Investors,

The market continued to exhale last week, exacerbated by additional increases in yields & interest rates. I think market pressure over the past week and a half has been caused by psychological selling pressure and the acceleration of yields. After a historically significant rally from the March 14th lows, the market is cooling off. The question all investors are asking is whether or not the rally was the start of a new medium to long-term trend, or if it was a head-fake rally within a new downtrend from the ATH’s. No one knows with certainty which is correct, which is why markets are moving significantly in both directions.

On March 13th, I shared my own research which prompted me to share the following:

“I reasonably think the S&P 500 could fall an additional -10% to -13% over the next 4-20 weeks.” - Edition #159

While I stand behind the analysis I shared in that post, and think it still poses a threat to markets today, we saw the S&P 500 rally +11% from the market close on 3/14 through the market close on 3/29. The analysis I offered wasn’t intended to predict super short-term price dynamics, which is why I gave a 4-20 week window — I recognize that markets are volatile and I don’t use long-term analysis to make highly short-term predictions.

During the market rally, I viewed price action as an opportunity to reduce risk, secure profits, take money off the table, and secure cash for future purchases. This is exactly what I did with money I manage for family members, though I left crypto allocations untouched. Did I sell everything? Absolutely not! It’s likely that I reduced their equity portfolios by 15% to 20% in order to increase their cash position. This accomplished two things:

1. Leave plenty of exposure in the event that I am wrong, therefore providing upside in the event that the market continued to rise in the short-term.

2. Increase cash to take advantage of lower valuations in the event that I am correct.

I also did one final action, which I am not recommending for readers, although I certainly wanted to bring it to your attention: I took a relatively large position, approximately 5% of total portfolio value, in the Direxion Daily FTSE China Bear 3X Shares ETF, $YANG. This allows me to directly profit from downside risks, using leveraged strategies (extreme risk) to amplify returns if the Chinese stock market falls. With a 3x leveraged fund, this informally turns my 5% exposure into a 15% allocation.

Why did I take this position? Here are the reasons:

1. When I took the position on 4/7/22, the S&P 500 had only fallen -3% from the close on 3/29 (recent highs). If we are in the early stages of another decline towards the YTD lows, this means that the S&P 500 would have to fall an additional -7%. Because Chinese stocks are more volatile than U.S. stocks, this would be a larger magnitude decline for Chinese stocks. Specifically, the iShares Trust MSCI China ETF, $MCHI, would have needed to fall more than -17% in order to return to the YTD lows. Considering that the $YANG ETF is 3x leveraged, this would imply returns of more than +50% if this scenario played out.

2. I set a rule that I would sell the entire position if/when I am incorrect and the position falls by -13%. This means I’m taking a risk of -13% to generate returns of +50%, a risk/reward ratio of 3.8x. In my opinion, anything with a risk/return ratio larger than 2.5x is extremely attractive.

