Edition #13 - 6.2.2021

Federal Reserve Comments on Inflation, Value > Growth, Mortgage Origination Quality

Economy:

Today, two members of the Federal Reserve, Neel Kashkari & Lael Brainard, gave independent statements & interviews about their views on the economy & progress towards the Fed’s economic goals. With the significance of last week’s PCE report, the core topic of their statements were related to the Fed’s ability to control & manage inflation, should inflation continue to accelerate & linger for longer than expected. Here are some of the key statements that I noted during both of their meetings.

Neel Kashkari, President of the Federal Reserve Bank of Minneapolis:

When asked if the “consequences are dire” if inflation cannot be easily managed:

“If we’re wrong & I’m misreading the labor market and we’re actually at full potential and these inflation readings are here to stay, the Federal reserve has the tools to adjust interest rates to keep inflation in check and prevent it from spiraling out of control. But let me tell you something, there was a lot of complacency in the 10 years following the Great Financial Crisis when millions of Americans were on the sidelines. So if it took 10 years to rebuild the labor market, we cannot have another 10 year recovery. So while I appreciate the fact that some people are really worried about inflation, they didn’t seem that worried when millions of Americans were on the sidelines in the last recovery.”

In regards to the labor shortages, how much truth is there to the idea that the boost in Federal unemployment benefits have prevented people from re-entering the labor force?

“We don’t know for sure. It’s very hard to disaggregate how much of it are the generous unemployment benefits. How much of it is because schools have been closed and not fully reopened, and how much of it is because people are still afraid? I’m optimistic that in 3 or 4 months, schools will be fully reopened, hopefully the virus will really have been crushed, and those unemployment benefits will expire. Those 3 factors we know are having some effect. Which one is the biggest, I’m not sure.”

Lael Brainard, member of the Federal Reserve Board of Governors:

In regards to inflation:

“Although continued vigilance is warranted, the inflation and employment data thus far appear to reflect a temporary misalignment of supply and demand that should fade over time as the demand surge normalizes, reopening is completed, and supply adapts to the post-pandemic new normal. Under our guidance, adjustments in the path of monetary policy are transparently tied to realized progress on our maximum-employment and 2 percent average-inflation goals. Jobs are down by between 8 and 10 million compared with the level we would have seen in the absence of the pandemic. And it will be important to see sustained progress on inflation given the preceding multiple year trend of inflation below 2 percent. While we are far from our goals, we are seeing welcome progress, and I expect to see further progress in coming months.

I am attentive to the risks on both sides of this expected path. I will carefully monitor inflation and indicators of inflation expectations for any signs that longer-term inflation expectations are evolving in unwelcome ways. Should inflation move materially and persistently above 2 percent, we have the tools and experience to gently guide inflation back down to target, and no one should doubt our commitment to do so.”

Essentially, I expect that key members of the Federal Reserve will continue to make reassuring statements that any spikes in inflation are temporary, exacerbated by shortages & shocks to supply chains etc. The Fed certainly has the tools that can attempt to limit & slow inflation, but the real question is at what point will they consider using them? Clearly, we’re extremely far from that point at the present moment, but what if the labor market continues to steadily recover over the next 4 months while the PCE jumps to 4% or 5%? What if the core CPI rises to 7% or 8%?

While I don’t think these hypotheticals are the likely case, they certainly are within the realm of possibility. In order to combat those inflationary pressures, particularly if they are believed to sustain around those levels, the Fed would essentially be cornered into raising rates. With the expectation that rates will be lifted some time in 2023, any increase in the federal funds rate prior to 2023 would likely cause a correction in asset prices, so this is certainly something I am keeping an eye on.

I have no doubt that the Fed has to the tools to rein in inflationary pressures, but they will have to do so with several key factors in mind. If they must raise rates to combat inflation, what will be the severity of the impact on the labor market, financial liquidity conditions, and asset prices?

I think it’s worthwhile to have inflationary hedges in a portfolio, whether that is to commodity-related stocks (lumber, oil, industrial metals, etc.), gold, or even Bitcoin. There’s a reason why my largest allocation over the last month has been to the energy, lumber, steel and consumer discretionary. They’ve been high momentum plays YTD as inflationary concerns continue to actualize.

Stock Market:

Courtesy of J.C. Parets (@allstarcharts on Twitter), I saw an excellent chart that highlights the recent outperformance of value over growth since mid-February 2021.

These graphs simply show the ratio of growth/value for both small and large-cap ETF’s. Very simply, as growth outperforms value, the ratio rises. As value outperforms growth, the ratio declines. As we can see from the chart, it’s paid to be invested in growth-related stocks since 2014, which massively outperformed value during that period. Even during a rising rate environment from 2016-2018, growth still outperformed!

However, as inflationary pressures have continued to mount, with nominal yields rising, and higher expectations of future economic growth getting priced into the market, growth stocks have had come under pressure. Investors have officially rotated into mature businesses that pay strong dividends, have consistent cash flows, and generate steady profits. It’s hard to say when this rotation will end, as the trend is evident in both small & large-cap stocks. With the massive outperformance of growth over recent years, it would make sense for value to have its time to shine and thus recoup some of the relative underperformance it has had. Growth will once again have its moment, but 2021 is so far shaping up to be the year for value investors.

