Investors,

I want to formally announce “Cubic Analytics”, the official name and brand of the newsletter going forward! When I launched my research in May 2021, I knew that “Caleb’s Market Update” was only a temporary name for the publication. As the newsletter has grown, it’s become increasingly important to shift the branding.

This change won’t have any material impact to the content, quality, or frequency of the newsletter or my research. Everything is staying the exact same, except for the official rebranding as “Cubic Analytics”. There will be two logos that you’ll see going forward, depending on where they’re published:

Why Cubic? First of all, my newsletter has three core pillars: macroeconomics, the stock market, and Bitcoin. In every publication, we’ve analyzed the fascinating data & charts pertaining to these three topics, showing how interconnected the markets are. This “power of three” is something that stood out to me, recognizing that it’s a core feature of my analysis.

Secondly, cubic functions have a distinct visualization. By plotting f(x) = x³ - x, we get:

The shape of this function is reminiscent of the business cycle, stock market cycles, and even crypto cycles: long-term growth is often accompanied by short-term volatility and corrections. While GDP has experienced contractions and periods of stagnation, long-term economic growth recovers and our economy continues to expand. The cubic function is a great reminder that you can’t have long-term growth without periods of decline or stagnation. It also speaks to my intrinsic optimism and recognition that innovation and human ingenuity will prevail over short-term obstacles.

To celebrate this announcement, I’m providing a 10% discount to premium membership, which can be redeemed through the link below:

Economy:

Without question, the most important factor hanging over the global economy is the Russian invasion of Ukraine. I’m not a geopolitical expert and I’ll never pretend to be, so all I want to say on this topic is that my thoughts are with the people of Ukraine. I’m currently looking at various NGO’s and non-profits who are accepting Bitcoin donations to help provide essential resources and support to Ukraine. Please let me know if you have any info on this.

Here in the U.S., the second most important economic news was the release of the January 2022 PCE data. The PCE, or personal consumption expenditures, is the Federal Reserve’s preferred method of measuring inflation, so this report has significant implications for how the Fed is viewing the inflation circumstances.

The January report showed a +6.1% YoY increase in the PCE data, the fastest increase since February 1982. This proves one simple fact: Regardless of how it’s measured (via the CPI, PPI, PCE, or their core counterparts), inflation is accelerating at a historic pace. This is irrefutable.

Diving deeper into the data, we can see the individual contributors to the PCE results:

The major distortions in the market are coming from two primary groups: Motor Vehicles & Parts and Gasoline & Energy Goods. There is no sign that these will abate soon, from my perspective. The other factors are relatively stagnant, but still at historically elevated levels.

