Edition #143

Updated Thoughts on Stock Market Dynamics & Yields

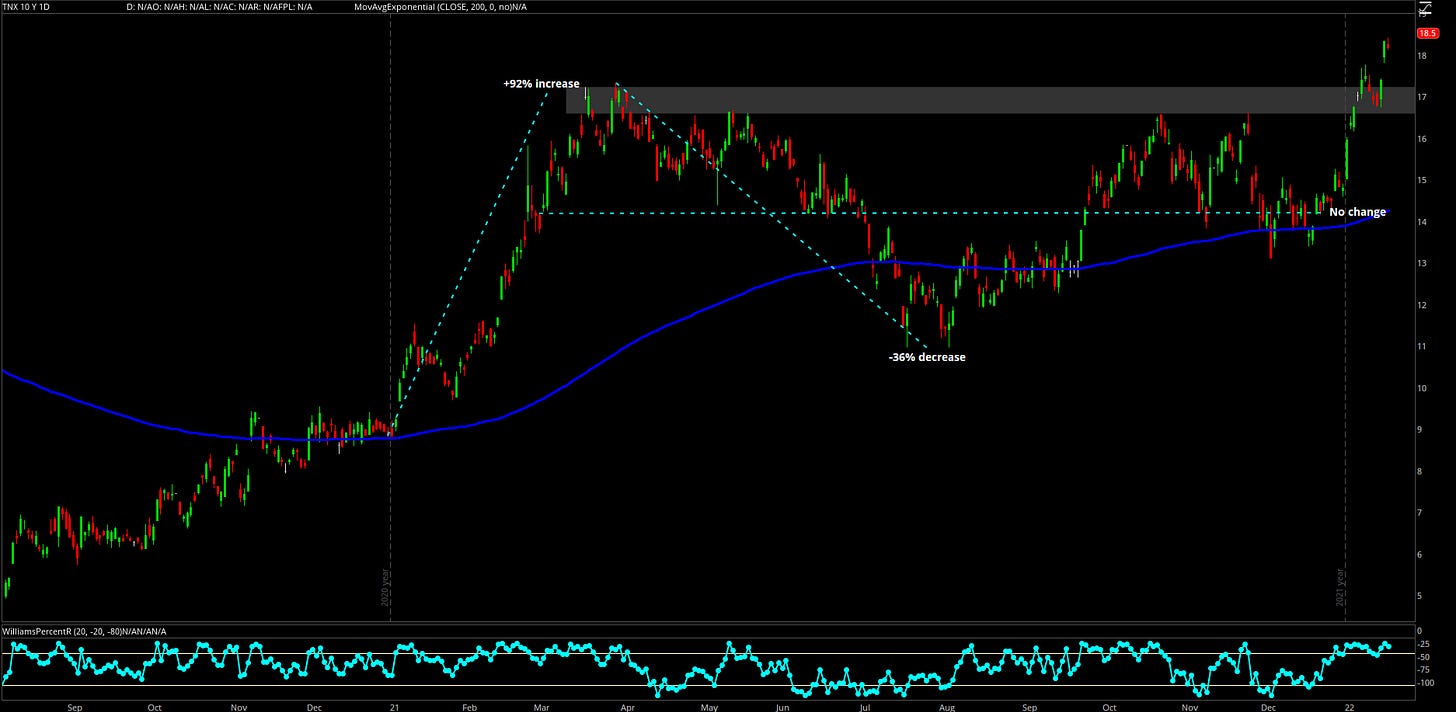

It’s been a stale week in terms of new data across the economy & financial markets. Most, if not all, of the focus has been on the stock market, which has continued to face pressures from rising Treasury yields. As many of you will recall from my “Investment Outlook for 2022”, the likelihood of rates rising is what caused me to forecast below-average returns for U.S. stocks in 2022. So far, 10-year yields have risen substantially to start the year. The 10-year Treasury yield index, $TNX, has already increased by +20.8% this calendar year. As of market close on 1/19/22, here’s how $TNX has evolved since August 2020:

It’s important to note that I’ve been highlighting these levels since September and November 2021, discussing the implications of the channel breakout & potential return to the 2021 highs.

The current yield on the 10-year Treasury is 1.856% vs. 1.086% exactly one year ago. Yields have now broken above the consistent resistance zone in grey, which pushed price lower every single retest in 2021. It appears that the index is starting to use this range as support since the breakout at the beginning of the year. Seemingly, the technicals & structure are reaffirming the fundamental expectations for yields to continue to rise in 2022.

Yesterday afternoon, I took to Twitter to share some in-depth thoughts on this yield environment and to review the path we took to get here. With the lack of relevant new data, I thought sharing those thoughts here would provide some beneficial perspective. The original thread can be read here, but it will be easier to digest in one continuous format:

“There’s a difference between these two rising rate environments:

Yields slowly inch higher, pricing in moderate economic growth and an uptick in inflation.