Cryptocurrency:

No new data or information.

Real Estate:

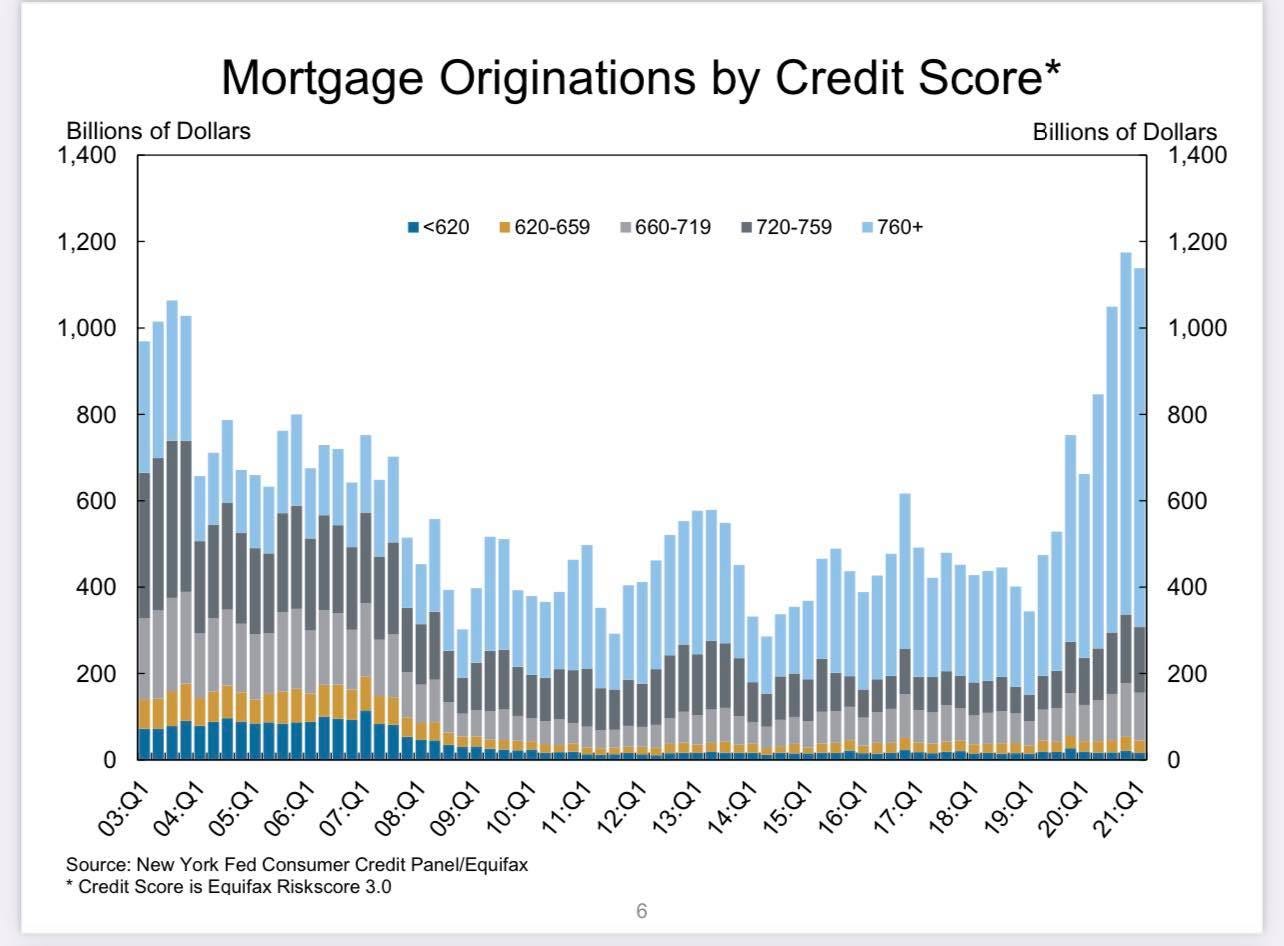

I saw a fantastic chart showing the composition of mortgage originations by credit score. With such significant gains in the real estate market, particularly over the last 12 months, it makes sense for a lot of people to scream “bubble” and believe that a pop is imminent. While that’s certainly a possibility, it’s not one that I find likely, which is reaffirmed by this chart.

If we look at the left tail of the data, we can see the exuberance of the Housing Crisis illustrated by the significant percentage of mortgages issued to borrowers with a sub-720 credit score. In fact, in Q1 2007 more than half of mortgage originations were given to individuals with a credit score lower than 660! What this shows is a lack of lending standards, which we can look back on with hindsight to know that things weren’t going to end well when the economy came under pressure. It also points to a level of exuberance, when everyone & anyone is able to get a mortgage to purchase a home, or even take on their 2nd or 3rd mortgages despite their low credit ratings.

Quite simply, the quality of housing credit is magnificently better today than it was during the years preceding the Housing Crisis. While we can point to the fact that the total amount of mortgage originations is even higher than the peak during the housing bubble, I take comfort in the fact that lending quality is significantly better.

Until tomorrow,

Caleb Franzen