Bullish Crypto Trade Ideas

Investors,

This premium report will focus entirely on trade setups that I’m seeing in the crypto market and how I’m approaching risk management in the stock market for the upcoming week. While these setups are based purely on price structure and technical analysis, I will clearly outline how I’m navigating these trades, their risk/reward, and which specific setups I’m currently involved in.

Before doing so, I wanted to update my view on disinflationary trends going forward.

If you’re not interested in macroeconomics and disinflation, please scroll to the section titled “Trade Ideas & Setups” further below.

Disinflation:

In short, I fully expect to see the pace of inflation decline dramatically in the months ahead, likely falling below +3.0% YoY for headline CPI within the next four reports. In yesterday’s edition of Cubic Analytics, I touched on how banking data and labor market trends are likely to exacerbate disinflation going forward. I wanted to also shed light on two other important dynamics:

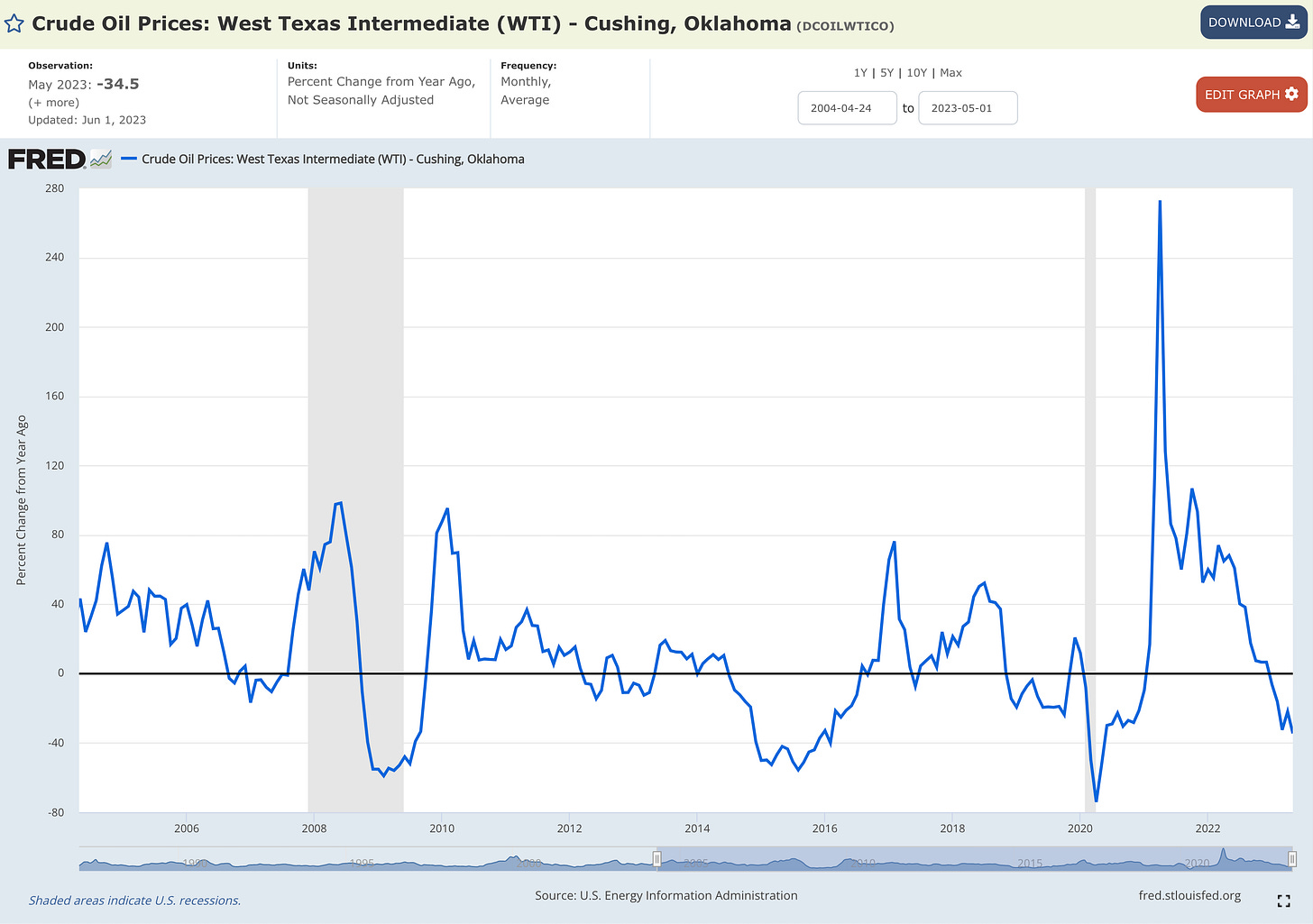

1. Energy is plummeting: I’ve been covering the massive downtrend in crude oil and other commodities for months now, but the negative rate of change is reaching new lows within the disinflationary cycle. For example, take the average price of crude oil in the month of May 2023, down -34.5% YoY:

This YoY metric is hitting news lows since the post-COVID economic recovery, likely to produce even more disinflation for both CPI and PPI for May 2023. Additionally, the -9.7% MoM decline (deflationary) is likely to produce broad-based disinflation in the upcoming inflation reports.

