Edition #167

Yields & Wages Accelerate, S&P 500's Dividend Yield, Bitcoin's Supply Distribution

Investors,

Economic conditions & financial markets are adhering to the predictions that I made in my “Investment Outlook for 2022”, which I reiterated in my ad hoc deep-dive “Navigating Uncertainty” on March 5, 2022.

The combined takeaways from those two reports are:

As the Federal Reserve withdrawals monetary stimulus, then shifts towards a constrictive monetary policy, tailwinds for asset prices are retracted. This is why I gave a 70% chance for the stock market to have “stale returns” between -5% and +10%. I also gave a 10% chance for “risk-off consolidation”, in which the S&P 500 would return worse than -5%.

An aggressive Federal Reserve, poised to fight inflation with their rhetoric and policy, would bring elevated levels of volatility to all financial markets.

Higher interest rates would put pressure on long-duration assets, particularly non-profitable tech/growth stocks.

So long as the Fed remains aggressive, by raising interest rates and reducing their balance sheet, investors must accept increased volatility and adjust their portfolios accordingly.

Market pressure, caused by volatility in response to tightening monetary policy, will create solid buying opportunities for long-term investors who are able to dollar-cost average & stomach short-term downside.

These aspects have been and will continue to drive markets in 2022. Generally speaking, the weekly research I provide with Cubic Analytics is designed to update key developments in macroeconomics, the stock market, and Bitcoin with respect to the core factors driving markets. In my opinion, monetary policy & yields are the ultimate driver of markets, which is why they are the first and most important layer of my analysis. Let’s dive into this week’s data:

Macroeconomics — Yields, Wages, and Federal Reserve Rhetoric:

Before diving into the economic data that I want to discuss, it’s important to get a 30,000 foot view of the broad-based economic conditions. The data below is provided by Pantera Capital, a cryptocurrency asset management firm:

Essentially, most of the core economic data points are at multi-decade lows/highs or all-time lows/highs. I found it interesting to compare the current economic data vs. the data from 1979, when the U.S. consumer was facing immense inflationary pressures.

I want to focus particularly on the 10-year Treasury yield, which ended the week at 2.7%. I’ve been adamant since last October that I expect yields to continue to rise. I doubled-down on this opinion in November when the Fed announced a tapering of their asset purchases, and I’ve remained consistent on this perspective throughout 2022. In my research “Navigating Uncertainty”, I shared the following commentary regarding 10-year Treasury yields and included the following chart of the 10-year Treasury Yield Index, $TNX:

“Combining the inflationary factors, monetary policy outlook, bond market dynamics, and my own personal technical analysis, I reiterate my expectation for yields to rise. This will exacerbate the trends we’ve been seeing since November 2021, likely causing increased volatility in financial markets and increasing economic uncertainties.”

What have we seen since I shared this analysis? The yield on the 10-year Treasury has increased from 1.72% to 2.7%. While this is “only” a 0.98% nominal increase in the yield, it represents an acceleration of +57%.

In the chart below, the 10-year Treasury Yield Index, $TNX, has increased exponentially since my prediction for a rebound higher on 3/5/2022 (teal line):

The 10-year Yield Index perfectly followed the prediction that I made, rebounding exactly on the level that I outlined. Yields are rocketing higher, reflecting the increasingly aggressive stance from the Federal Reserve and the bond market’s opinion that inflation will continue to rise. These two factors alone are causing rates to rise so dramatically, and I continue to believe that yields have tailwinds to rise further.

In last week’s analysis, I shared data regarding nominal wage growth and highlighted the direct correlation to the federal funds rate. This week, new data was released by the Federal Reserve Bank of Atlanta:

This data tracks the rolling three-month rate of change for median wage growth, currently measured at a +6.0%. What’s causing this? Likely the following:

The labor market is extremely strong at the moment, with companies of all sizes looking to expand their workforce in order to meet strong consumer demand.

Companies are willing to pay a premium to attract talented & skilled workers, which has unquestionably been a low supply/high demand commodity.

Employees, controlling a high degree of negotiating power, are able to demand higher wages in order to adjust for inflationary pressures.

Quits rates have been historically elevated, indicating that employees are leaving their current employer for a new employer. These new opportunities are being taken for a variety of reasons, but notably: more responsibility, more flexibility, more aligned with interests/career goals, and higher pay.

If we consider that the median U.S. household income for fiscal year 2021 was $79,900, according to the U.S. Department of Housing & Urban Development, we can broadly conclude that the median household has increased their annual income by roughly $5,700 in 2022.

This pace likely isn’t sustainable over the long-run, but indicates why the Federal Reserve has cited labor market strength as a justification for more aggressive monetary tightening. The fact is, U.S. households seem well-positioned to pay their existing debt obligations.

