Investors,

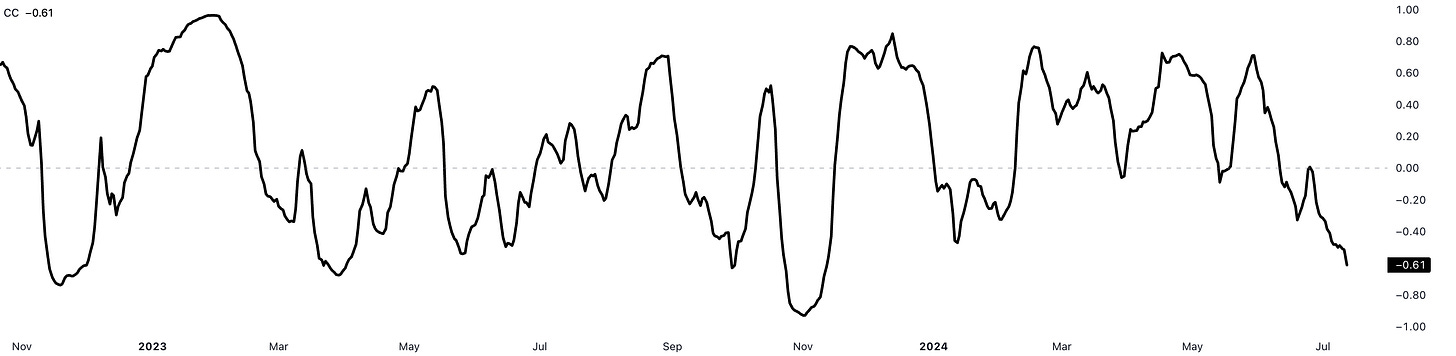

Bitcoin is undervalued relative to the stock market, according to an important correlation that I’ve been sharing since 2022. Specifically, I’m talking about:

🟠 Bitcoin $BTCUSD

⚫ High beta stocks vs. low volatility stocks (SPHB/SPLV)

Is it a perfect correlation?

No, but it’s been very insightful and has developed a wide divergence recently.

In fact, the rolling 30-day correlation just made new 8-month lows on Friday of -61%.

The last time the correlation was this negative was in November 2023, when the price of Bitcoin was trading at $37,000. Given this correlation since Q3 2020 and the fact that the Dow Jones and the S&P 500 made new all-time highs on Friday, my interpretation is that Bitcoin is currently undervalued relative to the stock market.

For this reason, I’m extremely excited about a new product launch on Wall Street, the 2x Leveraged and Inverse Spot Bitcoin ETFs from REX Shares & Tuttle Capital Management:

T-REX 2X Long Bitcoin Daily Target ETF BTCL 0.00%↑

T-REX 2X Inverse Bitcoin Daily Target ETF BTCZ 0.00%↑

These funds are super unique because they are spot BTC products, unlike the other leveraged and/or inverse ETFs that use futures. Futures-based products are complex & inefficient because of contango and/or backwardation, so these spot ETF products can be better for some investors, depending on their timeframe.

To read more about these products (just launched this week), check out the sponsor section at the bottom of this report or go directly to the REX Shares website!

Macroeconomics:

The June CPI data, released on Wednesday, was the best inflation data that we’ve received so far in 2024, illustrating strong directional progress towards the Fed’s +2% YoY inflation target. Specifically, we saw headline & core figures on a MoM & YoY basis come in below estimates and below prior results from May 2024:

Headline CPI inflation:

MoM results = -0.1% vs. estimates of +0.1% and prior +0.0%

YoY results = +3.0% vs. estimates of +3.1% and prior +3.3%

Core CPI inflation:

MoM results = +0.1% vs. estimates of +0.2% and prior +0.2%

YoY results = +3.3% vs. estimates of +3.4% and prior +3.4%

This was a massive win for team disinflation, which I’ve been championing since December 2022. In turn, we’re one step closer to non-recessionary Fed rate cuts.

There are three key charts that I want to highlight from the June 2024 CPI data:

1. Headline CPI ex-Energy inflation was +3.12% YoY, down from +3.22% prior.

This was the lowest YoY print since April 2021, down substantially from the peak in September 2022 at +7.3% and near the peak level from 1992 - 2020 of roughly +3%. On a month-over-month basis, headline CPI ex-energy was +0.09%, the lowest reading since January 2021.

While non-energy prices are still rising, the pace of their increase is declining, which is the very definition of inflation. Again, it’s vital to remember and understand that the Federal Reserve is not trying to bring prices back to their pre-COVID levels — instead, they are trying to return inflation to +2% YoY. Even if the Fed “wins” their battle, they intentionally want to see U.S. consumer lose their purchasing power.

Personally, I prefer this measurement over core CPI because I recognize the importance of food prices and because food prices aren’t controlled by a cartel, like oil & energy prices. Therefore, I think that it’s a more appropriate broad-based measurement of inflation dynamics than core CPI.

2. Headline CPI ex-Shelter inflation was +1.8% YoY, down from +2.12% prior.

To make sure that we’re all on the same page, it’s important to understand the composition of the CPI basket, in which Shelter is 33% of headline CPI and 41% of core CPI. However, due to the lag effects of OER, which the Federal Reserve has acknowledged, it’s difficult to pretend that CPI is providing an accurate measurement of inflation when private rental data is flat or negative YoY and the Shelter component is reflecting +5.1% inflation.

