Edition #112

Q3 GDP Data, FAANG Earnings & Market Caps, Bitcoin Price Analysis

Economics:

Without a doubt, the most significant economic data released this week was the Q3 GDP report, which was released on Thursday morning. Upon the release, I took to Twitter to reference some specific data point & provide my commentary on the results. Before we dive into what I said, here’s a post from LiveSquawk that gives the overall headline numbers:

Not great, but not terrible. The GDP growth rate doesn’t do much to reaffirm the economic boom of a recovery, which appears to be waning. Keep in mind that these are the annualized numbers (essentially raising each quarterly result to the power of 4), so the actual quarter-over-quarter growth rates are much lower.

Michael McDonough posted an excellent table to show the various components and the respective contributions to the percent change. These figures are also annualized.

It’s great to see the data in this frame because we can see how each of the components have evolved over time per quarter. The fact that nonfarm inventories contributed 2.14% to GDP’s aggregate growth of 2% is not a good sign. Inventories do not contribute to economic growth therefore we don’t want to see a case where the contribution of inventories to current GDP are greater than the entire GDP growth rate. If we discount inventory growth, GDP growth was negative. Ouch. As I said, this isn’t exactly what we want to see during a supposed economic recovery/boom.

To add onto this train of thought, here’s some great comparisons of the contributing factors to GDP in the current quarter vs. prior quarter contributions:

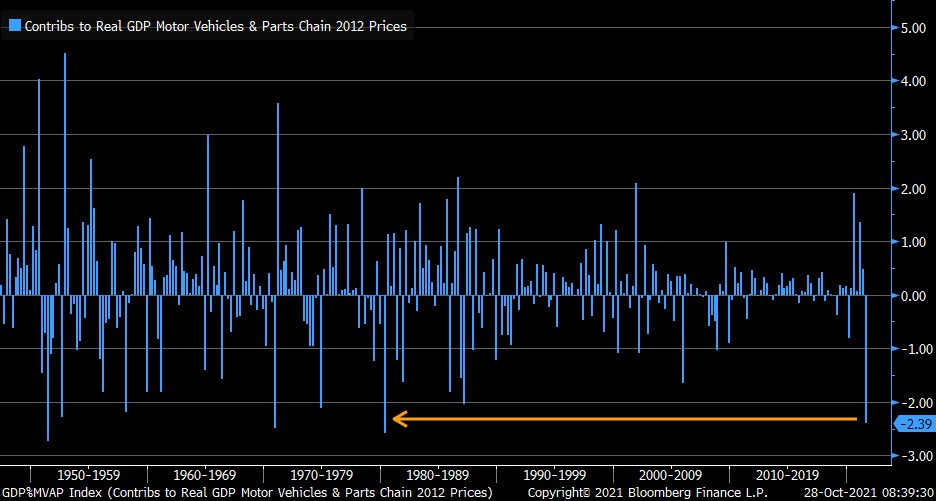

Each of these categories are trending in the opposite direction that I personally would want to from a strong economy. Lastly, Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab shared the following data about the auto industry, saying that “autos subtracted 2.4% from GDP in 3Q21… the worst contribution since 1980”:

I added to this by saying that there is “plenty of drag from autos, which are clearly impacted by semiconductor shortage AND supply-chain dynamics. Double whammy leads to the worst auto contribution to GDP in 40 years!”

Again, at a high level, this was a disappointing result for Q3 2021 GDP. By definition, it was a disappointment considering that consensus estimates were expecting an annualized growth rate of +2.7% but the result was +2.0%.

In response to the report, global yields on short-term maturities continued to ascend higher. Brian Chappatta, a columnist at Bloomberg shared the following:

From top left to bottom right, Brian shows the 2-year yields for Australia, Canada, the United Kingdom, and the U.S., all of which have made considerable gains since the starting point of each graph on April 30, 2021. In response to seeing this data, I wrote a thread on Twitter to discuss:

“A concern that I’m starting to have is that the Federal Reserve is preparing to tighten monetary policy into a weakening expansion” While the tapering process will still provide liquidity, it will be a deceleration in the amount of monetary stimulus. The tone of the Fed & other central banks regarding inflation has continued to shift dramatically. At the beginning of the year, they didn’t expect inflation, then it became a transitory spike, then that inflation COULD be more sticky, and now that it’s persistent.

