Edition #10 - 5.28.2021

Monetarist Theory, Carl Icahn Hints at Crypto, Redfin CEO Addresses the Housing Crisis

Economy:

In one of my recent newsletters, I highlighted my belief that additional QE and/or growth of the federal reserves balance sheet would primarily result in asset price inflation rather than consumer price inflation. This is really only a position that has been popularized in the aftermath of QE, when consumer price inflation never materialized despite historic levels of money printing and the money supply rapidly increased for a sustained period. The lack of inflation left many economists, and many became embarrassed by their predictions for hyperinflation or stagflation. What made so many of these economists wrong? What theory did they rely on that led them to fear significant levels of consumer price inflation?

At the core of this question, there is an equation in traditional economics which states that the money supply times velocity equals the price of goods & services times the quantity of goods & services (MV = PQ). This concept was written at length by Milton Friedman in the 70s and 80s and has continued to remain a core teaching within academia and monetary theory. In fact, those who subscribed to this popular ideology were referred to as monetary theorists. The assumption is that if the money supply grows, the right hand side of the equation must increase to remain balanced. Because prices are considered to be more flexible & dynamic than supply, which is often considered “sticker”, the formula predicts that prices of goods & services will rise. Logically, this makes sense. If more dollars are in circulation, competing for the same amount of goods & services as before, the dollar cost of those goods & services should adjust upwards to reflect the decrease in scarcity & value of the dollar. Additionally, if the rate of growth of the money supply increases faster than the rate of economic growth, prices should theoretically rise.

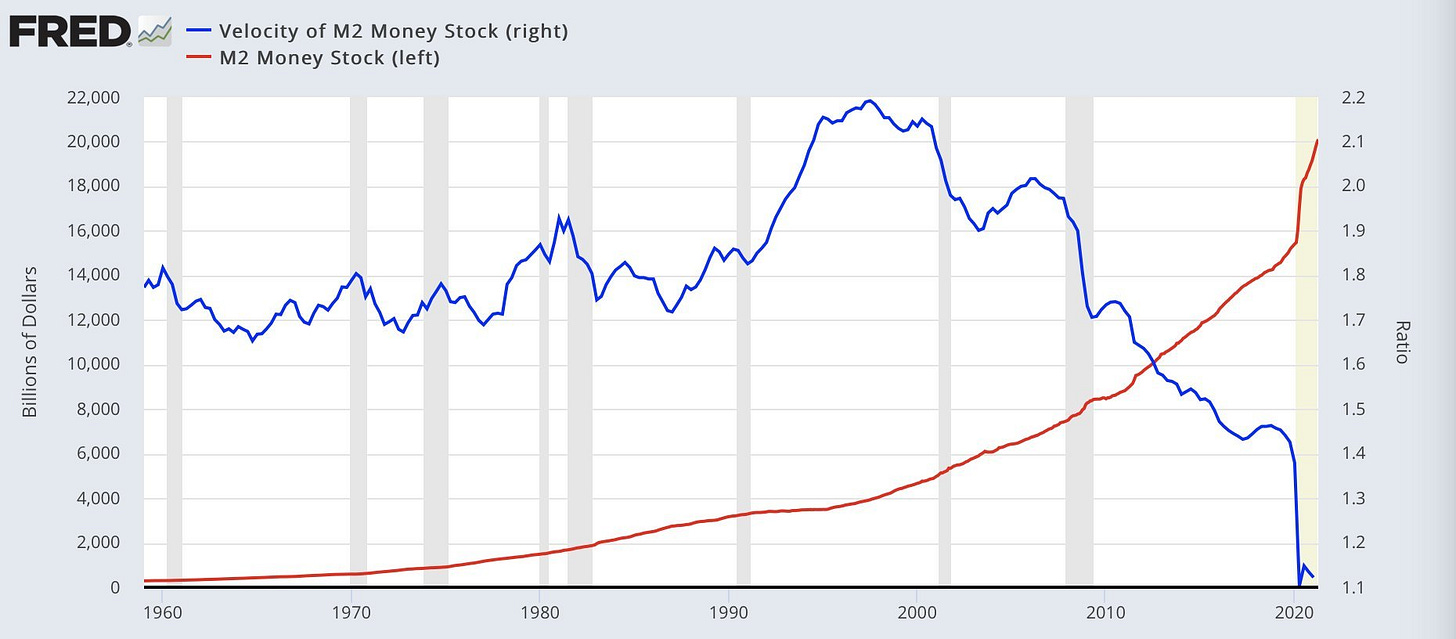

As such, the monetarist theory explained that an inflation in the money supply greater than the growth of an economy would cause an inflation in consumer prices! At the time monetarist theory was becoming mainstream, velocity was known to be a near-constant variable & fluctuated between 1.7-1.9 rather consistently. Even when U.S. experienced a high degree of inflation from the late-60’s through 1980, velocity continued to fluctuate during this range. Meanwhile the money supply was growing relatively quickly. This gave the monetarists some justification of their theory.

