Edition #111

Cash & Bank Assets, Large-Cap Tech Earnings, Ethereum Adoption

Economy:

On 10/25, Lisa Abramowicz posted an extremely interesting chart on Twitter, showing the continued declines in commercial & industrial lending activity.

On August 23, I wrote in my Edition #83 newsletter that:

“One of the primary goals of the Fed is to increase the attractiveness of borrowing by lowering interest rates. This excess liquidity & cost of capital would normally attract businesses to borrow money to fund new projects, expand production capacity, replace old assets with new assets, etc., etc. The Fed is openly acknowledging that, despite continued efforts in monetary stimulus, businesses aren’t borrowing, and in fact are slowing down their borrowing activity.”

This chart continues to prove what I discussed above: that businesses aren’t willing to acquire more debt despite historically low interest rates, ample liquidity, and easy lending standards.

Surprisingly, or unsurprisingly depending who you ask, banks are unable to lend out the reserve assets they’ve been able to receive from the Fed’s asset purchase program. In fact, the bank’s holdings of cash & securities in bank credit (ie. credit facilities held at the Federal Reserve) are higher than ever before as a percent of total assets!

There’s almost no debate that businesses are saturated in debt for useful purposes (commercial & industrial loans/leases) and are primarily looking to borrow to refinance existing debt, or to increase existing revolving lines of credit for operational purposes. From my perspective, this isn’t the look of an economy that is expanding their capacity utilization, but simply the look of businesses managing existing debt. The impact of quantitative easing & the Fed’s asset purchases has been diminished in terms of increasing the demand for debt, and is effectively primarily influencing asset price appreciation.

Stock Market:

With earnings season upon us, some of the biggest market leaders have now reported quarterly earnings. As I did at the end of last quarter, it thought it would be interesting to briefly touch on some of the growth metrics we’re seeing from the tech giants in their quarterly earnings reports…

1. Microsoft ($MSFT):

Total revenue of $45.3Bn, up +22% relative to the same quarter last year.

Cloud revenue (Azure) of $17Bn, up +31% YoY.

Net income of $20.5Bn, up +47.5% YoY.

Cash & cash equivalents = $19.1Bn.

2. Alphabet Inc. / Google ($GOOGL):

Total revenue of $65.1Bn, up 41% YoY.

Search revenue = $37.9Bn vs. $26.3Bn in Q3 2020 (+44%)

Youtube ad revenue = $7.2Bn vs. $5.0Bn in Q3 2020 (+44%).

Google Cloud revenue = $4.99Bn vs. $3.4Bn in Q3 2020 (+47%).

Net income of $18.9Bn, up +68% YoY.

Cash & cash equivalents = $23.7Bn.

3. Facebook ($FB):

Total revenue of $29Bn, up 35% YoY.

Monthly active users (MAU’s) of 2.91Bn in September 2021, up 6% YoY.

Net income of $9.19Bn, up 17% YoY.

Cash & cash equivalents = $14.49Bn.

Apple & Amazon have yet to report, but I’ll be happy to give an update once they do. All I can say to this is “WOW!” It’s amazing to see such insanely strong numbers coming from the largest companies in the world. Not only are the raw numbers phenomenal in terms of dollar values, but the growth rates for $MSFT and $GOOGL are climbing at an insane pace. Recently on this newsletter, I discussed how the valuations of some of these companies were substantially higher than the broader market, but justified why this was the case. For those who don’t remember, the justification was that the companies have a proven track record of being able to consistently deliver extremely high growth in revenue and earnings. Until proven otherwise, they’ll continue to have a premium in terms of their price/earnings and price/sales ratio.

Investors are willing to pay for the best of the best, just as consumers are willing to pay more for a pair of Nike shoes vs. a pair of Skechers.

Cryptocurrency:

While most of my focus in crypto is centered on Bitcoin, I also have an extremely strong outlook on the adoption of Ethereum. Generally speaking, there are strong tailwinds for adoption within the entire crypto industry, but smart contracts and software development on the Ethereum blockchain is truly amazing. I saw this fantastic chart from Lex Moskovski highlighting that 28% of Ethereum’s supply is currently locked into smart contracts.

This new ATH in locked-in supply indicates that owners of ETH aren’t just holding the asset as a speculative investment, but rather implementing the asset for functional use on Ethereum’s blockchain infrastructure. Smart contracts are simply self-executing agreements between 2 or more parties, which means that individuals/institutions are actually using the Ethereum infrastructure to enter agreements. At 28% of total supply, that’s an implied value of $131Bn as of 4pm on 10/27/21.

Additionally, if 28% of ETH’s supply is being locked into these smart contracts, this would indicate that there is less ETH available to be sold on the open market. In turn, this makes price more sticky & less volatile. Over the course of the last 10 months, the amount of ETH’s supply that is locked into smart contract agreements has risen from 17% to 28%.

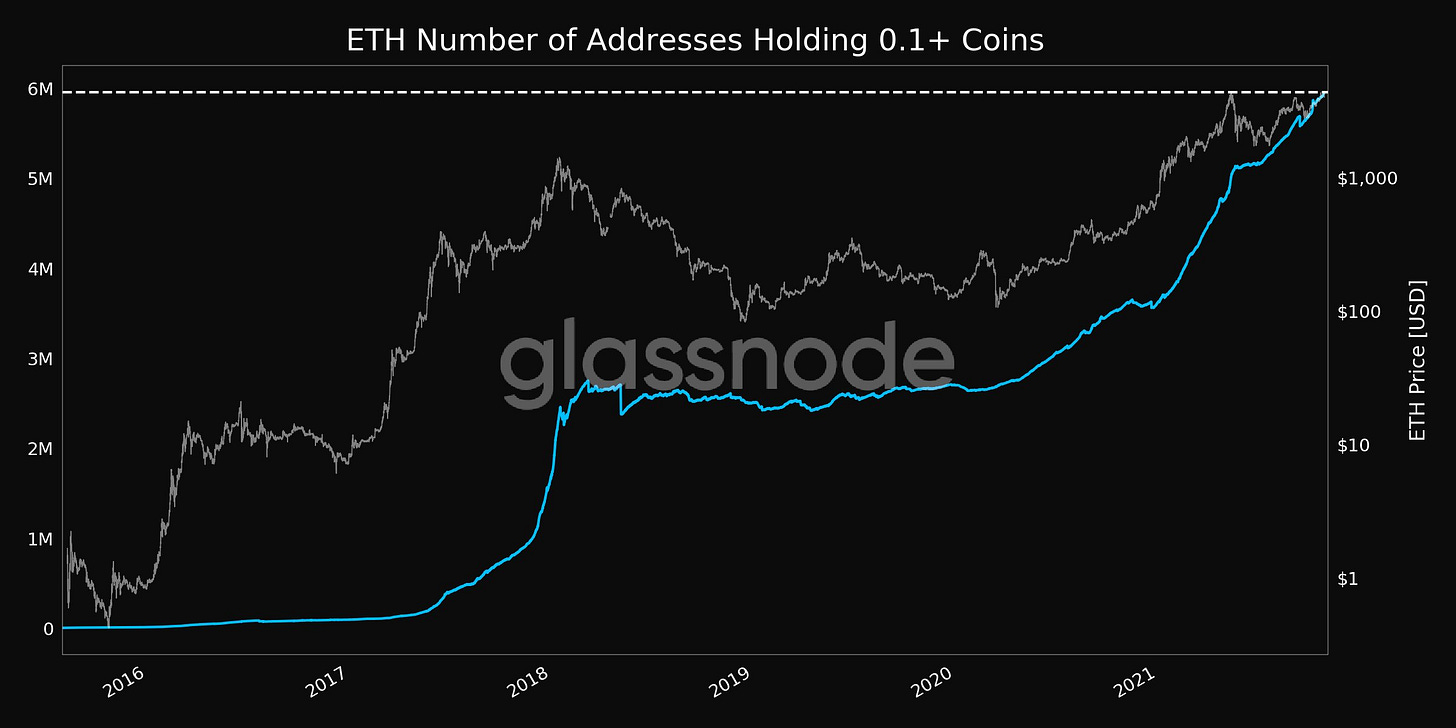

Other metrics we can evaluate are the number of Ethereum investors. While many, if not most, are using the asset as a speculative investment, it’s plausible to think that they will one day become more adept users of the Ethereum blockchain. Here is the number of wallets holding at least 0.1 ETH, which reached 5,956,241 as of 10/27, overlaid on top of the price:

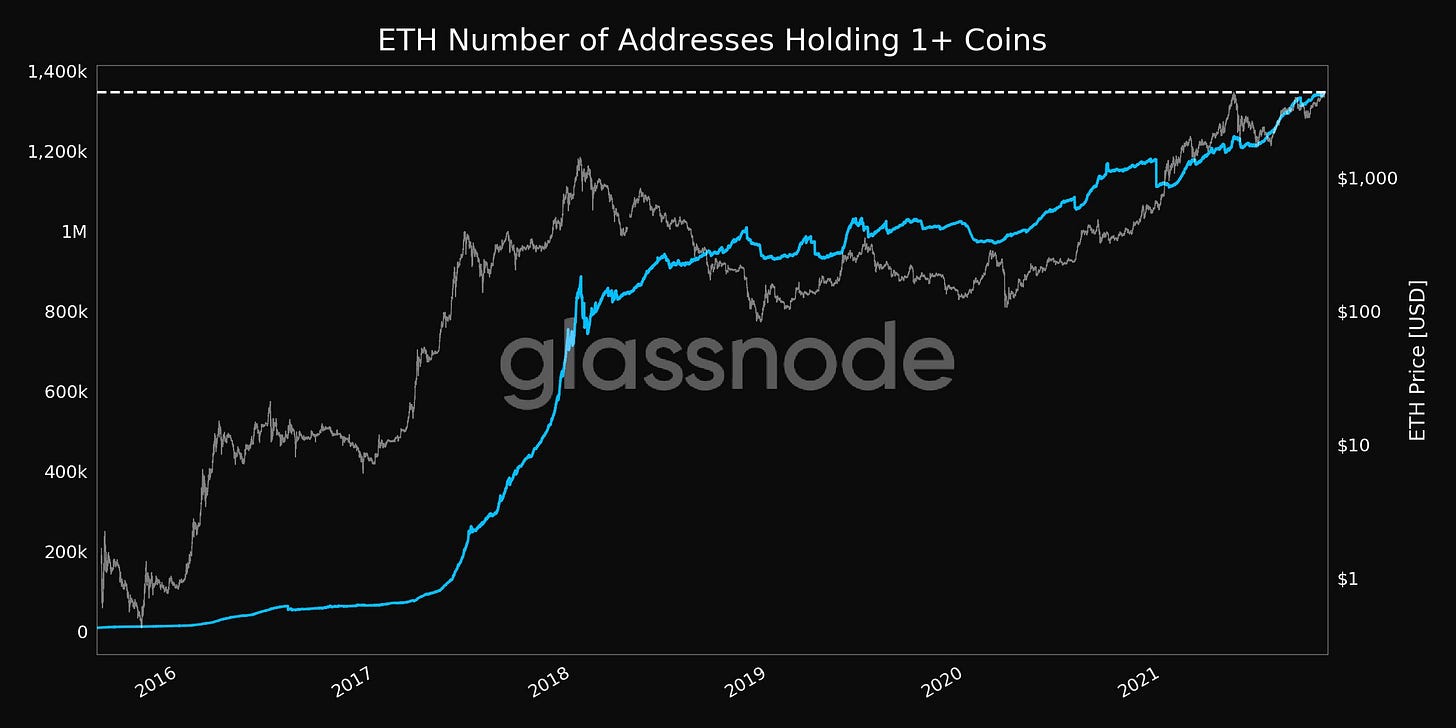

As we can see, it’s growing at an extremely fast rate; however, it hasn’t seemed to hit the exponential phase that we saw during the 2017 bull market. Additionally, we can examine the same metric but for addresses holding at least 1 ETH:

The number of addresses holding at least 1 ETH hit 1,346,121 as of 10/27. Essentially, we can identify the same trend between these two charts: a decisive & steady increase in wallets/addresses holding ETH, but not at an exponential rate as we’ve seen in prior cycles. With Ethereum currently trading around $4,000, I believe the fundamentals appear strong to warrant this price.

Talk soon,

Caleb Franzen