I don’t necessarily fear stagflation, but it’s clear that those who have been calling for stagflation are feeling vindicated in this moment. The annualized Q3 GDP growth was +2.0% vs. the GDP price index rising +5.7% (and a 12-month inflation rate exceeding +5.3% for every month in Q3 2021). Powell & Fed officials have stated that their monetary policy strategy is effective in stimulating demand, but doesn’t improve supply-chain dynamics. The bottlenecks are expected to persist for the majority of 2022 or beyond. This will impact inflation.

LAGARDE SAYS IF SUPPLY BOTTLENECKS LAST LONGER, FEED THROUGH TO WAGES, PRICE PRESSURES COULD BE MORE PERSISTENTIf the Fed sees improvements in the labor market & has already met their inflation requirements to raise rates, what happens if/when inflation is more persistent & sticky? They’ll consider raising more aggressively. If not, the market will do it on its own with rising Treasury yields (as we’ve been seeing). This is not doom & gloom, but a substantiated concern of a more restrictive monetary policy in the face of a potentially slowing economy, global supply-chain bottlenecks, and inflation that has proven to not be transitory (yet). There’s a lot of pressure on the Fed right now.”

At this point, I don’t really have much more to add to what I said on Thursday morning. I don’t doubt that we’re in an economic expansion, but questions are starting to rise about the strength of the recovery, particularly if inflation continues to put mounting pressure on the U.S. consumer.

Stock Market:

In Thursday’s publication, I did a high-level review of the recent earnings reports for Microsoft, Google, and Facebook, promising that I’d cover Apple & Amazon once they reported. Both companies reported earnings after the close on Thursday, so let’s dive in:

1. Apple ($AAPL):

Record quarterly revenue of $83.4Bn, up +29% relative to the same quarter last year. Revenue composition was:

iPhone: 46.6%

Mac: 11%

iPad: 9.9%

Wearables, Home, Accessories: 10.5%

Services (iCloud, Apple Music, App Store, etc.): 21.9%

Net income of $20.5Bn up +62% YoY.

Cash & cash equivalents = $39.8Bn

2. Amazon ($AMZN):

Total revenue of $110.8Bn, up +15% relative to the same quarter last year.

The North America region accounted for 59% of their total sales mix.

Cloud revenue (AWS) of $16.1Bn, up 39% YoY.

Net income of $3.1Bn, down -50% YoY.

Cash & cash equivalents = $29.9Bn.

Generally, I’d say these are very strong earnings. Amazon had the most concerning earnings out of all the FAANG companies, seeing the smallest YoY revenue growth and was the only company to see a decrease in their net income. Overall, I’m still extremely optimistic about their stock, particularly as cloud services continue to make up a larger portion of their operations; however, I’d be more keen to own Google & Microsoft over Amazon at this moment.

I saw an excellent chart from Holger Zschaepitz on Thursday evening showing the growth of the FAANG constituents’ market caps since 2013:

Pretty amazing stuff. I don’t see any reason why you wouldn’t bet on the best performing horse to win the race. Thankfully, in investing, you get to pick more than one horse and they can all win.

Cryptocurrency:

Bitcoin continues to ramp higher after experiencing a minor dip over the past week. After price hit new ATH’s of $66.9k at the beginning of last week, price started to consolidate. In real-time on 10/21, I posted the following chart & commentary on Twitter, highlighting my thoughts on Bitcoin’s potential path forward:

“Price closed above the breakout zone yesterday (10/20), but barely. Today’s decline shows retail is cashing out at all-time highs, recouping losses or securing gains. Totally normal. I think price declines to the 21 day EMA (yellow) before we see the next extension higher. Support around $58k”

So, what has developed since this post? As of Friday evening at 8:00pm, here’s the chart of Bitcoin:

My forecast is working to perfection so far, and I think we are due for a monster breakout to new ATH’s over the coming week. I continue to reiterate my expectation of $110k-$135k by end-of-year.

Talk soon,

Caleb Franzen