Edition #1 - 5.17.2021

Introduction & First Edition

First & foremost, thank you for tuning in to my first newsletter & post on SubStack! My goal with this platform is very simple: to provide daily updates on the most important financial topics that help to shape my investment thesis, views on the economy & various market conditions. Every weekday, I will post a handful of charts that are related to three key topics: the economy, the equity market, & cryptocurrencies (almost exclusively related to Bitcoin & perhaps some Ethereum). In the event that there is worthwhile activity in the real estate or bond market, I’ll be sure to expand the typical newsletter to include that data.

Below, I’ve provided a more in-depth summary of what you can expect from these publications. If you’re keen to skip straight to the contents of this first edition, please scroll down to about the 1/3 mark of the newsletter where I kick things off with “Economy”.

Today, the problem is not how to find information, but rather how to select the key information & know the actionable takeaways. With the world’s knowledge at our fingertips, there is an abundance of news and incoming data released amongst a backdrop of an ever-changing society. In regards to economics & the markets, this presents two problems: finding the key information that can help give you an edge & remaining flexible to shift, adjust & modify your actions when new data is released. One thing is for certain, society’s dependency on legacy media has shifted towards independent sources & social media in a more decentralized manner.

For me personally, I’ve connected with key thought-leaders on Twitter & LinkedIn who post new economic data, updated conditions in the financial markets, and a variety of market-moving updates. The individuals range from economists, CIO’s of hedge funds, portfolio managers at the top investment institutions, innovators in cryptocurrency, journalists from Bloomberg, retail traders & thought-provoking market participants. The posts & ideas they share help to shape, challenge, & reaffirm my views on market topics. I want to consolidate the info I read on a daily basis into the crème de la crème to help you stay up to date with the most relevant daily news in the economy & financial markets. This newsletter will check two boxes for you:

Provide you with the most important information, data & news regarding economics & finance. Unlike me, you don’t need to follow hundreds of people on Twitter & sift through thousands of posts per day to identify the top highlights that are impactful to the economy, the market, and your portfolio. I’ll make that process easier for you, providing you with the raw data, charts & news that you need to make informed decisions.

Provide you with my commentary & analysis for each news item & chart that I share. I’m not just going to show you what is important, I want to tell you why it’s important & how it changes or reaffirms my views. As concisely as possible, I’ll explain what we’re looking at, why it’s relevant, & how it impacts my views on the economy, the stock market & my investment thesis.