One of the key explanations for why we have yet to see inflation occur since the Quantitative Easing began in 2008 is because velocity, the speed or rate at which money is exchanged within the economy, has tremendously declined. Therefore, the increase in the money supply has been offset by the decrease in velocity, which has resulted in an absence of substantial consumer price inflation. Considering that M2 money supply was roughly $7.5Tn at the onset of the Great Recession and has grown to $20.1Tn today, it must be the case that velocity has decreased by a significant proportion for inflationary pressures to have been muted. The chart below shows the historical levels of both the M2 monetary supply and the M2 velocity:

As we can see, velocity has decreased by nearly half since 2008, falling from 1.97 in Q4 2007 to 1.1 today. As I’ve pointed out in prior newsletters, the amount of money held in reserves & excess reserves is at all-time highs, meaning banks have more cash on hand than borrowers have demand for, and thus the capital sits idle. Essentially, a significant amount of the money that has been printed has simply remained in the financial system rather than the actually economy in which goods & services are produced & transacted. If the newly printed money adds to the monetary base, but doesn’t actually flow into the economy, enable transactions, and facilitate economic activity, it’s pretty obvious why the inflation rate has yet to pick up to a significant level! Essentially, consumer prices can’t rise if the increased money supply doesn’t make it to the hands of the consumer. Here is the most recent graph showing the trajectory of total reserves of depository institutions, currently at $3.887Tn:

Additionally, the amount of excess reserves held in the system, which represents the amount of money held by banks in reserves that exceeds the reserve requirement from regulators, was also near ATH’s when it was discontinued in August 2020:

Considering that they follow the same trajectory, I’d be willing to wager that the amount of excess reserves is currently at ATH’s.

While the monetary base has increased by nearly 3x since 2008, the velocity of M2 money supply has decreased by 50%, and reserves of depository institutions have increased by 89x from $43.5Bn to $3.887Tn. Ideally, banks want to lend that money out to earn interest (revenue) on the loans, but that just simply isn’t happening. While it seems strange at first glance, there’s actually a logical explanation for this phenomenon. In fact, the Federal Reserve Bank wrote a research paper on this topic in 2009 titled, “Why Are Banks Holding So Many Excess Reserves?”, where they reached the following conclusion:

“The total level of reserves in the banking system is determined almost entirely by the actions of the central bank and is not affected by private banks’ lending decisions”. While changing lending behavior may lead to small changes in the level of required reserves, the vast majority of newly-created reserves [from Quantitative Easing] will end up being held as excess reserves almost no matter how banks react”.

Essentially, the FBNY is acknowledging that the amount of liquidity provided from their asset purchases is so significant and that they inherently understood the newly printed money would not even make it into circulation & simply sit in reserves. It’s interesting to note that the FBNY notes that lending behavior wouldn’t necessarily influence reserves, but didn’t mention anything about borrowing behavior from businesses. It takes two to tango, and banks are in the business of connecting savers with borrowers. One important question to address going forward is, how can we stimulate businesses to take on new debt for productive means rather than refinancing existing debt and/or borrowing money for share repurchase programs or to increase dividends. Ideally, it might be more economically useful for the businesses to finance new investment opportunities, take on new projects, expand their operations, fund R&D, and generally increase their capital expenditures. While this latter group of activities is certainly increasing, it wouldn’t hurt to have more.

Stock Market:

I didn’t see any notable new information that reaffirmed or shaped my investment thesis yesterday, so I’m going to skip this category and instead discuss real estate further below. The only thing worth noting is that the meme stocks such as $AMC $GME $BBW $RKT $KOSS are regaining a significant amount of steam again, and it’s possible we see some de-risking over the next two weeks if these names continue to behave irrationally. I’ll keep an eye on it.

