Edition #152

Capacity Utilization Signals Strength, Stocks Fall With Less Liquidity, Bitcoin's Price Trajectory, Real Estate's Supply-Side Factors

Investors,

This was a massive week of growth for this newsletter, so I just want to give a warm welcome to all the new subscribers! So far in 2022, the newsletter has grown by +48% and we are only seven weeks into the year! I just wanted to take a quick moment to thank all 500 of you for letting me share my market insights with you. Here’s the trajectory we’ve been on since I launched this research newsletter in May 2021:

If you know someone who would benefit from reading these publications, please forward them this email and let’s keep this momentum going.

Here are the key takeaways from today’s publication:

Capacity utilization, a measure of productive efficiency, continues to recover in the United States despite being in a multi-decade downtrend. The January 2022 measure was 77.6%, the highest since March 2019.

Consumer price inflation has been worrisome, but producer price inflation is rising even faster. This could produce trickle-down effects to consumer prices. The January 2022 PPI rose by +9.7% on a year-over-year basis.

U.S. stocks have contracted substantially in 2022, creating big swings in both directions. While macro headwinds & geopolitical tensions are the culprit from the media’s perspective, we can attribute the contraction to a decrease in liquidity. As I’ve continued to say, don’t fight the Fed.

Because Bitcoin’s supply-side is known with certainty and programmed to become increasingly scarce over time, the price of BTC will also become increasingly dependent on the demand-side of the equation. Benefiting from network effects, we can extrapolate the future price of BTC based on Metcalfe’s Law, as exhibited by Jurrien Timmer’s recent analysis. Using historical models from the growth of mobile phone adoption and internet user growth, we can evaluate two potential price paths for Bitcoin.

The real estate market is red hot, but slowing down on a YoY monthly growth rate. Likely slowing from the drastic rise in mortgage rates since Q4 2021, housing prices are still being supported by record low inventories. Thankfully, housing starts are beginning to accelerate higher.

The Economy:

Capacity utilization is an important metric to understand how efficient the manufacturing sector is operating. The measure is a percentage that is calculated by dividing actual production by maximum potential production. As one might expect, capacity utilization tends to decline dramatically during recessions as businesses slow down production, reduce their labor force, and lick their wounds. Conversely, we’d expect to see an increase in capacity utilization during economic booms & recoveries as businesses reestablish their activity, expand production, and drive output to meet high consumer demand.

If we track capacity utilization since the late 1960’s, we see:

The long-term downtrend is extremely obvious but I’ve highlighted the trend with the red channel. Despite this long-term downtrend, the U.S. economy has made a remarkable comeback since the COVID lows in April 2020 when it hit a low of 63.4%. The most recent data for January 2022 reflected a capacity utilization rate of 77.6%, which is the highest reading since March 2019.

I was admittedly shocked to see such a strong number, especially considering how much slack there is in the labor market with 10.9 million job openings at the end of December 2021. This is an encouraging sign, reflecting a smooth-operating economy in terms of production activity. While one could make the case that the maximum potential capacity of production has declined, helping to boost utilization, I’d need to see substantive data to share their sentiment.

While manufacturing businesses are running increasingly tight ships, producers of goods & services are facing substantial price pressures. While this newsletter has predominantly focused on consumer prices, as measured by the CPI, we’ve also discussed the producer price index (PPI) as recently as Edition #134.

The PPI has essentially remained level since we covered it in November 2021, in which the data reflected a +9.6% increase year-over-year. The January 2022 data was released earlier this week, reflecting a +9.7% YoY increase.

Interestingly, the initial reports for November & December 2021 showed a +9.6% and +9.7% increase, but both have been revised to +9.8%. Essentially, the PPI is attempting to stabilize, but time will tell if it actually does.

In fact, we’ve seen this stabilization before. In August 2021, economists were stating that a stabilization in the CPI of +5.4% was confirmation that inflation was transitory. My response was the following, which I published in Edition #74:

“The question that remains is whether or not this stabilization will become the new trend or if we will reaccelerate again in the coming months. My bias is towards the latter, as I’ve reiterated here on this newsletter when I said that I wouldn’t be surprised if we see a 12-month inflation rate between +7% and +10% at some point during this year.”

When I published those words of caution, the 12-month inflation rate for the CPI was +5.4% and it has since risen to 7.5% in January 2022 after hitting +7.0% in December 2021. Considering the macro environment, continued supply-side bottlenecks, and strong consumer trends, I continue to believe that inflation will be persistent. Even once the Federal Reserve begins to raise interest rates, it’s hard for me to see a substantive slow-down in the rate of inflation. At this rate, I’d be surprised if we see a 12-month CPI inflation rate of less than +6.0% at any point in 2022. That’s my new inflation prediction.

