Chaos in financial markets has been steadily increasing, but last week was particularly tumultuous. For months, the discussion in these premium reports was centered around remaining patient and to avoid taking new trades, which is why I haven’t sent out a watchlist of stocks in quite some time. The risk/reward opportunities weren’t attractive and market uncertainty was on the rise. Notably, concerns around an aggressive tapering schedule and eventual tightening process made me lean towards a “wait and see” approach. From my perspective, it’s better to prevent a loss than to miss out on potential gains.

As mentioned in my general newsletter this weekend, January 2022 has already been an extremely poor month in terms of stock returns. The indexes are currently experiencing their worst month since either March 2020 or October 2008, which forces us to recognize an important fact. Both of those crashes were caused by fundamental impacts to the U.S. economy, which were then exacerbated by investor psychology and fear. At the present moment, the only catalyst for this sense of panic is the simple fact that the Federal Reserve is raising rates. Is the market predicting that less liquidity and higher debt-servicing costs will create a recession? In this market report, we’ll be covering this question specifically, as well as the following:

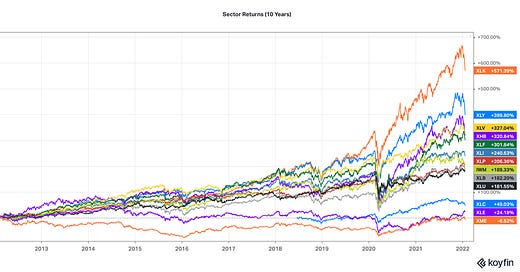

• Will a decade of sector returns reverse in favor of hated stocks?

• New fund manager survey from Bank of America shows that investors are overweight some interesting sectors.

• The relationship between liquidity and the S&P 500.