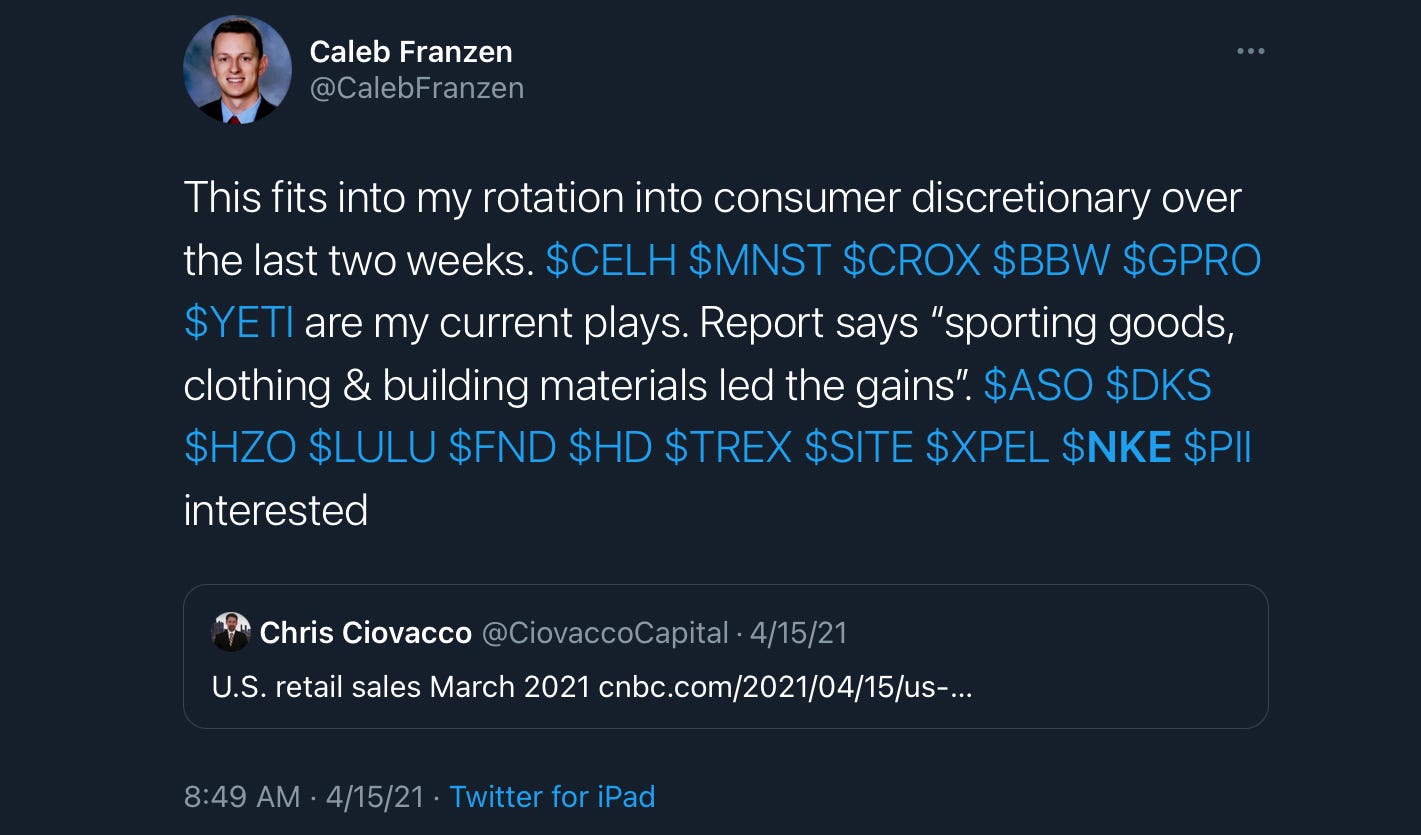

For example, when the retail sales number for March 2021 was released on 4/15/2021, I fully dissected that report & read several reviews from various economists, investors, and journalists. One of the key takeaways from that report was that clothing, sporting goods & building materials were some of the leading categories for the +9.7% increase in month-over-month sales. On Twitter, I immediately posted the following:

From the release of that post on 4/15 through the most recent market close on 5/14, here are the returns for each of the stocks I highlighted:

Celsius Holdings (CELH) -7.9%

Monster Beverage (MNST) -3.3%

Crocs (CROX) +26%

Build A Bear Workshop (BBW) +10.9%

GoPro (GPRO) -16.6%

Yeti Holdings (YETI) +5.2%

Academy Sports & Outdoors (ASO) +15.2%

Dicks Sporting Goods (DKS) +7.2%

MarineMax (HZO) +20.3%

Lululemon Athletica (LULU) -3.1%

Floor & Decor Holdings (FND) -1.4%

Home Depot (HD) +0.8%

Trex Company (TREX) +2.7%

SiteOne Landscape Supply (SITE) -1.2%

XPEL Inc (XPEL) +24.3%

Nike (NKE) +2.1%

Polaris (PII) -7.75%

A portfolio with an equal-weight allocation to this basket of 17 consumer discretionary stocks, largely related to clothing, sporting goods, & building materials, would have gained a return of +4.3% from the open on 4/15 through the close on 5/14. At first glance I actually felt that this was slightly underwhelming, but let’s compare to the performance of the major indices. During the same period, the Dow Jones ($DJX) returned +1.7%, the S&P 500 ($SPX) was +0.8%, the Nasdaq-100 ($NDX) -3.9%, and the Russell 2000 ($RUT) was -1.1%. Similarly, two of the most popular consumer discretionary ETF’s, $XLY & $FDIS, had respective returns of -4.3% & -3.7%. Any way you cut it, an equal-weight portfolio of these 17 stocks significantly outperformed the broad-market & sector-related ETF’s.

In short, I want to provide actionable analysis & commentary, driven by incoming data & newly released information. My investing process & economic views are very data-driven & adapt to new information as it is presented. That’s what I want to share with you. The charts, data & news in each publication will all be from the prior day’s session and will be released by 9:30am ET.

Each daily newsletter will be completely free! I don’t want any barrier to entry & encourage you to share this with as many people that you think will be interested & benefit from this publication. With that said, I will be providing certain premium content through this SubStack. The topics of these premium releases will be the following:

A weekly watchlist of at least 5 stocks that I think are primed to outperform the general market & even their respective sectors/industries. Each “top pick” will have a full breakdown in terms of technical analysis, a high-level overview of their most recent earnings report, and general investment thesis that makes me optimistic from a fundamental perspective. This report will be released every weekend, giving you time to conduct your own due diligence, research & analysis. At the end of the day, I am not your financial advisor & I am not aware of your current portfolio construction or risk tolerance. As such, the stocks that I introduce are not to be taken as a recommendation & I may have an existing position in any of the names that I include on the watchlist.

