Economics:

In light of relatively encouraging economic data this week, Treasury yields on every maturity level rose. This move higher reflects the market’s ability to front-run the Federal Reserve’s tapering and tightening process, which is now expected to happen as soon as March 2022 vs. original expectations of June 2022. During Friday’s session, new economic data was released pertaining to the labor market for December 2021. More specifically, the BLS released their “Employment Situation” report, in which the median expectation was for 450k new jobs. The result was a meager 199k, a major miss relative to expectations.

Some economists tried to highlight a silver lining with the unemployment rate declining from 4.2% to 3.9% in December 2021; however, this must be taken into consideration against a decline in labor force participation. As I’ve outlined in this newsletter, the labor force participation rate and unemployment rate will almost always move in opposite directions, because discouraged unemployed individuals who leave the labor force get dropped out of the unemployment rate calculation.

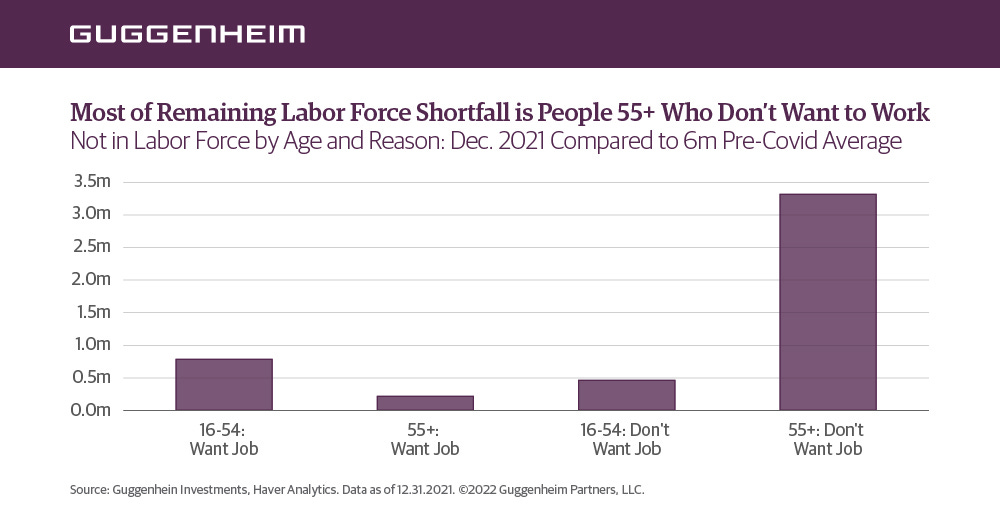

Scott Minerd of Guggenheim Partners shared the following data, which helps to frame the labor force vs. unemployment data:

Based on this data, it appears that “prime working age” individuals have a net positive demand for working while the age 55+ demographic is at a considerable net negative. I can’t say for certain whether or not this dynamic is intrinsically good or bad, but it could help to explain some under-the-hood evolutions in the labor force. Therefore, it might be a good idea to track the official labor force participation data for prime working age individuals. From the Federal Reserve’s perspective, this demographic falls into the age group of 25-54.

Interestingly enough, the labor force participation rate for prime working age individuals fell from 82.1% in November 2021 to 82.0% in December 2021. While a -0.1% decline may not seem considerable, it is equivalent to 103,000 individuals dropping out of the labor force between the ages of 25 and 54 in December 2021. From my perspective, the decreased unemployment rate for the labor market between November and December is almost entirely explained by the decrease in labor force participation, which isn’t something to be enthusiastic about.

The prime working age participation rate of 82% is still well-below the pre-pandemic level of 83.1%, which will need to recover for me to acknowledge a booming labor market.

Stock Market:

No update. Keep an eye out for this weekend’s premium market update where I’ll be giving a full breakdown of recent market dynamics. In my opinion, the pressure on U.S. stocks this week is fully explained by one key variable: yields.

Cryptocurrency:

With continued selling pressure in the crypto market, there is extreme staleness in terms of crypto commentary. Since the November peak, the total market cap of all cryptocurrencies has declined from $3Tn to $1.95Tn, or -35%. This is in line with Bitcoin’s decline of -40% since the November peak. As we can see from the chart below, tracking the total market cap of crypto, the current decline has been steep, even in logarithmic scale.

I wanted to provide some thoughts about how I’m viewing the price structure of crypto, which could help to navigate through these tough conditions. Since July 2020, we can see how price was able to make large extensions higher, followed by sideways consolidation. These consolidation zones are outlined in yellow.

When price breaks above those consolidation levels, it initiates a new leg higher. As we can see, this did not happen during the October & November breakout over the May all-time highs. This failed breakout has forced a lot of investors to reconsider their thesis or to simply cut their positions. From my perspective, I am staying optimistic until we see a decisive breakdown below the September 2021 lows, shown by the white levels. If the total crypto market cap is able to remain above this level, around $1.8Tn, I will remain optimistic about this current cycle. If we break below it, I will likely reduce my price targets for this cycle. If there is slippage below $1.8Tn, I believe the possibility of reaching $1.2Tn will increase substantially, although I don’t believe it would be the probable outcome. For me, this $1.8Tn level is the line in the sand for bulls & bears.

Talk soon,

Caleb Franzen