The Stock Market:

One of the core reasons why we evaluate economic conditions in this newsletter is to understand how macro data could influence the Federal Reserve’s monetary policy and market liquidity.

As we’ve discussed ad nauseam, the framework is simple:

Federal Reserve Asset Purchases ↑ Liquidity ↑ Interest Rates ↓ Asset Prices ↑

Federal Reserve Asset Purchases ↓ Liquidity ↓ Interest Rates ↑ Asset Prices ↓

While markets have seemingly come under pressure from concerns around inflation, Federal Reserve tapering/tightening, slowing growth, and recent geopolitical tensions, I’ve mostly been focused on yields and liquidity metrics. Since the COVID lows, we’ve seen a drastic rise in the 10-year Treasury yield index, $TNX:

This dramatic & sustained rise in yields, particularly since November 2021 when the Federal Reserve announced the tapering of their asset purchases, has put increased pressure on U.S. equities.

In fact, I saw an amazing chart this week from a Twitter account by the name of @FadingRallies, that shows how liquidity in the equity market is correlated to the price of the S&P 500. I added the red rectangles to highlight the correlation of the two variables when liquidity tightens:

As we can see from the chart above: tighter financial conditions → less liquidity → lower stock prices and choppy market conditions.

This recent decline in liquidity is fairly alarming, but it’s worth noting that these cascading declines don’t tend to last for very long. While it might be easy to take comfort in that trend, the current monetary policy environment seems far more aggressive than it has been in the past, particularly in light of a 40-year high in inflation. Should the Federal Reserve deliver on its promise to combat inflation, therefore driving interest rates higher and potentially reducing the size of their balance sheet, I wouldn’t be surprised to see additional pressure on U.S. equities. Once again, this was the core thesis behind my outlook for U.S. stocks to have below-average returns in 2022. That outlook is playing out to perfection so far & I continue to reiterate those views.

Bitcoin & Crypto:

Jurrien Timmer, the Director of Macro at Fidelity, shared an amazing thread of analysis on Twitter this past week. If you have 5-10 minutes, I highly encourage you to read the full publication here ↓↓↓

Throughout this newsletter, I’ve repeatedly highlighted the programmatic nature of Bitcoin’s supply curve which is designed to make the asset increasingly more scarce over time. Considering that supply is capped at 21 million BTC, it’s easy to conclude why the price of Bitcoin is so heavily reliant on demand cycles: when supply is known with certainty & designed to become increasingly scarce, demand is the primary variable that will influence price.

This is why we’ve also focused heavily on adoption metrics, understanding network effects, and Metcalfe’s Law. All three of these topics are related to demand, pointing to exponential growth, which is why I’ve often highlighted the comparison of Bitcoin’s adoption to that of the internet’s adoption.

The final post of Jurrien’s analysis was a home run, providing a concrete trajectory for Bitcoin’s price based on prior adoption curves. In his analysis, he modeled Bitcoin’s adoption and price based on the trajectories of mobile phone growth and internet user growth:

The adoption metric that Jurrien used is very simple and valid, measuring the number of wallets with a balance of at least $1. We can even see that the growth of $1 accounts is generally aligned with the price trajectory of Bitcoin! Again, this confirms that Bitcoin’s price has and will continue to become increasingly dependent on demand. The chart truly speaks for itself, but I’ll leave you with this:

Should Bitcoin’s adoption continue to expand in the same manner as prior network effect-based technologies, the potential price target at any given point in the future is considerably higher than the current price.

Real Estate:

It’s been quite awhile since we’ve discussed the real estate market in this newsletter, but I’m happy to share some interesting data that I saw this week from Len Kiefer, the Deputy Chief Economist at Freddie Mac.