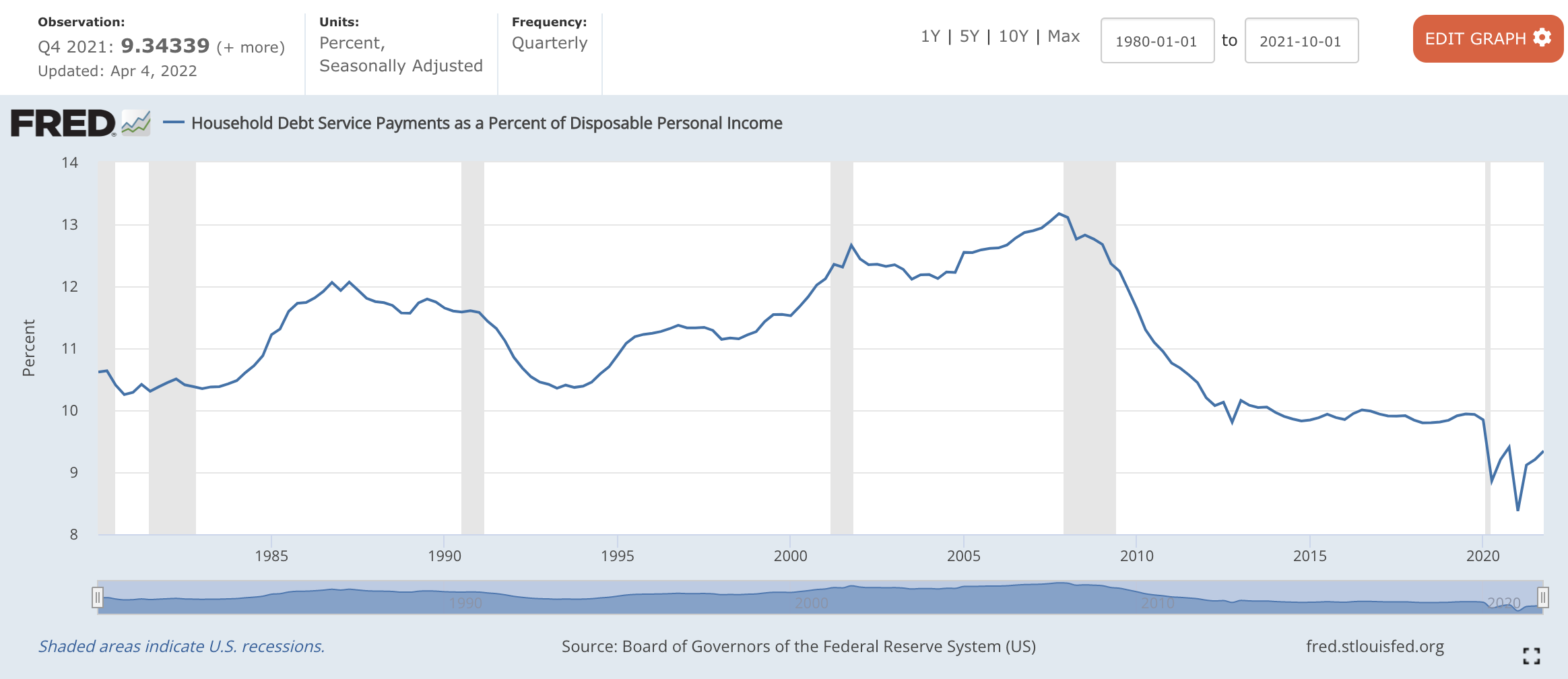

Currently at 9.34%, we can see that debt payments as a percentage of disposable personal income (DPI) are historically low, although elevated from the post-Pandemic lows. With DPI rising at an accelerated pace, the Federal Reserve has the ability to increase the base interest rate, the federal funds rate, faster than it has in the past. For all this talk of “the Federal Reserve CAN’T raise interest rates”, I’d argue that they can raise them higher than most of us currently think is feasible in order to fight inflation.

In fact, recent comments by Federal Reserve officials have taken an increasingly aggressive tone. Here are some examples, taken from this past week:

“I don’t expect food prices to come down anytime soon.” - Patrick Harker

“The Fed is 9-10 hikes away from the FOMC’s estimate of the neutral rate.” - Tom Barkin

“Currently, inflation is much too high and is subject to upside risks.” - Lael Brainard

“The Committee will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” - Lael Brainard

The size of the Fed’s balance sheet “easily argues for going faster and moving along at a quicker pace than we did before.” - Esther George

“I think we’re going to see GDP step down, because fiscal policy is waning relative to the money that went out during the pandemic. Rates are going to be rising.” - Esther George

“We’re still hearing that [employers can’t find workers, wages are rising, and businesses have pricing power].” - Esther George

The minutes were released from the Federal Reserve’s March meeting, confirming that they are targeting an aggressive unwinding of their balance sheet. It was announced that “participants generally agreed that monthly caps of about $60Bn for Treasury securities and about $35Bn for agency MBS would likely be appropriate”, and that “the caps could be phased in over a period of three months.”

