Edition #84

Global Bonds, $1Tn Valuation Club, BTC > $50k

Economy:

There are two charts that I want to review, both related to the global bond market. Unfortunately, they’re not on the same time scale but the theme & correlation between the two charts will remain.

First, here’s an amazing visualization showing the value of global bonds. I did some digging on the data and confirmed that the index is comprised of sovereign debt (bonds issued by governments) and corporate bonds issued by investment grade firms.

Since the mid-90’s, the value of the global bonds has risen at a consistent & steady level. There are brief periods where the value of global bonds decreased, but these are quickly shrugged off. Just recently, the index made new ATH’s and is currently at $68.837Tn (please note that the y-axis is in millions, therefore each 10M increment is actually 10Tn). Clearly there has been a strong demand for global bonds, on the aggregate. One could write a book about the reasons why this dynamic exists, but the simplest explanation is often best.

The value of global bonds has increased so significantly because of both supply and demand factors. In terms of supply, when debt is extremely cheap via low interest rates, a borrower is incentivized to issue more debt than it normally would have under higher interest rates. Therefore more debt gets issued. From a demand side, as global demographics have reflected an aging population, the older generations will shift their risk appetite to more conservative investments and shift away from stocks and into bonds or annuities. In either a bond or an annuity, an investor is accepting lower returns in fixed interest payments for a specified period of time. Once that security matures, the proceeds are typically rolled into a new bond/annuity to maintain consistent income & yield generated by the investment capital. Therefore, as the global demographics have produced a larger elderly population than prior generations, demand for fixed income, low volatility, “risk free” returns has increased (aka bonds).

The final reason is simple math. On this newsletter, we’ve covered the relationship between interest rates and the present value of an asset at length. For those who need a refresher: as interest rates go down, the present value of an asset goes up (all else being equal). As interest rates rise, the present value of an asset goes down (all else being equal). If you want to see how this relationship works mathematically, please refer to Edition #39 in the “Stock Market” section:

To this point, it’s no secret that yields have been massively declining on a global scale over the last 25+ years. The chart below shows government bond yields, in nominal and real terms, in the United States and for some of the key countries in Europe:

Many people will be surprised to see that Germany has negative nominal yields on the 10-year bund, but this has been the case now for several years. In terms of real yields (the nominal yield minus inflation), each country has negative yields on their respective government debt. In any event, the clear trend of interest rates is to the downside. Hence, yields down —> bond valuations rise.

I don’t foresee any reason that trends in the supply factors, demand factors, or interest rate factors will sustainably end or reverse. Therefore, I can unequivocally say that my opinion is for global bond values to rise consistently & steadily over time.

Stock Market:

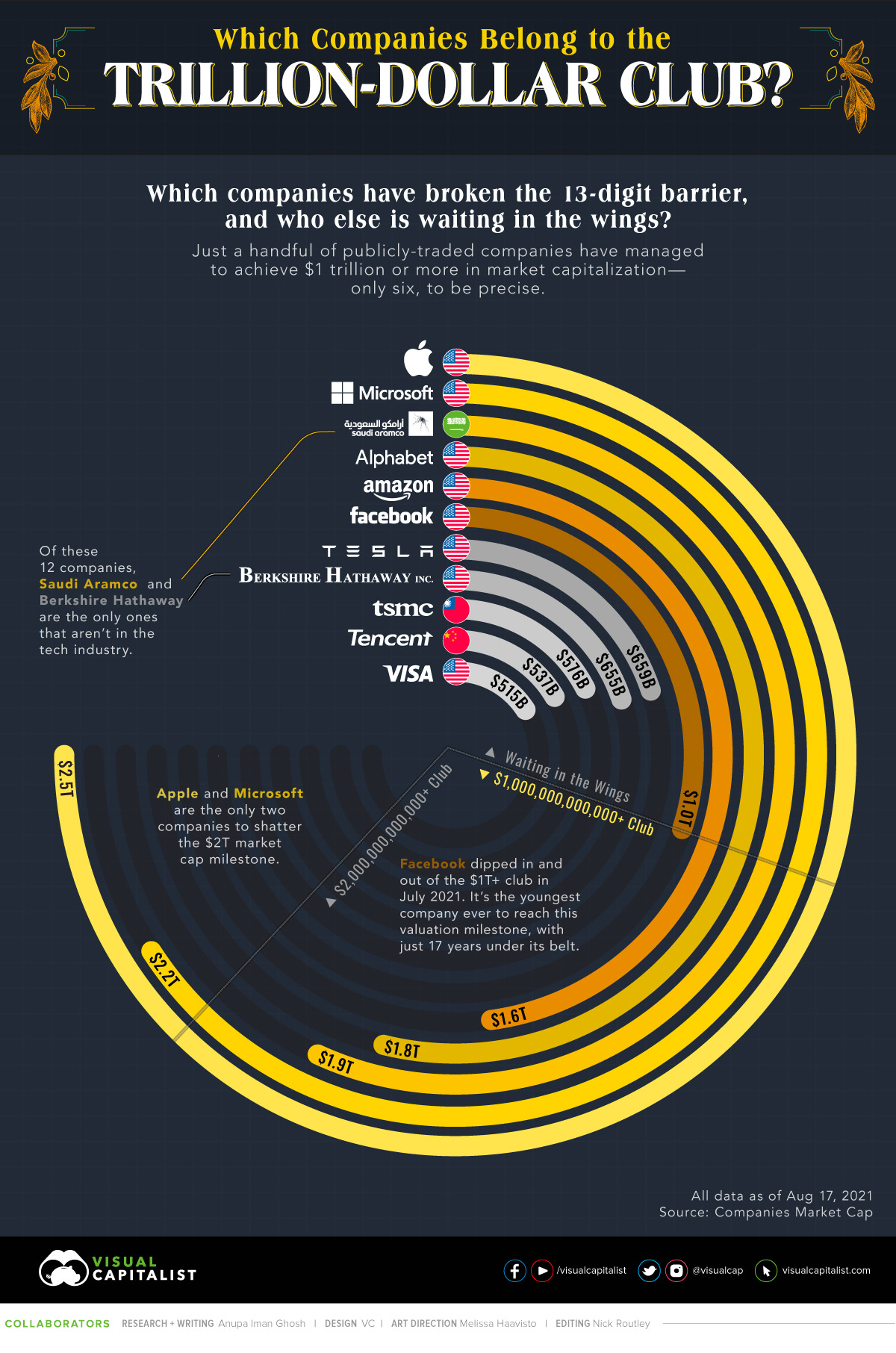

As a way to celebrate the S&P 500 and the Nasdaq hitting all-time highs yesterday, I thought it was fitting to share a post that I saw from Visual Capitalist (@VisualCap on Twitter). The chart below shows the eleven companies with some of the highest valuations, of which six exceed $1Tn, and two of which exceed $2Tn:

The graphic essentially speaks for itself, but I really enjoyed visualizing the data this way, reading the quick notes, and thought it was worthwhile to share.

Cryptocurrency:

I just wanted to take a quick moment to celebrate that the price of Bitcoin once again eclipsed $50,000 late on Sunday night and through Monday afternoon. At the time of writing, price has slipped to $49.2k, but this was a big moment of vindication for the Bitcoin community.

I perhaps got a bit too carried away & posted this on Twitter during the mayhem:

I hope you find it as funny as I did. I was really ecstatic when I saw that $50k was breached to the upside, as this was something that I predicted when it wasn’t a popular opinion & it felt like there was significant weight on the price of Bitcoin. I remained steadfast in my views about the digital asset and posted multiple times that I thought price would once again break above $50k during 2021.

In Edition #6 published on 5/24/21, when BTC was trading at $35k at the time of writing:

“I wouldn’t be surprised if we see a retest of the $27k-$29k range in the coming days or week… At the end of the day, I really don’t know where it goes in the short-term, but I reiterated to some of my close connections that I think price may get back over $50k again sometime this year.”

In Edition #14 published on 6/3/21, around a price of $37k:

“While the significance of the decline cannot be understated, and objectively seems to shift the trend towards the downside, I continue to remain optimistic on the cycle trend & have been purchasing BTC on a daily basis over the last week. I’ve had many friends & connections reach out to me about my opinion during this decline, in which I’ve continued to reiterate that I believe we’ll be back over $50k by the end of the year. In my eyes, that is the conservative view.”

Then, I posted the following on Twitter last weekend:

I think my views are pretty clear about where were headed in the intermediate and long-term. Over the short-term, I’m always open to a wide range of possibilities; however, my bias is to the upside. Substantially higher we go.

Until tomorrow,

Caleb Franzen

thanks. good write-up. New monthly subscriber here. Appreciate the clear writing and language. Re: bonds, how much lower can the 10-year go? Would the US let the 10-year go negative? I doubt it. Will tapering of QE lead to higher rates? Also, do you have any other crypto holdings besides BTC?