Edition #109 - Bitcoin

My Bitcoin Views & Outlook

Hi everyone,

I’m going to make this a unique newsletter & deviate from the standard type of report you’ve gotten used to reading. Rather than discussing data on the economy & stock market, I wanted to focus solely on Bitcoin. The purpose of this specific newsletter will be to briefly discuss how we got here over the course of the past 18 months, and then to share my thoughts & views on where we’re going. As institutional adoption continues to ramp up, I’m hoping that my connections in wealth management & banking are able to find this insightful. As always, I’m eager to hear back from you if you have feedback, points of contention, questions, or if you simply want to share your thoughts! Reach me directly at: calebfranzen@gmail.com

This newsletter will not serve as a breakdown of the technical aspects of Bitcoin as a form of innovative technology; however we will be focusing on theoretical discussions, quantitative analysis & mathematics. For those who are still unfamiliar with the technical innovations of Bitcoin & the design functionality, I highly encourage everyone to read the Bitcoin white paper, published by Satoshi Nakamoto on October 31, 2009. One day, I believe he/she/they will win the Nobel Prize.

1. How we got here:

It seems as though the Bitcoin & broader crypto market are moving at 1,000 mph, with several different catalysts that continue to unfold. My understanding of these catalysts and macroeconomic factors are what made me remain steadfast during the 50% drawdown in April-July 2021. In fact, I doubled down in May-June, selling a substantial portion of my equity portfolio to fund additional purchases of Bitcoin.

At the present moment, I only own Bitcoin & Ethereum; however, these two positions currently comprise about 80% of my total assets. It’s amazing to admit this because I didn’t have any cryptocurrency exposure until November 2020. Since 2015, I’ve been a cautious observer of the cryptocurrency space, and I would even classify myself as a skeptic up until the fiscal & monetary policy response to the coronavirus pandemic. In March of 2020, I put as much money as I could into U.S. stocks because I recognized that quantitative easing was upon us. The Federal Reserve’s significant increase in asset purchases, keeping interest rates artificially low to stimulate economic activity, opened the floodgates for asset price appreciation. In effect, this has caused investors to move out further on the risk curve as they seek sufficient yield on their capital. Recognizing this in real-time, I wanted as many reasonable risk assets that I could manage within my risk tolerance. My choice: U.S. equities.

I remember calling my family members & close friends to buy more stocks during this period, even if it was a small percentage of their bi-weekly paycheck. I told them that the most important thing at the time was to buy assets on a recurring & consistent basis. Shortly after spreading this message, one of my closest friends called me and said something along the lines of:

“You’re going to hate that I did this, but I also bought some Bitcoin.”

He knew that I had been a crypto & Bitcoin skeptic in the past, but I told him that I actually loved the idea. While I was skeptical of its effectiveness and fundamental value, the programmatic supply of Bitcoin with a maximum total supply of 21 million units had given it a reputation of being a possible hedge against an inflating money supply. While I remained hesitant, I recognized that if Bitcoin was effective in accomplishing this, it would become the apex solution as a store of value in the face of monetary manipulation, excessive fiscal policy, and central bank stimulus. As we headed into historic levels of monetary & fiscal stimulus, this was the ultimate proof-of-concept. After all, Bitcoin was created in the wake of the Great Financial Crisis as a decentralized alternative to the legacy financial/banking system.

If my memory serves me correctly, the price of one Bitcoin was around $4,500 at the time of the phone call with my friend. That investment has since appreciated by +1,350%, or 14.5x the initial investment. Proof of concept has been undeniably validated.

As Bitcoin continued to march higher throughout Q2 and Q3 2020, I dove deeper into analytical commentary and the technical properties of Bitcoin. I’d like to specifically highlight the work of Saifedean Ammous, Ross Stevens, Michael Saylor, Robert Breedlove, Anthony Pompliano, Dan Held, and Willy Woo as some of the most important thought-leaders in this space who helped to shape my views on the asset.