Cryptocurrency:

Carl Icahn was just interviewed on Bloomberg Markets & Finance, in which a 35 minute video segment was released on YouTube on 5/26. I had a chance to watch it yesterday, noting some of his key comments & insights on crypto. Here are the 3 main takeaways I think you should know:

“I’m looking at the whole business and how I might get involved in it with Icahn Enterprises in a relatively big way, because I do think it’s here to stay in one form or another.”

“A big way for us would not be to buy a few coins or something. I don’t believe in trading the market. A big way for us would be $1 - 1.5Bn, but sometimes we go bigger than that and sometimes we go smaller, so I’m not going to say exactly.”

“A lot of these other things out there are overvalued, there’s no question about that in my mind”, hinting that a lot of the cryptos that are currently in existence won’t be survivors down the line.

Icahn is the founder of Icahn Enterprises ($IEP), an investment conglomerate which manages a portfolio of $20Bn, as of 12/31/2020. If Icahn Enterprises were to announce in a 13-F filing or quarterly earnings report that they initiated a position in the $500M to $2Bn range, that would be a massive catalyst for the price of Bitcoin. It would also continue to show the historical level of institutional adoption.

Real Estate:

I saw a great thread on Twitter from the CEO of Redfin, Glenn Kelman. With the significant amount of data & resources that Redfin has in their database, it was really interesting to hear his thoughts on the current conditions of the real estate market & note some of the things that are at the top of his mind. Below is the full thread of 15 tweets, consolidated into a single quote. It’s a little lengthy, but I feel that the entire quote is a powerful statement full of amazing lessons in economics & social dynamics that don’t require any additional commentary or explanation. Here is the quote in its entirety:

“It has been hard to convey, through anecdotes or data, how bizarre the U.S. housing market has become. For example, a Bethesda, Maryland homebuyer working with Redfin included in her written offer a pledge to name her first-born child after the seller. She lost. There are now more Realtors than listings. Inventory is down 37% year over year to a record low. The typical home sells in 17 days, a record low. Home prices are up a record amount, 25% year over year, to a record high. And still homes sell on average for 1.7% higher than asking price, another record. But in two of America’s largest cities, inventory has increased, in New York by 28%, in San Francisco by 77%. San Francisco hasn’t had an inventory increase this large since 2008. And still in both markets, prices are increasing. In 2020, new-construction permits were *down* 13% in DC and New York, 40% in LA, 48% in Chicago, 50% in Seattle, 79% in San Francisco. Permits were *up* 25% in Miami, 56% in Vegas, 96% in Greenville, 122% in Detroit, 246% in Knoxville. Lumber prices are up 300%. In Redfin’s annual survey of nearly 2,000 homebuyers, 63% reported having bid on a home they hadn’t seen in person. In an April survey of 600 Redfin users who had relocated in the past year, about two thirds of the people who moved got a house the same size or bigger, but about the same proportion, two thirds, spent the same or *less* on housing. Even though most of the people who moved got a bigger home, 78% reported having the same or more disposable income after their move. Idaho home prices could triple and still seem affordable to a Californian. For low-tax states, 4 people move in for every 1 who leaves. For Texas, this ratio is 5:1.; for Florida 7:1. Cities & states have no leverage to raise taxes, after many promised new money for social justice; the federal government will have to fund long-term investments. This migration to lower-cost areas may lead to lower workforce participation. For many families Redfin has relocated, the money saved on housing costs lets one parent stop working. A wave of Redfin customers are retiring early. Lenders are calling employers to confirm that the homebuyer will have permission to work remotely when the pandemic ends. Rates are lower for loans on primary residences, and the lender also wants to make sure the borrower actually plans to work after getting the loan. The average housing budget for out-of-towners moving to Nashville was $720k, ~50% higher than locals’ $485k budget. It used to be coastal elites who worried that every adult in the family had to win a career lottery, just to afford a home. Now that feeling may spread. It’s not just income that’s k-shaped, but mobility. 90% of people earnings $100,000+ per year expect to be able to work virtually, compared to 10% of those earnings $40,000 or less per year. The folks who need low-cost housing the most have the least flexibility to move. An investor recently said, with an ancient touch of awe but also greed, that one source of America’s miraculous economic recovery was the bounty of “the land itself”. We have more room to grow than we ever imagined. We just have to make sure that it benefits everyone.”

Until tomorrow,

Caleb Franzen