Edition #119

Mixed Economic Data, Reviewing My Stock Market Prediction, Metcalfe's Law & Crypto

Economy:

On a high level, there were three key reports that were released at the end of the week that I thought gave a great overall depiction of some broad economic conditions at the moment.

First, the Job Openings & Labor Turnover Survey (JOLTS) was released for September 2021, highlighting that there were 10.44M openings vs. estimates of 10.3M. The prior month of August was originally 10.44M but revised up to 10.63M. Much of the focus in these reports is still centered around the continuously rising quits rate, which has now reached new all-time highs of 3.4% in the private sector. Many people seem to think this is a bad thing, but it’s actually quite positive from my perspective. With an abundance of people quitting their existing positions, the likelihood that they’re remaining unemployed is quite small. Even if someone quits their job in order to accept an offer at a new company, they are counted in the quits rate data.

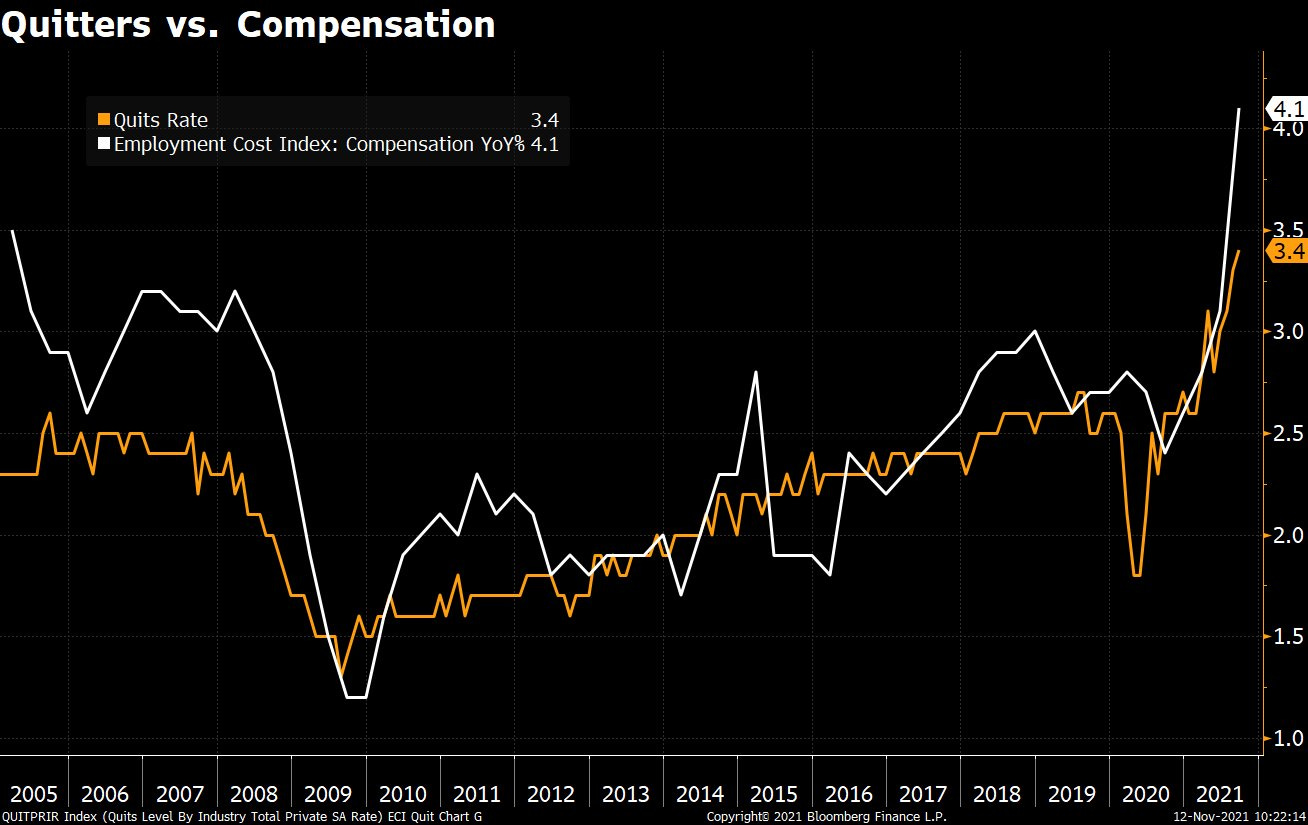

I prefer to view this as a rotation of the labor force, allowing employees to find better opportunities more aligned with their interests & skills, as well as increase their salary & wage. According to data from Indeed, “promotional increases within the same company typically amount to around 3%, whereas a person that switches jobs can expect a pay raise of about 10% to 20%. Another report from Forbes explains that “staying employed at the same company for over two years on average is going to make you earn less over your lifetime by about 50% or more”. Below is the trend of the quits rate vs. employee compensation.

With over 10M job openings and employers struggling to attract new workers, wages are rising in order to match the increased competition to allure potential employees. This rapid increase in wages, dramatically higher than the trend, has likely helped boost the quits rate as employees find better opportunities. This is great for job-seekers, despite their current employment status, on the aggregate.

A new report from Goldman Sachs helps to shed some light on the 5M people that are currently “missing” from the labor market. They estimate that 1.5M individuals have retired early, 1M naturally retired, 1.7M are considered to be in their prime working years (but out of the labor market), and 0.9M are older than age 55 and not looking for new opportunities (perhaps due to COVID & health reasons).

Second, U.S. consumer sentiment has fallen to the lowest level since 2011, likely reflecting an increased concern around cost of living adjustments and inflation.

After this graph was shared by Lisa Abramowicz on Twitter, I posited the following:

In my opinion, the growing dislocation between income/wealth groups is a massive contributor to a loss of confidence in the economy in light of accelerating inflation.