Essentially, the Fed is preparing the market for $95Bn/month of monetary tightening, a stark contrast to the $120Bn/month of monetary stimulus they provided for twenty-two months during the pandemic.

Stock Market — Facing Pressure From Rising Rates:

This week was nasty for the broad stock market, facing relentless pressure from rising yields. In a week where the 10-year Treasury Yield Index increased by +14%, each of the major indexes were pushed lower:

Dow Jones Industrial Average $DJX: -0.28%

S&P 500 $SPX: -1.27%

Nasdaq-100 $NDX: -3.59%

Russell 2000 $RUT: -4.6%

Essentially, stocks further out on the risk-curve got punished the most. In a rising rate environment, this is exactly what I expect to see.

“Long-duration” stocks, those whose price is heavily dependent on the high growth of future cash flows, are ultra-sensitive to yields. In an environment where interest rates are falling, these stocks soar higher. In an environment where interest rates are rising, these stocks crater lower. This is why I’ve been explicitly bearish on non-profitable tech/growth stocks, generally represented by $ARKK, since November 2021. Since I published research on 11/27, “A Deep-Dive on Equity Prices, Rates, and Asset Returns”, $ARKK has fallen -43.4%.

Staying focused on the dynamics between the stocks and yields, this is an excellent graphic from Bespoke’s recent blog post, “Treasuries Yields Blow Past Dividend Yields”:

Historically, the 10-year Treasury yield has exceeded the dividend yield of the S&P 500. There are brief periods in which the S&P 500’s dividend yield exceeds the 10-year Treasury yield: 2008, 2015/2016, and 2020. Logically, these have represented generational buying opportunities because stock market investors are able to capitalize on higher guaranteed dividends AND the higher upside offered by stocks vs. bonds.

Investors are constantly forced to chose between allocating new capital. When the yield on the S&P 500 is greater than the 10-year Treasury yield, investors are incentivized to increase their demand for stocks vs. Treasuries. When the Treasury yield exceeds the S&P 500’s dividend yield, investors are incentivized to increase their appetite for bonds over stocks; UNLESS the risk-premium for stocks outweighs the lower relative yield.

In a market environment where yields are rising, both are seemingly unattractive; which is why we’ve been seeing consistent market pressure since November 2021. With the recent explosion of yields, investors are now able to generate a higher guaranteed return from bonds than the S&P 500. However, stocks & bonds are seemingly unattractive in a market environment where yields are expected to keep rising, which is why we’ve been seeing consistent market pressure across both assets.

Should yields rise further, which I expect to be the case, bonds and stocks will both face downward pressure in the short-term. Some stocks will be better suited to handle rising yields, particularly in a risk-off environment, which I have been discussing at length with premium members. Broadly speaking, I’m seeing large levels of demand in defensive sectors and commodity-related industries.

Tune in for tomorrow’s premium report and get it delivered straight to your inbox:

Bitcoin — Supply & Distribution Dynamics:

Bitcoin has not been immune to the pressures caused by rising yields, though I do believe it’s well-positioned to handle said pressures. Keep in mind, we’ve seen yields rise consistently in 2022. Nonetheless, here’s the YTD performance for each of the major asset classes:

Stocks:

Dow Jones Industrial Average $DJX: -4.5%

S&P 500 $SPX: -5.8%

Nasdaq-100 $NDX: -12.2%

Russell 2000 $RUT: -11.2%

Bonds:

iShares 20-year Treasury Bond Fund $TLT: -15.5%

iShares Trust Core U.S. Aggregate Bond Fund $AGG: -8.2%

Crypto:

Bitcoin $BTC: -8.1%

Ethereum $ETH: -12.2%

Bitcoin has outperformed the Nasdaq-100 (tech stocks), the Russell 2000 (small cap stocks), the 20-year Treasury bond, the U.S. aggregate bond fund, and Ethereum so far in 2022. For all of the asset management, banking, and financial professional readers in the audience, I truly want to highlight this point. Please let it sink in.

As it pertains to on-chain data, Willy Woo shared excellent analysis on wallet-size composition amongst Bitcoin investors.

From the data, we can discern that whale wallets (Bitcoin wallets holding more than 1,000 BTC = $42,500,000) have been consistently declining since the parabolic peak in July 2011. In that market cycle, Bitcoin hit a peak of $31 and was likely the first official on-ramp for early Bitcoin adopters/investors. We can speculate that it was the first on-ramp for new investors because it perfectly signaled the peak in the percentage of whale wallets. It marked an inflection point of retail adoption, allowing small investors to consistently increase their ownership of the network’s value over time.