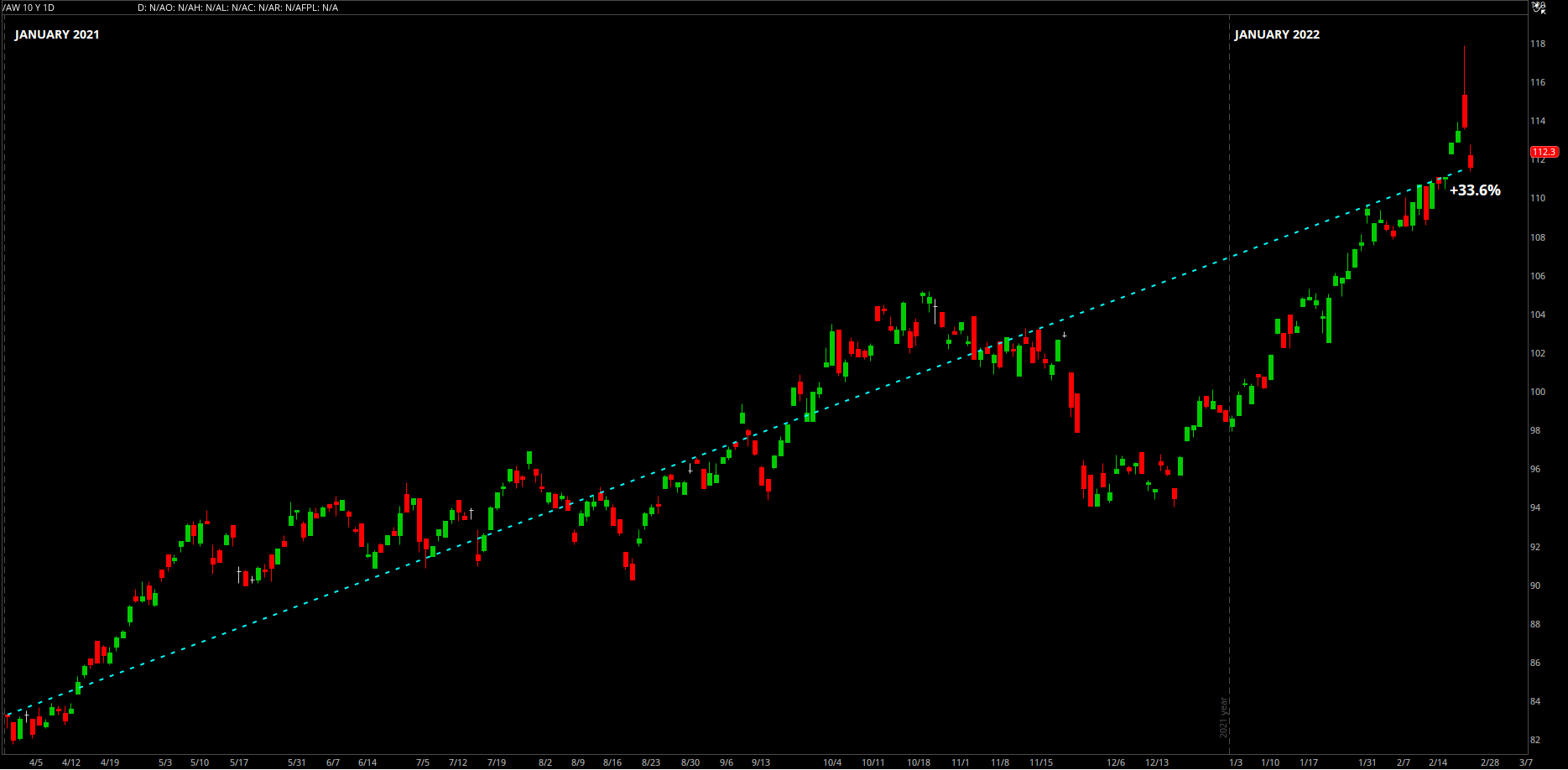

As a result of global sanctions, reduced energy trade (Russia is the third largest exporter of oil in the world), and higher demand for essential goods & services, I expect to see continued inflationary pressures in the coming months. The Bloomberg Commodity Index is currently +33.6% higher than the starting point in 2021. Within the first two months of 2022, the Index has already gained +13.2% YTD.

The Bloomberg Commodity Index is a general measure of the commodity market, heavily influenced by energy-related resources (oil, natural gas, etc.), which make up 33% of the index. Clearly, other commodities are also soaring. Take wheat, for example:

Wheat prices are up nearly +50% since the beginning of 2021, and are up +11.3% YTD as of Friday’s close (despite falling -7.76% during Friday’s session). All commodity prices are accelerating higher, whether they’re related to energy, industrial metals, or food. Since November 2021, soybean prices have risen by +34%, corn prices by +19%, and rice by +18%.

As I mentioned earlier, I fully expect for these inflationary pressures to continue amidst rising global uncertainty, conflict, and the simple momentum of inflationary dynamics.

Stock Market:

With an emphasis on what’s happening in the commodity markets, I saw a fantastic chart from Liz Ann Sonders highlighting the correlation between commodities & the stock market:

Clearly, we’d need to see more data to make any conclusive statements, but this recent divergence is quite interesting. Why has this happened? I’m positing that it’s for one primary reason: inflation. Commodities are rising because of inflation, while stocks were rising in spite of inflation. When the Federal Reserve signaled an official shift in their monetary policy and started to taper their asset purchases in November 2021, we’ve seen a divergence between stocks and commodities. This divergence accelerated at the start of 2022, when inflation data continued to accelerate and Q4 GDP was stronger than expected.