Given that these lag effects are variable, but generally accepted to be 8-12 months behind, I think it’s appropriate to remove Shelter in order to gauge how all other CPI components are evolving. The fact of the matter is that non-Shelter components are experiencing a rate of inflation that is not only below the Fed’s +2% target, but is also consistent with the historical average of inflation since the 1990’s.

Headline CPI ex-Shelter has now resumed its disinflationary trend for the past two reports, illustrating the broad-based nature of disinflation without the influence of the CPI’s largest component.

3. Services Ex-Shelter inflation was +4.8% YoY, down from +5.0% prior.

Throughout 2024, I’ve cited this specific variable as my biggest concern about the CPI data due to the ongoing reacceleration in the YoY reading; however, for the first time in several months, we just saw this inflation rate decelerate again.

I’m not calling for a victory lap here based on one monthly deceleration, but I’m very pleased to see that the acceleration stopped and I’m hopeful that disinflation will continue in the months ahead. The reacceleration in 2024 has certainly been worrisome from the Fed’s perspective, so a resumption of disinflation in services ex-Shelter will help to inspire more confidence that rate cuts are becoming appropriate.

All in all, the June CPI data provided unequivocal evidence of disinflation.

Prices are still rising.

As consumers, it sucks.

But as investors, we must recognize that disinflation has been one of the primary catalysts for the bullish trend in asset prices since inflation peaked in June 2022, which not-so-coincidentally was also the time that the list of new 52-week lows in the stock market also peaked.

Therefore, as we think about using macro data to make better decisions as investors, I think it’s vital to monitor inflation dynamics and continue to see disinflation persist.

Stock Market:

Stocks are hitting new ATH’s, in a market environment where breadth is expanding.

Just this week, we saw new all-time highs for:

The Dow Jones Industrial Average ($DJX)

The S&P 500 ($SPX)

The Nasdaq-100 ($NDX)

The equal-weight Nasdaq-100 ($QQQE)

Equal-weight technology stocks ($PSCT)

Value stocks ($VTV)

Growth stocks ($VUG)

High dividend stocks ($VYM)

Dividend growth stocks ($DGRO)

The financial sector ($XLF)

The healthcare sector ($XLV)

The technology sector ($XLK)

The communications sector ($XLC)

Semiconductors ($SMH)

Broker-dealers ($IAI)

And many, many others.

I’ll continue to pound the table on this, but there’s nothing more bullish than making new ATH’s, which is backed by extensive evidence & market history.

Forward returns at new all-time highs beat forward returns at any other time.

Why?

Because asset prices trend.

Because the market is forward-looking.

Because bull markets climb a wall of worry.

Because momentum is a key driver of returns.

Because strength begets more strength.

You can accept these truths or you can fight against them.

I’ve worked extensively over the past 15 months to prove why you should accept them.

So when we’re seeing such rapid & broad-based expansion in the U.S. stock market this past week, that’s simply a key signal that more stocks are participating in the uptrend, which is inherently a bullish characteristic of an uptrend: breadth expands and rotation helps to fuel part of the next leg higher.

This is exactly what I outlined in my pinned post on X, where explored the question of whether or not investors should be concerned about “weak” breadth.

Hint: the answer was no.

Since that post on June 19th, just less than a month ago, U.S. indices have produced strong returns:

Dow Jones Industrial Average: +2.9%

S&P 500: +2.35%

Nasdaq-100 $NDX: +2.15%

Russell 2000 $RUT: +6.1%

Looks like a bullish expansion to me, which is exactly what I forecasted.

If you missed that post, I’d strongly recommend going back to read it so that you can see all of the evidence & perspectives that I shared at the time to remain bullish on equities during a period of “weak” breadth.

Bitcoin:

The most important thing for me with Bitcoin is that price can get back above the 200-day moving average cloud, which is currently trading between $58,168 - $59,117.

Throughout the bull market, the 200-day moving average cloud has worked nearly perfectly as dynamic support, aside from a short-lived breakdown in August through October 2023.

As we can see during that period, the cloud even acted temporarily as resistance before achieving a bullish breakout and running from $28k to $74k in a matter of 5 months.

It’s factually true that bull markets (in any asset class) can be characterized by the price of that asset trading above its 200-day moving average. Therefore, if we want to objectively reaffirm that bullish dynamics have returned, it holds true that price will need to break above the 200-day MA cloud & stay above it.

If/when that happens, which is my current base case, then I expect to see bullish follow-through and another upside continuation rally.

The risk here is that the cloud is currently holding as resistance, similar to the several rejections that occurred in Q3’23 before achieving a breakout. Therefore, I have no clue when the breakout will come… it could be tomorrow, next week, or next month.

My view is (and has been) that this dip between $54k and $60k is a strong buying opportunity, so I’ve certainly been adding to my exposure in this range with spot, leveraged ETFs, and even various spot ETFs in my Roth IRA.

That’s just what I’m doing, based on my own personal outlook, thesis, & risk appetite.

Best,

Caleb Franzen,

Founder of Cubic Analytics

SPONSOR:

This edition was made possible by the support of REX Shares, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged & direct/inverse, to the NYSE FANG+ Index.

I first collaborated with the REX Shares team in 2023 because I’ve been using their products as trading vehicles since 2022 and it was an organic & seamless fit. They have a unique product-suite, ranging from leveraged products, to inverse products, and income-generating products.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.

Caleb, unfortunately BTCL and BTCZ don’t invest in bitcoin directly either - they hold bitcoin futures …