Investors,

As much as I love analyzing the economy and monetary policy situation, my interest in markets was sparked by analyzing investment opportunities and breaking down the potential investment thesis of publicly traded stocks. Over the past year, I’ve shared unfiltered deep-dives on over 40 stocks, analyzing the qualitative and quantitative investment thesis of each company. I’ve shared this analysis exclusively with premium (paid) members of Cubic Analytics, ranging from my “Portfolio Strategy” series in 2022 to the “Monthly Deep-Dive” series that I started in 2023, in addition to ad-hoc commentary that I’ve shared when appropriate.

I was doing some research last night (Friday evening) and stumbled across a publicly traded company that I’ve never heard of before, which is surprising given its ~40 year history as a publicly traded stock and a multi-billion dollar valuation. After conducting some curiosity-level research into the company, I’ve decided to take a closer look and share exclusive analysis and conclusions with premium members in tomorrow’s report.

This company’s fundamental operations are extremely boring. Most investors would dismiss the stock because there’s minimal excitement associated with its day-to-day business. However, the stock’s returns & substantial dividend are anything but boring.

Over a 20-year period, the stock (blue) has considerably outperformed the S&P 500 (red) and Dow Jones (purple):

While the stock is volatile and has experienced substantial selloffs like the one it’s currently undergoing, these periods have provided strong buying opportunities for long-term investors who understood the core investment thesis. I don’t know if this core investment thesis has merits today, but I’m excited to find out and share my research with premium members.

Either way, I’ll be conducting a thorough and unbiased review with premium members, showing how I think about long-term opportunities and the various approaches I use to diagnose the viability of a potential investment thesis.

Of course, a big thank you to the team at MicroSectors for sponsoring this edition of Cubic Analytics!

Without further ado, these are the top developments from the past week:

Macroeconomics:

With too many charts and datapoints to choose from, I’m going to share all of the best that I stumbled across and/or created with brief comments for each. Despite all of the chaotic headlines and narratives at play, I think it’s important to cut through the BS and focus on the predominant trends with an objective mindset.

The first four charts below are all taken from the Fed’s latest publication on U.S. household credit:

• Mortgage originations have declined substantially, which shouldn’t be a surprise given the fact that the average 30-year mortgage rate is 6.9% as of Friday. However, the composition is still skewed towards borrowers with strong credit (>760). This is a stark difference vs. the composition leading into the bursting of the housing bubble in 2007-2008. This shows the impact of persistently high mortgage rates reducing the demand for housing, with originations falling to the lowest level since 2014.

• Delinquencies are starting to rise, but only in certain aspects of the credit market, notably in auto and credit cards. This is worrisome, but doesn’t reflect a need to panic. Should these datapoints accelerate in coming months, or perhaps spread into the mortgage market, I will start expressing concern.

• Still focusing on delinquencies, the total balance of credit classified as “delinquent” (at least 30 days past due) is very muted relative to historical data. Nonetheless, it’s no longer declining/flat and we actually saw a brief increase relative to the prior quarter.

• Consumer foreclosures & bankruptcies have been in a steady downtrend for the past decade, currently at/near historic lows. Despite all the negative headlines we’ve seen about layoffs, consumer deterioration, and economic slowdowns, we’re not seeing a follow-through in terms of severe economic weakness. This is great news, though we could start to see a material deterioration in the quarters ahead.

• Published on May 18th, the Conference Board’s Leading Economic Indicators continues to decline, marking the 13th consecutive monthly decline. Their April 2023 data showed a contraction of -0.6% after March’s -1.2% decline. This brings the 6-month rate of change to -4.4%. Based on the historical correlation to real GDP growth, the annual change in the LEI foreshadows a dramatic slowdown in economic growth.

• Empire State Manufacturing came in significantly worse than expected, showing a result of -31.8. Relative to the April data of 10.8, this was the sharpest month-over-month decline since April 2020. We continue to see evidence of weak manufacturing data, though it’s worth noting that the United States is predominantly a service-sector economy, so this isn’t necessarily representative of the aggregate economy.

• Advanced Retail Sales for April 2023 grew +0.4% vs. expectations of +0.8% and prior results of -0.7%. With four out of the last five reports having a negative result, it’s just good to see a rise in consumer activity, even if the April CPI data showed inflation of +0.4% month-over-month also. In other words, real retail sales was flat MoM.

• Staying focused on the retail sales data, we see that the year-over-year trend is extremely weak, showing a growth rate of +0.5%. This is essentially zero growth in retail sales activity over the trailing twelve-month period, ending in April. With headline CPI at +4.9%, this means that real retail sales is contracting very decisively.