Weekly list of the top 10 holdings in my portfolio & cash allocation. This will cover what I own & how much I’m allocated to my highest conviction names. Again, these are not recommendations & may not be suitable for your specific financial goals or risk tolerance levels. Nonetheless, this will give you the chance to gauge my own risk appetite & how I stay nimble within the market as a full-time trader.

Ad hoc deep dives & market commentary. While these daily newsletter will show you what is helping to shape my investment perspectives & economic views, I intend to provide full updates that thoroughly discuss & dissect my views in their entirety. For example, last week I started writing an update on my views regarding the current market conditions. I covered the change in economic conditions, rising rates due to higher inflation expectations & results, rotation out of tech/growth stocks into value (notably industrials, materials, financials, energy) and also touched on the labor market. Writing is super beneficial to help me cement & work through my thoughts. It allows me time to research certain things further & test my ideas with real data. I’m looking forward to sharing those market reports with you.

Summaries of FOMC statements, minutes & speeches from key members of the Federal Reserve. I continue to believe that monetary policy & interest rates are the primary driver of intermediate & long-term asset returns. The FOMC releases are typically convoluted, full of “Fed-speak”, lengthy & hard to digest. With that said, they are also full of key insights. The Fed has made a concerted effort since Ben Bernanke to increase their transparency, thus providing economists & investors a roadmap for their future actions, economic goals, and criteria for policy adjustments. Stay ahead of the curve (pun intended) by letting me sift through the noise & give you the key points of these releases/statements.

Now that I’ve gotten all the logistics taken care of, let’s dive right in & begin with Edition #1, covering all the most important market-related items that I saw during the session on 5/14/2021 & over the weekend.

Economy:

The key economic release on Friday was the April 2021 retail sales number. After a tremendous result for the month of March, which significantly beat even the most optimistic estimates, the release for April had additional focus to see if the momentum could continue. Particularly in light of the weak jobs numbers that were released for Non-Farm Payroll (266k vs. estimates in the 900k range), the record-high print for job openings (8.123M vs. estimates in the 7.5M range), and higher than expected CPI data for April (+4.2% YoY vs. median estimates of +3.6%. This was the highest inflation print since September 2008.)

The U.S. Census Bureau reported a 0.00% change in month-over-month sales for April 2021; however, the prior month of March was revised up from +9.7% to +10.7%. So, while the prior month was bolstered even more than initially expected, the April number was quite a disappointment. The retail & food service sales, unadjusted for price changes, were $619.9Bn and were “virtually unchanged” with a range of +/-0.05%. With the underwhelming report, the market responded by pricing in a “lower-for-longer” outcome in regards to interest rates & the Federal Funds Rate (FFR). Yields on the 5, 10 & 30-year Treasuries fell by a substantial margin, although they remain elevated near their YTD highs. Stocks rallied during Friday’s session under the assumption that monetary stimulus would need to persist at existing rates to maintain ample liquidity & meet economic goals.

In any event, the most concise summary of the retail sales report was presented by Gregory Daco (@GregDaco on Twitter), the Chief U.S. Economist at Oxford Economics:

This chart shows the month-over-month (MoM) percent change in retail sales by category. The biggest surprise to me was that Clothing fell by -5.1% and Sports/Hobbies/Books/Music fell by -3.6%, especially considering that these categories jumped by +22.7% and +24.2% in the prior month. I was hoping to see continued momentum in both of these spaces, but it’s very possible that the March result was a substantial outlier. With that said, Building Materials was much more resilient with a MoM change of -0.4% vs. March 2021’s +13.9%. The two biggest bright spots in the report were in Electronics & Appliance Stores (+1.2% vs. last month’s +17.5%) and Motor Vehicle & Parts Dealers (+2.9% vs. last month’s +17.1%).

Finally, here is a great chart from the Federal Reserve Economic Data showing the YoY change in advanced retail sales:

This pace of the acceleration is going to slow down at some point, but I expect that we’ll continue to see elevated levels of growth, likely remaining over double-digits for the next several months & through Q3.

As it relates to the retail sales report, here are the consumer discretionary stocks that I am most optimistic on over the next 1-3 months: $CROX $YETI $PII $DKS $ASO $HIBB $FL $GRMN $STX $DELL $HPQ $SONO $FND $SITE $TREX $BECN $TGLS $FBHS $DE $XPEL $ORLY $AZO

For the full report from the Census Bureau: https://www.census.gov/retail/marts/www/marts_current.pdf

Stock Market:

Last week was a tough week for the equity market. In summary, the major indices had the following weekly returns:

Dow Jones ($DJX) -1.13%

S&P 500 ($SPX) -1.38%

Nasdaq-100 ($NDX) -2.38%

Russell 2000 ($RUT) -2.1%

Meanwhile, the Market Volatility Index ($VIX) closed at +12.8% for the week, but peaked on Wednesday at +69.1%. After the close on Wednesday, I posted a thread on Twitter outlining that the S&P 500, and thus the overall market, was at a key inflection point in terms of the short & intermediate term price action. Here is the chart & general commentary that I shared on 5/12:

Attentive followers know I’ve had these technicals on my chart since 3/10/2021. In April, I highlighted that price was retesting the upper-bound resistance trendline at Point #7. The S&P continued to consolidate around this level, retested the 21 day exponential moving average (yellow) on 5/4/2021, and then rolled over this week. The index is now trading at two critical levels: retesting the 55 day EMA (teal) after falling -2.14% today & also retesting the rising trendline which has acted as support 3 times since the COVID lows last year. Price has dipped below the 55 EMA 3 times since last September, however, price has not yet fallen below the rising support trendline. If this trendline breaks, I believe there is a chance the index falls to the 200 EMA (dark blue), currently at $3,730, or retest the red or yellow trendlines. These trendlines are in the high-$3,700’s & $3,830. Any of these scenarios represent a decline of about -6% to -8.3% from Wednesday’s close of $4,063, but could feel substantially worse for those overweight tech/growth or high-beta stocks. The final thing to note is that the Williams%R indicator (an oscillator that gives insight into an asset’s momentum relative to its behavior over the last 16 trading days) is the most oversold since October 2020 & experienced the sharpest decline since the move from the September 2020 highs. After the shakedown in September, the S&P 500 rallied more than +14% over the next 3 months & are currently up +30% from the 9/24/2020 lows.

With the hindsight of how the rest of the week played out, it seems as if the index has once again found support on the rising trendline & 55 day EMA. After the Wednesday close, the S&P 500 gained +2.7% over the last two days of the week & closed at $4,173. Zooming in, here is the updated chart:

With price closing above the 21 EMA, which is above the 55 EMA, which is above the 200 EMA, this is a key sign that we’re still in a bull market & shows that momentum remains strong to the upside. That isn’t to say that we’re out of the woods yet, as a mere -2.8% decline would push the price of the index below the trendline support. Another important thing to note is that the two trendlines are shaped in a wedge, set on a collision course which will intersect in mid-September 2021. It’s very possible that we continue to consolidate & coil within this wedge. By the time the resistance & support bands intersect, the S&P’s correlated price is $4,660, which gives an implied upside of +11.6% over the next 4 months. The technicals are just a guide based on the historical price action & trajectory, so this is NOT a concrete price target. Regardless, I remain very bullish on U.S. equities, even if nominal yields continue to inch up throughout the year.

Cryptocurrency:

The price of Bitcoin has been in a sideways consolidation since mid-February, fluctuating between $44k-$63.5k. It’s gone through moments of euphoria as financial institutions & corporations continue to accelerate adoption. It’s also gone through moments of extreme panic, experiencing multiple drawdowns of -20% or worse. Last week, on 5/12, Elon Musk announced that Tesla would stop accepting Bitcoin as a means of payment for their vehicles, although they would continue to hold the crypto asset on their balance sheet & that “Tesla would not be selling any Bitcoin”. Musk cited concerns over the carbon footprint required to secure the Bitcoin network & the coal usage of miners who validate the blockchain/public ledger.

This has re-sparked an intense debate about Bitcoin’s energy efficiency, which I’m not going to parse through here. I encourage everyone to conduct their own research into this topic & let the dust settle as it may. With that said, the price of Bitcoin has fallen -18% since Musk’s post at 6:06pm ET on 5/12 (based on the $44,300 price at the time of writing). This downturn is definitely a substantial test on the psychology of this current Bitcoin market, as well as a fundamental question against the philosophy of what Bitcoin stands for in terms of its principles. With this -18% drawdown, I wanted to put this bull-cycle in context relative to prior bull-cycles following a Bitcoin halving event, courtesy of @ecoinometrics on Twitter.

