such a move. For months, I’ve been saying this is the most aggressive Federal Reserve we’ve seen in a long time, going back to the Volcker era of the late 70’s and early 80’s. It’s vital to understand that the Fed’s rhetoric and forward guidance IS a policy tool. With that said, Blake Davis shared a fantastic chart to highlight the significance of the Fed’s recent policy rate hikes, referencing the rate of change oscillator at the lower-bound:

This is having a significant ripple effect throughout the economy. For example, consider mortgage rates accelerating at historic paces. With the Fed no longer buying $40Bn/month in mortgage-backed securities, interest rates are rising rapidly. As of June 16th, 2022, the average 30-year fixed mortgage rate is 5.78% vs. 2.93% on June 17th, 2021. With average 30-year mortgage rates doubling over the past year, new homebuyers are in a difficult position to afford historically high home prices.

Michael McDonough provided phenomenal data on the mortgage market and the implications for homebuyers. In the chart on the left, we can see that homebuyers are spending 40% of their disposable income on their debt-service payments for their mortgage:

Quite simply, mortgage payments as a percentage of disposable income haven’t been this high since the housing bubble in the early 2000’s. The chart on the right is also extremely interesting, reflecting how the four geographic quadrants of the United States are all experiencing historic accelerations in monthly mortgage payments.

The Federal Reserve is unequivocally tightening monetary policy into a weakening economic environment, something I warned about in October 2021 on Twitter. In a thread, I wrote:

“A concern that I’m starting to have is that the Federal Reserve is preparing to tighten monetary policy into a weakening expansion. While the tapering process will still provide liquidity, it will be a deceleration in the amount of monetary stimulus. The tone of the Fed & other central banks regarding inflation has continued to shift dramatically. At the beginning of the year, they didn’t expect inflation, then it became a transitory spike, then that inflation COULD be more sticky, now it’s persistent.

I don’t necessarily fear stagflation, but it’s clear that those who have been calling for stagflation are feeling vindicated in this moment. The annualized Q3 GDP growth was +2.0% vs. the GDP price index rising +5.7%.

Powell & Fed officials have stated that their monetary policy strategy is effective in stimulating demand, but doesn’t improve supply-chain dynamics. The bottlenecks are expected to persist for the majority of 2022 or beyond. This will impact inflation.

If the Fed sees improvements in the labor market & has already met their inflation requirements to raise rates, what happens if/when inflation is more persistent & sticky? They’ll consider raising more aggressively. If not, the market will do it on its own with higher Treasury yields. This is not doom & gloom, but a substantiated concern of a more restrictive monetary policy in the face of a potentially slowing economy, global supply-chain bottlenecks, and inflation that has proven to not be transitory. There’s a lot of pressure on the Fed right now.”

Considering that the U.S. consumer is facing record high home prices, record high mortgage payments, record high inflation, historic decreases in their investment portfolios and net worth, and are cautious of a looming recession after Q1 2022’s GDP contraction, it’s no wonder why consumer sentiment is the worst it’s ever been.

In fact, economic data and the U.S. consumer continue to deteriorate. On Wednesday, June 15th, the retail sales data for May 2022 was released and reflected a monthly decrease of -0.3%. However, the retail sales data is not adjusted for inflation, so it’s important to recognize that the inflation adjusted retail sales data declined by -1.2% on a monthly basis in May 2022. This was a significant decline relative to the April data, which was actually revised lower to a monthly growth rate of +0.7%.

With fears of a weakening consumer, the likelihood of a recession is growing substantially (defined as two consecutive quarters of negative real GDP growth). With Q1 2022 already reflecting negative real growth, we are inching closer to achieving the formal definition of a recession in the United States.

Stock Market:

As the Federal Reserve embarks on a monetary tightening regime, raising interest rates to combat historic inflation, asset prices continue to experience heightened volatility and downside pressure. For the 12+ months that I’ve been writing this newsletter, I’ve preached the importance of understanding monetary policy and interest rates and their impact on asset prices. Recall, all else being equal, interest rates have an inverse relationship with asset prices. With interest rates rising at a rapid pace, we officially have bear markets in the S&P 500, Nasdaq-100, and the Russell 2000. Only the Dow Jones Industrial Average hasn’t reached official bear market territory (price down -20% or more from 52-week highs).

As we look at the market today, I think it’s vital to point out the current price action of the Dow Jones $DJX:

For the week, the Dow closed down -4.8% and nearly retested the pre-COVID highs! This is a monumental retest of a former resistance level, which turned into support in Q4 2020 and Q1 2021. In my opinion, this is the official line in the sand for bulls & bears, which will have severe consequences and implications for risk sentiment going forward.

Should we break below this range, I think we will officially be in a bear market trend and continue to decline going forward. Should we use this range as support, similar to the price action we saw in Q1 2021, we live to die another day.

