Edition #137

Fed Signals Strength, Growth Stocks Face Pressure, Bitcoin vs. Yields

Economy:

As a follow-up to their policy decision meeting on December 14th & 15th, the Federal Reserve released their meeting minutes yesterday afternoon. When the policy decision meeting took place last month, I had said that there wasn’t anything surprising about the announcement or Jerome Powell’s press conference, noting that:

“I believe the Fed is justified to accelerate the rate of their tapering process in light of a 39-year record level of inflation and continued improvements in the labor market.”

I also stated that the Fed is walking a thin line by trying to balance the economic recovery while simultaneously combatting multi-decade levels of inflation. As a reminder, the key highlights from the monetary policy meeting were:

The Federal Reserve would double the magnitude of their tapering process, reducing their cumulative purchases of Treasuries and mortgage-backed securities by $30Bn/month vs. the prior rate of $15Bn/month. It is now expected that the Fed will target $90Bn/month in total asset purchases.

The Federal Reserve’s officials are projecting a median of three rate hikes in 2022, with a completion of the tapering process in March 2022. The Fed also projects a median of three rate hikes in 2023.

With the release of the minutes yesterday, we now have clarity regarding the acute details of the Fed’s discussion in December. In my opinion, this single sentence from the minutes describes the entire theme of the press release:

“[Fed officials] noted that current conditions included a stronger economic outlook, higher inflation, and a larger balance sheet and thus could warrant a potentially faster pace of policy rate normalization.”

The message is extremely simple: the Federal Reserve has provided historic stimulus, that has been effective in generating economic stability and growth. For a variety of factors, inflation is surging and causing concern for consumers, businesses, government officials, and even investors. The Fed’s mandate to maintain price stability is forcing them to address inflation more aggressively than they anticipated, because they simply didn’t foresee inflation reaching these levels. Their inflation projections in real-time were wrong. As such, they recognize the need to reduce their asset purchases at an accelerated rate in order to normalize their balance sheet and raise interest rates.

As I discussed in my “Investment Outlook for 2022”, I think there is a near-certainty that the Fed completes their taper and raises the federal funds rate (FFR) in 2022. How many times, and to what level? I don’t know.

Here were some of the key aspects from the minutes:

“Growth in business fixed investment appeared to be rising at a slow pace again in the fourth quarter, as supply bottlenecks continued to weigh on business equipment spending, and the limited availability of construction materials was still holding back spending on nonresidential structures.”

From my perspective, in order to achieve a strong economic recovery & period of sustained growth, these issues must improve and/or subside.

“The potential for a less accommodative policy stance over the next few years contributed to a notable rise in two- and five-year Treasury yields.”

This is something I’ve been discussing on this newsletter and via Twitter, and was a critical aspect of my “Investment Outlook for 2022”. With shorter-term yields moving higher, investors should be prepared for tighter financial conditions and weakness in speculative assets.

“In November, commercial and industrial (C&I) loans on banks’ books grew for the first time since the beginning of the year.”

This is an extremely encouraging sign and is something I’ve been waiting to see. Despite all of the Fed’s money creation over the past 18 months, lending activity has been stale, reflecting poor demand from businesses to expand capacity. In order to have a strong recovery, we’ll need to see businesses increase their investment activity to buy productive assets and/or increase their labor capacity.

“The credit quality of large nonfinancial corporations remained solid amid strong earnings growth. S&P 500 firms’ earnings reports for the third quarter again exceeded analyst expectations. In November, the volume of upgrades outpaced that of downgrades for both investment- and speculative-grade nonfinancial corporate bonds. Trailing default rates on corporate bonds and leveraged loans declined to close to historical lows in October and November”.

This reaffirms that financial markets are operating smoothly & business conditions are healthy.

“Several participants viewed labor market conditions as already largely consistent with maximum employment.”

I found this section to be quite interesting because the Fed states that “the U.S. labor market was very tight”. While I believe the labor market is very strong, I think it’s important to at least mention that the recent JOLTS data showed 10.6M job openings on November 30th. Considering that the October data was over 11M, it seems apparent that there’s also quite a bit of slack. This could be a point of optimism, because it means that there’s still a lot of progress to be made with a quits rate of 3.0%.

