Cash On The Sidelines

Investors,

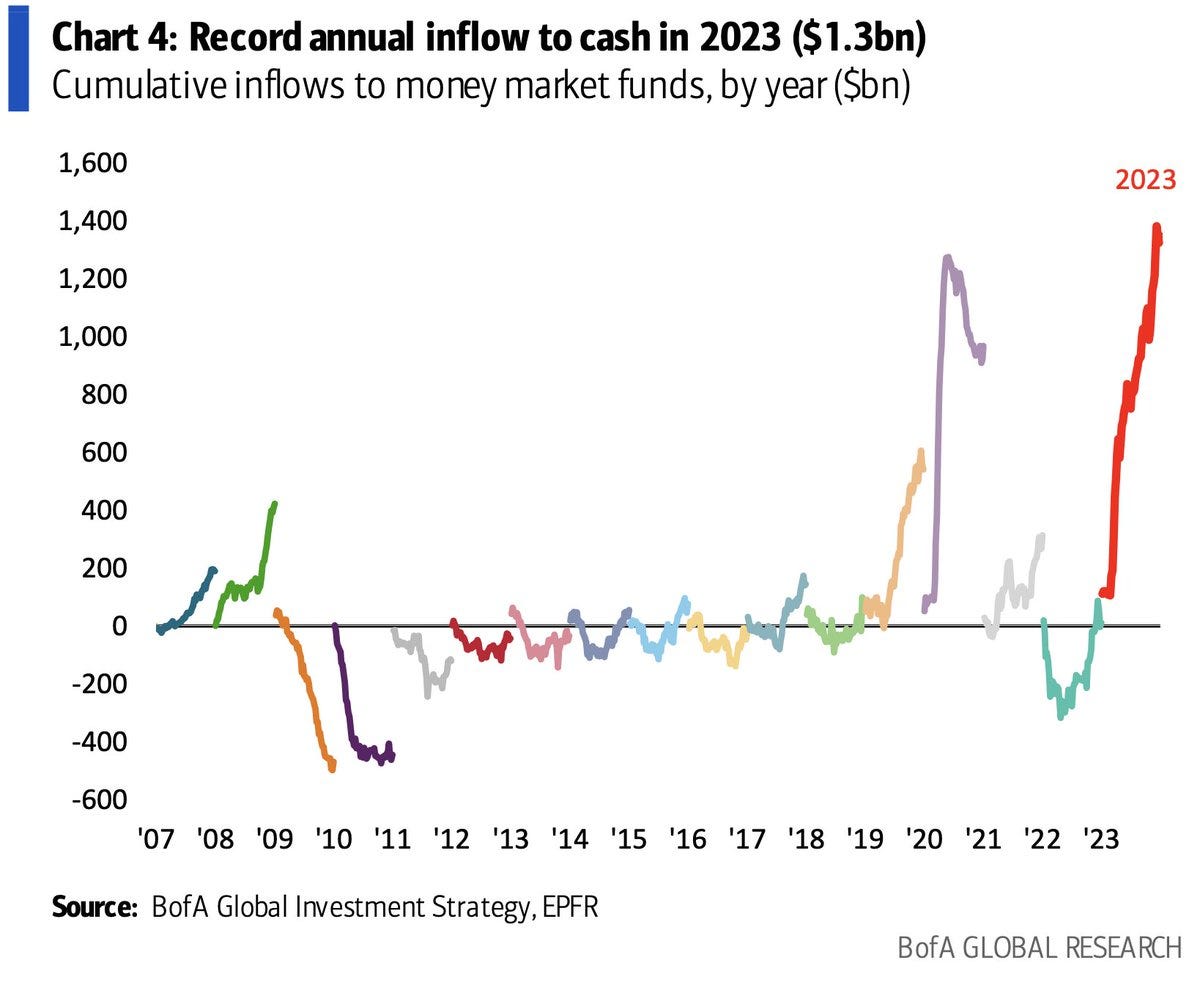

As we head into 2024, I think the following chart has one of the most simple but meaningful implications for the coming year in financial markets:

On an annual basis, we’ve never seen this much capital flow into money market funds, where it’s generating a return somewhere between 5.0% and 5.3%. The result is that assets under management in MMF’s is hitting new all-time highs (though it hasn’t made new ATH’s relative to the market cap of the U.S. stock market):

As we enter 2024, I’m hearing many bears say “where is the cash going to come from to buy stocks up here?” and the answer lies in the two charts above. Dry powder is at record highs and underperformed the entirety of 2023, which means that those investors will likely reconsider how to allocate that capital in the new year. For right or for wrong, I’m guessing that MMF exposure will decline in favor of stocks.

I know that it’s New Year’s Eve, so I’m going to keep this premium report short (1,976 words) but packed with value. Let’s dive straight in…