Investors,

First of all, I hope everyone was able to maintain their composure this past week & stick to their convictions. Wild weeks always test our convictions and make it extremely hard to stay level-headed, so you’ve already won most of the battle if you remained calm. Personally, I’m starting to get really excited about a handful of stocks that have become much more fairly valued over the past 2-8 weeks, which I’ll be sharing at the end of this newsletter. I plan to begin dipping my toes in many of these stocks for my medium & long-term portfolio.

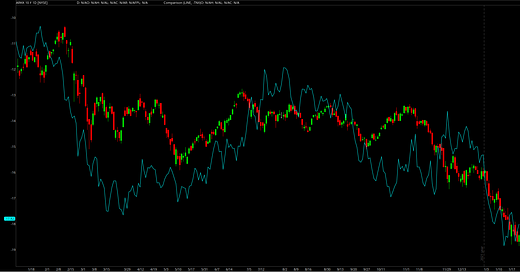

Actual market data was quite stale this week, so practically all of the charts & data that we’ll discuss in this edition are from my own research & analysis. The takeaways from this data will reinforce the sentiment & ideas we’ve been discussing for months, as well as the general themes that I outlined in my “Investment Outlook for 2022”. That is, market pressure has popped many bubbles, hurting non-profitable tech, growth and small caps the most amidst a rising rate environment. This has substantiated my recent warnings to be patient and wait for opportunities in the market to come to us. The expectation for rates to rise in anticipation of the Federal Reserve’s monetary policy was the core justification for my below-average return outlook for U.S. stocks in 2022. The recent Federal Reserve policy meeting, Q4 2021 GDP data, and comments from various Fed officials have pushed interest rates higher, faster than the market had originally anticipated. It’s keeping investors on their toes, making sound research even more important.

With that said, let’s dive right in…