In October 2020, I posted the following analysis on Twitter: “Is Bitcoin gearing up for another significant move higher? A base has formed over the last two years and is looking to be in the early stages of a breakout. Bullish as firms orient their balance sheets to hold Bitcoin and PayPal adopts the infrastructure for crypto purchases/transfers.” At the time, this was what the price chart looked like at a price of roughly $13,000:

In trading, this is a classic breakout formation which typically leads to substantial gains in the price of the asset. Most analysts would refer to this as a cup & handle pattern and they use it to time an entry into a stock or asset in preparation for the breakout acceleration. As we know, the price of Bitcoin hasn’t really looked back since. In fact, it hasn’t traded below $13,000 since the day I posted that analysis on 10/25/2020. Over the past 12 months, Bitcoin has appreciated by roughly +400%.

2. Where we are now & what’s next:

I began publishing this newsletter in May 2021. Since the very first edition was published on 5/17, I’ve been providing a variety of analysis on Bitcoin including: Bitcoin halving dynamics, news about institutional adoption, price forecasts, Metcalfe’s Law, on-chain analysis, mining capacity, and a variety of other data points. I’ve been extremely clear about my outlook, sticking my neck out at several points to give predictions. Knowing what we know about how the price structure of Bitcoin was developing in October 2020, what can we understand about the current price structure?

Here’s the current view as of 10/22 at a price of $61,000:

Doesn’t it look familiar? It’s nearly identical to the chart we just covered above. In fact, we can even see the former breakout level from the first chart in the bottom right corner with the blue horizontal levels! In the October 2020 post, we can see that price was initially rejected from the breakout level, experienced a correction of -21%, and then proceeded to experience a monster breakout. Once we achieved the breakout, price rallied +370% in less than 6 months. If (big “if”) we repeat that same acceleration, that would push the price of Bitcoin to over $300,000.