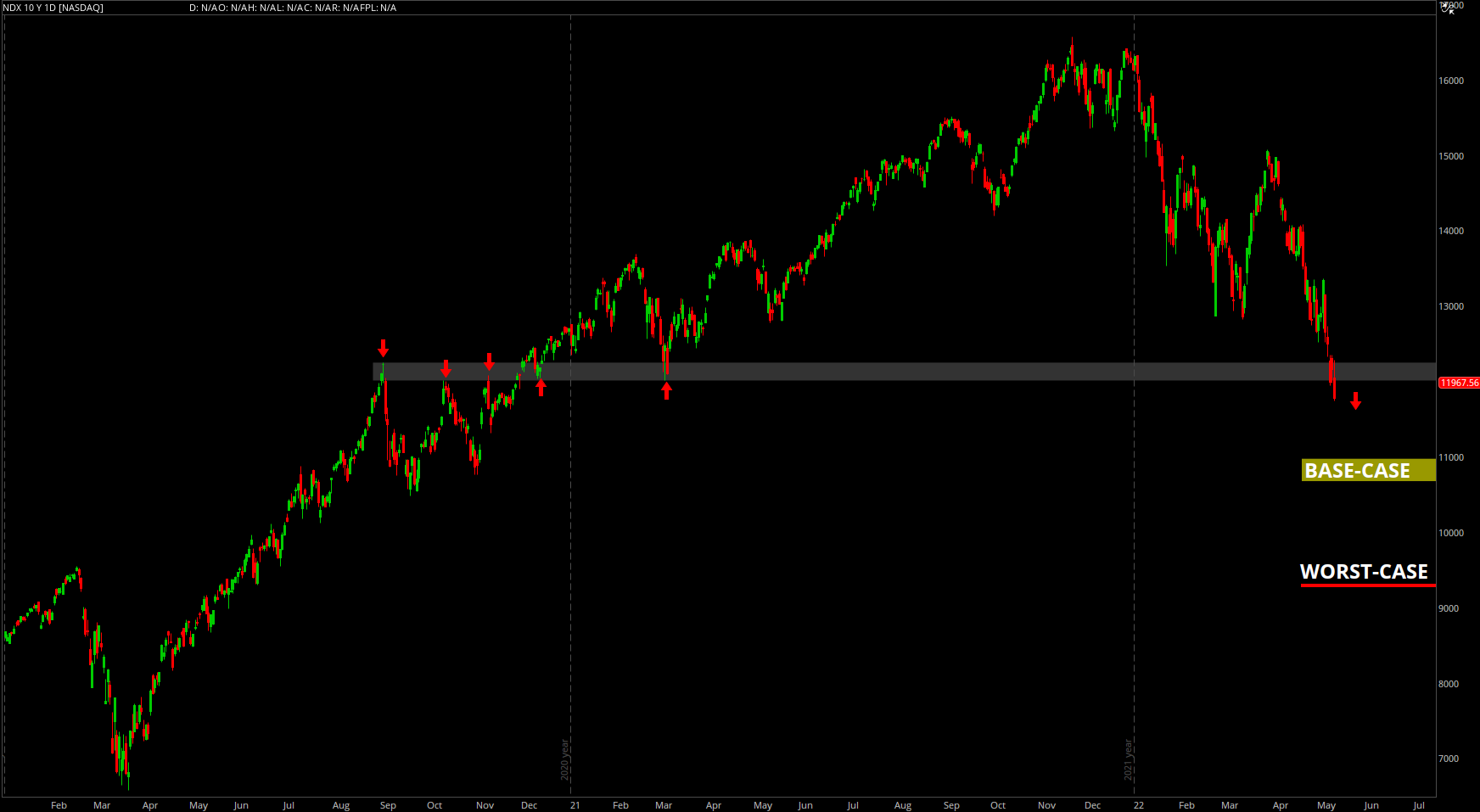

On May 11th, I shared an important forecast on Twitter by sharing my base case and worst case scenarios for the Nasdaq-100 $NDX, shown below:

Base case = $10,870-$11,160, or downside of -6.75% to -9.1% at the time.

Worst case = $9,480, or downside of -20.7% at the time.

This week, we officially hit my base case target range and hit a weekly low of $11,037. Here’s an official update of the chart:

As we can see in the chart above, we didn’t have a direct trajectory towards my base case scenario. Markets are choppy & volatile, so I didn’t expect to see a straight line towards my targets; however, it’s extremely worrisome to see price action continue to deteriorate in this manner.

What we do know for certain is that we’re living through historic times in the stock market. For example, here are some recent milestones that we achieved this week:

On Thursday, 6/16/22, 90% of stocks in the S&P 500 had negative returns. This was the 5th time over a 7-day period, the only such occasion in stock market history.

The S&P 500 has had a negative return in 10 of the past 11 weeks, the second occurrence in stock market history other than 1970.

Bitcoin:

This week, I made a fantastic discovery about the correlation between Bitcoin and the semiconductor stock Micron Technologies ($MU). I noticed that they both had extremely similar price movements in 2021, so I decided to take a long-term view and see if they had a strong historic correlation. It turns out my hunch was right…

In the chart below, we’re looking at Bitcoin (candles) vs. Micron Technologies (teal) in logarithmic scale since 2016:

This is an unbelievable degree of correlation, particularly because it has been so effective for such a long period (5+ years). This analysis is important for two reasons:

In order to confirm a trend reversal for Bitcoin, we can use Micron stock to reaffirm or deny the price action of BTC. As such, investors should continue to monitor Micron stock to identify a continuation or reversal of the ongoing bear market trend.

Investors could use Micron stock as a hedge against their Bitcoin position in order to try and reduce portfolio volatility and drawdowns. An investor who shorts $MU while being long $BTC would theoretically experience less downside than an investor who is solely long $BTC in a bear market.

I want to reiterate the significance of this finding and underscore the importance of monitoring this relationship going forward. With Micron hitting new YTD lows this week, falling more than -7.9%, I expect to see Bitcoin take out the $20k lows and fall into the high-teens in the coming days. It appears that Bitcoin and Micron can alternate in terms of which one leads the other; however, Micron seems to be leading the decline after a strong start to the year.

Based on the correlation, Micron’s current stock price implies that Bitcoin should be trading closer to $18,000 at the present moment. That figure could change with ongoing developments in the price of Micron stock.

I launched an official YouTube channel earlier this week and made a video about this on Thursday. If you want to learn more about this relationship, the implications, and why it’s so significant, I’d encourage you to watch the video below:

Please subscribe if you want to see more video content like this going foward!

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.

Great discovery on Bitcoin's correlation to $MU.

Also enjoyed your YT videos. Keep the good works mate.