This chart shows the price action of the current halving cycle (the 3rd in Bitcoin’s 12 year history), beginning in May 2020, in orange. The blue “cloud” is the price action of the 2013 halving cycle (upper-bound) & the 2017 cycle (lower-bound). The dark blue line is the mean trajectory of the 2013 & 2017 cycles. The y-axis is given in logarithmic scale, which is usually a little strange for people to digest since we often aren’t exposed to continuously exponential growth. A logarithmic chart reflects a percent change in the underlying asset’s price rather than a nominal value change that we see often see in a linear chart. As such, a log chart will usually follow a progression of 1, 2, 4, 8 16, 32, etc. in which each rung along the axis is equidistant & represents a doubling, or 100% growth. That’s essentially what we have above, where the distance between $10k and $20k is the same as $50k to $100k and then to $200k.

This chart gives me a few takeaways. First, volatility is to be expected during bull cycles. In both the 2013 & 2017 cycles, Bitcoin suffered multiple drawdowns in excess of -30%. Long-term bitcoiners are accustomed to this behavior & new bitcoiners have learned to accept this or simply leave the market. Second, Bitcoin’s path during this recent cycle has been relatively in line with the mean of the 2013 & 2017 cycles. My expectation is that the current price trajectory will continue to consolidate & coil around the mean from the prior cycles. Third, I want to talk about the price behavior of Bitcoin during prior halving periods.

If you are already aware of what the Bitcoin halving event is, feel free to skip to the next paragraph. If you would like a brief introduction on this topic, please continue. From its inception in 2009, the Bitcoin network was programmatically designed such that 50 new Bitcoin were “created” every 10 minutes by being rewarded to miners (aka computers) who verified transactions on the blockchain. The “blocks” that they verified are groups of individual transactions that form the public ledger & give Bitcoin its feature of decentralization. Bitcoin mining is a relatively complex topic so I’ll skip all the details, simply to say that in November of 2012, the amount of Bitcoin that were rewarded to miners every 10 minutes was cut to 25 Bitcoin. This was a programmatic feature of the Bitcoin infrastructure, in which the rate of incoming supply would decrease by half every 4 years until a fixed number of 21 million total Bitcoin were mined. Learning about this programmatic feature was arguably the key moment of my realization of the value & potential of Bitcoin, as it gives an intrinsic dynamic of increasing scarcity.

As it relates to this third point, I want to specifically cover the multiple that the price of Bitcoin gained during each new halving period, from the date of the halving to the peak of the cycle. The first halving occurred on 11/28/2012, when Bitcoin was $12.22. Price rapidly accelerated and peaked on 11/29/2013 at $1,068, growing by a multiple of 87x. 18 months after the first halving (6 months after the 11/29/13 peak), the price of Bitcoin was $572, reflecting a 46.8x multiple relative to the pre-halving price. The second halving occurred on 7/9/2016 when Bitcoin was $657. Fast-forward roughly 18 months and price peaked on 12/17/2017 at $19,783, a 30.1x growth multiple. The present cycle started with the 3rd halving event on 5/11/2020, in which price closed at $8,601. Through today, 5/16/2021, the price of Bitcoin has grown by 5.15x to a current price of $44,300.

If we examine the relationship between the first and second cycles, we can uncover some key insights. From the beginning to the peak, the second cycle grew by a multiple 65% less than the first cycle (given by [1-(30/87)]). If this current cycle grows by the same ratio, or 35% of the prior cycle’s multiple, that gives a growth forecast of 10.5x. If we instead measure the ratio from 18 months after the halving event, in which the cycles produced growth multiples of 47x and 30x, we can conclude that the second cycle grew by a multiple 36% less than the first cycle (given by [1-(30/47)]). If this current cycle grows by the same ratio, or 64% of the prior cycle’s multiple, that gives us an expected growth multiple of 19.26x. We now have a range of an expected cycle peak of [10.5x, 19.26x] relative to the price of $8,601 at the time of the 3rd halving. Essentially, this gives a model for the Bitcoin price to reach $90,310 - $165,655 within 18 months of 5/11/2020. If this is truly another hyperbolic cycle like the ones that have followed the previous two halving events, it’s only just getting started. That is not a prediction, but merely an analysis of the prior trends, trajectory, and behavior.

I’ll leave you with this: I increased my position over this weekend & intend to continue adding at various levels.

Until tomorrow,

Caleb Franzen