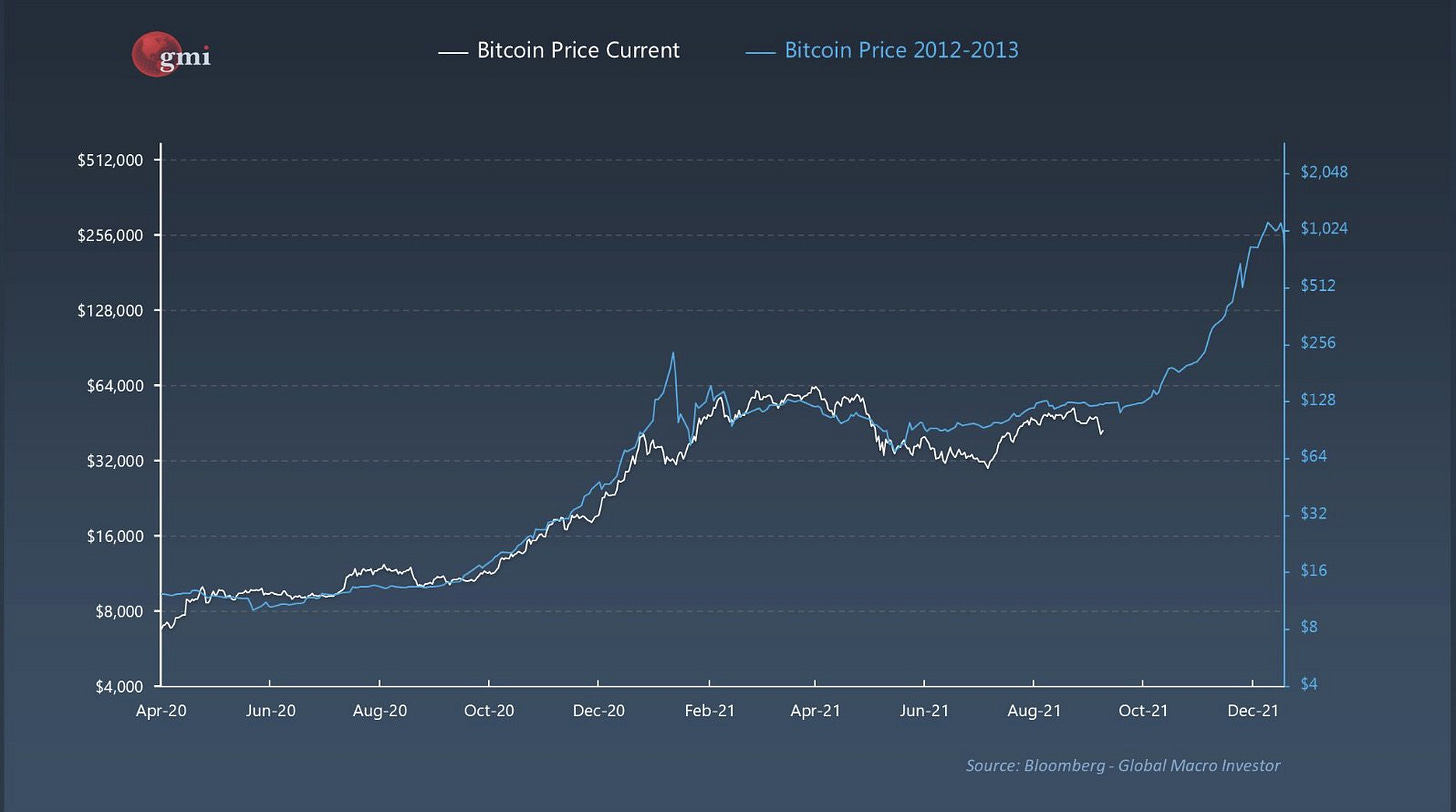

We can also look back to prior cycles to see any similarities in the trend & price action. Below is a recent chart provided by Raoul Pal on Twitter, showing the asinine similarities between the current path of Bitcoin’s price structure (white) vs. the prior path of Bitcoin’s price structure in 2012-2013 (blue):

It’s worth noting that Raoul published this chart on 9/24/2021 when the price of BTC was trading around $43k vs. the current price of $61k. As we can see, the similarities are uncanny. At the beginning of the 2012/2013 cycle, the price of Bitcoin rallied from $8/BTC to $256/BTC. That’s a 32x increase. Compared to the current cycle, we “only” grew by a factor of 8x, or 25% of the 2012/2013 cycle’s gain.

Now let’s skip to the current state of affairs… At this stage of the 2012/2013 cycle, the price of Bitcoin was trading around $128 per unit and then proceeded to reach a new highs of $1,024. That’s an 8x increase. Because we’ve witnessed a 25% retention in the factor multiple, that would imply that the current price could rise by a factor of 2x. The current price of $61k is roughly aligned with the $128 level from the 2012/2013 cycle, therefore we can easily see a route to achieving a price of at least $120k in the near future based on this model alone. If we used the analog relationship used by this chart, we can see that the price action of 2012/2013 would equate to a maximum price of $256,000 this cycle.