Yields rise forcefully, caused by decade-highs in inflation and tightening monetary policy amidst slowing economic growth.

10-year yields rose quickly in January/February 2021, but then cooled off and spent the rest of the year in consolidation mode. The market began to recognize the rapid & sustained increase in yields, causing many individual stocks to pop.

The peak in many tech/growth names was correlated with this yield increase. Some notable stocks that popped at this time:

Zillow ($ZG), Peloton ($PTON), Digital Turbine ($APPS), Teladoc ($TDOC), Pinterest ($PINS), Lemonade ($LMND), Fiverr ($FVRR), Crispr Therapeutics ($CRSP), Twilio ($TWLO), Palantir ($PLTR), Spotify ($SPOT), etc.

Just look at $ARKK, $IPO, and $SPAK… they all peaked in February 2021. Risk-off.

The market digested the rise in yields, convinced by the Fed’s language/posturing that inflation would be transitory. Many tech & growth names rallied back. The market would soon realize that inflation wasn’t slowing down and that the Fed would maintain their historic asset purchases.

In mid-2021, inflation kept accelerating & the economy was chugging along. The market & the Fed seriously discussed the likelihood of tightening monetary policy.

Yields rose significantly.

Since those July/August 2021 lows, $TNX has risen by +63%. Since January 2021, it’s up +97%.

We officially entered category #2 in July/August. A handful of other tech/growth stocks peaked around this time:

Roku ($ROKU), Square ($SQ), Paypal ($PYPL), Five9 ($FIVN), Autodesk ($ADSK), Snapchat ($SNAP), Domo ($DOMO)

The other stocks I mentioned earlier entered free-fall mode. More risk-off.

With the announcement of the taper in November 2021, we’ve seen the market submit to rising yields. The market was already pricing-in the taper announcement & tightening process, but continued inflationary pressures accelerated the shift in monetary policy.

The market has ‘brought forward’ a reduction in monetary stimulus and a more aggressive tightening schedule. We’ve now seen another significant selloff in tech/growth stocks since the November announcement.

DocuSign ($DOCU), The Trade Desk ($TTD), Sprout Social ($SPT), Asana ($ASAN), Sea Limited ($SE), Crowdstrike ($CRWD), Bill.com ($BILL), Unity ($U), Snowflake ($SNOW), Datadog ($DDOG), etc.

More risk-off.

The December 2021 inflation data, released on 1/12/22, cemented the selloff. All of the stocks mentioned above have accelerated to the downside over the past week, with most of the market taking a turn lower. Since 1/12/22:

• Dow Jones Industrial Average ($DJX) -2.4%

• S&P 500 ($SPX) -2.8%

• Nasdaq-100 ($NDX) -4%

• Russell 2000 ($RUT) -4.4%

Q4 2021 GDP is being released on 1/27/2022, which will be a massively important report. Questions:

• Is GDP growing in-line with inflation increases?

• Will GDP continue to decelerate relative to Q3 2021?

• How are consumer trends evolving relative to inflationary pressures?

A high GDP print will cause yields to rise further, pulling forward economic growth expectations & forcing the market to price this in. If this case plays out, I fully expect to see a sharper selloff in risk-assets as the Fed gets the green light for aggressive monetary policy.

A low GDP print would obviously dampen economic conditions, but would signal a move closer to stagflation. That puts the Fed in an even tougher position. I'm reminded of a post from David Rosenberg, @EconguyRosie, questioning if a recession is required to curb inflation:

We are unquestionably in category #2 regarding the current rate environment. 10-year yields have increased by +37% since the December 2021 lows & up +21.5% in 2022. Traditionally, equities & risk-assets don't perform well in this environment.

Yields ↑ Asset Prices ↓

While rising yields have benefitted some sectors, notably financials, energy, commodities, & materials, they are starting to lose steam. They are NOT immune to drastic increases in yields. At the end of the day, present values are simply a function of future cash flows.”

I truly believe the chart of 10-year yields is one of the most important ones to watch in 2022, as it will be directly correlated to inflation expectations, economic growth expectations, and monetary policy. It will force the market to re-price risk, causing a ripple effect in equity markets and for risk-assets in particular. In order to navigate the markets effectively in 2022, it will be paramount for investors to first understand how and why rates are fluctuating. I believe the commentary above is a perfect, real-time compliment to the “Investment Outlook for 2022” that I published on January 2, 2022. So far, the most likely case scenario that I outlined in that publication has played out quite well, although we’re only three weeks in…

Talk soon,

Caleb Franzen