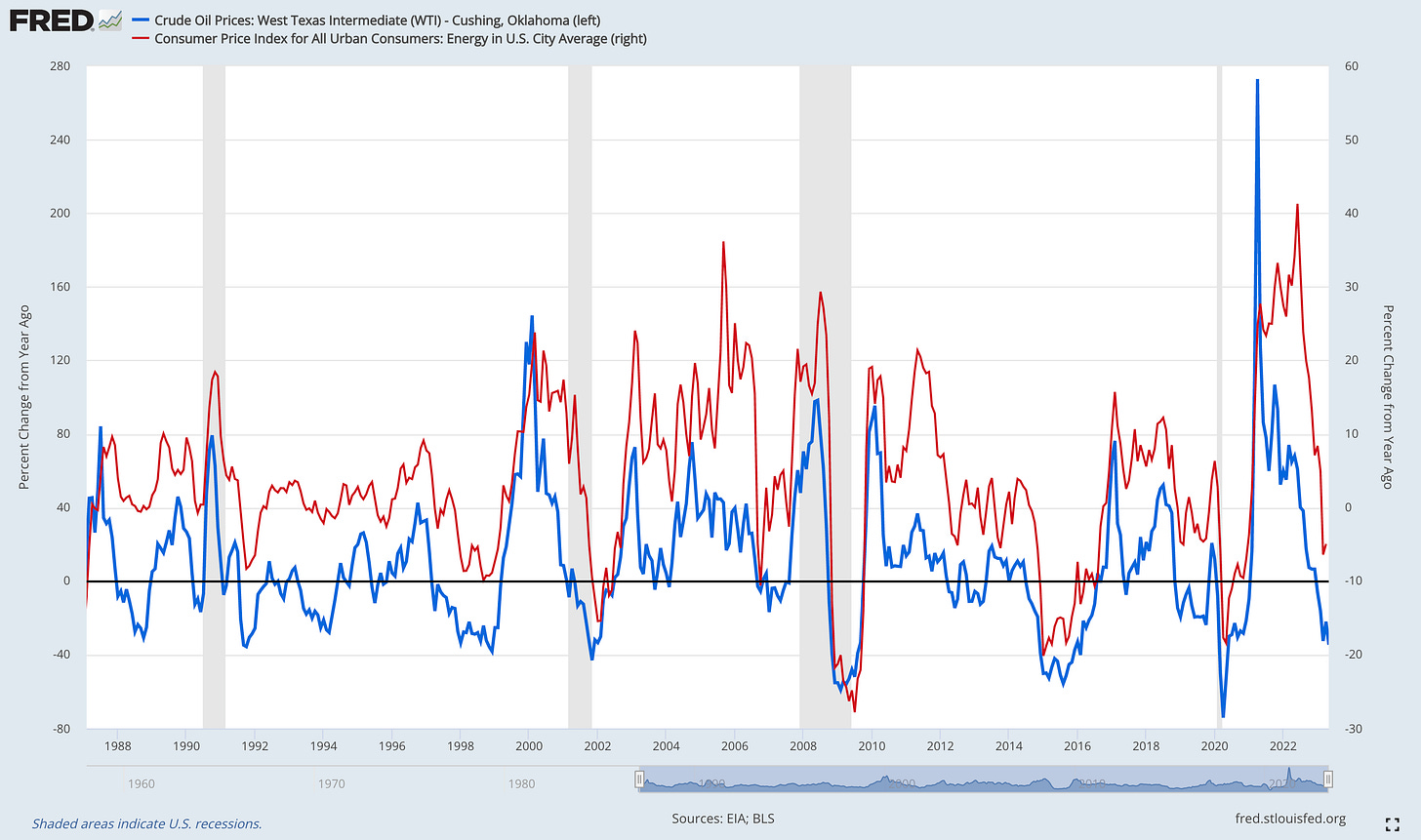

Why is this specific variable so important to my outlook? Because the YoY deflation for crude oil prices is almost certainly going to produce YoY deflation for the Energy component of CPI. History proves that these two variables have a tight relationship and that average crude oil prices lead the Energy component by a few months, and the energy component leads headline CPI by a few months.

2. Shelter is plummeting: The Shelter component of CPI is bogus and lags the actual housing/rental market by 8-12 months, per the Fed’s own admission, meaning investors should rely on private market data in order to analyze shelter. Regarding the housing market, the S&P Case-Shiller National Home Price Index was updated for March 2023, published on May 30th, showing a +0.66% YoY rate of change.

This has been the sharpest and most sustained contraction in the history of the data series, going back to the 1980’s. Amazingly, this measurement was +20.8% YoY in March 2022, so we’ve already seen a 20 point decline in this datapoint! Particularly as we approach the June 2023 report, I fully expect to see a negative print for this variable.

Turning to the rental market, Apartment List published their June 2023 report on rents and painted a fairly abysmal picture about the rental market. For example, they used the following language to describe the current market environment:

“Sluggish demand”

“Increasing supply”

“YoY growth is solidly below average”

“The rate of easing has picked up steam since last summer”

“Rent growth is stalling”

Apartment List’s data-driven approach reaffirms that this is true, and rents are firmly decelerating on a YoY basis:

As one might expect, the rate of change in home prices and rental prices are mirroring each other quite well; however, they are both starkly different than the Shelter component of the CPI:

It’s time for Shelter, which comprises 33% of the overall CPI, to plummet.

Combined with a deceleration in credit creation, outright contractions in deposits and M2 money supply, the upcoming restart of student loan payments, historically loose supply chain conditions, normalization of wages, historically tight monetary policy, and the energy/shelter data discussed above, I fully expect to see inflation rapidly decelerate in the months ahead.

In other words, expect stronger disinflation going forward.

Enough of the macro, let’s jump into my top trade ideas & setups: