Bitcoin's Most Important Correlation

Analyzing Mega-Cap Tech, Disinflation, and Bitcoin vs. Semiconductors

Investors,

These are the facts:

The Nasdaq-100 ($QQQ) hit new 52-week highs on Friday.

The Technology Select Sector ETF ($XLK) hit new 52-week highs on Friday.

The iShares Expanded Tech ETF ($IGV) hit new 52-week highs on Friday.

The VanEck Semiconductor ETF ($SMH) hit new 52-week highs on Friday.

The Vanguard Mega-Cap Growth ETF ($MGK) hit new 52-week highs on Friday.

The NYSE FANG+ Index $NYFANG hit new 52-week highs on Friday.

The companies/stocks within these funds can be characterized as the largest, best, most important, innovative, profitable, resilient, and attractive companies in the entire world.

These are the stocks leading the market higher and I wouldn’t have it any other way.

Did I predict that this was going to happen in 2023? No. Have I been talking about it for months? Yes. Am I complaining about it? Nope.

Bears believe that the outperformance of either tech, mega-caps, and/or growth stocks vs. the broader market is bad news; however, I’d show those people one simple chart:

Above is the performance of the Nasdaq-100 vs. the Russell 2000, starting in 2003.

There are two aspects that I’d like to highlight:

Since the Great Recession, aka one of the strongest/longest bull markets ever, this relationship has been rising steadily. While it hasn’t gone up in a straight line, the trend here is pretty clear — tech outperforms small caps during a bull market.

This relationship was in a multi-year downtrend prior to the GFC, indicating that small cap stocks were outperforming large tech. Was that a healthy or more preferred environment? Not necessarily, considered that it occurred during the inflation of the housing bubble.

I have no idea if this period of outperformance is sustainable, how long it will last, or what the magnitude of outperformance will be going forward; however, I don’t think it’s fair to look at this ongoing market dynamic and say “THAT’S BEARISH!”

History tells us, quite simply, that it’s not bearish.

I also want to say how proud I am of the team at MicroSectors for having the #1 performing fund of 2023, the MicroSectors FANG+ Index 3X Leveraged ETN FNGU 0.00%↑. Considering the strength of mega-cap tech in 2023, being long the NYSE FANG+ Index has been one of the best trades of the year. With $FNGU, investors get 3x beta on the performance of the underlying $NYFANG, generating a performance of +247% YTD! This past week alone, the fund gained +16.7%!

Their team has a variety of direct & inverse ETN’s, providing unique exposure to oil & gas, energy, banks, gold, gold miners, and FANG+. I’ve been trading their 3x inverse gold miner ETN GDXD 0.00%↑ for the past several weeks, and my position is currently up +32%. You can read more about their gold products below:

Macroeconomics:

The Personal Consumption Expenditures (PCE) data for April 2023 was released on Friday, reigniting concerns about inflationary pressures. I’m here to make sure that you don’t freak out about it, as I firmly believe that disinflation is still the trend.

First of all, the PCE is important because it’s the Federal Reserve’s preferred way of measuring inflation and the trend of inflation. On a YoY basis, PCE inflation ticked higher from 4.2% to 4.4% in April 2023. Seemingly, this provides evidence that my theory of disinflation is incorrect! Right?

No.

Here’s why:

Upticks in the YoY measurement of PCE inflation from one month to the next aren’t uncommon, particularly within a disinflationary environment! The chart above highlights multiple examples of this over the past 30+ years. As such, I’m not going to get fearful about one datapoint showing an increase for one month, particularly given the weight of the evidence that continues to suggest that the U.S. is in disinflation.

The 5-year Breakeven Inflation Rate (T5YIE) is right on 52-week lows and my belief is that they’re going to fall much further in the months ahead.

Meanwhile, the University of Michigan’s survey for 1-year inflation expectations fell to 4.2% after a recent re-acceleration:

As I’ve been saying since December 2022, we should expect to see some upside surprises in the inflation data within a broader trend of disinflation. It’s important to remind people that inflation (a rate of change for prices) has peaked, but prices themselves have not peaked. Here’s an analogy:

Amidst relatively stronger economic data (referring to U.S. manufacturing & service PMI’s and initial unemployment claims) and the uptick in the PCE data above, the market is now firmly expecting for the Federal Reserve to raise rates by another +0.25% in the upcoming meeting on June 14th.

The CME FedWatch Tool is putting the likelihood of a rate hike at 64.2% as of Friday, reaffirming the signal that I’ve been interpreting from the bond market for the past several weeks. In other words, people are finally listening to the 3M and 6M Treasury yields, which continue to indicate that the Fed will keep raising interest rates.

Don’t believe me? Just look at the historical relationship between:

3M Treasury Yield 🔵 = 5.32%

6M Treasury Yield 🔴 = 5.42%

Effective Federal Funds Rate 🟢 = 5.08%

With short-term yields still trading above the federal funds rate, the market is currently telling us to price in at least one more rate hike! By subtracting the current federal funds rate from the respective Treasury yields, we can interpret how much of a rate hike the bond market is pricing in:

5.32% - 5.08% = +0.24% rate hike

5.42% - 5.08% = +0.34% rate hike

While these spreads will change daily based on movements in the Treasury market, the takeaway is extremely clear: expect another rate hike.

Stock Market:

Expanding on the discussion at the start of this report, it’s been amazing to see stocks trend higher despite the recent acceleration in Treasury yields. Yields across the maturity spectrum are all trading above their respective 200-day moving averages, indicating strong momentum for yields to keep pushing higher. Considering that, all else being equal, yields and asset prices have an inverse relationship, the simultaneous rise in both yields and asset prices has been an interesting development.

For one, I think this highlights how unattractive bonds are in the current environment given the ongoing charade regarding the U.S. debt ceiling. Rumors on Friday indicate that a deal could be reached any day now; however, I expect maximum drama around this topic so I’m not holding my breath. With no major alternative in the U.S. market, and given the massive success of stocks in 2023, investors are continuing to pour capital into the stock market.

While tech stocks have been the biggest beneficiary of these inflows, the Dow Jones is actually showing bullish dynamics as well. After a poor start to the week, the Dow had a strong intraday recovery on Thursday and experienced continued momentum on Friday’s session, gaining exactly +1.0% for the day.

Here are some notes for the Dow Jones:

After trending within the red descending channel for the majority of 2022, the breakout in Q4 2022 was a bullish indication. In fact, the index has used the upper-bound as support 2x after previously using it as resistance. This is generally bullish.

After falling below the 200-day moving average (yellow) in January 2022, the Dow Jones was rejected on this dynamic resistance range multiple times throughout the year. However, a breakout in Q4’22 has now flipped the 200 MA into support! This is generally bullish.

The Dow Jones has been making higher lows since October 2022, outlined by the rising teal trendline. You can see that price has already started to rebound on this level on Friday, which was perfectly aligned with the 200-day moving average. If we fall and close below this level, I’ll start to get concerned; however, that hasn’t happened yet.

I think it’s vital to remember that bears always have something to be pessimistic about and bulls always have something to be optimistic about. Cutting through the BS and focusing on objective analysis is so important, which is why I focus on key levels, statistical indicators, and listen to the signals that they provide. If and when they turn bearish, I’ll become more bearish. So long as they continue to reflect bullish dynamics, I’ll lean towards being bullish. It’s that simple.

Staying flexible & humble are the most underrated aspects of successful investors.

Bitcoin:

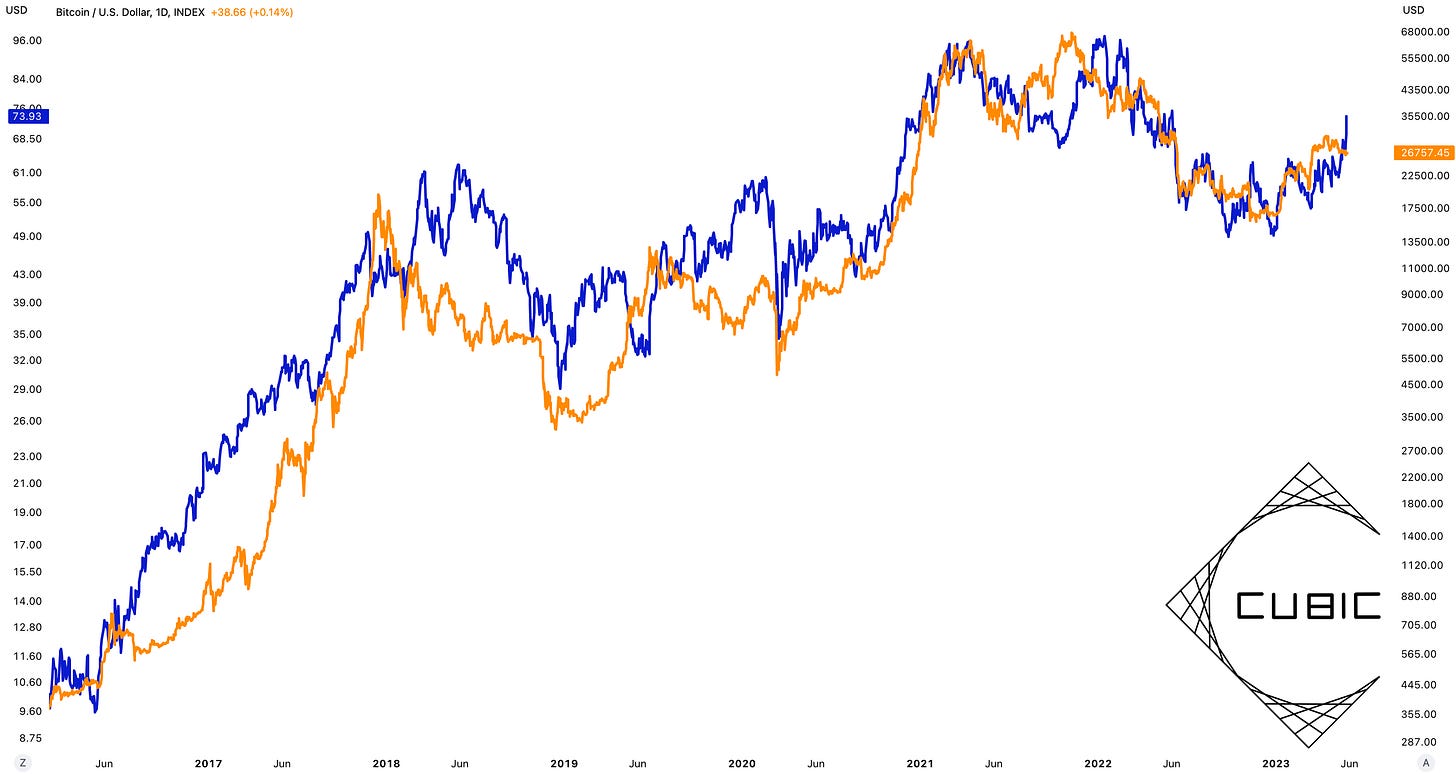

With all of the attention on semiconductor stocks right now, I thought this was an appropriate time to highlight the correlation between BTC and Micron Technologies ($MU), the multi-billion semiconductor stock. I first discovered and shared this relationship in June 2022 on Twitter and discussed it on Anthony Pompliano’s podcast, which you can listen to here.

Based on my hours of research, I can’t find any better correlation between Bitcoin and an individual stock! As such, I think it’s vital to listen to the signal that it’s telling us.

Bitcoin 🟠

Micron Technologies ($MU) 🔵

This relationship has been effective since 2016 and it’s easily the most long-standing, consistent, and tight correlation I’ve found for Bitcoin with traditional assets. Given the strong acceleration in Micron’s stock over the past several weeks (and YTD), I think that semiconductor stocks like MU are indicating that Bitcoin could experience strong price appreciation in the weeks/months ahead.

Why is this relationship important? Several reasons:

Analysts can simultaneously evaluate both BTC and MU as a way to identify confluence or divergence, confirming a bullish or bearish signal by “double-checking” one asset vs. another.

Investors could hedge their BTC exposure by shorting Micron stock, or hedge their Micron exposure by shorting BTC. Alternatively, an investor who would want Bitcoin-style performance with less volatility could be attracted to Micron stock because of the proven directional correlation.

For those investors who don’t understand the fundamental value or investment thesis in Bitcoin, this chart helps to bridge the value proposition of Bitcoin. It’s quite amazing that MU stock, which has a market capitalization of $80Bn, perfectly follows the behavior of Bitcoin (or vice versa). This is a stock with a CEO, tens of thousands of employees, billions of dollars worth of tangible assets, proven business relationships, marketing operations, and long-term debt. Yet they benefit and suffer from the same market dynamics as Bitcoin, a digital asset with pure decentralization, no CEO, no marketing team, and no debt. In other words, if someone can understand the investment thesis & value proposition of Micron, this chart should convince them about Bitcoin’s thesis & value.

I truly believe that this is one of the most amazing relationships I’ve stumbled across in my own independent analysis and I’ll continue to pound the table on its importance and significance.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.