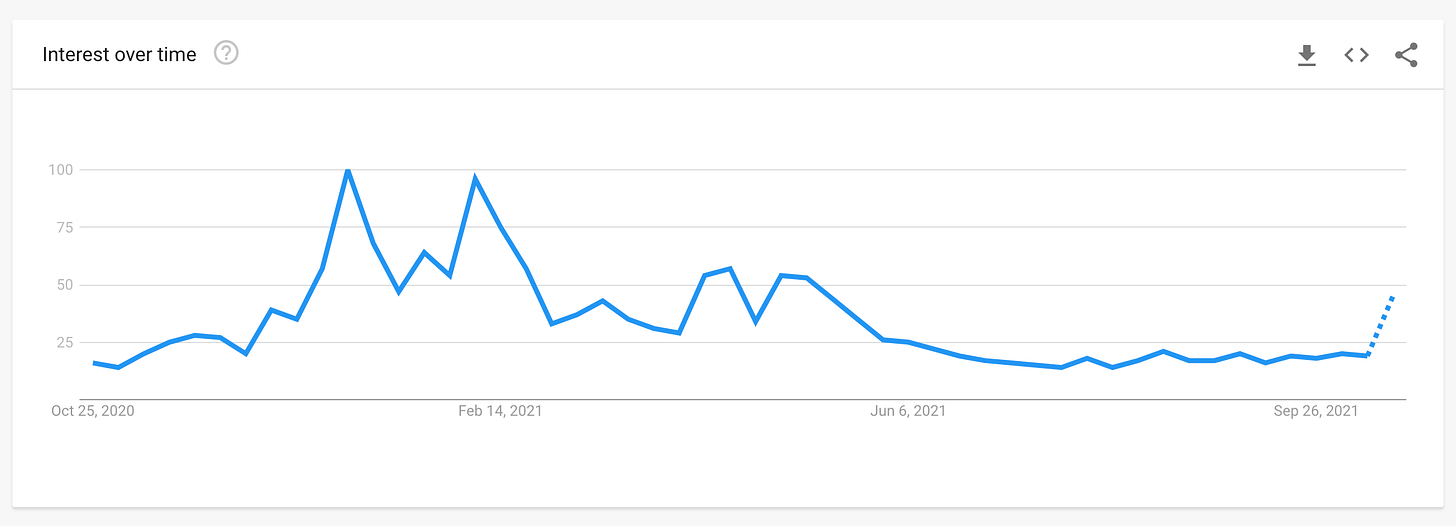

Another data point we can analyze is search activity from Google Trends. For those who are unaware, Google Trends allows you to search for any term/phrase and it will output a visualization of the search history of that term/saying over a specified period of time. The visualization tool indexes the most searched period to 100 and the least searched period to 0 in order to determine the relative search frequency of at the current moment.

If we do analysis on the term “buy bitcoin” over the past 5 years, we get the following:

By using the word “buy”, we can get a measure of actual conviction rather than people doing research about the crypto asset and trying to learn more about the digital currency. Nonetheless, a search for “bitcoin” alone gives an extremely similar view. As we can see, Google search activity for “buy bitcoin” reached the highest level in 2017. Even during this most recent cycle, search history only reached 50% of the 2017 peak. At the present moment, search history is less than 25% of the 2017 peak.

Even if we examine the search history data over the past 12 months, we get the following:

If we tether the maximum search activity to 100, we see a peak in December 2020 & January 2021. At the present moment, search activity for “buy bitcoin” is only 25% of what it was during the peak in December & January.

So what does this mean? It means that there is no sense of FOMO in the market right now. Essentially, retail activity (buying/selling from individual investors like you and me) is extremely muted. At the present moment, we don’t have crypto-ignorant buyers coming into the market in order to buy bitcoin to make a quick buck. What happens once the FOMO begins? If/when that happens, I think we’ll finally get the exponential phase of this current cycle.