While inflationary pressures have continued, with strong economic data increasing 5, 10, and 30-year interest rates, U.S. stocks have continued to selloff. Additionally, the geopolitical tensions with Ukraine/Russia have caused investors to worry about an uncertain future. Meanwhile, the inflationary pressures have been accretive to commodity prices. Considering that Russia is the third largest exporter of oil and is a critical supplier of natural gas to Europe, energy-related commodities have been rising even faster.

Personally, I think commodity prices are headed higher. Therefore, the only way this divergence will end is if equities rally substantially. While I do think U.S. stocks are trading at more attractive valuations than they were 3 months ago, I tend to think that they’ll trade at more attractive discounts in the near future.

As most people know by now, my 2022 market outlook predicted an 80% chance for U.S. stocks to have below-average returns. I stand by the core factors that led me to that conclusion, therefore, I don’t foresee a rubber band rally back to new highs in the coming weeks. It’s possible, but I don’t think it’s likely.

In this weekend’s premium report, I’ll be analyzing the key investment themes I’ve been sharing for the past several weeks that have been producing strong returns relative to the market. In my February 6th publication, Edition #149, I shared 6 stocks in a specific industry that I thought was set to outperform. Here’s how those stocks have performed since 2/6/22:

+31%

+21%

+21%

+19%

+6%

+4%

+2%

Avg. = +16.3%

Meanwhile, the S&P 500 is -3.5%.

Among other things, the premium newsletter this weekend will be centered around the attractive opportunities that are present in the market right now. Stay tuned.

Bitcoin:

Bitcoin’s resilience has continued to be on display for the world to see, both as a tool for humanitarian rights and as an investment vehicle. Yesterday, I read a phenomenal post about a young man in Ukraine who was attempting to flee Ukraine to the West.

Unable to withdraw funds out of his bank and unable to send international transactions, the young man is able to utilize Bitcoin in a permissionless, programmatic, and decentralized monetary network. Armed with his hardware wallet where his Bitcoin is stored, he is able to send monetary value across the world over the internet. He does not need a bank or a centralized intermediary, and can move around the globe with his Bitcoin stored on a small piece of hardware. Theoretically, he could have millions of dollars on that hardware wallet and be able to walk around with it in his pocket.

This is a significant part of Bitcoin’s value proposition, something that most American’s can’t truly understand the importance of. We aren’t being invaded, aren’t forced to evacuate, and have access to a plethora of financial services. What about the 3 billion people who live under authoritarian regimes led by dictators? What about the people of Lebanon, Sudan, Yemen, Venezuela, Zimbabwe, Argentina, and Turkey facing sustained levels of hyperinflation?

Thankfully, these aren’t concerns we face in the U.S. and Europe, but we’re starting to see how Bitcoin’s use-cases are being utilized to provide economic access, economic sovereignty, and financial freedom.

Aside from the humanitarian resilience of Bitcoin from a philosophical standpoint, its price action has also been resilient. From February 1, 2022 - February 23, 2022 (hours before Russia’s invasion of Ukraine) the S&P 500 had fallen -6.5%. Meanwhile, Bitcoin had fallen -2.7% over the same time frame.

Since the market open on February 24th, the S&P 500 has gained +5.5% while Bitcoin has gained +12.4%. It’s experienced less overall downside than the S&P 500 since the beginning of the month and has a stronger recovery when assets rallied on Thursday & Friday. While I write this newsletter, Bitcoin is trading at $39,670. Here’s what I have to say about that:

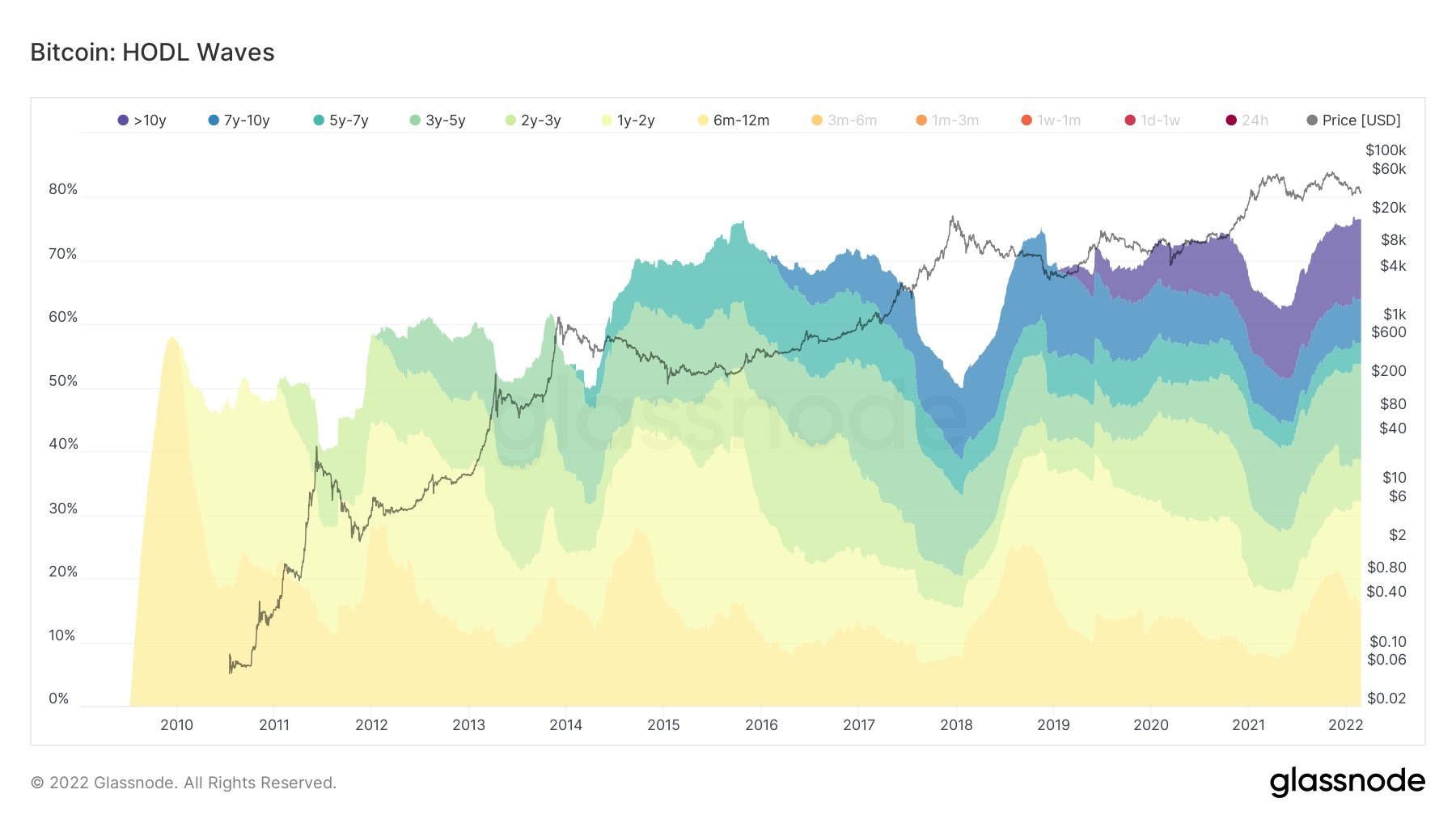

Aside from this general discussion, I wanted to share an interesting piece of on-chain data that I saw from Joe Burnett on Twitter.

I’ve actually discussed this data point before, but this chart is showing a segmentation of supply “stickiness” and investor conviction. This chart shows us that 76% of Bitcoin’s total circulating supply hasn’t been moved in at least 6 months, reflecting that investors aren’t selling their BTC.

We can narrow this down even further:

60% of Bitcoin’s supply hasn’t been moved in at least 12 months and roughly 10% hasn’t been moved in at least 10 years! This is proof positive that investors’ conviction in Bitcoin is at all-time highs. When demand increases substantially, Bitcoiners likely won’t be interested in selling at the market price. This will force potential buyers to increase their bids, driving the price higher to entice the owners to sell. More and more, people are becoming long-term holders of pure, digital scarcity.

Talk soon,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.