As it pertains to U.S. economic conditions, these minutes give me a sign of optimism. The recovery isn’t perfect, but we can’t expect it to be. There are areas of strength and other areas are lagging, but generally improving. In response to the minutes being released, yields on U.S. Treasuries accelerated higher, particularly for short-term debt.

Stock Market:

If you haven’t already, I strongly encourage you to read my Investment Outlook for 2022” that I published this past weekend. It offers an extensive breakdown of why I expect stocks to have below-average returns this calendar year, and I also share the top 22 stocks that I’m most optimistic about this year. That paper can be read here:

It’s already been an exciting start for 2022! After a great first session, U.S. stocks have faced pressure for two consecutive sessions. The second day of pressure was worse than the first, caused by the clear hawkishness from the Fed’s minutes. In fact, yesterday’s -3.12% was the worst day for the Nasdaq-100 since March 2021. While technology & growth-oriented stocks got crushed amidst a steady rise in yields, energy and financial stocks have been outperforming the market. The rate-sensitive group that I refer to as “non-profitable tech” has continued to reflect signs of weakness in each session of 2022. On Monday morning, I posted the following:

Each of these companies have consistently produced extremely high revenue growth, even prior to the pandemic. Due to the reliance on digital/software/cloud companies during the pandemic, their revenue growth has accelerated, but most aren’t profitable. Some of their increased growth hasn’t been able to sustain, and the stocks are taking a beating with the rise in rates. One way I gauge this group of stocks is through the Ark Innovation ETF ($ARKK). Aside from some of the names in my Twitter post, the fund also includes: $TSLA, $ROKU, $TDOC, $ZM, $COIN, and many others.

Yesterday, $ARKK’s shares broke below a critical support level that I’ve been outlining on Twitter. This breakdown move doesn’t generate enthusiasm for investors, and represents a “get out of the way” signal. For months, I’ve been telling premium Substack members that non-profitable tech doesn’t look attractive and was reflecting signs of weakness. The trend to the downside has only continued.

The best characterization of Wednesday’s session is dismal. Of the near 250 stocks I track on a daily basis, only 5 were positive. The S&P 500 itself was -1.94%. When I analyze the broader indexes, I definitely see room to fall further considering that we’re only -2.4% away from the ATH’s on Monday & Tuesday. I wouldn’t be surprised to see another -2.5% to -3.5% correction ahead in the coming week and will reassess if/when we get there. It’s still a big “if”.

I’ll be keeping an eye on the volatility index today & tomorrow, specifically to see if it breaks above 20. The $VIX closed at 19.73 Wednesday, gaining +16.68% during the session. Those kinds of volatility spikes typically lead to short moments of weakness, which reaffirms the -2.5% to -3.5% drawdown I mentioned above.

Cryptocurrency:

The crypto markets have been facing continued pressure since the last market update that I provided. In my last newsletter from 12/16, Bitcoin was trading at $48,900 vs. a current price of $43,100 at the time of writing. In December, I published some exciting data regarding the correlation between Bitcoin and 10-year Treasury yields. As we’ve discussed at length on this newsletter, typically we see the following correlation between yields and asset prices:

• Yields ↑ Asset Prices ↓

• Yields ↓ Asset Prices ↑

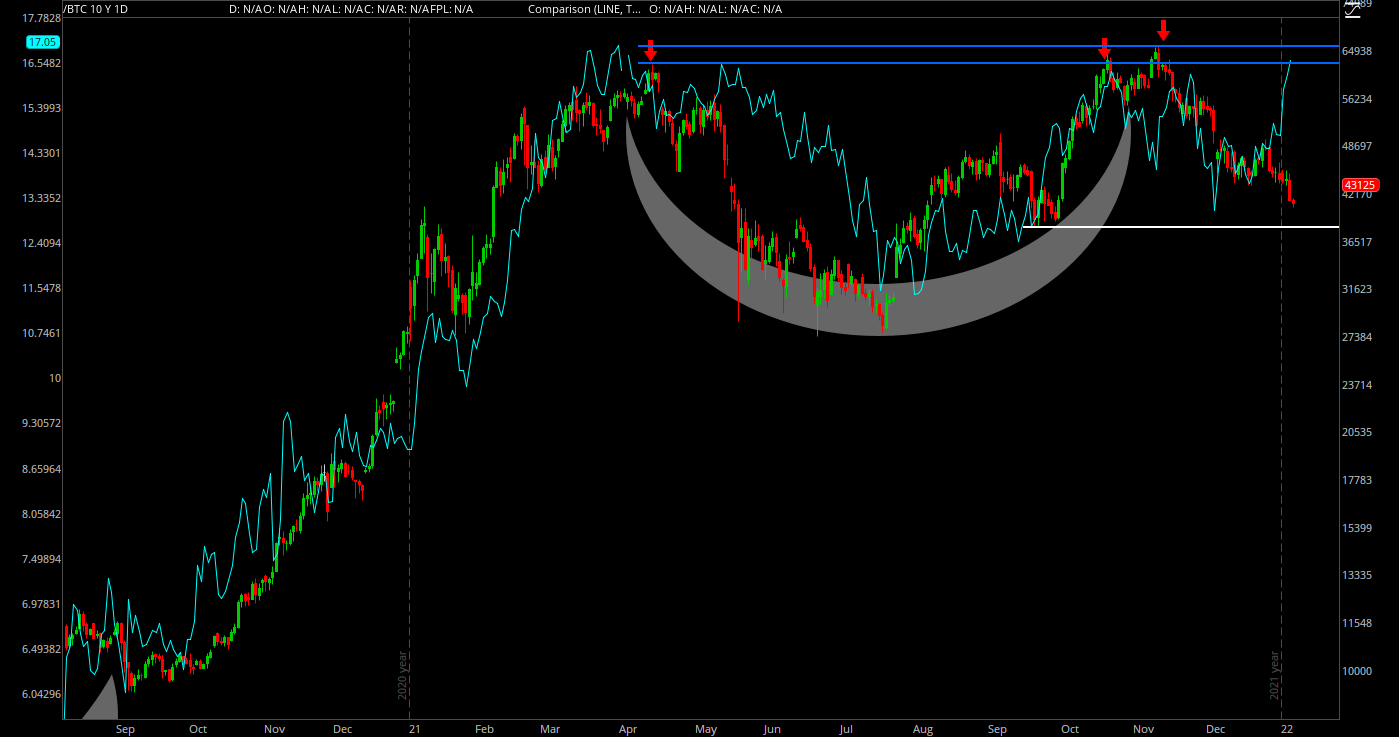

In the research that I published below, I highlighted an interesting dynamic taking place between the price of Bitcoin and yields that existing since August 2020. The full analysis can be read by clicking the link below (the quality of the chart is much better):

Since 12/28, this correlation has begun to deviate. Instead of seeing 10-year yields and Bitcoin’s price move in the same direction, we’re seeing a divergence.

As noted by the chart above, we can see that the two variables are moving in opposite directions for the first time in 16 months. While we did see a major widening between these two variables in May-July 2021, they both moved to the downside. That behavior is quite different from the current dynamics, where they’re simply moving away from each other: Yields ↑ Bitcoin ↓

I believe this recent divergence could end within 5-20 days, but I can’t say for certain. Considering that the 10-year yield index is preparing to break above the 2021 highs, that could be a sign that rates are preparing to move higher, faster. With Bitcoin and 10-year yields moving in the same direction for the past 16 months, that’s a trend I want to follow.

The long-term price chart of Bitcoin is still encouraging in my view. The pullback, while feeling severe, is actually quite mild considering Bitcoin’s history as a volatile asset. Despite suffering a -37% consolidation, I place no credibility on the “Bitcoin is Dead!” headlines.

The structural similarities between the 2019-2020 base vs. the current base are still intact. So long as we remain above $39.5k-$40.5k (the September lows, shortly after El Salvador officially adopted BTC as legal tender), I will remain extremely optimistic on this current cycle. Even if we break below that range, shown in white, I will remain optimistic. I am equally as prepared for a move below $25k (not a prediction) as I am for a move above $70k.

Talk soon,

Caleb Franzen