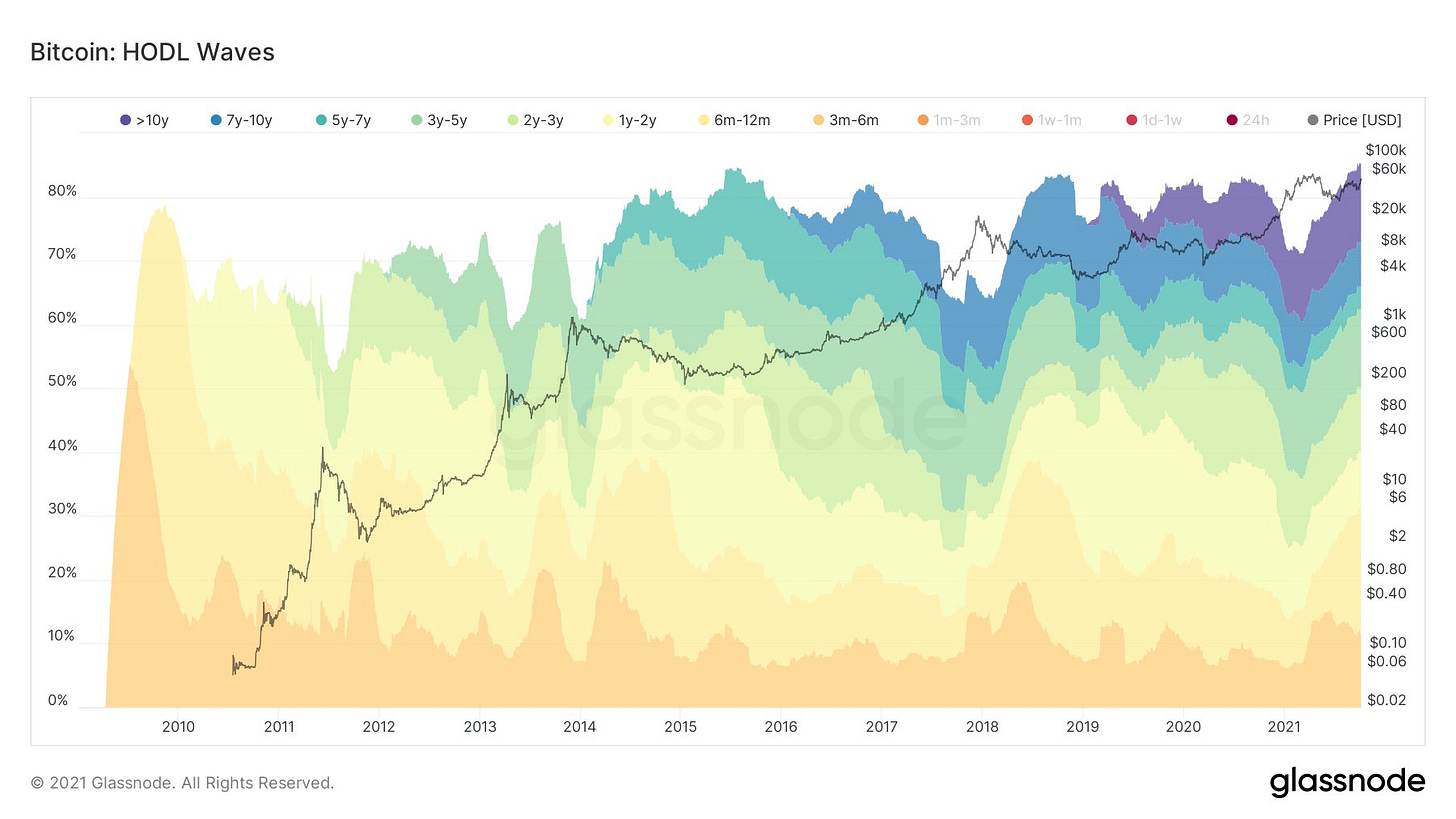

Any sense of FOMO will be additionally compounded by an extremely tight supply shock. If there is a relatively limited amount of Bitcoin that is “available for sale”, and sellers have a high conviction in the digital asset, they won’t be willing to part with their investment until the price is substantially higher. We can quantify this conviction through “HODL Waves”, which allows us to peer into the blockchain and view how many Bitcoin have been transferred over various time periods:

Based on this chart, we can see that the cumulative percentage of HODL waves longer than 3 months is approximately 85%, meaning that 85% of all Bitcoin in current supply haven’t been moved in at least 90 days. Owners simply aren’t selling.

Institutions continue to flock into the digital asset space, allocating substantial capital into Bitcoin from an investment perspective. These institutional investors and companies are less price sensitive and allocate capital with a longer-term perspective. With the approval of the first U.S. Bitcoin Futures ETF earlier this week ($BITO), wealth management firms & capital allocators now have an easy/accessible way to buy Bitcoin on their client’s behalf. This was extremely difficult prior to the approval. The issue is, these Futures ETF’s are simply a derivative of the underlying asset; therefore, the funds don’t need to actually buy Bitcoin but merely trade derivative contracts. The real fireworks will start once the Spot ETF gets approved, which is designed to have the fund purchase the underlying asset outright.

For example, the first ever Spot Gold ETF was approved in November 2004 under the ticker symbol $GLD. Here’s what happened to the price of gold thereafter:

Obviously there were a lot of various fundamental factors at play, but the approval & introduction of the Spot Gold ETF was certainly a contributing factor to the 5x gains that happened thereafter. At the moment, I have somewhat dismissive towards the Futures ETF for Bitcoin, although it’s certainly an encouraging step in the right direction. The Futures ETF is mostly a win for the financial services industry rather than a win for investors. I’ll become enthusiastic when we get the Spot ETF approved, likely happening in the coming months.

CONCLUSION:

The way I view Bitcoin is analogous to a black hole in a universe of financial assets. Bitcoin’s programmatic supply, open source code, decentralized nature, incentivization of clean energy, and immutability, make it the apex asset amidst all financial assets. It is unconfiscatable, infinitely divisible, universally transferrable, and is literally programmed to become increasingly more scarce over time due to the 4-year halving cycle.

At the time of writing, there are currently 18.85M Bitcoin in circulation out of the 21M maximum supply. These 18.85M Bitcoin have been mined over the past 12 years, with the final 2.15M scheduled to be mined over the next 119 years. Because of the open source nature of Bitcoin, we can clearly forecast future supply based on the programmatic nature of its supply schedule. Based on a 4-year halving cycle, which reduces block validation rewards by half every four years, the current block reward of 6.25 BTC per block validation will soon be reduced to 3.125 in 2024, 1.5625 in 2028, 0.78125 in 2032, so on & so forth until the total supply reaches 21M.