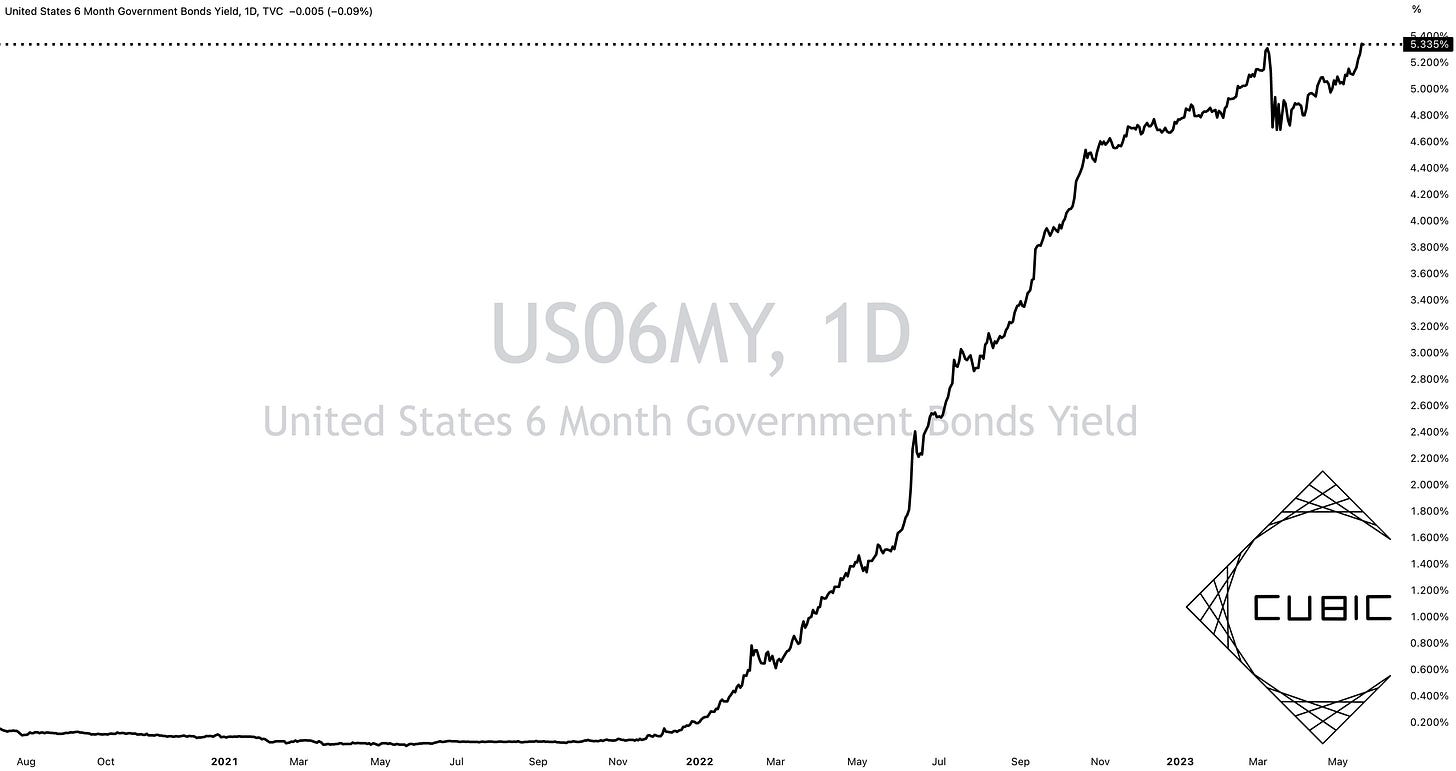

• The 6-month Treasury yield made new YTD and multi-year highs this week, closing on Friday at 5.335%. It’s now recouped all of the losses that followed the reaction to the collapse of SVB & SBNY. As I explained to premium investors in April, the strong uptrend in the 3M Treasury yield made me confident that we’d see other yields grind higher. So far, so good. With the effective federal funds rate at 5.08%, the 6M Treasury yield is pricing in another +0.25% rate hike in June. I’m listening to this signal.

• Loans & leases from commercial banks in the United States continues to decelerate in the aftermath of bank failures/shutdowns. On a YoY basis, the total balance of loans & leases grew at a pace of +8.0% as of 5/17/23. This represents a further downshift vs. the prior result of +8.7% at the start of the month and +11.7% in late-January 2023. As I’ve stressed all year, we should expect to see a further downtrend in lending activity and deceleration on a YoY basis, perhaps into negative territory.

• Focusing specifically on bank deposits on a YoY basis, we’re also seeing a further contraction in deposits. This highlights that deposit outflows are still ongoing, which has the potential to further suppress lending activity and perhaps bring about more stress within the traditional financial system. The latest deposit data as of 5/17/23 shows a year-over-year contraction of -5.1%, the steepest decline in the history of the data series. Quite simply, this is not a normal development.

Stock Market & Bitcoin

I’ll be providing market analysis in tomorrow’s premium report. See you there!

Congratulations for making it this far. Here’s a 10% discount code for premium :)

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.