Investors,

If you only have a few moments, here are the key takeaways we’ll be discussing in this edition:

• Inflation for the January 2022 CPI hit +7.5% on a trailing 12-month basis. This is the highest reading since 1982, meanwhile the Federal Reserve continues to purchase assets at historic levels and maintain the federal funds rate at 0% to 0.25%.

• The Fed hast lost control of the inflation narrative and is behind the curve.

• With the rapid rise in Treasury yields, the spread between the S&P 500 dividend payment and the 10-year Treasury yield is the most negative it’s been since 2019.

• The inflation rate of Bitcoin’s supply is drastically lower than the inflation rate of the USD, making it clear which system protects the sovereignty of an individual’s purchasing power.

Economy:

Market participants and economists have been waiting in anticipation of the January 2022 CPI data, which was released on Thursday morning. At this point, it’s become clear that inflationary has not been transitory and that the Federal Reserve’s expectations have missed the mark. After retiring the word “transitory” at the end of November 2021, the consumer price index has only continued to gain upward momentum.

At the start of the week, the median forecast was for an increase of +7.2% relative to January 2021. According to Jonathan Ferro from Bloomberg, the major international banks had a range of estimates between +7.1% to +7.4% as of February 9th.

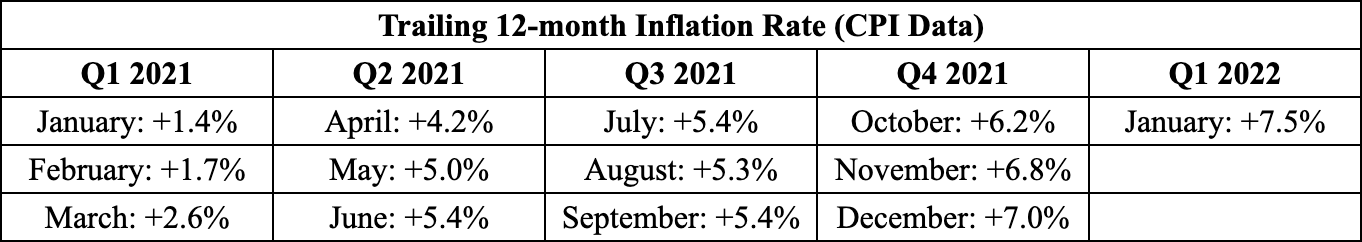

The result came in significantly higher at +7.5%, the highest YoY change since February 1982. It’s worth noting just how high inflation has risen over the past 12 months, considering that the January 2021 data showed a year-over-year change of +1.4%. There has unequivocally been a massive acceleration over the past year. Here is the data for each month since January 2021:

To visualize the trend more clearly, Holger Zschaepitz shared the following chart with the historical context of the headline CPI data (+7.5%) and the core CPI (+6.0%):

I’ve recently been raising a point of contention around the “Shelter” component of the CPI data, which came in at +4.4% on a YoY basis in Jan’22. As I’ve mentioned previously, shelter is the largest component of the CPI and makes up nearly one-third of the overall weighting. Recent data from ApartmentList shows that the National Rent Index gained +17.8% over the 12-month period ending January 2022. Additionally, the Case-Shiller U.S. National Home Price Index gained +18.8% over the past year in their most recent update, published on January 25th.

Again, if housing & rental prices have accelerated so significantly, how can the “Shelter” component only be up +4.4% over the past year? Considering that it makes up one-third of the CPI calculation, it’s very possible that U.S. consumers are facing much higher inflation than the +7.5%.

For the rest of the data, here are some of the key components contributing to the acceleration of inflation:

While inflation hits 40-year highs, the Federal Reserve continues to purchase U.S. Treasuries and agency-MBS at substantial amounts, growing their balance sheet to new all-time highs of $8.878Tn. While the Fed has communicated their willingness to step-in and fight inflation, their actions have been much less aggressive (so far). While the tapering process has been underway since November 2021, it’s expected to complete at the end of next month.

The preferred topic of conversation amongst economists is the level of aggression that the Fed should pursue once the tapering process is complete. The new favorable preference is for a 0.5% interest rate hike in March. Just a few weeks ago, this seemed like an extremely unlikely scenario, but has continued to gain traction.

On February 1st, the President of the St. Louis Federal Reserve, James Bullard, expressed that he “doesn’t think a 50-basis point hike really helps us right now”. Just nine days later, Bullard shifted to a more hawkish stance, advocating for a federal funds rate range of 1.0% to 1.25% by July 1, 2022. While the Federal Reserve was seemingly managing inflation expectations until September 2021, they’ve lost control of the narrative and repeatedly contradict themselves just a week or two apart.

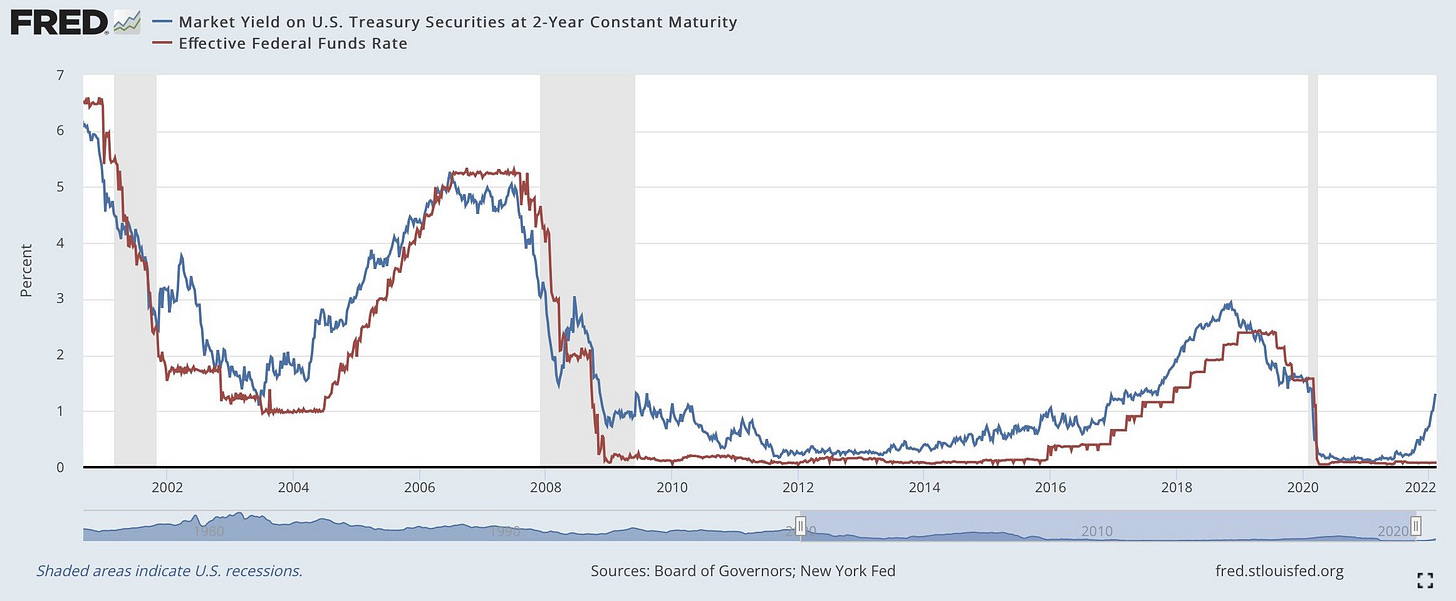

Historically, we’ve seen a tight correlation between the federal funds rate (FFR) and the yield on 2-year Treasuries. Logically, this makes perfect sense! However, we’ve started to see a massive divergence over the past 16 months with the rapid ascension in yields while the Federal Reserve keeps the FFR at the lower-bound of 0%.

THIS is what economists mean when we say that the Fed is “behind the curve”. Now, they’re forced to combat historic levels of inflation while financial markets & the economy are still drunk on monetary stimulus. Instead of being proactive, they’re having to be reactive. The problem is, they should have reacted months ago but they didn’t have the foresight or the gumption to act.

Stock Market:

With a relatively strong economic recovery (good, not great), 40-year highs in inflation, and a drastic shift in monetary policy, yields on U.S. Treasuries have continued to accelerate higher. The 10-year yield, which was at 1.36% at the beginning of December 2021, is currently at 1.94% as of Friday evening. Earlier in the week, the yield on the 10-year Treasury exceeded 2.0% for the first time since July 2019.

One important way to measure risk premium is by comparing the dividend yield of the S&P 500 vs. the 10-year Treasury yield. This essentially compares the “guaranteed” nominal yield of owning stocks (risk assets) vs. the guaranteed nominal return of owning government debt (risk-free assets).

When the spread between these yields is high, it indicates that investors can earn a relatively high return for owning risk assets relative to owning risk-free assets. This makes risk assets more attractive! Conversely, when the spread is small or negative, investors earn less of a premium for owning risk assets, making bonds more attractive. Here’s data on the current spread from Liz Ann Sonders:

We can see that the spread was abnormally high in Q1 2020, which is something I remember seeing in real-time and thinking “why wouldn’t I want to own stocks right now relative to risk-free assets?” Clearly, that spread has been reduced in favor of owning bonds since 2021 and has decisively flipped into negative territory.

Investors are now confronted with a tough decision and forced to question whether or not the risk of equities is desirable relative to the yield on U.S. Treasuries. For what it’s worth, this shouldn’t move the needle for most investors, but it’s an interesting dynamic to pay attention to. Personally, I think the spread will fall further into negative territory, almost certainly below -1.00% by June 2022. I’ll be curious to see how this develops, as it will continue to make equities less attractive if it continues to decline.

Cryptocurrency:

In Edition #141, published on January 15, I discussed the interesting topic of Bitcoin’s supply inflation. I highly recommend reading that newsletter for those who are interested in how Bitcoin’s programmatic monetary policy provides certainty in regards to the inflation of BTC’s money supply.

In light of the January 2022 CPI data, I thought it was worthwhile to share this data once again. While the Federal Reserve conducted massive monetary stimulus and increased M2 by 40% in less than 24 months, Bitcoin’s supply has only increased by +3.9% since February 2020. Even better, Bitcoin’s future supply curve is only expected to flatten even further, meaning that the rate of new supply will continue to decrease.

Here’s the path of Bitcoin’s inflation rate:

I reposted this image on Twitter, with the following commentary:

“Programmatic monetary policy creates economic certainty.

The issuance of new Bitcoin into the monetary network is designed to increase at a decreasing rate, until the 21 million cap is achieved.

It is literally programmed to become increasingly scarce over time.”

In closing, I also created the following one-pager to outline my fundamental investment thesis for Bitcoin:

This brief and concise analysis is something that I put together during the recent decline in Bitcoin’s price from the November all-time highs. I think it’s extremely important to understand the core investment philosophy behind any asset you own, and Bitcoin’s investment thesis is a beautiful combination of mathematics, economics, and finance.

Talk soon,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.