Bitcoiners Are Insane

Investors,

The same people who have been wrong about disinflation for the past 12 months are now telling you to be worried about how “less friendly” base effects will reignite YoY inflationary pressures going forward.

I’m not joking — they are once again refusing to acknowledge the entrenchment of disinflation and are trying to stoke fears that inflation won’t just be sticky, but that it will accelerate from here on out.

Based on what? Base effects & YoY comps. Nothing else.

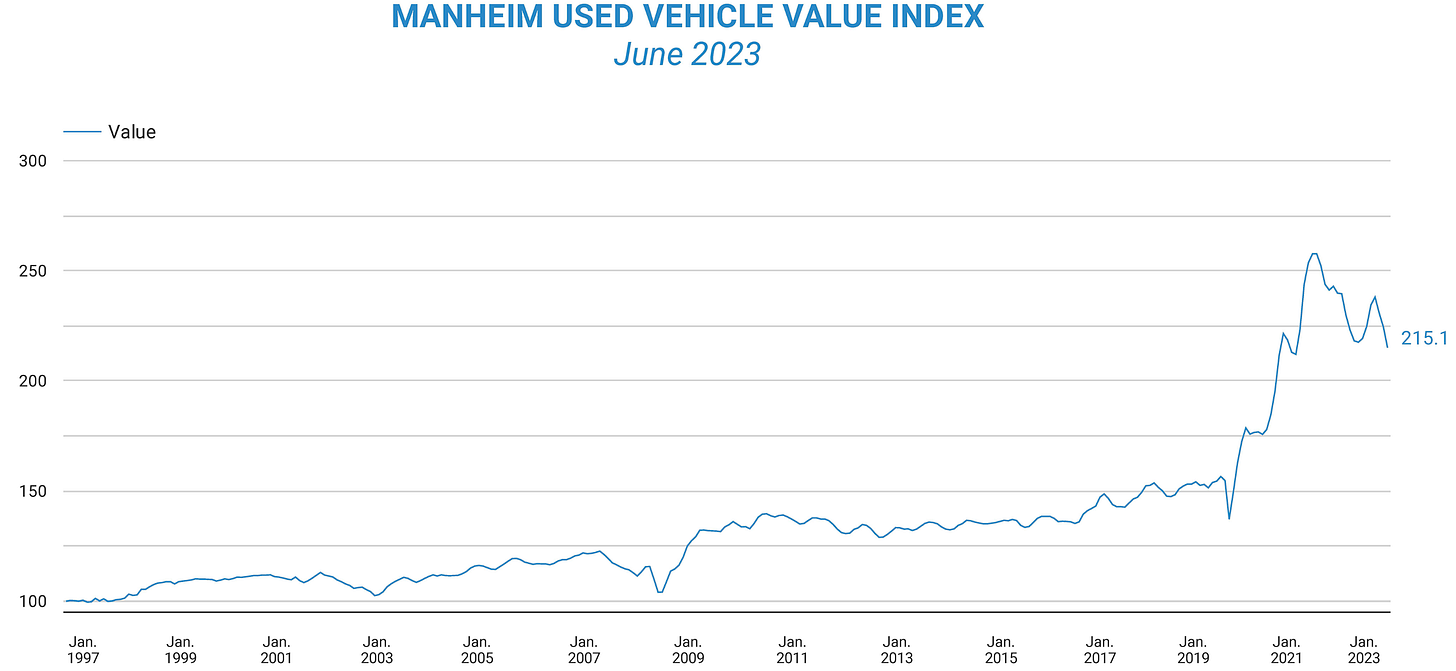

These are the same people who predicted that inflation would surge back in Q1 due to higher oil prices due to OPEC supply cuts. These are the same people who predicted that inflation would surge back due to the reopening of the Chinese economy at the beginning of the year. These are the same people who predicted that inflation would surge back due to sticky wage growth. These are the same people who predicted that inflation would surge back due to an uptick in the Manheim Used Car Index. These are the same people who predicted that inflation would surge back due to higher agricultural commodity prices. These are the same people who predicted that inflation would surge back due to higher car insurance prices (yes, actually).

These are the same people who have been wrong all year, yet they are now screaming about how year-over-year base effects will be less accretive to disinflation, despite refusing to acknowledge disinflation for the past 8+ months.

The irony is, all of the fears that they stoked about the individual variables I listed above never came true. Crude oil prices are down -6.5% YTD, despite rallying +18.5% since May 4th, and are down -22% YoY. I believe that crude oil will once again get rejected on the 200-day moving average cloud, similar to how it used this dynamic range as support in 2021.

Clearly, crude oil has been in a downtrend since breaking below the 200-day MA cloud & price has been rejected on it multiple times over the past 12 months.

The China Reopening has been a flop, with their economy experiencing significant deflation in producer prices (-5.4% YoY) and practically zero inflation in consumer prices (+0.2% YoY). Relative to their historical growth rates, China is floundering.

Moving on, nominal wage growth has persistently been around +4.4% YoY for each month during 2023; however, YoY CPI has fallen from +6.3% to +3.0% over that same period. In other words, we have clear evidence that broad-based inflation is cooling off while wages continue to grow at a steady pace.

Nonetheless, other measures of wage growth, like the Atlanta Fed’s Wage Growth Tracker are showing a rapid deceleration of wage growth:

To cap off wage dynamics, they are unequivocally disinflationary.

The Inflationistas, as I like to refer to them as, have also been completely wrong about used car prices after FUD’ing that the Manheim Used Vehicle Value Index started to tick higher in Q1 2023. However, that uptick didn’t last long…

The latest data from Manheim suggests that used car prices fell -4.4% in the month of June and were down -10.3% YoY, the largest such decline in decades. Inflationistas have been proven wrong once again.

Their latest fear-mongering about the lack of base effects going forward is lazy, refusing to acknowledge the weight of the evidence that foreshadows much more disinflation in the months/quarters ahead. It refuses to acknowledge the lag effects of Shelter, which is 1/3rd of the CPI basket. It refuses to acknowledge the Prices Paid Index for the service sector. It refuses to acknowledge the rapid disinflation of U.S. producer prices. It refuses to acknowledge how student loan repayment will kick in later this year, most likely. It refuses to acknowledge the ongoing contraction in M2, reserves, and deposits on a YoY basis. It refuses to acknowledge the lag effects of the Federal Reserve’s rate hike cycle, in which roughly 350 basis points of rate hikes haven’t had their impact on the economy yet. It refuses to acknowledge the lack of supply chain bottlenecks, which have evaporated. It refuses to acknowledge the ongoing contraction in the Fed’s balance sheet as a tightening of financial conditions. It refuses to acknowledge the deceleration in lending activity and less credit creation.

It refuses to acknowledge…. ughhh so many things.

Don’t fall for their irresponsible narrative around base effects & have trust in the weight of the evidence that continues to highlight disinflationary dynamics.

That’s enough macro for this premium report, so let’s jump straight into the market data and analyze the key trends that continue to unfold, with or without the bears.