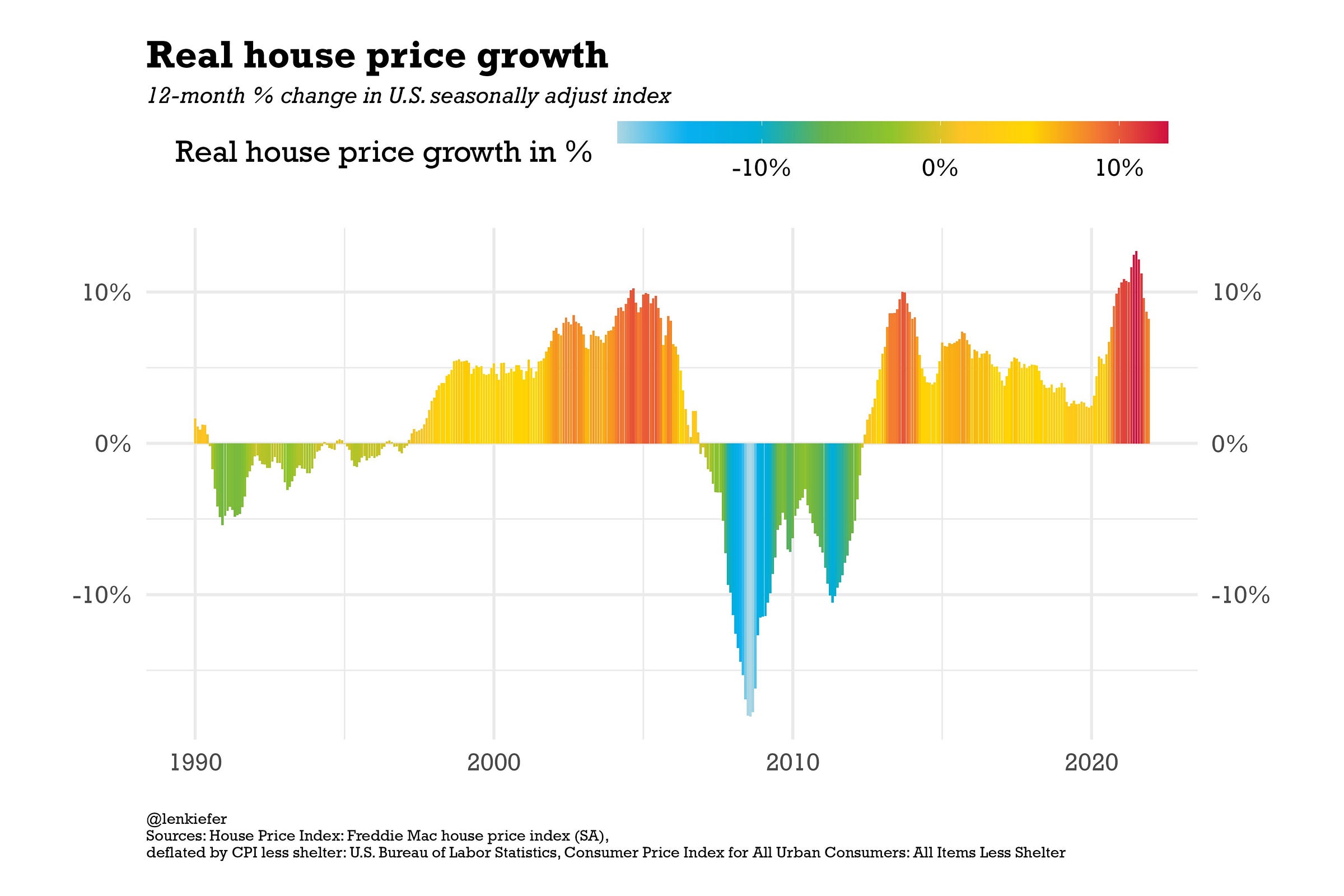

The first is just a general update on the national housing market, clearly showing a gradual slowdown. Specifically, the graph is tracking the 12-month change in the Home Price Index, adjusted for the rate of inflation. Therefore, there are two variables being considered here: nominal home price growth and inflation.

While the market has continued to gain steam, it appeared to have achieved peak acceleration in 2021. Nonetheless, the market has climbed higher in recent months despite the recent uptick in mortgage rates, as shown in the chart below:

As debt-servicing costs become more expensive with U.S. home prices at record-highs, economic theory tells us that demand should slip. Does that mean prices will fall? Not necessarily! It would be more appropriate to say that the rise in mortgage rates will dampen additional increases in home prices; however, the direction of home prices will also be dependent on supply! The data reflects that supply, aka inventory, is at record lows. A new report from the National Association of Realtors (NAR) showed an inventory of 860,000 homes in January 2022, a record low since data started to be collected in 1999. This figure represents a year-over-year decline of -16.5%.

With supply at record lows, and continuing to decline, potential buyers are being forced to compete at higher rates despite rising mortgage costs. Essentially, the supply factors are offsetting the demand factors and causing prices to remain elevated. While many analysts are focused on how rising mortgage rates should cause the housing market to decline, I encourage you to also consider the supply-side and to understand how these factors are being equilibrated.

At the very least, these supply-side factors could begin to abate with developers increasing home production at a fast rate.

Talk soon,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.