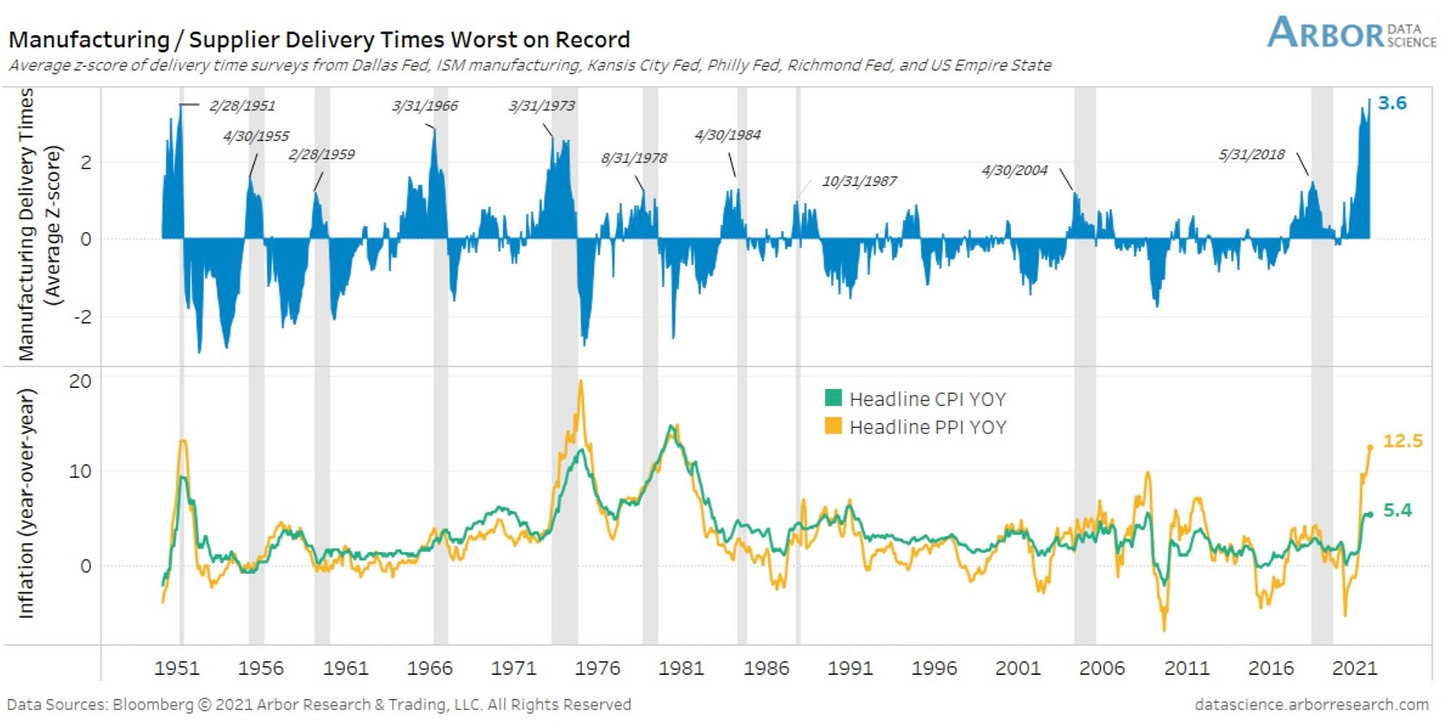

Finally, a great chart from Arbor Data Science shows how supplier delivery times remain at historically elevated levels. These dynamics shed light on supply shortages & bottlenecks, which have been providing a boost to inflation so far in 2021.

The Fed has repeatedly called on these bottlenecks as the primary culprit of inflation, which is why I have been paying such close attention to shipping routes and container costs. This confirms much of those concerns.

Stock Market:

In Edition #104, I didn’t have any data to discuss regarding the stock market. Instead, I predicted that “the S&P and the Nasdaq [will] gain at least an additional 8-10% from these current levels through the end of 2021. I wrote this after market-close on 10/6, the stock market was in the midst of the strongest pullback of 2021 at -5.8% and -8.4% for each of the two indexes I highlighted above. In the face of rising yields, market participants were pounding the table that a further correction was imminent and that the party was coming to an end with the inevitable announcement of tapering.

I kept a more level head in fact, even posting my watch list of the most attractive setups in the market at the time. This window actually provided an extremely attractive opportunity for investors, and the watch list I published had extremely strong returns over the subsequent 1-month period:

As of today, here are the returns of the S&P 500 and the Nasdaq-100 since the close on 10/6, when I wrote my prediction for an 8-10% gain:

S&P 500 ($SPX): +7.3%

Nasdaq-100 ($NDX): +9.7%

So far, just about spot on and there’s still roughly 6 weeks left in the year. Recall, I’ve previously shared that I think there’s a chance the S&P 500 reaches $5,000 by year-end, which would only require an additional +6.7%. Very feasible, but perhaps not the “likely case” scenario.

Cryptocurrency:

Two things I wanted to cover. First, in regards to the broader crypto market… I’ve repeatedly shared data about adoption curves, highlighting the obvious similarities between internet users 1990’s to the current path of crypto users/investors. The last time we discussed this was in Edition #107, but I found some new data from Coinbase Inc.’s recent earnings report:

The comparison remains rock solid & will likely continue to evolve in similar fashion. Not exact, but very similar. Notice how the y-axis is given in logarithmic scale in order to more reasonably interpret the exponential growth of both users. This model forecasts that crypto will exceed 1Bn users sometime after 2024, versus the current level of roughly 200M. I think this is very reasonable, but could likely happen sooner.

I think it’s so important to comprehend this: the crypto market will almost certainly experience 5x growth over the next 5 years. Regardless of your views about the current market conditions, you’d almost certainly be amenable to having some exposure to this industry. Metcalfe’s Law states that a network’s value is proportional to the square of the number of nodes on the network, which can be computers or users. Metcalfe’s Law is used to explain network effects, highlighting how users gain more value when there are other users to interact with. For example, Facebook & Instagram benefit from network effects & Metcalfe’s Law. If I didn’t know anyone using Facebook/Instagram, I would have no incentive to use the platform because I have no one to interact with. However, if everyone I know is on the platform, I have incentives to share photos, like content, interact with others, and digitally socialize.

The key of Metcalfe’s law is that the value derived from a network’s number of users grows exponential to the number of users. Therefore, if we expect the number of crypto users to multiply by 5x over the course of the next 5 years, Metcalfe’s Law hints that the total market cap of crypto will grow by 5-squared, or 25x. Considering that crypto’s current total market cap is $2.8Tn as of 5pm on 11/12/2021, that would imply $70Tn in approximately 5 years. Wouldn’t that be something…

Talk soon,

Caleb Franzen