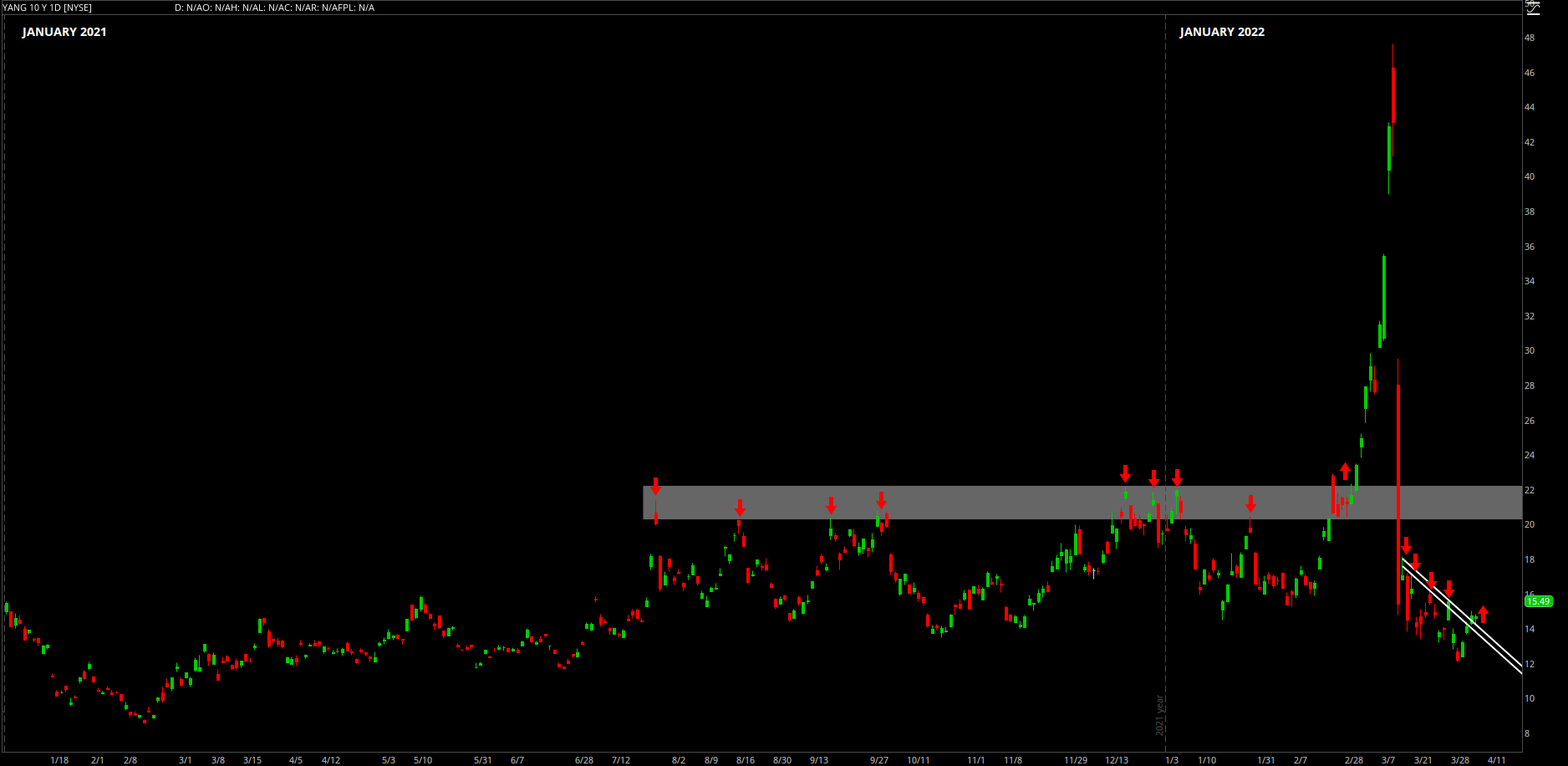

3. Analyzing $YANG, the risk/return becomes even more attractive. Let’s analyze the chart starting from January 2021:

Clearly, $YANG went on a monumental rise at the start of the 2022, reaching highs of roughly $48/share for a YTD gain of +140%. Since those highs, the fund has fallen roughly -73%! As I mentioned earlier, this investment is extremely volatile and high risk.

You might notice the white trendlines that I drew on the chart. On Thursday, the fund’s price was able to breakout above this resistance level, reflecting higher demand from investors for downside protection. This trendline breakout triggered my purchase of the fund.

Let’s suppose that we aren’t able to return back to the YTD highs of $48/share. The next logical point of return would be the 2021 highs, between $21-$23/share. Considering that this range acted as resistance 8 times over the past 7 months, it’s reasonable to think it may act as resistance again in the future. I bought shares at $15.50, implying that a rally to $22/share would generate a return of +42%. This is in-line with the rough expectations I outlined to generate a risk/return of 3.8x. If, however, we are able to launch through that resistance level and return to a price of $35/share (big “if”), that would indicate a return of +126%. If we do manage to return back to the YTD highs of $48, the return would be larger than +200%.

To be clear, I’m making a lot of “if’s” and assumptions about how market dynamics will unfold; however, I will be willing to exit the position at a -13% loss if my assumptions are incorrect. With estimated returns of roughly +42%, +50%, +126%, and +210%, that’s a risk that I’m willing to exercise.

Shares of $YANG closed the week at $15.49, therefore my recent position is flat so far. As always, please read the disclaimer at the end of this newsletter: my personal portfolio actions should not be considered buy/sell recommendations as my risk tolerance, financial goals, time horizons, and ability to manage said risk are specifically my own. All of your portfolio decisions should be discussed with a registered financial advisor and/or fiduciary.

I wanted to share this trade idea to start today’s update, but I have plenty more insights & research to share below, covering S&P 500 data, global liquidity implications, and interesting data for the semiconductor industry. Let’s begin!