Here’s what else we know about Bitcoin’s supply. The creator of Bitcoin owns 1M BTC in a public wallet, which have never been moved since they were deposited there. Of the total 18.85M in circulating supply, it’s estimated that between 3-4M have been lost due to forgotten passwords, private keys, etc. The likelihood that they get recovered is close to 0%. Because of these two factors, we can “remove” between 4-5M from BTC’s maximum total supply of 21M to give us a baseline for “attainable” supply. Essentially, there will likely only be 16-17M Bitcoin in circulation at the maximum supply level assuming no more BTC are lost from irresponsible owners. If we thought Bitcoin was scarce at 21M, it’s even more scarce at a total circulating supply of 16-17M.

According to a 2021 study from Capgemini Financial Services Analysis, there were 20.8 million millionaires throughout the global population.

If every single one of them wanted to own just 1 Bitcoin, they literally couldn’t. It’s too scarce.

From a 30,000 foot view, what does the landscape look like? We have historically great asset managers like Ray Dalio and Paul Tudor Jones buying Bitcoin and getting involved in the space. Pension funds, insurance companies and endowments are buying Bitcoin. Companies like Microstrategy, Tesla, Square, and Coinbase have purchased Bitcoin as an alternative to cash on their balance sheet. In the case of Microstrategy, they’ve been able to issue debt with the specific intention of buying more Bitcoin, of which all debt-raising rounds have been oversubscribed. Companies like Visa, Mastercard, PayPal, and Interactive Brokers have begun to use Bitcoin’s infrastructure & help to enable transactions on the network. Traditional banks like JPMorgan, Goldman Sachs, and Morgan Stanley have made Bitcoin accessible for their high net worth clients and are beginning to get involved at an institutional level. El Salvador became the first country to make Bitcoin legal tender as an alternative to U.S. dollars. All mining capacity in China has been banned, forcing miners to seek alternative refuge in other regions throughout the world. Chinese miners were the most reliant on coal & non-renewable energy sources out of any country, therefore the migration of hash capacity will prioritize more renewable energy. The current compute power of the Bitcoin network is nearly 150,000,000,000,000,000,000 calculations per second and continues to rise with the migration out of China. This technology is only 12 years old, and all of the factors listed above have come to fruition over the past 16 months.

From an economic standpoint, the Federal Reserve’s balance sheet has more than doubled since the pre-pandemic level, from $4.1Tn to $8.5Tn. Inflation is at multi-decade highs. The U.S. government is expected to raise the debt ceiling again, and is even considering minting a $1Tn coin. The “Build Back Better” reconciliation bill is expected to be $3.5Tn, on top of historical levels of fiscal stimulus past over the prior 18 months.

From a fundamental perspective, the bull case for Bitcoin is clear. The U.S. government will continue to spend an exorbitant amount of money, the Federal Reserve will continue to print an exorbitant amount of money, and all assets will do well in this environment over the long-run. The reconciliation bill I cited above is currently the equivalent of 57,232,163 BTC, or more than 3x the total current supply. The total supply of Bitcoin can never be increased and yet we’re seeing the government decide to spend 3x Bitcoin’s value. I’m not speaking to the merit of the bill and whether or not the spending is worthwhile — I’m only focusing on the spending in and of itself.

Last week, I gave my definitive statement on where I expect the price of Bitcoin to be going in the near future. In that publication, I said that “I think that there’s a very strong chance that we finish 2021 with the price of Bitcoin exceeding $120k, with a cycle peak being achieved in February-March 2022 that could push us well above the $250k figure. Either way, the two long-term models that I rely on give me confidence that the long-term magnet for the price of Bitcoin is well into the 7-figures, exceeding $1M per BTC within the next 5-10 years.”

The models that I referenced above are the stock to flow model and a historical linear regression model, both of which show the price of Bitcoin exceeding $1M in the near future. That would bring the total market cap to $19Tn. Considering that the total market cap of all the gold in the world is over $11Tn, I certainly think this is feasible over the long-term.

Because of Bitcoin’s fixed supply, network effects, and the impact of Metcalfe’s law, I believe it is the apex asset in an environment of expanding money supply & increased global government spending. Capital inflows will come from the currency market, the bond market, fixed income, equities, and potentially even from real estate, all of which have non-fixed supply dynamics. In a world of increasing supply, the asset with a fixed supply will have strong tailwinds.

Talk soon,

Caleb Franzen