In addition to this distribution data from Willy Woo, On-Chain College shared complimentary data that shows the increase in wallets holding at least 1 BTC:

After dipping & consolidating since the prior all-time high in Q1 2021, we’ve seen small wallets holding less than 1 BTC continue to cross above the 1 BTC threshold at a consistent & accelerating pace. This confirms the idea that smaller network participants are growing and continuing to adopt the digital asset as a store of value.

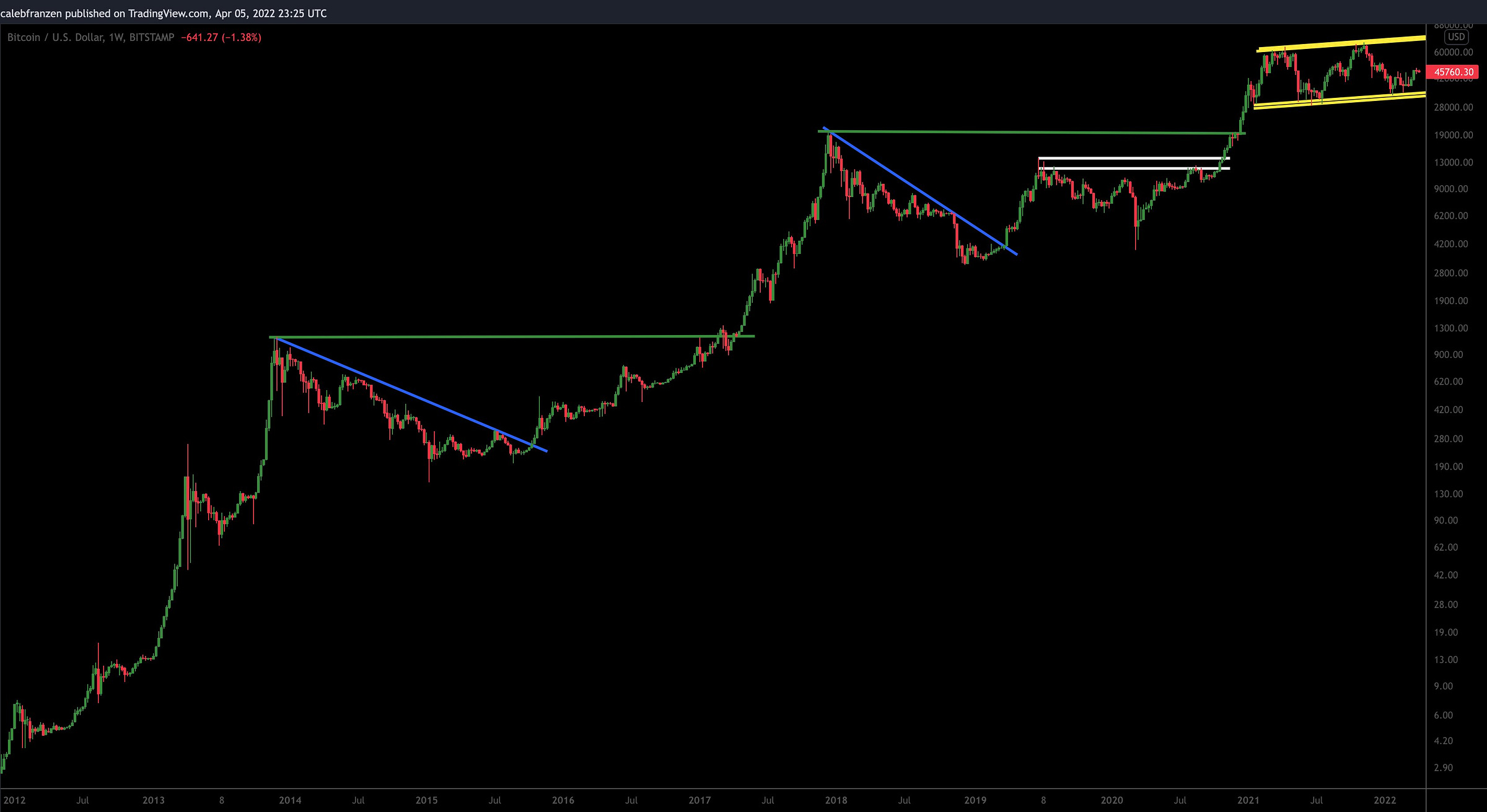

On April 5th, I shared the following chart on Twitter with the caption, “One of these Bitcoin market cycles is not like the others...”:

Talk soon,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.